February 2023

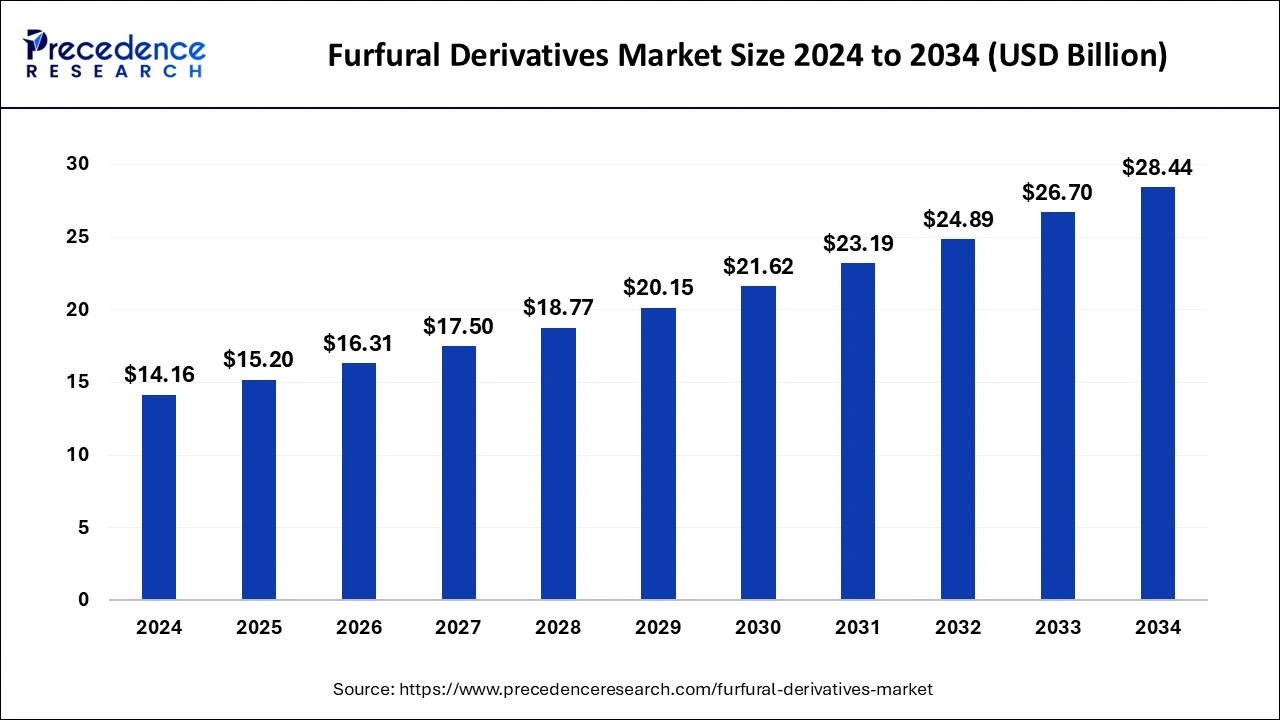

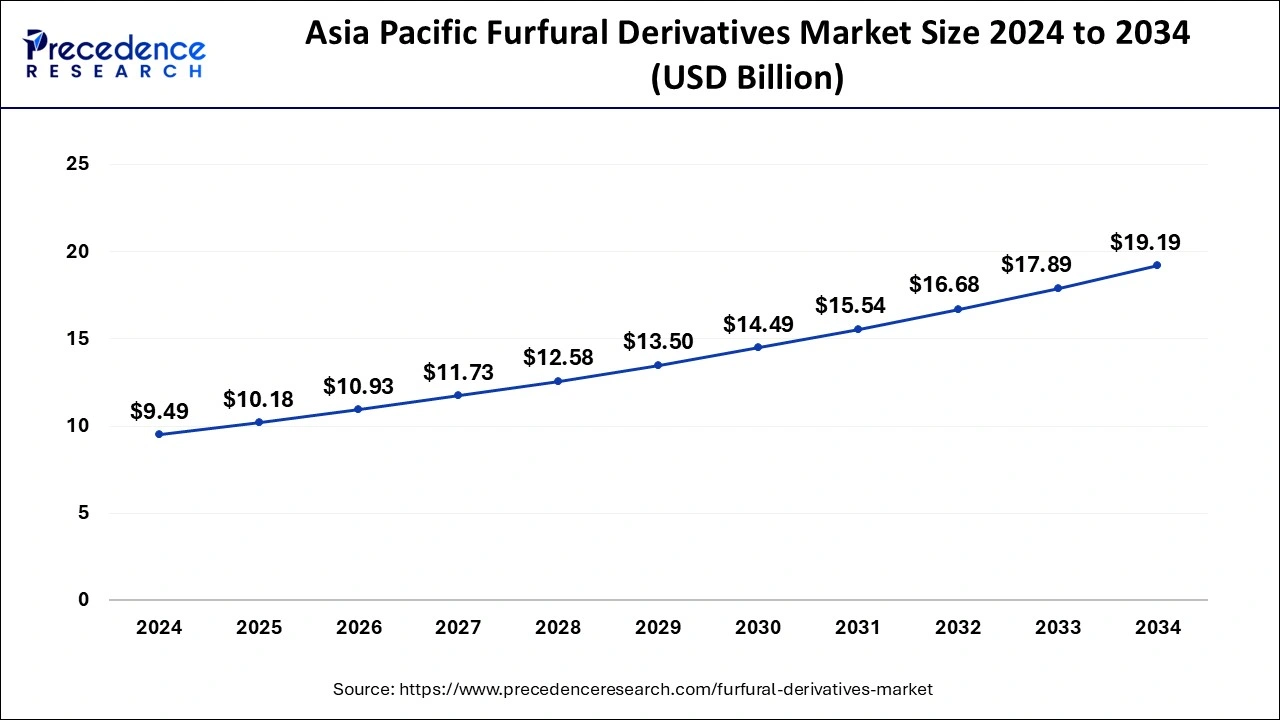

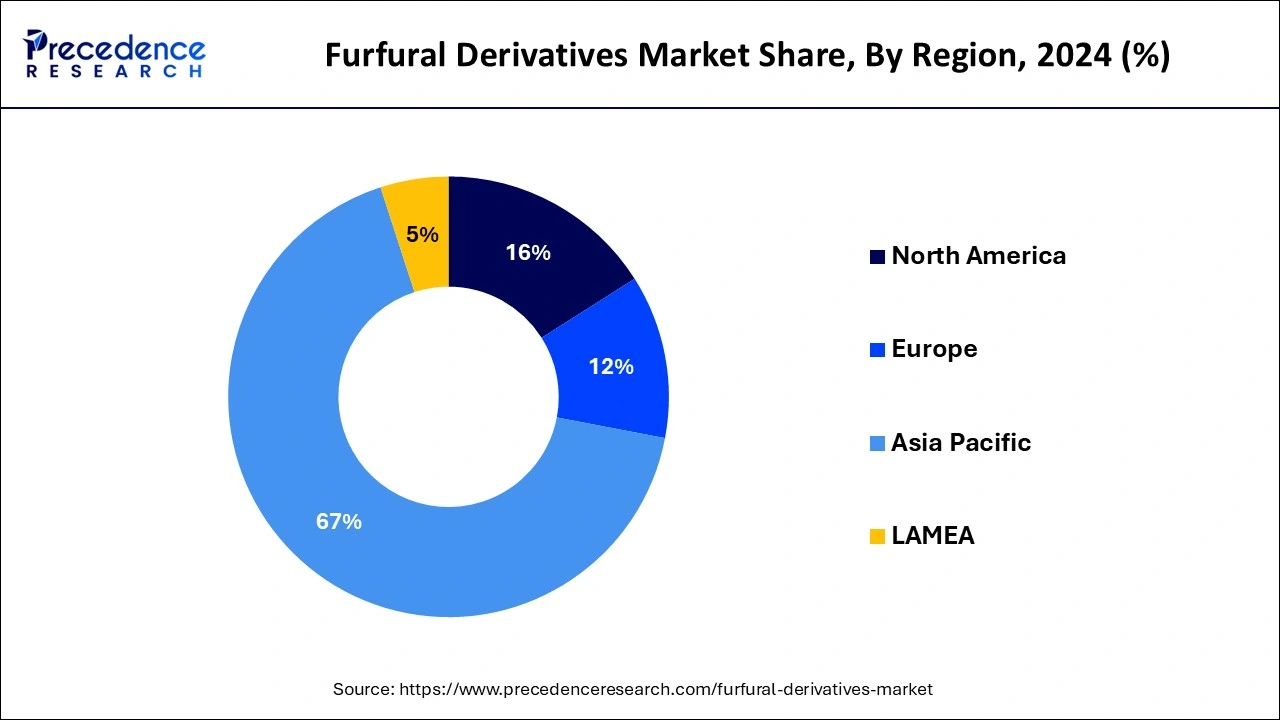

The global furfural derivatives market size is accounted at USD 15.20 billion in 2025 and is forecasted to hit around USD 28.44 billion by 2034, representing a CAGR of 7.22% from 2025 to 2034. The Asia Pacific market size was estimated at USD 9.49 billion in 2024 and is expanding at a CAGR of 7.30% during the forecast period. The market sizing and forecasts are revenue-based (USD Million/Billion), with 2024 as the base year.

The global furfural derivatives market size was calculated at USD 14.16 billion in 2024 and is predicted to increase from USD 15.20 billion in 2025 to approximately USD 28.44 billion by 2034, expanding at a CAGR of 7.22% from 2025 to 2034. The rising demand for biofuels due to the increasing environmental pollution drives the growth of the market.

The Asia Pacific furfural derivatives market size was exhibited at USD 9.49 billion in 2024 and is projected to be worth around USD 19.19 billion by 2034, growing at a CAGR of 7.30% from 2025 to 2034.

Asia Pacific led the furfural derivatives market with the largest market share in 2024. The region is observed to sustain the position throughout the forecast period. The dominance of the market in the region is attributed to the rising industrialization in the regional countries that are negatively impacting the environment by using the petrochemical products in the operations, these petrochemicals are highly hazardous to the environment due to its increased carbon emission. The rising awareness among the population and governments regarding rising pollution due to the higher use of petrochemicals is driving the demand for furfural derivatives while promoting the expansion of the market. The increasing demand for renewable and sustainable energy sources is also influences the growth of the furfural derivatives market in the region.

India has recently started receiving opportunities to increase the global biofuel deployment from the Global Biofuels Alliance that launched in the 2023 with eight different countries leaders.

Europe is expected to witness the fastest growth in the furfural derivatives market during the forecast period. The growth of the market is expected to increase due to the rising concern over the environment and stringent government policies in terms of the zero-carbon emission which fuel the demand for the biochemical products such as biofuels are driving the expansion of the furfural derivatives market in the region.

Furfural is one of the important parts of the biofuels that is made from agricultural residues such as rice husk, corncob, sugarcane bagasse, or wooden residues. Furfural is highly used in the manufacturing of biofuels such as biochemicals, biodiesel, and biojets. Furfural derivatives are emerging as the ideal product as an alternative to petrochemical products with zero-carbon emission and less hazardous to the environment. Furfurals are widely accepted in industries such as agrochemicals, plastics, and pharmaceuticals. Furfural derivatives are used in the production of resins, coating, paints, and varnishes. The rising environmental concern and the favorable government policies in the adoption of biochemicals are contributing to the growth of the furfural derivatives market.

| Report Coverage | Details |

| Growth Rate from 2025 to 2034 | CAGR of 7.22% |

| Market Size in 2025 | USD 15.20 Billion |

| Market Size in 2024 | USD 14.16 Billion |

| Market Size by 2034 | USD 28.44 Billion |

| Largest Market | Asia Pacific |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Route, Raw Material, Application, and End-user |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

The increasing demand for the biofuels

The continuously rising environmental pollution due to the higher use of petrochemicals in the various end-use industrial operations such as in agriculture, automobile, industrial manufacturing, and others. And the rising awareness regarding the global warming and rising environmental pollution creating the health problems in the humans are driving the demand for the biofuels and biochemicals as an alternative product to the petrochemicals that driving the demand for the furfural derivatives market. Furfural is made by the organic substance like the agricultural waste such as rice husk, corncob, wooden residues, and sugarcane bagasse all these substances are used in the manufacturing of biochemical and biofuels that are environmentally safer and act as the ideal alternative to the petrochemical products.

Fluctuating prices raw material

The fluctuating prices of raw material is observed to act as a restraint for the furfural derivatives market. Uncertainty surrounding raw material prices can create challenges for long-term planning, investment, and expansion initiatives within the furfural derivatives industry. Manufacturers may hesitate to commit resources to new projects or capacity expansions if they anticipate continued volatility in raw material prices. This can impede industry growth, limit innovation, and hinder the development of new products or technologies within the furfural derivatives market.

Expansion of application

Furfural is the most commonly found chemical in industrial applications due to its flexible production. It is a chemical that is produced from biomass. Furfural are the most widely used chemicals in industries such as agrochemicals, plastics manufacturing, and pharmaceuticals. Furfural and its derivatives are highly used in the applications like transportation fuels, ungicides and nematicides, lubricants, gasoline additives, decolorizing agents, drugs, jet fuel blend stocks, bio-plastics, insecticides, drugs, flavor enhancers for food and drinks, wood modification and book preservation, and rapid all-weather repair system for bomb-damaged runways and potholes. Thus, the rising investments in research and development activities in focusing on the new development in the furfural derivatives are further propelling the growth of the market.

The Tetrahydrofuran segment led the furfural derivatives market with the largest share in 2024. Tetrahydrofuran is used as a solvent and reaction medium in pharmaceutical synthesis and drug formulation processes. It is commonly employed in the production of pharmaceutical intermediates, active pharmaceutical ingredients (APIs), and drug delivery systems due to its ability to dissolve a wide range of organic compounds and facilitate chemical reactions. The pharmaceutical industry's increasing demand for THF for drug development and manufacturing purposes further strengthens its position as a leading segment in the furfural derivatives market.

The sugarcane bagasse segment dominated the furfural derivatives market with the largest market share in 2024. Sugarcane bagasse is highly used in the manufacturing of biochemicals due to its higher source of biomolecules that helps in the formulation of the biofuels. sugar cane bagasse contains the preposition of the phytochemicals like terpenoids, phytosterols, fatty acids, flavonoids, and phenolic acids, the microbial population and phytochemicals that are available in the sugarcane which situated in the soil (rhizosphere) and on the surface (phyllosphere) consists of plenty of potential for various industrial applications. Sugarcane bagasse is considered as the most sustainable safeguard method of producing biofuels and bioactive compounds.

The derivatives segment had the largest market share in the furfural derivatives market in 2024. Furfural derivatives are highly used in the manufacturing of gasoline additives, alternative fuel to petrochemical, raisins, lubricants in automobiles. Furfural derivatives are highly used in the drug formulation in pharmaceutical and food and beverages industry as a flavor enhancer in the food and beverages. It is used in the various end-use industries such as agrochemicals, food and beverages, pharmaceuticals, and others.

The chemicals segment held a significant share of the furfural derivatives market in 2024. Furfural derivatives play a crucial role in the production of furan resins, which are widely used in foundry and casting applications, as well as in the manufacturing of adhesives, binders, and coatings. Furan resins offer excellent thermal stability, chemical resistance, and mechanical properties, making them suitable for high-performance applications in construction, automotive, aerospace, and electronics industries. The chemicals segment captures a significant share of the furfural derivatives market due to the robust demand for furan resins and related products.

Furfural derivatives, particularly furfuryl alcohol and tetrahydrofurfuryl alcohol, serve as important solvents and surfactants in various industrial and consumer applications. These derivatives exhibit solvent properties and can act as effective dispersants, emulsifiers, and wetting agents in coatings, adhesives, paints, and personal care products.

The pharmaceuticals segment held a considerable share of the furfural derivatives market in 2024. Furfural derivatives have demonstrated potential therapeutic properties, making them valuable ingredients in pharmaceutical formulations. Compounds derived from furfural, such as furfural alcohol and furfurylamine, exhibit antimicrobial, anti-inflammatory, and analgesic properties, which are beneficial for treating various medical conditions, including infections, inflammation, and pain management.

The food and beverages industry segment is expected to grow at a notable rate in the furfural derivatives market during the forecast period. Furfural is being widely adopted in the food and beverages product as an additive that enhances the shelf-life of the product. It is also used as a flavor enhancer and added in the wide range of products for enhancing the taste. Furfural consists of vitamin C which is the major component in fruit juices and wines. It is also used in alcoholic and non-alcoholic drinks as a flavor enhancer and increases the shelf life of the product. Thus, these factors are driving the demand for furfural in the food and beverages industry.

By Route

By Raw Material

By Application

By End-user

By Geography

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

February 2023