January 2025

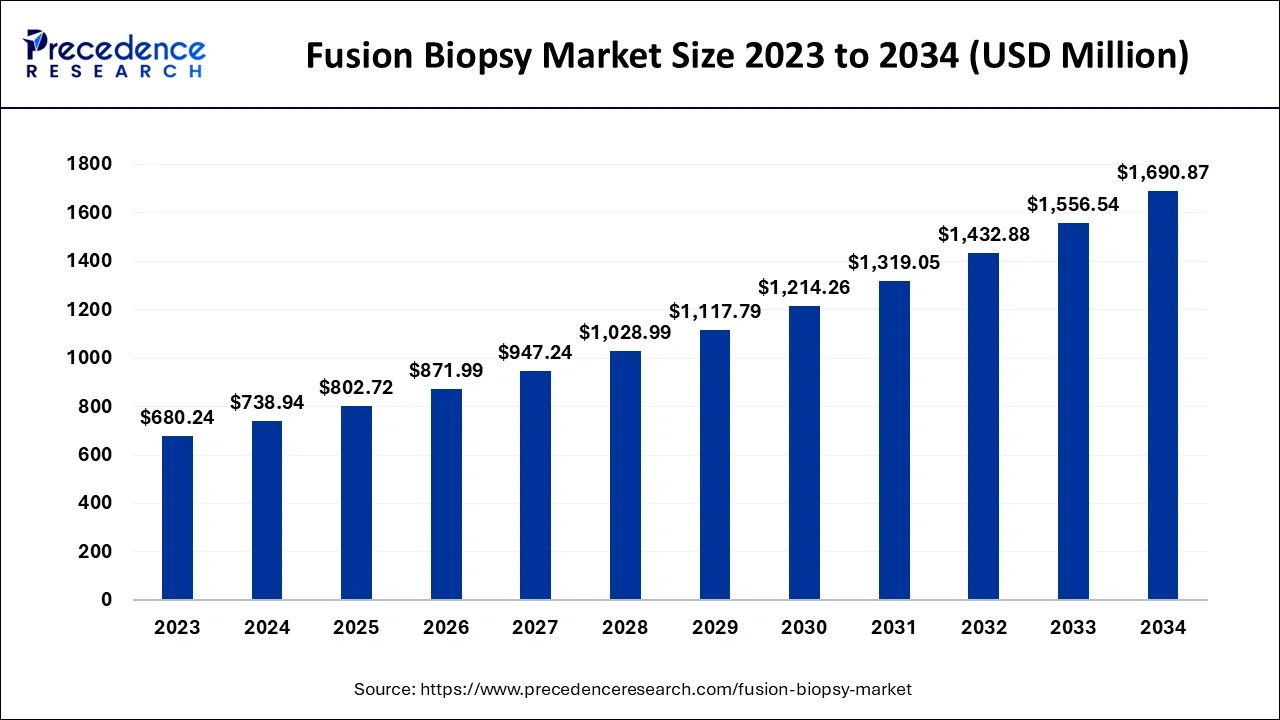

The global fusion biopsy market size accounted for USD 738.94 million in 2024, grew to USD 802.72 million in 2025 and is predicted to hit around USD 1,690.87 million by 2034, representing a CAGR of 8.63% between 2024 and 2034. The North America fusion biopsy market size is calculated at USD 302.97 million in 2024 and is expected to grow at notable a CAGR of 8.75% during the forecast year.

The global fusion biopsy market size is calculated at USD 738.94 million in 2024 and is anticipated to reach around USD 1,690.87 million by 2034, expanding at a CAGR of 8.63% from 2024 to 2034. The increasing incidence of prostate cancer worldwide is the key factor driving the fusion biopsy market growth. Advancements in molecular profiling, coupled with the development of technology, can fuel market growth further.

In the last few years innovations in artificial intelligence have opened new doors for the diagnosis and treatment of prostate cancer. The most substantial advancement in this area is the combination of fusion magnetic resonance technology with AI technology. Also, AI algorithms can use large sets of clinical data, MRI images, and histopathologic outcomes to recognize the pattern related to disease progression in the fusion biopsy market. Furthermore, the integration of fusion MRI-TB and AI seems promising for enhancing overall patient outcomes and transforming urologic oncology.

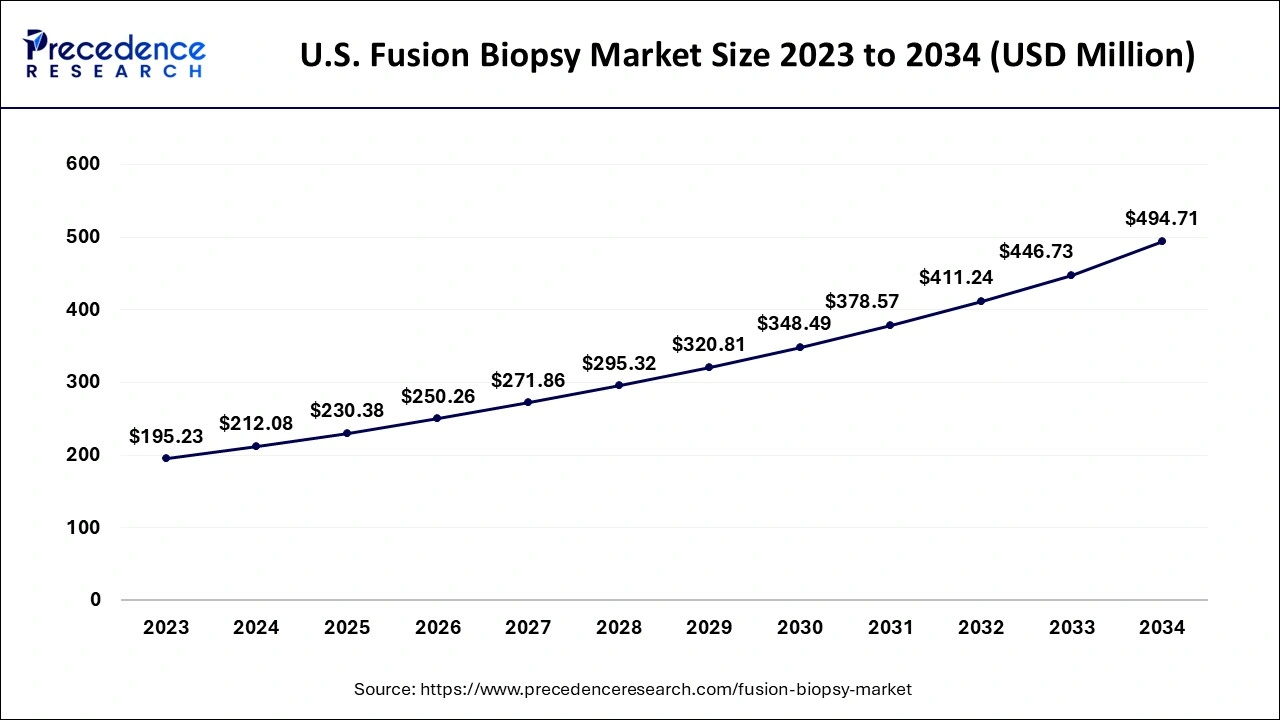

The U.S. fusion biopsy market size is exhibited at USD 212.08 million in 2024 and is expected to be worth around USD 494.71 million by 2034, growing at a CAGR of 8.82% from 2024 to 2034.

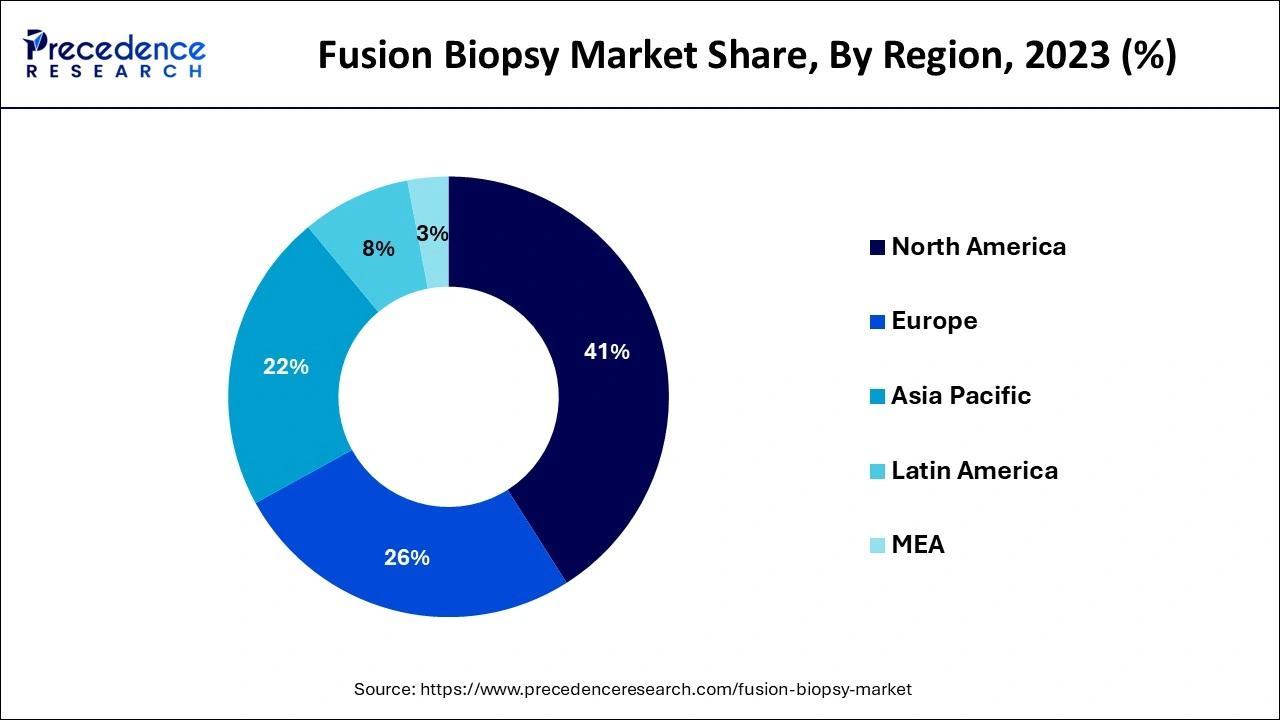

North America dominated the fusion biopsy market in 2023. The dominance of the region can be attributed to the increasing number of cancer cases along with the growing adoption of innovative diagnostic technologies. In North America, the U.S. led the market owing to the improved effectiveness and adoption of advanced cancer detection technologies. Furthermore, strong government support and developed healthcare infrastructure can support this market growth further.

Asia Pacific region is expected to show the fastest growth over the studied period. The growth of the region can be credited to the rising awareness regarding protests against cancer in the region and advanced healthcare infrastructure in emerging countries such as China, India, and Japan. Furthermore, the surge in the aging population in countries like Japan and South Korea impacts market growth positively.

The fusion biopsy market encompasses the diagnosis, treatment, and surgical procedures for detecting and curing cancer. This innovative diagnostic method offers physicians a complete picture of the targeted area by blending the insights from Country traditional magnetic resonance imaging and ultrasound imaging. This technology further reduces the chances of negative results by offering enhanced precision and imaging, which triggers more accurate tissue harvesting.

Men prostate cancer rates across the globe (2022)

| Country | Number |

| World | 1,467,854 |

| United States of America | 230,125 |

| China | 134,156 |

| Japan | 104,318 |

| Brazil | 102,519 |

| Germany | 65,269 |

| Report Coverage | Details |

| Market Size by 2034 | USD 1,690.87 Million |

| Market Size in 2024 | USD 738.94 Million |

| Market Size in 2025 | USD 802.72 Million |

| Market Growth Rate from 2024 to 2034 | CAGR of 8.63% |

| Largest Market | North America |

| Base Year | 2023 |

| Forecast Period | 2024 to 2034 |

| Segments Covered | Biopsy Route, End Use, and Regions |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Rising use of Multi-Modality Imaging

There is a growing trend towards the utilization of multi-modality imaging (ultrasound, MRI, and CT) in the fusion biopsy market for more precise tumor detection. In addition, the use of point-of-care (POC) diagnostics is also escalating owing to the increasing use of fusion biopsy technologies in healthcare settings and outpatient clinics for rapid diagnosis and treatment.

Limited reimbursement policies

Sufficient reimbursement policies in some areas may constrain the extensive adoption of fusion biopsy market procedures, as the cost is being borne by healthcare institutions or patients. Moreover, requirements for skilled personnel and technical complexities can impact market growth negatively as they can pose hurdles in the widespread adoption with limited access to skilled persons.

Increasing adoption of liquid biopsies

Liquid biopsies, assess cell-free nucleic acids in a blood vessel and provide a non-invasive solution to conventional tissue biopsies. Fusion biopsies can be carried out by using liquid biopsies, which enable the early detection of genomic alterations in tumor cells or cDNAs. Furthermore, the increasing adoption of liquid biopsies for the detection and control of cancer is anticipated to create future opportunities for the fusion biopsy market.

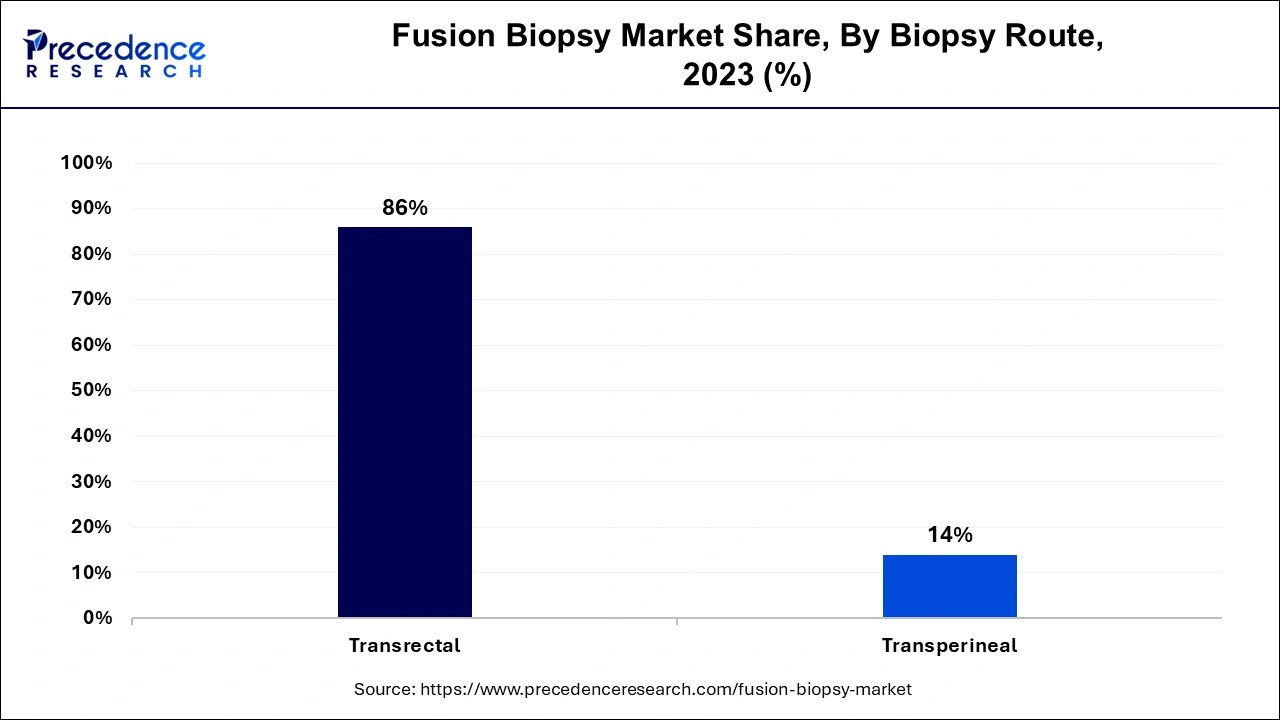

The transrectal segment led the fusion biopsy market in 2023. The dominance of the segment can be attributed to the increasing commercial availability of fusion biopsy systems for the transrectal approach. Despite this, the segment's growth has been constrained because of the complexities like sepsis, fever, rectal bleeding, and hematuria, following transrectal procedures. Transrectal ultrasound can identify abnormalities in the nearby area of the rectum, including the prostate. Also known as endorectal ultrasound.

The transperineal fusion biopsy segment is expected to grow at a fast rate in the fusion biopsy market over the forecast period. The growth of the segment can be credited to the effectiveness provided by this segment in terms of accuracy and the entire sampling procedure. However, transperineal biopsy reduces the risk of infection associated with the diagnostic procedure. This biopsy also allows a greater chance of detecting the cancer, especially in the anterior of the prostate.

The hospital segment dominated the global fusion biopsy market in 2023. The dominance of the segment can be linked to the high purchasing power of the hospitals and associated organizations. The widespread availability of resources and skilled personnel in hospitals including anesthesiologists, MRI scanners, urologists, and radiologists enable them to perform on-demand fusion biopsies. Furthermore, in the hospital segment, there is increasing adoption of transperineal fusion biopsy systems to gain wide hospital acceptance, fuelling segment growth.

The ambulatory care centers segment is anticipated to show the fastest growth in the fusion biopsy market during the projected period. The growth of the segment is driven by the growing incidence of prostate cancer especially, in rural areas where having short access to medical services. Additionally, the launch of low-cost and highly portable MRI can improve the adoption rate of targeted ultrasound biopsies in these centers.

By Biopsy Route

By End Use

By Geography

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

January 2025

February 2025

July 2024

August 2022