September 2024

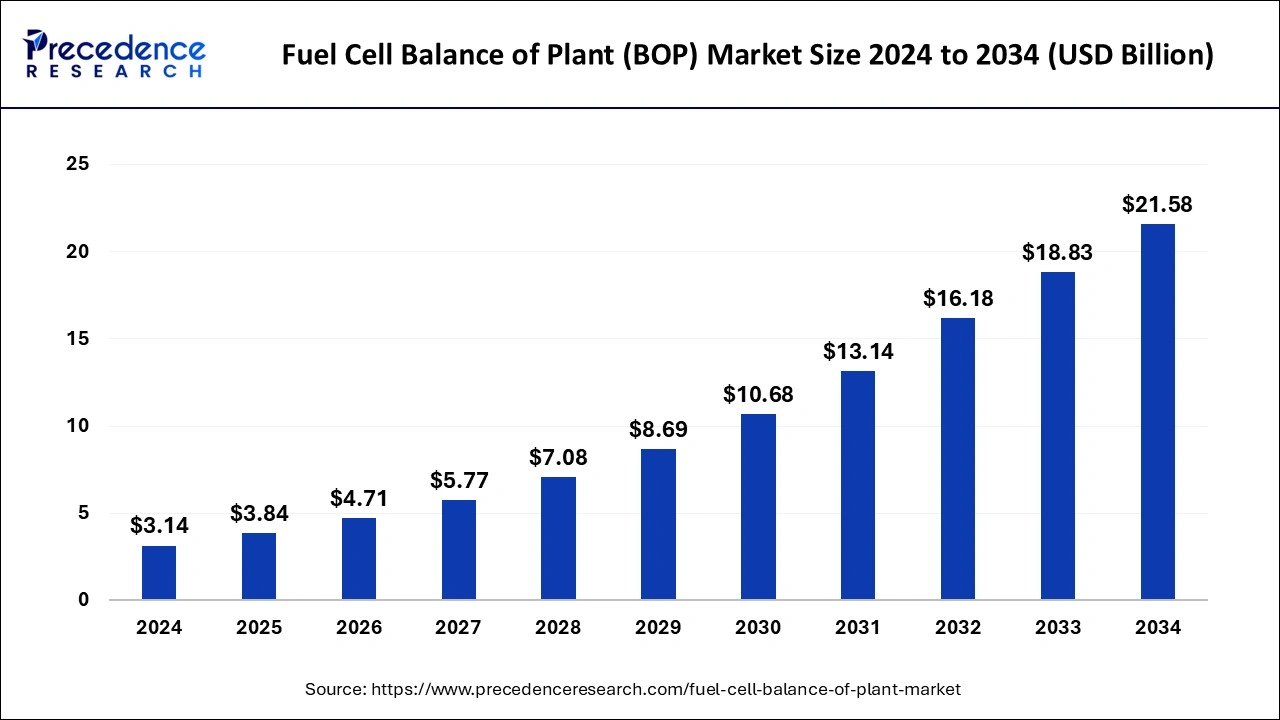

The global fuel cell balance of plant (BOP) market size is estimated at USD 3.84 billion in 2025 and is predicted to reach around USD 21.58 billion by 2034, accelerating at a CAGR of 21.25% from 2025 to 2034. The Asia Pacific fuel cell balance of plant (BOP) market size surpassed USD 1.92 billion in 2025 and is expanding at a CAGR of 21.38% during the forecast period. The market sizing and forecasts are revenue-based (USD Million/Billion), with 2024 as the base year.

The global fuel cell balance of plant (BOP) market size was estimated for USD 3.14 billion in 2024 and is anticipated to reach around USD 21.58 billion by 2034, growing at a CAGR of 21.25% from 2025 to 2034. The exciting applications of fuel cells in automotive, stationary power generation, and portable devices resulting in efficient BOP operations, air, fuel, water, and temperature management, cost reduction, and power conditioning fuels the expansion of the fuel cell balance of plant (BOP) market

Artificial intelligence, machine learning, and real-time data analytics allow for addressing the nonlinearity and dynamic behavior in reactor operations. The implementation of AI and the Internet of Things (IoT) enables the creation of systems that give early warning. AI-powered systems allow for real-time data transmission to regulatory authorities and decision-makers, which ensures better coordination during incidents. AI-driven monitoring systems enhance operational efficiency, safety, and decision-making capabilities. By combining AI and mobile computing within data sources, operators and researchers can analyze the system’s behavior which helps in making correct informed decisions through the prediction and monitoring of the overall plant’s behavior in real-time.

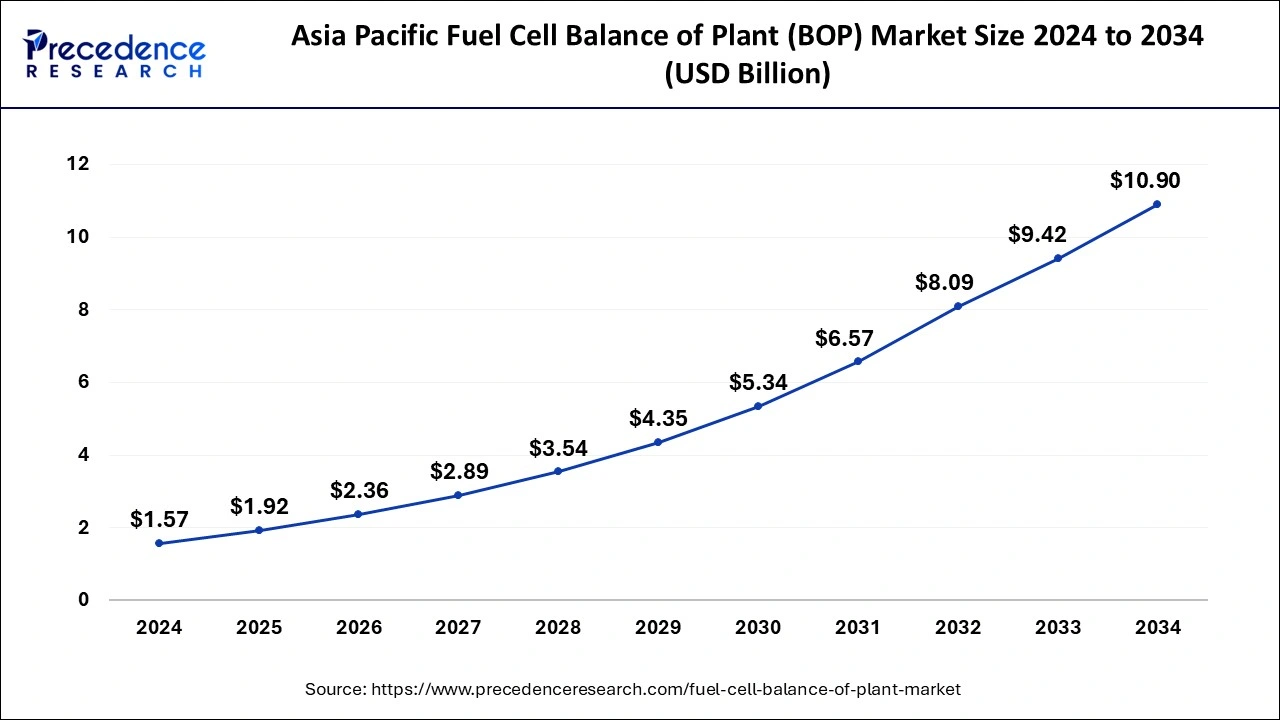

The Asia Pacific fuel cell balance of plant (BOP) market size was estimated at USD 1.57 billion in 2024 and is anticipated to be surpass around USD 10.90 billion by 2034, rising at a CAGR of 21.38% from 2025 to 2034.

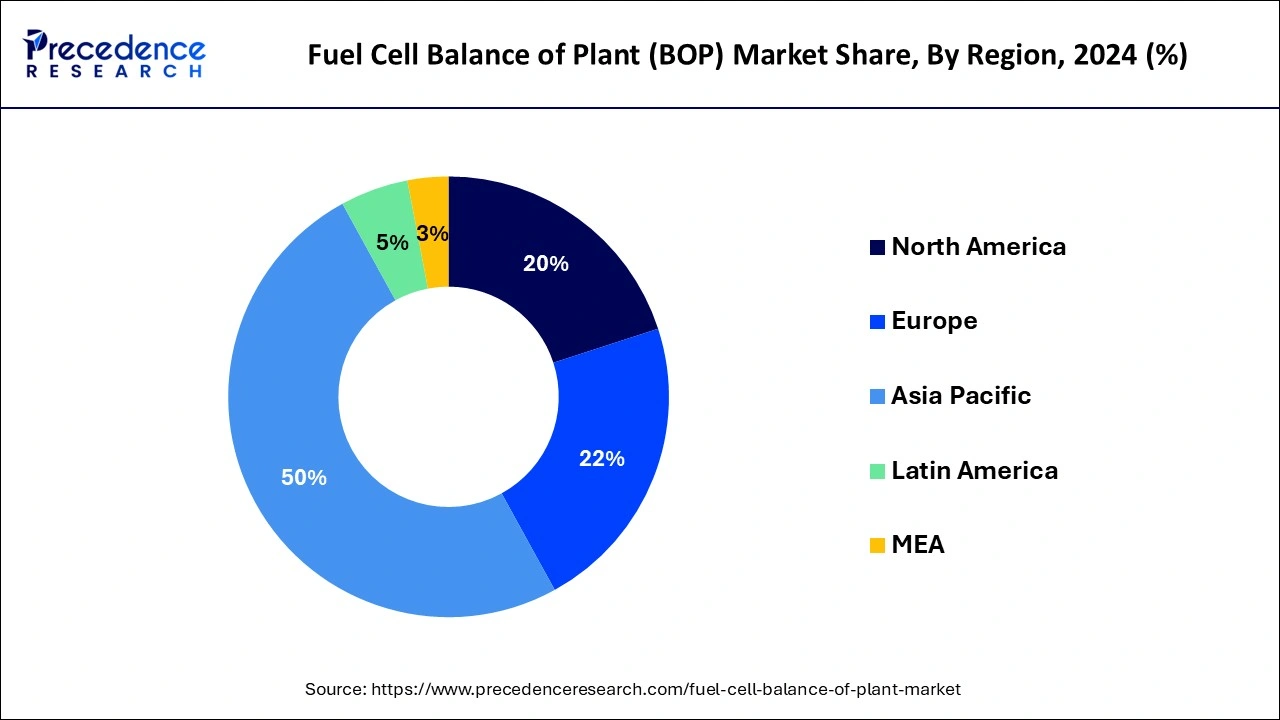

Asia Pacific dominated the global fuel cell balance of plant (BOP) market with the largest share of 50% in 2024. It has experienced rapid economic growth, industrialization, and urbanization, leading to increased energy demand. Many countries in the Asia-Pacific region have adopted policies and initiatives to support clean energy technologies. These include subsidies, incentives, and targets for renewable energy and emission reduction, creating a favorable environment for fuel cell adoption. Thus, the demand for clean and efficient energy solutions, such as fuel cells, has grown significantly across the region.

The strategies and policies in the Asia Pacific region encourage fuel cell systems for transportation applications in India, China, Japan, and South Korea. Japan primarily deals with fuel cells followed by South Korea. The significant demand for power systems and combined heat in Japan and other countries fuels the robust growth of the market in the Asia Pacific region. A strong government support and strategic market focus drive the market’s growth in Japan. Japan leads the market by being the first to commercialize residential fuel cell systems. Adopting hydrogen energy as a sustainable solution in Japan boosts this country’s growth due to imported energy sources.

North America is projected to grow at the fastest CAGR during the forecast period. In this region, the fuel cell balance of plant (BOP) market is witnessing robust ecosystem for fuel cell research, development, and innovation. Government-funded initiatives, research institutions, and private sector investments drive technological advancements. North America is experiencing a surge in interest in fuel cell vehicles (FCVs). Automakers are developing and commercializing FCVs, with a particular focus on hydrogen-powered trucks and commercial vehicles. This trend is expected to boost the fuel cell BOP market for transportation applications.

The supportive legislation in the North American region aiming at reducing carbon emissions drives the market’s growth in this region. The available financing for fuel cell R&D initiatives also boosts the demand for the fuel cell BOP market. The growing awareness of the U.S. population towards clean energy and favorable government initiatives aiming to reduce carbon emissions accelerate the need for fuel cells in the regional market. Several policies and incentives offered by the government help to promote the development and adoption of fuel cell technologies.

Various European countries, such as Germany, the United Kingdom, and France, have been actively supporting the development and adoption of fuel cell technology. Government incentives, subsidies, and funding programs promote the use of fuel cells in various applications. Also, Europe is actively developing a hydrogen economy, with a focus on green hydrogen production and utilization.

The fuel cell balance of plant (BOP) is a component and systems that are required to support and operate a fuel cell system efficiently. These cells are devices that electrochemically convert the energy stored in a fuel, usually hydrogen, into electricity with nominal emissions and greater efficiency. The fuel cell BOP is a vital part of the whole fuel cell system, and its efficiency and design create a significant role in the overall performance and commercial viability of fuel cell technology. It is crucial for integrating fuel cells into various applications, such as automotive, stationary power generation, and portable devices.

Advancements in BOP components and their improved efficiency have played a crucial role in enhancing the overall performance of fuel cell systems, making them more commercially viable and environmentally friendly. This market growth is also fueled by government incentives and regulations promoting clean energy solutions. The Fuel Cell BOP market continues to evolve, with a focus on reducing costs, improving reliability, and expanding applications, promising a sustainable and cleaner energy future.

| Report Coverage | Details |

| Growth Rate from 2025 to 2034 | CAGR of 21.25% |

| Market Size in 2025 | USD 3.84 Billion |

| Market Size by 2034 | USD 21.58 Billion |

| Largest Market | Asia Pacific |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | By Component and By End User |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Reducing greenhouse gas emissions

As societies around the world confront the existential threat of climate change, there is a growing emphasis on transitioning to cleaner and more sustainable energy sources. Fuel cells, known for their minimal greenhouse gas emissions, are emerging as a vital component of this transition. They can generate electricity with remarkable efficiency while producing little to no harmful emissions, especially when supplied with hydrogen generated from renewable sources or green hydrogen production methods. In response to this environmental crisis, governments, both at the national and local levels, are enacting stringent regulations and emission reduction targets.

For instance, the U.S. implemented a range of policies designed for mitigating greenhouse gas (GHG) emissions and at least 16 states and Puerto Rico have ratified legislation establishing GHG emissions lessening requirements, with more requiring state agencies to report or inventory GHG emissions.

In addition, consumers are showing a growing preference for products and services that align with their environmental values, further fueling the demand for clean energy solutions like fuel cell BOP systems. As the urgency to reduce greenhouse gas emissions intensifies, the fuel cell BOP market plays a pivotal role in providing a sustainable, low-emission alternative to conventional power generation, offering a pathway towards a cleaner and more environmentally responsible energy future.

Higher initial costs

Fuel cell technology, while promising clean and efficient energy generation, often comes with a substantial upfront investment. These elevated capital expenses encompass the manufacturing and installation of fuel cell systems, as well as the development of supporting infrastructure, particularly in the case of hydrogen fuel cells. Businesses and organizations may find these upfront costs daunting, leading to uncertainty regarding the return on investment. Long payback periods and substantial financial commitment can discourage potential adopters. Moreover, high capital requirements heighten the financial risk associated with fuel cell projects, dissuading investors and businesses from engaging with the technology. Access to favorable financing terms and loans can be a hurdle, particularly for smaller enterprises.

The perception of high risk associated with unproven technology and the need for infrastructure development further compound the cost-related restraints. While high initial costs present a formidable challenge, government incentives, subsidies, and tax credits can help alleviate the financial burden on adopters. Continued research and development efforts, economies of scale, and advancements in manufacturing processes hold the promise of reducing these costs, making fuel cell BOP systems more accessible and competitive over time. As the industry matures and technological innovations continue, the fuel cell BOP market may overcome this restraint, unlocking its full potential.

Green hydrogen production, storage, and distribution

Green hydrogen, produced through a process of electrolysis using renewable energy sources such as wind and solar power, is considered a key enabler of a sustainable and low-carbon energy future. It offers several advantages for fuel cell technology. First, it addresses one of the critical challenges of fuel cells: the source of hydrogen. Producing hydrogen through renewable means, it ensures a clean and sustainable fuel source, reducing the environmental footprint of fuel cell systems.

This green hydrogen can be stored and transported, making it accessible for various applications and locations. It can also serve as an energy carrier, allowing excess renewable energy to be stored and later used for power generation. This capability aligns with the intermittent nature of renewable energy sources, providing grid stability and energy reliability.

The fuel cell BOP market stands to benefit significantly from the rise of green hydrogen. As the demand for green hydrogen increases, there's a growing need for efficient and reliable BOP systems to support fuel cell applications across industries. Fuel cells powered by green hydrogen are poised to play a crucial role in sectors like transportation, stationary power generation, and industrial applications, further propelling the demand for fuel cell BOP components. Thus, the increasing production, storage, and distribution of green hydrogen are creating a synergistic relationship with the fuel cell BOP market.

The power supply segment has held the biggest market share in 2024. The power supply component is a critical element of a fuel cell BOP system, as it provides the electrical power needed for various functions within the system. This includes supplying power to the fuel cell stack, control systems, and auxiliary components. The stability and reliability of the power supply are paramount to ensure the overall efficiency and performance of the fuel cell.

The hydrogen processing segment is anticipated to grow at a remarkable CAGR during the forecast period. Hydrogen processing components are responsible for storing, purifying, and delivering hydrogen to the fuel cell stack. They play a pivotal role in ensuring a consistent and high-quality supply of hydrogen fuel for the electrochemical reaction.

The structural plastics segment generated the highest market share in 2024. In the fuel cell balance of plant (BOP) market, structural plastics are mainly used in the construction of various BOP components, providing lightweight and durable solutions. These materials are essential for ensuring the structural integrity and longevity of the BOP components.

The elastomers segment is expected to expand at the fastest CAGR over the projected period. Elastomers are flexible and elastic materials commonly employed in seals, gaskets, and other components that require a degree of pliability and resilience to maintain airtight or watertight seals and connections in the BOP.

By Component

By End User

By Geography

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

September 2024

January 2025

December 2024

January 2025