January 2025

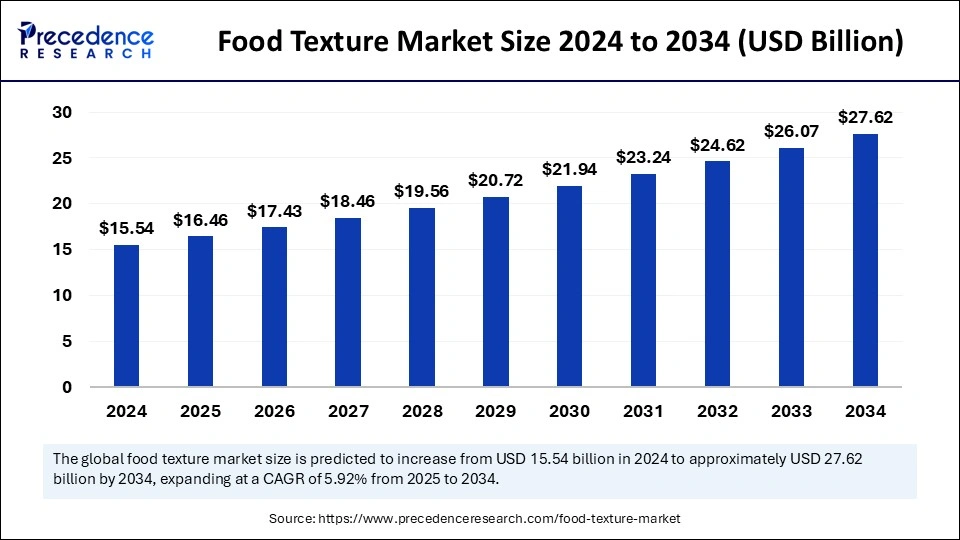

The global food texture market size is calculated at USD 16.46 billion in 2025 and is forecasted to reach around USD 27.62 billion by 2034, accelerating at a CAGR of 5.92% from 2025 to 2034.The market sizing and forecasts are revenue-based (USD Million/Billion), with 2024 as the base year.

The global food texture market size accounted for USD 15.54 billion in 2024 and is predicted to increase from USD 16.46 billion in 2025 to approximately USD 27.62 billion by 2034, expanding at a CAGR of 5.92% from 2025 to 2034.The food texture market is expanding due to rising demand for processed foods, sustainability-driven textures, and evolving lifestyles.

Artificial intelligence is transforming the food texture industry via better, more precise automated texture analysis. Deep learning, and specially CNNs, has made food recognition easier through automatic analysis of textures in RGB and spectral images. With predictive models powered by ANNs, food quality may be predicted, which increases uniformity, while reducing mistakes made by humans.AI-based texture analysis is extremely useful in the dairy, bakery, and plant-based sectors, embedded in the products to make sure of mouthfeel, while ensuring quality control. For instance, some models of AI have been developed by researchers to predict with about 90% accuracy softness in bread and tenderness in meat.

Moreover, the combination of hyperspectral imaging and AI is being used to assess freshness and detect adulteration. The role of AI in understanding food texture is getting wide and broad, incorporating innovations into food processing, quality control, satisfaction among clients, while cutting waste by discerning just-in-time spotting of defects.

The food texture market focuses on ingredients and additives aimed at enhancing texture, consistency, and mouthfeel in food and beverages. Key components in the food industry include hydrocolloids, emulsifiers, starches, and gums, all playing a part to improve stability, viscosity, and sensory appeal. Texture is very important to food formulation as it can influence consumer acceptance, shelf life, and overall quality of the products. The rising demand for processed and convenience foods, plant-based alternatives, and clean-label products is one of the major factors propelling the market growth.

Major applying sectors include dairy, bakery, confectionery, beverages, sauces, and meat substitutes. To manufacture innovative, sustainable, and natural texturizing solutions, manufacturers are investing in R&D. The adoption of plant-based and functional ingredients is shaping the food texture market, as it encourages the development of healthier and more attractive food products. The market is also expected to witness an increase due to the advancement of food technology and growing consumer choice.

| Report Coverage | Details |

| Market Size by 2034 | USD 27.62 Billion |

| Market Size in 2025 | USD 16.46 Billion |

| Market Size in 2024 | USD 15.54 Billion |

| Market Growth Rate from 2025 to 2034 | CAGR of 5.92% |

| Dominated Region | North America |

| Fastest Growing Market | Asia Pacific |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Type, Application, Product, and Regions |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America and Middle East & Africa |

Plant-Based Product Innovation

The rise in consumer demand for plant-based products is significantly influencing the food texture market. Impossible Foods and Beyond Meat are formulating methods in their innovation to make use of plant-derived proteins and emulsifiers to replicate meat's fibrous, juicy texture. Substitutes for dairy made using plants, like oats and almond milk, are stabilizers and texturizers done to replicate the creaminess of conventional dairy.

The mung bean proteins in Just Egg are recreating the gel-like quality held by eggs. Such trends represent an opportunity for ingredient makers to produce clean-label hydrocolloids, starches, and proteins that build mouthfeel without artificial ingredients. Therefore, plant-based innovation encompasses a change in food texture solutions to respond to consumer needs for authenticity and sustainability.

Limited Functional Alternatives for Certain Textures

One key factor that hinders the growth of the food texture market is the difficulty in accurately reproducing complex textures within plant-based and clean-label products. Although some progress has been made, replicating certain textures using natural or plant-derived ingredients remains an obstacle. For example, gluten-free bakery doesn’t get the elasticity and chewiness which gluten delivers, resulting in a product being commonly rather crumbly or dense. Although plant-based meats have taken tremendous steps recently, one still deserves credit for honing in on the marbling and juiciness that animal fat provides for its corresponding mouthfeel.

At the same time, texture issues arise with dairy-free cheese alternatives, which tend to become rubbery or grainy when melted, due to the lack of casein, the key milk protein. These limitations reduce consumer acceptance and slow down market growth. However, research, trials, and consumer testing for developing these functional alternatives take up a lot of time and effort, which hinders their widespread acceptance.

3D Food Printing Reshapes Food Texture Innovation

The advancement of 3D food printing technology is another highly significant emerging factor creating opportunities in the global food texture market. By allowing for precise control over food textures, 3D food printing can create very complex structures with personalized mouthfeel experiences. For example, Austrian food Tech Company Revo Foods has recently introduced to German supermarkets its 3D-printed plant-based salmon filet, a landmark case in the commercialization of 3D-printed food products.

Also, researchers are working on using insect protein powders in 3D printing to create healthy, beautiful food items that tackle the shortcomings of sustainability and consumer acceptance. These new advances signify that 3D food printing in food texture design will foster the fulfilling of changing consumer tastes and support sustainability pursuance efforts.

In 2024, cellulose derivatives witnessed the lead in food texture market. Increasing consumer preference for clean-label ingredients sourced from plants is spearheading their cause. Food manufacturers use cellulose derivatives to add texture, maintaining transparency in the ingredient lists. These derivatives provide a naturally derived, attractive alternative to synthetic additives that conform to the demands for minimally processed foods.

The starch segment is anticipated to witness the fastest growth during the forecast period. Rising application of starch-based texturizers, for their multifunctional properties in terms of thickening, gelling, and stabilizing, really gives them a fill up. Since plant-based and gluten-free product demand is skyrocketing, many manufacturers are more and keener to use modified and native starches in order to improve texture while maintaining the integrity of their labels. Further application of starch in dairy, bakeries, and ready-to-eat meals encourages its rapid expansion.

The dairy products and ice cream segment held the largest share in food texture market. The continued demand for premium-textured, indulgent dairy substances has stimulated the growth of texture-enhancing ingredients. Moreover, smooth and creamy texture has become a deciding factor in attracting customers. Hence, manufacturing companies use stabilizers and emulsifiers to improve the mouthfeel consistency in ice creams and dairy-based drinks.

The bakery segment will witness the fastest growth during the forecast period. With market changing trends to the consumers' expectations, soft-chewy and airy baked goods trigger higher demand for texture-modifying ingredients. More and more textures, such as natural hydrocolloids, are being introduced into products. However, these include enzymes and emulsifiers to improve dough stability and expand its shelf life while maintaining its freshness. Growing consumer demand for gluten-free and high-protein bakery products has further contributed to rapid growth.

In 2024, the natural segment led the market. The growing demand for genuinely clean-label food from consumers is convincingly in favor of naturally sourced texturizers. Brands focus on transparency and the least amount of processing, utilizing natural food ingredients, such as pectin, gums, and starches, which can assist in boosting texture without disputing label value. This is further driven by increasing health awareness as well as regulatory backing for natural food additives.

The synthetic segment shows significant market growth due to cost-effective and functionality-cantered options. In several cases, synthetic texturizers provide much better stability and prolonged shelf life with consistent activities. This is vital for large-scale food production. Therefore, with a predominant focus on cheaper commodities along with production efficiency, synthetic ingredients are widely embraced into confectionery, sauces, and ready-to-eat meals. However, modern innovations are essentially required to align synthetic options with increasing clean-label tendencies.

North America Food Texture Market Trends

North America held the dominating share of the market in 2024; the food texture market is in a state of significant transition, infused by what the consumer’s desire; healthier options, technological advancements, and ever-changing regulations. The movement toward clean-label, plant-based, and allergen-free foods have driven manufacturers to seek out new ways of texturizing their products to fit the sensory appeal. In the U.S., government-driven initiatives and industry-led innovations are influencing the food texture market. The Food and Drug Administration (FDA) has put forth proposed regulations for front-of-package (FOP) labelling that call for warning labels on packaged foods high in fat, sugar, and sodium.

The intention is to help arrest the rise in obesity and diseases of lifestyle through consumer nudging toward healthier reformulation by the manufacturers, which in turn impacts texture. Fast-food chains and processed food manufacturers alike are also grappling with alternative creative enhancements of texture while following in accordance with consumer preferences that lean toward more natural and less-processed eating experiences.

Canada Food Texture Market Trends

In Canada, the plant-based and alternative proteins market is growing rapidly with a focus on texture, among other things. NECTAR, a Canadian food innovation research initiative, performed blind taste tests with over 1,150 omnivores to assess the textural integrity of plant-based meat products. The "Taste of the Industry 2024" report reviewed over 54 different plant-based meat products across several categories, with a particular emphasis on enhancing bite, chew, and juiciness-those appealing properties cited by consumers as crucial for acceptance. Add to this the government initiatives supporting agrifood innovation that have also fueled the development of texturizing ingredients from pea proteins, lentils, and seaweed, all helping Canadian food manufacturers to keep pace with a changing landscape.

Asia Pacific Food Texture Market Trends

Asia Pacific is seen to grow at the fastest rate in the upcoming years, driven by urbanization, changing dietary habits, and a blend of some modern and some traditional food composition. More and more consumers are drawn toward processed and convenience foods with a range of textures, and are demanding natural ingredients and clean-label products at the same time. Companies are thus taking advantage of the advanced food processing techniques, fermentation, and plant-based ingredients to enhance textural quality across various food categories, while supported by governments that are encouraging food innovation and sustainability.

China Food Texture Market Trends

Chinese food industry is relying on innovations in texturizing agents and ingredients as processed food consumption continues to grow. Snack, bakery, and confectionery textures are increasingly driven by the demand for a multi-layered, chewy, and crispy experience. One popular product example is Xinqitian's 3D peel-off gummies, which allow consumers to literally peel away layers for a novel textural adventure more evocative of interactive food. China is also pushing for reduced food waste, which has led to the advent of restructured and reformulated foods that, while appealing to texture factors, also protract shelf life.

Europe's Food Texture Market Set for Remarkable Growth

Europe is observed to grow at a considerable growth rate in the upcoming period, driven by sustainability and regulations as well as changes in consumer-bearing preferences. A greater excellence of texture in alternative proteins and dairy-free products is now required, transforming Europe into an area for the growth of plant-based diets. Natural ingredients instead of artificial texturizers are preferred by consumers; therefore, hydrocolloids and fibres are employed. Such EU policies as the Farm to Fork Strategy favour sustainable kinds of innovation. Modern technologies of fermentation, biotechnology, and HPP continue improving textures, assuring the integrity of products and sensorial appeal.

UK Food Texture Market Trends

The United Kingdom is taking the lead on innovations in food texture, to improve the sensory attraction of alternative protein and sustainable food products. Companies are harnessing the power of extrusion technology and fermentation-derived texturizers to remedy mouthfeel, with brands such as THIS™ and Meatless Farm dealing with things like bite resistance and moisture retention. The Food Standards Agency is now taking active regulation of texturizing ingredients, aimed at ensuring safety and transparency. With the continued influx of investments in food tech startups, the UK is emerging as a leader in next-generation texture optimization for all kinds of food categories.

By Type

By Application

By Product

By Geography

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

January 2025

January 2025

September 2024

January 2025