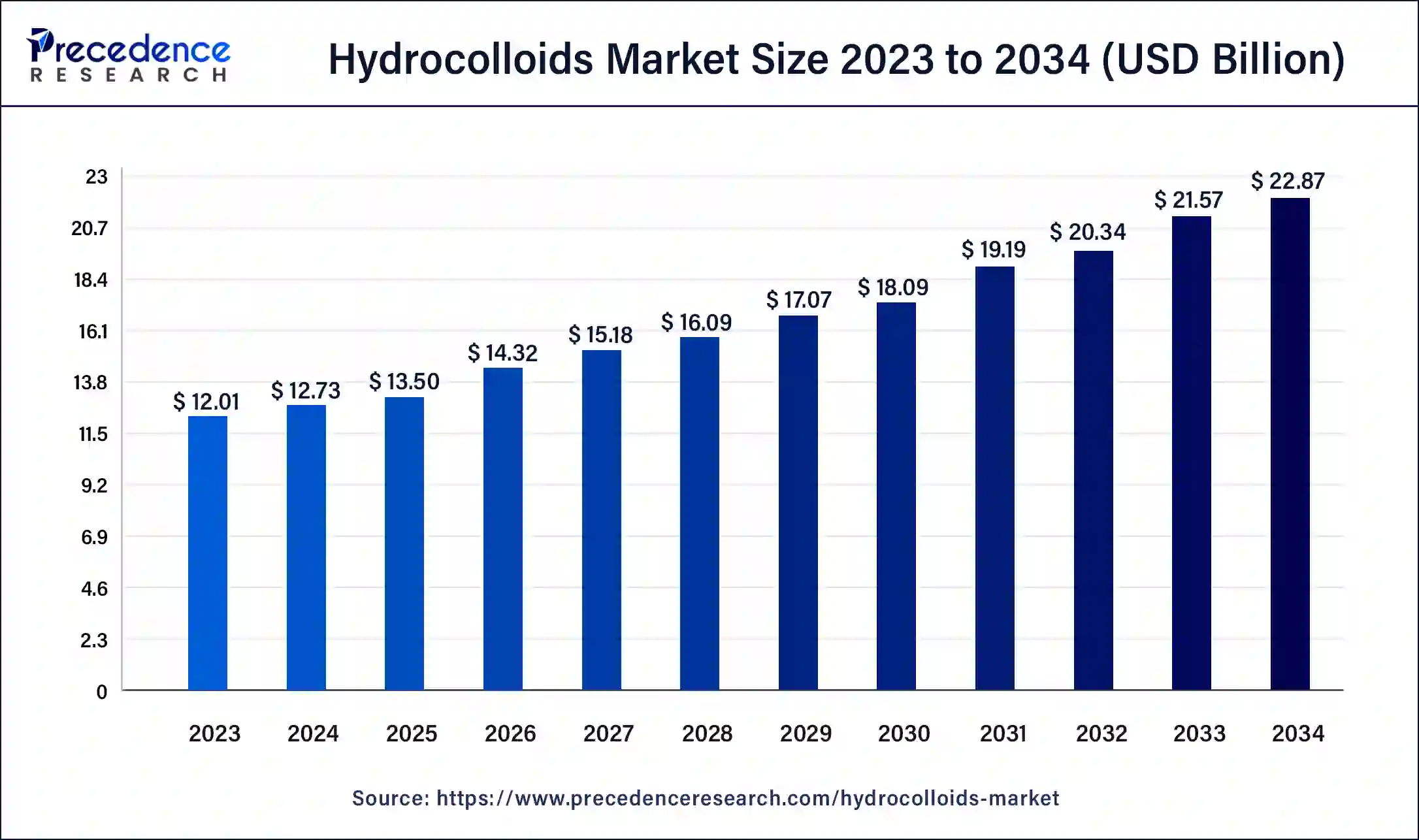

The global hydrocolloids market size was USD 12.01 billion in 2023, calculated at USD 12.73 billion in 2024 and is expected to be worth around USD 22.87 billion by 2034. The market is slated to expand at 6.03% CAGR from 2024 to 2034.

The global hydrocolloids market size is worth around USD 12.73 billion in 2024 and is anticipated to reach around USD 22.87 billion by 2034, growing at a CAGR of 6.03% over the forecast period 2024 to 2034. The burgeoning food, pharmaceutical, & cosmetic sectors, changing consumer preferences, growing research & development, and increasing investments & collaborations drive the market.

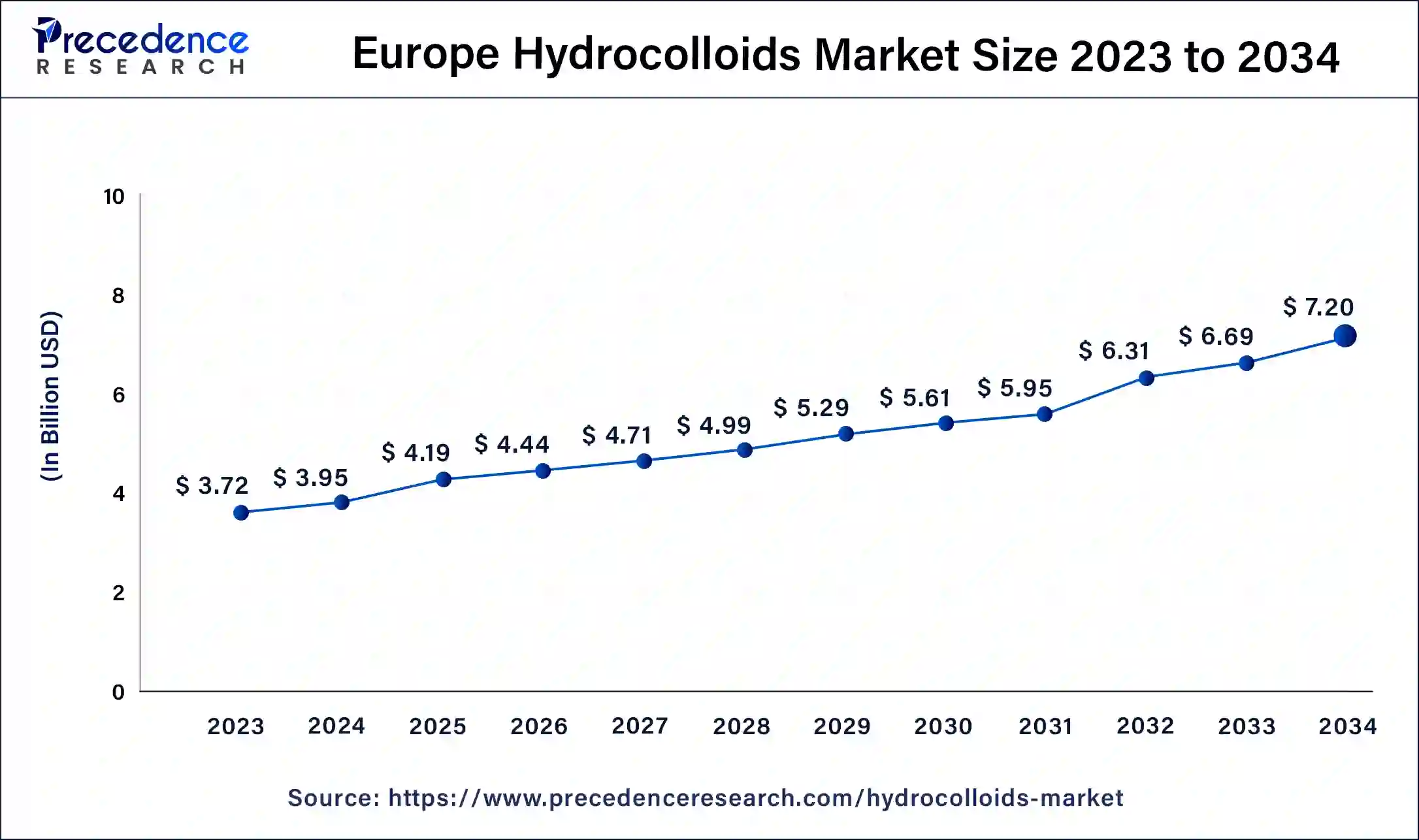

The Europe hydrocolloids market size was exhibited at USD 3.72 billion in 2023 and is projected to be worth around USD 7.20 billion by 2034, poised to grow at a CAGR of 6.18% from 2024 to 2034.

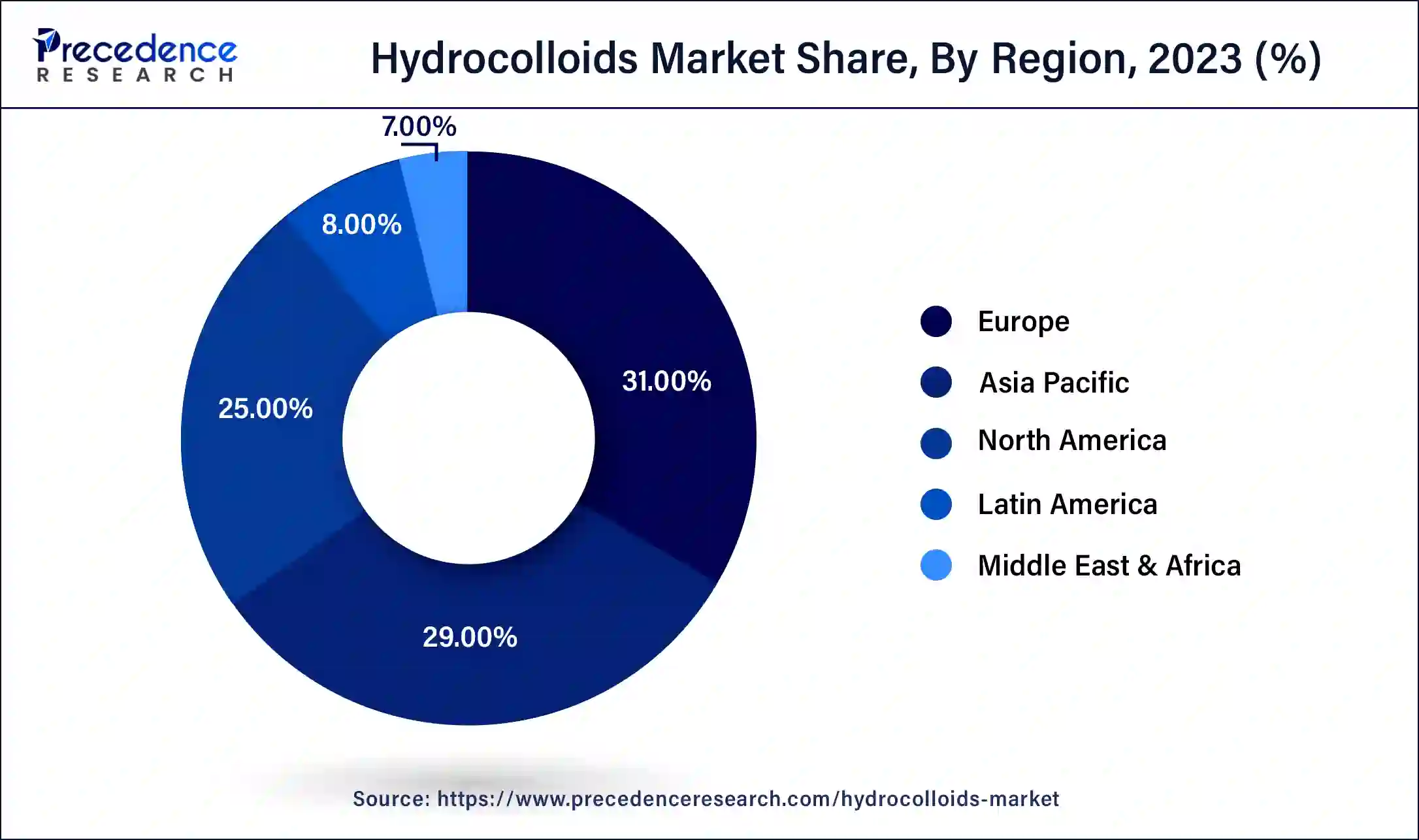

Europe held the largest share of the hydrocolloids market in 2023. The favorable government policies, increasing investments & collaborations, demand for sustainability, and rising food, pharmaceutical, and cosmetic sectors in the region drive the market. Europe is the second-largest global cosmetic products market. Germany is the largest cosmetic products market in Europe, followed by France, Italy, the UK, Spain, and Poland. The increasing demand for packaged and vegan foods increases the use of seaweed hydrocolloids in Europe.

Asia-Pacific held the second-largest share of the hydrocolloids market in 2023. The increasing population, rapid urbanization, changing consumer demands, favorable government policies & investments, increasing collaborations, increasing manufacturing sector, and presence of key players drive the market. The market is also driven by booming food, pharmaceutical, textile, and cosmetic sectors in the region.

The Indian Government’s initiatives, like the World Food India event, spread awareness about food processing and its rich culinary traditions and enhanced investments in the sector to boost the food processing industry in the world. India’s food sector attracted around $6.79 billion in FDI equity inflow from 2014 to 2023.

China has the second-largest packaged food market in the world, with an estimated sales of $327.6 billion in 2023. Indonesia is a major producer of carrageenan seaweed hydrocolloids. It exports almost all of its hydrocolloids to China, supported by significant Chinese investments in Indonesian processing. Additionally, the growing research & development activities within the region and rising R&D investments augment the market.

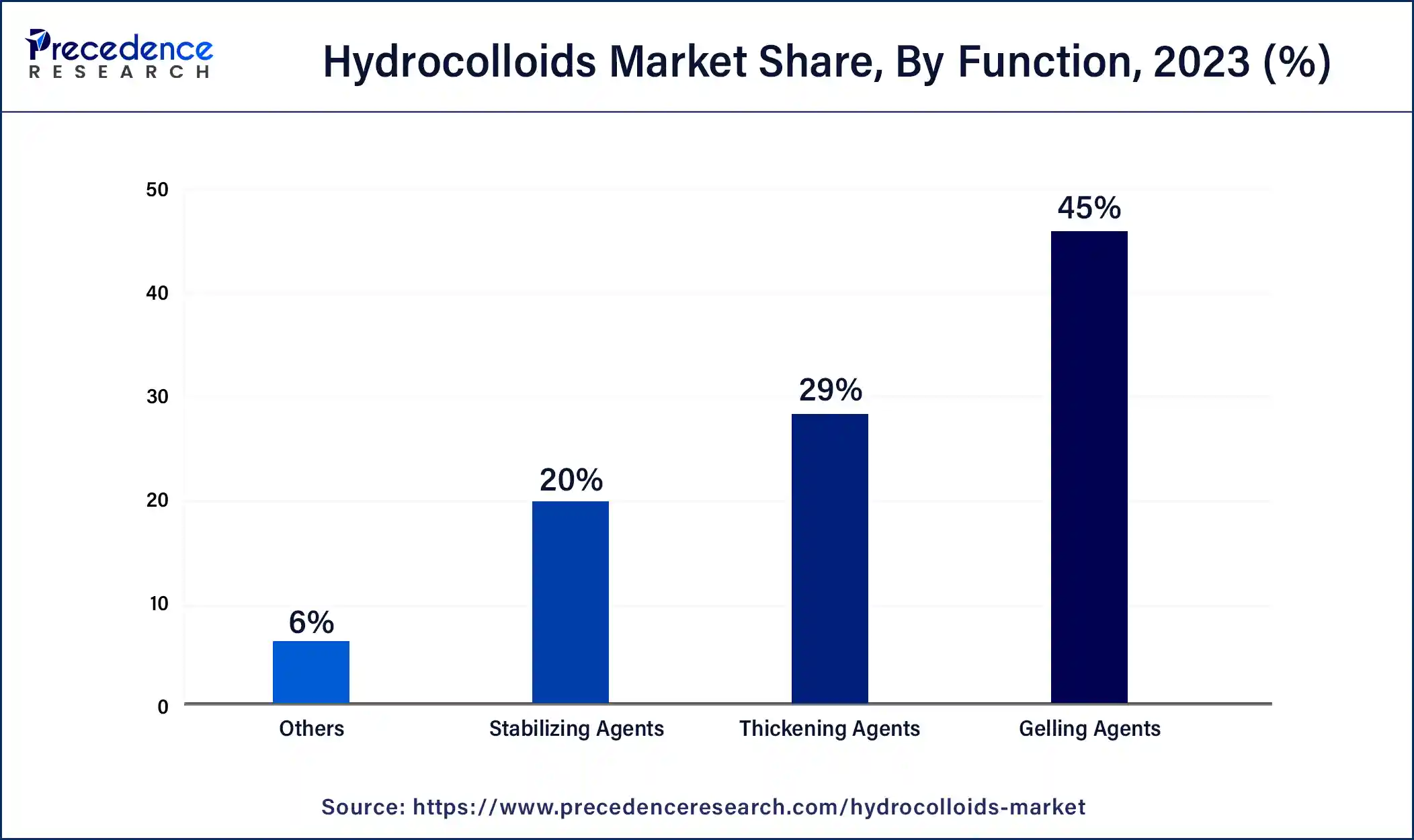

Hydrocolloids are polysaccharides or proteins possessing the property of forming gels in water. Their properties depend on their solubility, viscosity, gel strength, and interaction with other ingredients. Hydrocolloids commonly used are carrageenan, agar, pectin, guar gum, xanthum gum, and gelatin. They are predominantly used in the food industry as stabilizers, thickening agents, gelling agents, emulsifiers, and texture modifiers. They are also used in the pharmaceutical, personal care, textile, and other industries. In the pharmaceutical industry, they are used as binders, disintegrants, and controlled-release agents in tablets and capsules. They are also used in wound dressings as absorbents and gelling agents. Additionally, they are used in personal care products, including lotions, shampoos, and toothpaste.

How Can AI Improve the Hydrocolloids Market?

Artificial Intelligence (AI) is integrated into numerous fields for advancements in the field to reduce cost, increase productivity, and attract customers. Researchers are investigating the role of AI in the hydrocolloids market. However, it is demonstrated that AI and machine learning algorithms can aid in determining the properties of hydrocolloids. According to a 2024 study, researchers used machine-learning algorithms to predict the flow behavior of hydrocolloids, which were subsequently correlated with the textural features of their corresponding plant-based meat analogs.

Furthermore, one of the most common applications of AI is 3D printing. 3D printing is an expanding technique with recent potential applications in the food, biomedicine, and environment. The demand for environmental sustainability and safer products leads to the development of bio-ink. Bio-ink utilizes hydrocolloids and starch to improve its rheological properties, structure, and printability. 3D printing is widely used in the food industry to produce plant-based meat and meat-based products. Hydrocolloids affect the yield stress, viscosity, shear-thinning behavior, and shear recovery of different meat-based inks.

| Report Coverage | Details |

| Market Size by 2034 | USD 22.87 Billion |

| Market Size by 2024 | USD 12.73 Billion |

| Market Growth Rate from 2024 to 2034 | CAGR of 6.03% |

| Largest Market | Europe |

| Base Year | 2023 |

| Forecast Period | 2024 to 2034 |

| Segments Covered | Product, Function, Application, and Regions |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America and Middle East & Africa |

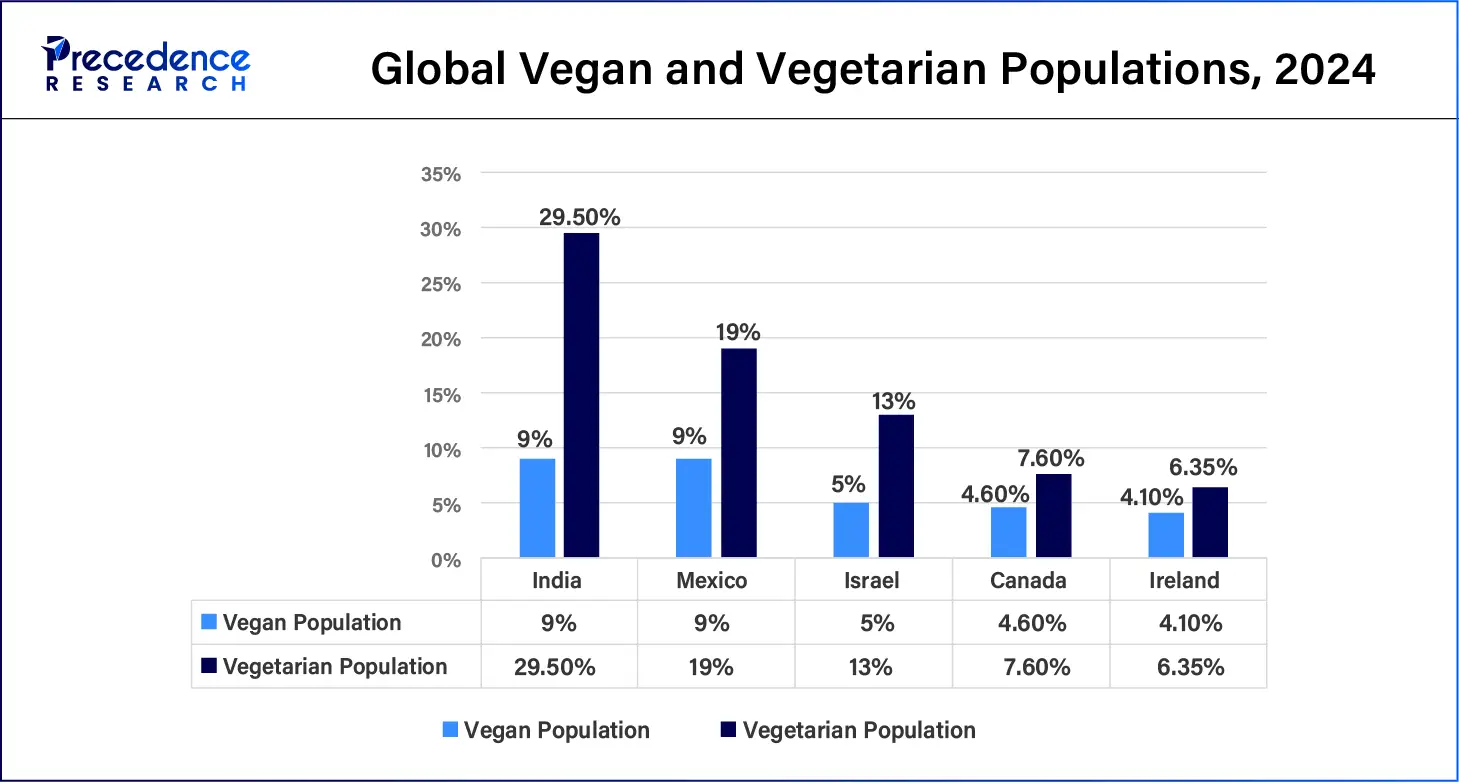

Rising demand for vegan food

There has been a rapidly rising demand for vegetarian or vegan food globally among the population over the last decade. The surge may be due to environmental concerns, combating intensive farming, or religious convictions. More people are shifting towards plant-based foods to substitute animal-based products. This leads to an increasing demand for plant-based hydrocolloids in the food and other sectors. India, Mexico, Israel, Canada, and Ireland are the top five countries globally with the highest vegan & vegetarian populations, followed by Sweden, Denmark, Norway, Italy, and Japan.

Examples of plant-based vegan hydrocolloids include agar-agar, carrageenan, pectin, and sodium alginate. These natural hydrocolloids offer similar textures and consistencies, allowing chefs and manufacturers to create delicious and ethical plant-based dishes. Hence, these natural hydrocolloids offer a sustainable and ethical alternative to animal-based ingredients in vegan and vegetarian foods.

Supply chain issues

The major challenge of the hydrocolloids market is the imbalanced supply chain. The high global demand across various sectors leads to insufficient supply, causing disruptions in the supply chain. This challenge is majorly caused by a shortage of raw materials. The demand for natural hydrocolloids makes it difficult to supply sufficient amounts of raw materials due to poor agricultural productivity and climate change. Additionally, it can also be caused by a shortage of labor, affecting agricultural activities and transportation. These factors hinder the market growth.

Booming cosmetic sector

The cosmetic sector is booming worldwide due to increased innovative products, growing interest in wellness and health, and increased investments. Hydrocolloids play an essential role in cosmetic and personal care products to improve stability, viscosity, and emulsifying properties. They are widely used in products like lotions, shampoos, toothpaste, and shaving foams. One of the major advantages of hydrocolloids in cosmetic products is their ability to provide hydration and moisturization to the skin. Hence, formulators select suitable hydrocolloids based on their properties to make high-quality products that meet consumer demands. Additionally, hydrocolloids can help reduce inflammation and redness for sensitive or irritated skin. Hence, it can improve skin texture, leaving it soft and revitalized. According to the Cosmetic, Toiletry & Perfumery Association, the U.S. had the largest market in 2023, followed by Europe, China, Brazil, Japan, India, and South Korea.

The gelatin segment dominated the hydrocolloids market in 2023. Gelatin is the most commonly used hydrocolloid of a natural origin derived from animal meat for human consumption. Although it is used in many industries, it is predominantly used in the food industry. Like other hydrocolloids, it acts as a thickening, stabilizing, gelling, foaming, emulsifying, and texturing agent. It has widespread use in confectionary, dairy, meat, and bakery products. However, it offers superior advantages over other hydrocolloids. It is a clean-label product and does not require any chemical modification. It is a completely safe product as it has received GRAS (Generally Recognized as Safe) status. It is easy to digest and can be consumed daily. Additionally, it has a longer shelf life, stabilizing food for easier transport and storage.

The xanthan gum segment is expected to grow at a significant rate in the hydrocolloids market during the forecast period. Xanthan gum is a natural polysaccharide obtained from a bacteria found on the leaf surfaces of green vegetables. The demand for natural and vegan foods increases the demand for xanthan gum. Xanthan gum has high stabilizing and suspending properties, excellent freeze-thaw stability, and is resistant to wide pH ranges, temperature variations, and enzymatic degradation. Xanthan gum is widely used in the food sector in salad dressings, sauces, desserts, dairy, and bakery products. It is also used in toothpaste, lotions, shampoos, and formulations such as tablets in the cosmetic and pharmaceutical sectors. Additionally, it is used in cleaners & detergents, feed & pet food, and other industrial applications, including adhesives & sealants, fertilizers, paper, textile, and ore mining.

The thickening agents segment is anticipated to grow with the highest CAGR in the hydrocolloids market during the studied years. A thickening agent increases the viscosity of the liquid without changing the liquid. Hence, a thickening agent is used to increase flow property without affecting the taste. It is used in soups, gravies, jams, jellies, and sauces. The most commonly used thickening agents include guar gum, cassia gum, agar, pectin, xanthan gum, carrageenan, etc. Furthermore, it is used in pharmaceutical formulations like liquid and semisolid oral and topical, parenteral, and matric-based solid dosage forms. It is also used to stabilize suspensions. A thickening agent is used in personal care products to provide more appealing consistency and smoothness.

The stabilizing agents segment is anticipated to grow significantly in the hydrocolloids market during the forecast period. Hydrocolloids are extensively used as emulsifying and stabilizing agents. Emulsions are unstable formulations that tend to break down into oil and water. Emulsifiers are surface-active agents that adsorb at the oil-water interface and protect the formed droplets against coalescence. The most commonly used hydrocolloids as stabilizing agents include gum arabic, modified starches, modified celluloses, and some kinds of pectin and galactomannans. Hydrocolloids like xanthan gums can also slow down or prevent creaming by modifying the rheology of the continuous phase, stabilizing the formulation. Stabilizing agents are primarily required in food, pharmaceutical, and cosmetic applications.

The food & beverage segment held the dominant share of the hydrocolloids market in 2023. The food & beverage sector is a rapidly growing industry globally. Hydrocolloids possess versatile applications in the food industry as thickening, gelling, stabilizing, and emulsifying agents. They are used in a variety of food preparations like soups, gravies, salad dressings, beverages, sauces, etc., to improve stability and enhance the quality of the food. They also aid in increasing the shelf life of the products. Thus, the use of hydrocolloids attracts more customers, fulfilling their requirements and generating revenue. The rising investments in the food & beverage sector, changing consumer demands due to the increasing population, and technological advancements drive the market. Furthermore, the growing research and development activities promote new and innovative hydrocolloids with advanced properties and novel applications within the food & beverage industry.

Segments Covered in the Report

By Product

By Function

By Application

By Geography

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client