List of Contents

Fuel Cell Electric Vehicle Market Size and Forecast 2025 to 2034

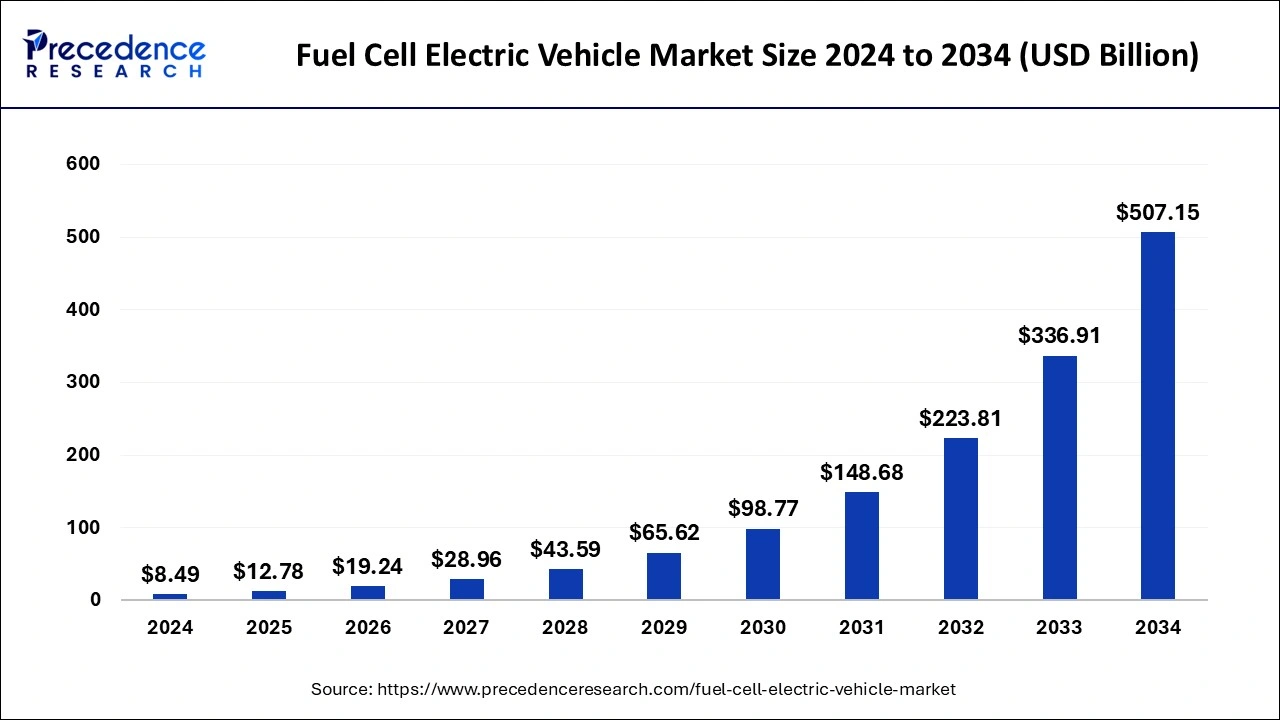

The global fuel cell electric vehicle market size was accounted for USD 8.49 billion in 2024 and is anticipated to reach around USD 507.15 billion by 2034, growing at a CAGR of 50.53% from 2025 to 2034. The rising demand for electric vehicles due to growing concern for environmental issues has raised the fuel cell electric vehicle market demand.

Fuel Cell Electric Vehicle Market Key Takeaways

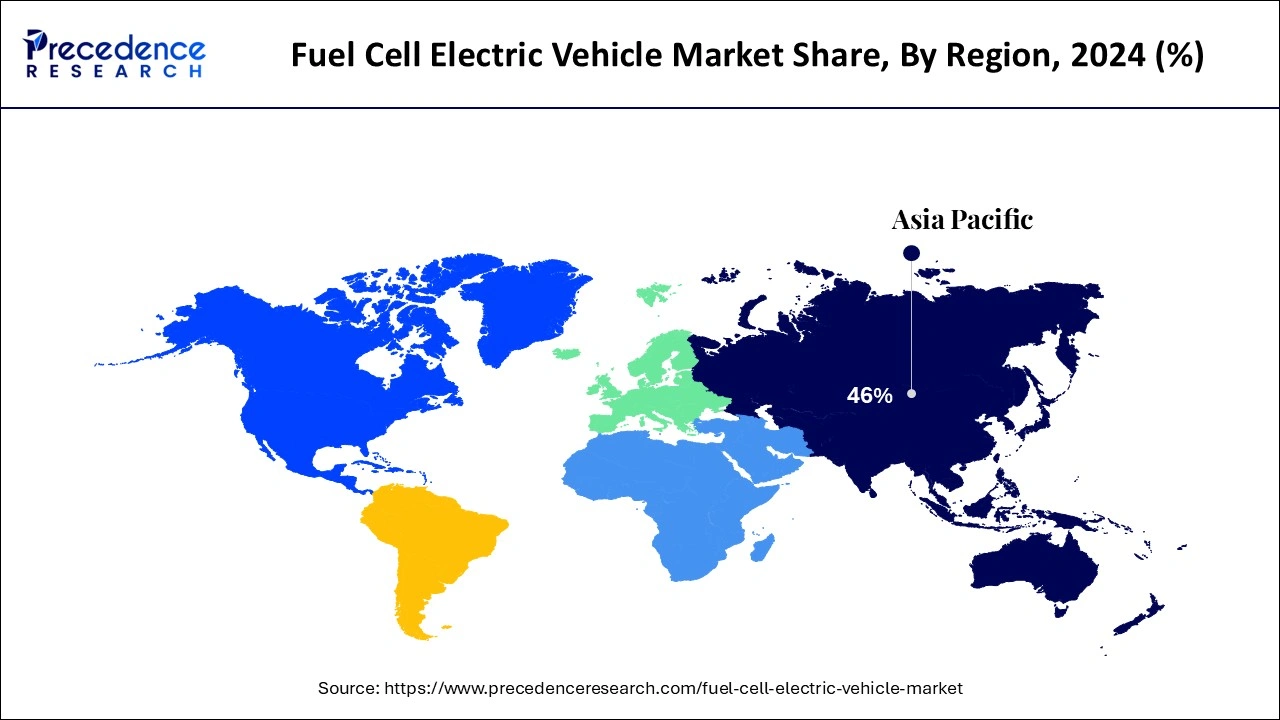

- Asia Pacific dominated the global market with the largest market share of 64% in 2024.

- North America is projected to expand at the notable CAGR during the forecast period.

- By vehicle, the passenger vehicle segment has held the largest market share in 2024.

- By range, the short distance segment captured the biggest market share in 2024.

Role of AI Integration in Fuel Cell Electric Vehicle Market

The integration of AI in the fuel cell electric vehicle market contributes to the advancement of the market. The implementation of AI has influenced the manufacturing of electric vehicles as it can detect defective parts and enhance the reliability of the market. It can help to predict the maintenance of the vehicle which reduces the extra charges for sudden damage of the vehicle. It can monitor the charging of the cell and alert for prior charging which is helpful for the consumers. It helps to enhance the performance of the vehicle, decrease charges, and help the integration of enhanced features.

Asia Pacific Fuel Cell Electric Vehicle Market Size and Growth 2025 to 2034

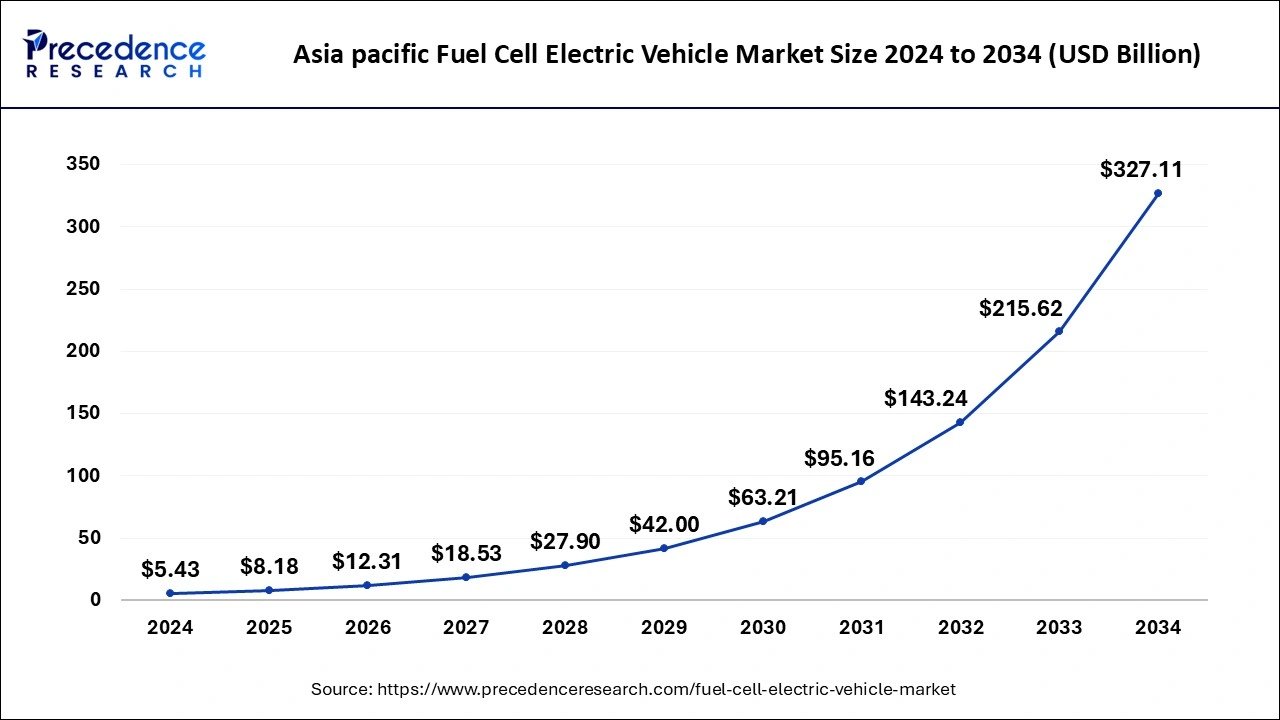

The Asia Pacific fuel cell electric vehicle market size was exhibited at USD 5.43 billion in 2024 and is projected to be worth around USD 327.11 billion by 2034, growing at a CAGR of 50.66% from 2025 to 2034.

The fuel cell electric vehicles in the Asia Pacific region is expected to have a good market size. In order to curb pollution levels and the ban on diesel engines that is stringent government policies in place. In order to accept these vehicles the Asia Pacific region is making policies. Across the country the construction of 1000 refueling stations will be done by 2032 in order to meet the industry demand with the stringent regulation policies in place.

The Asia Pacific market for the fuel cell electrical vehicle will rise globally. In the Asia Pacific region, the major players you Hyundai Motor Company and Toyota Motor Company are offering cars, buses and logistical vehicles. Asia Pacific FCEV market size is projected to hit around USD 15 billion by 2032.

Market Overview

The fuel cell technology is not yet capable of delivering very high our needs associated with different circumstances. In a declaration by Japan, it's stated of being carbon neutral by the year 2050. As an awareness related to the benefits of good air quality and the bad effects of regular emissions is driving the market. Governments are taking initiatives to invest and enhance the infrastructure for the electric vehicles. Further helps in expanding the market. Various technological advancements and increased number of refueling facilities are helping the market grow. Rapid industrialization and expansion of the production facilities is fostering the acceptance of fuel cell electric vehicles in Asia Pacific region. A major challenge ahead of the FCEV market is high investment required for the electric vehicle charging infrastructure.

However, there are increasing investments from the government as well as the private sector. In the development of this infrastructure, so the market is expected to grow. The FCEV market was badly impacted by the COVID-19 pandemic. Due to lockdowns and restrictions on traveling the production and delivery was delayed. The raw material supplies were also delayed. However, post pandemic, there has been a recovery as there is an ease on restrictions and there are supportive government policies. The FCEV use a fuel cell to convert or transform the chemical energy in oxygen and hydrogen directly into the electrical energy. The hydrogen is supplied from an onboard storage tank, while the oxygen is derived from the air. If economical FCEV's are developed they will reduce the dependency on oil and help in combating global warming.

Growth Factors

- As a result of strict vehicle emission regulations in many nations across the world the fuel cell electric vehicle market shall boom.

- In North America, stringent rules are made for the emission regulations, which make North America the greatest market.

- In European countries, governments are investing in the development of fuel-cell electric vehicle technologies because driving the global market.

- In the Asia Pacific region, the adoption of electric vehicles is leading to growth in this market. The FCEV's market provides low-emission mobility solutions. Latin America is also adopting this technology.

- Owing to the benefits like improved efficiency, zero emission and lower refuelling time, the segment is expected to grow in the forecast period.

- Rapid industrialization and extensive production facilities, which are made available, are helping in penetrating the market. As the private sector and the government sectors are investing in building the infrastructure, growth is expected.

Market Scope

| Report Coverage | Details |

| Market Size in 2025 | USD 428.70 Billion |

| Market Size by 2034 | CAGR of 53.30% |

| Market Growth Rate from 2025 to 2034 | CAGR of 50.53% |

| Largest Market | Asia Pacific |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Vehicle, Type, Range, Geography |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America and Middle East & Africa |

Vehicle Insights

The vehicle segment can be further classified in two bus, truck, passenger vehicles and light commercial vehicles. As there are stringent norms to eradicate the vehicle pollution the category of the passenger vehicle is expected to have a larger market share. As there is a rising per capita income the passenger vehicles are expected to have a larger market share. Consumers are demanding for clean personal mobility. Countries are planning to convert the taxis and cabs into fuel cell electric vehicles for eradicating the pollution. By the year 2040, South Korea is targeting to deploy around 1,20,000 fuel cell vehicles.

RangeInsights

The range segment covers short range distances and long range distance is covered by the fuel cell electrical vehicles. The short distance segment is expected to reach 45% growth from 2023 to 2032. In comparison to the long range category, the short range category will witness a faster growth as there is a rising demand for low emission vehicles for commuting everyday. The consumers are giving a preference to FCEV's In order to cover shorter distances for traveling or commuting. In order to transport goods within ports and airports, many companies are making use of FCEV's. Many transport vehicles are used for covering short range distances to eliminate their carbon footprints.

Fuel Cell Electric Vehicle Market Companies

- Audi AG

- Ballard Power systems Inc.

- BMW Group

- Daimler AG

- Honda Motor Co limited

- Volvo group

- Toyota Motor Corporation

- General Motors company

- Man Se

- American Honda Motor Co.

- Toshiba

Recent Development

- In September 2024, BMW announced the launch of its first-ever series production hydrogen-powered fuel cell electric vehicle (FCEV) in 2028.

- In October 2024, Hyundai announced the launch of INITIUM hydrogen fuel cell electric vehicle (FCEV) concept at its ‘Clearly Committed' event held at Hyundai Motorstudio Goyang.

Segments Covered in the Report

By Vehicle

- Passenger Vehicles

- Light commercial vehicles

- Bus

- Trucks

- Heavy Duty Vehicles

- Agriculture

- Automotive

- Others

By Range

- Short Range

- Long Range

By Geography

- North America

- U.S.

- Canada

- Europe

- U.K.

- Germany

- France

- Asia-Pacific

- China

- India

- Japan

- South Korea

- Malaysia

- Philippines

- Latin America

- Brazil

- Rest of Latin America

- Middle East & Africa (MEA)

- GCC

- North Africa

- South Africa

- Rest of the Middle East & Africa

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client