January 2025

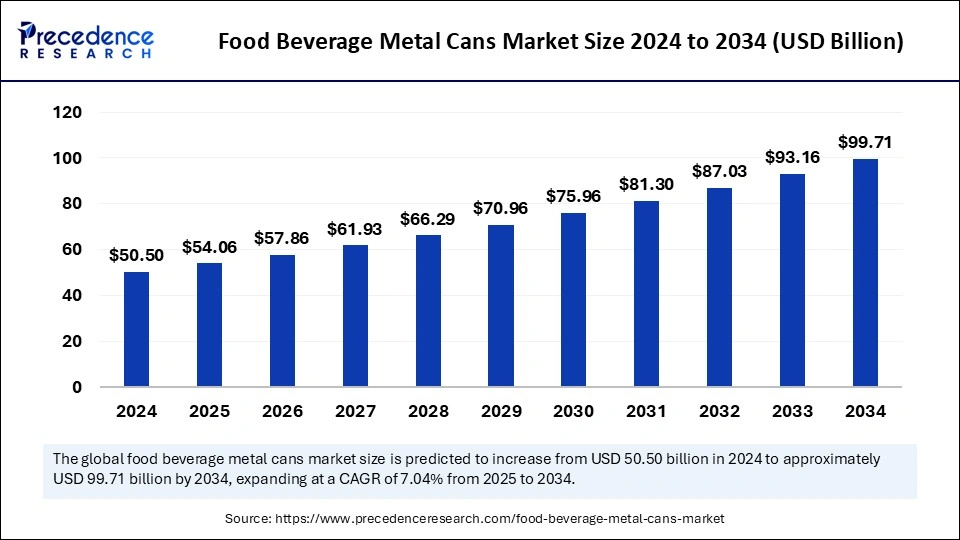

The global food beverage metal cans market size is calculated at USD 54.06 billion in 2025 and is forecasted to reach around USD 99.71 billion by 2034, accelerating at a CAGR of 7.04% from 2025 to 2034. The market sizing and forecasts are revenue-based (USD Million/Billion), with 2024 as the base year.

The global food beverage metal cans market size was estimated at USD 50.50 billion in 2024 and is predicted to increase from USD 54.06 billion in 2025 to approximately USD 99.71 billion by 2034, expanding at a CAGR of 7.04% from 2025 to 2034. The market is increasing rapidly because consumers choose sustainable, durable, efficient packaging, which increases shelf life and maintains product freshness.

The integration of artificial intelligence within the food and beverage metal cans industry has transformed production operations, strengthened product quality assessment, and enhanced manufacturing operations efficiency. The selection process using AI sends defect-free cans to customers, which leads to superior product quality as well as positive brand perception.

This machine learning system maintains precise filling controls to stop excess and insufficient filling while producing homogeneous products with decreased waste output. AI-driven systems provide manufacturers with assistance to detect manufacturing line failures, which enables them to perform maintenance tasks before system breakdowns and production delays develop. The food beverage metal cans market will experience improved efficiency and lower production costs due to AI analytics, according to future expectations, which ensures product uniformity across the supply chain.

The food beverage metal cans market consists of production activities that manufacture packaging containers built specifically for safeguarding food and beverage products. This market offers different categories of products, which consist of beverage cans, food cans, and customized packages for perishable as well as non-perishable goods. The market expands worldwide due to rising customer demand for sustainable yet high-performance packaging solutions while achieving ongoing improvements in materials technology and design.

Food and beverage manufacturers are driving the market because customers want high convenience and extended product lifespan. Metal cans deliver defense against outer elements like air, light, and moisture, so products maintain their quality and freshness. The increasing global consumption of processed foods, ready-to-eat meals, and soft drinks has spurred the necessity for the use of metal cans for packaging. The metal can industry will maintain its expansion because technological developments create improved lightweight and efficient production methods for these containers.

| Report Coverage | Details |

| Market Size by 2034 | USD 99.71 Billion |

| Market Size in 2025 | USD 54.06 Billion |

| Market Size in 2024 | USD 50.50 Billion |

| Market Growth Rate from 2025 to 2034 | CAGR of 7.04% |

| Dominating Region | North America |

| Fastest Growing Region | Asia Pacific |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Type, Material, Application, and Regions. |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa. |

Rising demand for ready-to-eat and convenience foods

The changes in urban lifestyles force people to reduce their meal preparation time, thus speeding up consumer demand for convenient, ready-to-eat foods. The selection of these food options gives working people access to both quick preparation times and nutritious fast foods while maintaining their original values.

The packaging solution of metal cans increases in popularity for ready-to-eat and convenience foods because these products benefit from multiple advantages. Food protection occurs because it can possess the ability to shield food from external elements, including air, light, and moisture. The environmentally advantageous characteristics of metal cans include strength, durability, lightweight, and recyclability properties.

Availability of alternative packaging options

The alternative packaging options, like plastic and glass, limit the expansion potential of the food & beverage metal cans market. Glass stands as a popular choice because its nonreactive nature safeguards food quality and maintains products through long durations. Beverage businesses use glass bottles extensively to safeguard products such as beer through dark containers because these shield content from light-induced decay. Furthermore, plastic packaging shows advantages in market competitiveness due to its adaptable design and its lightweight properties.

Rising innovations in packaging

Research shows that new sustainable packaging options have emerged since consumers started highlighting environmental preservation, while the market has increased significantly. The growing environmental awareness creates a business need for selecting recyclable materials as their preferred packaging materials.

Lightweight production leads to material savings and transportation cost reduction because of reduced weight, while biodegradable coating increases the environmental benefit of packaging. The design has transformed through digital printing, which creates high-quality images and flexible print solutions. Manufacturing techniques help producers generate reduced packaging materials so they can personalize packages based on client specifications.

The two-piece cans segment contributed the largest share of the food & beverage metal cans market in 2024. Producers achieve quick and efficient two-piece can manufacturing, which leads to reduced costs during production. The manufacturing of two-piece cans consumes reduced raw materials to make them more environmentally sustainable. The two-piece design finds widespread use in instant food packaging since it protects contents naturally while eliminating production requirements for thermal processing. The increasing consumer preference for sustainable packaging, which is high quality and cost-efficient, will keep two-piece cans as the market leader in the packaging industry.

The three-piece cans segment is expected to grow considerably in the food & beverage metal cans market over the forecast period. The production process for three-piece cans utilizes basic machinery which enables these containers to work for various manufacturing requirements. The three-piece design contains three essential components, including a cylindrical body section as well as a top portion and a bottom piece that undergo sealing processes. Three-piece cans serve as effective product protectors by lengthening shelf stability, which decreases food waste rates. The printing capabilities directly can enable companies to customize branding and product labeling for harder market competition. The flexible design option enables manufacturers to create distinct custom shapes, which simultaneously improves the useful design and visual presentation of cans. A three-piece structure creates essential brand differentiation options for companies.

The aluminum cans segment accounted for the largest food & beverage metal cans market share. The beverage industry utilizes aluminum cans primarily because they enable quality retention and ease of use, particularly for carbonated beverages. During sterilization, when processors need to cool and heat aluminum, the material remains easy to work with because it maintains protected contents and keeps production costs low. The strong market efficiency of aluminum encompasses efficient recycling capability, which leads to lower environmental hazards through its sustainable practices. The aluminum can finds strong demand in the sectors of carbonated soft drinks and alcoholic beverages, which include beer and wine.

The steel cans segment is anticipated to witness significant growth in the food & beverage metal cans market over the studied period. The superior properties make steel cans outstanding for safeguarding bulky items because they deliver enhanced protection with added tamper-proof characteristics. Steel cans defend products from light, water, and air. Thus, they protect product longevity and minimize food spoilage. Steel cans are suitable for diligent preservation needs in foods and beverages. Steel cans have become a standard packaging solution for large-scale applications because they are cheaper than aluminum. Steel cans find their primary usage in commercial food serving areas because they meet essential durability standards. Steel cans resistant to damage prove ideal for protecting fragile products because they last well throughout transportation periods.

The beverages segment contributed the largest share of the food beverage metal cans market in 2024. The major benefits that beverage cans deliver to customers through portability, convenience, and easy use-based functionality. The beverage cans market is expanding due to rising alcohol beverage sales, including beer and ready-to-drink cocktails. The beverage cans segment will retain its top market status since portable sustainable packaging demand continues to expand.

The food segment is expected to show considerable growth over the forecast period. The market evolves because consumers prefer ready-to-eat, convenient foods. Food cans help maintain freshness and nutritional values for extended periods, thus making them popular among time-conscious people searching for rapid meal options. The food demand will increase due to the progress made in canning technologies that help preserve food products longer.

North America Food Beverage Metal Cans Market Trends

North America accounted for the largest share of the food beverage metal cans market in 2024. North American consumers continuously implement canned food into their diets because of its extended durability, simple storage, and retail options. The growth of this market segment continues because organizations in the region maintain steady investments toward research initiatives and technological improvements for packaging methods.

The United States shows strong growth that results from rising consumer interest and business collaborations in the sector. The upward trend of American consumers focused on health and reduced-calorie beverages drives increasing demand for canned beverages and health products. The U.S. will sustain its leadership role in the food and beverage metal cans industry through investments in sustainable operations and new product advancement.

Asia Pacific Food Beverage Metal Cans Market Trends

Asia Pacific is anticipated to witness the fastest growth in the food beverage metal cans market during the forecasted years. The increasing demand for canned products and beverages stems from rising income levels and urban development in developing nations. With the rising consumer demand for ready-to-eat products, people with hectic lifestyles are choosing metal can packaging. The market expansion is due to rising frozen food intake and alcoholic beverage consumption in South Korea, China, and Japan.

China stands as a leading international fruit and vegetable manufacturer because its raw material supply enables the production of canned foods and beverages. The people with increasing disposable income and a rising urban population in China are fueling the demand for ready-to-eat food and beverages that come in convenient metal cans.

Europe Food Beverage Metal Cans Market Trends

Europe is observed to grow at a considerable growth in the food beverage metal cans market. Market growth will increase with the rise of ready-to-drink products because continuous advancement in metal recycling tools establishes a circular economy that minimizes packaging's environmental impact. Multiple major manufacturers establish their operations through numerous production sites throughout the United Kingdom to benefit the market. High-quality standards prevail in the food industry because of mandatory regulations regarding food safety and packaging requirements.

By Type

By Material

By Application

By Geography

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

January 2025

October 2024

October 2024

January 2025