February 2025

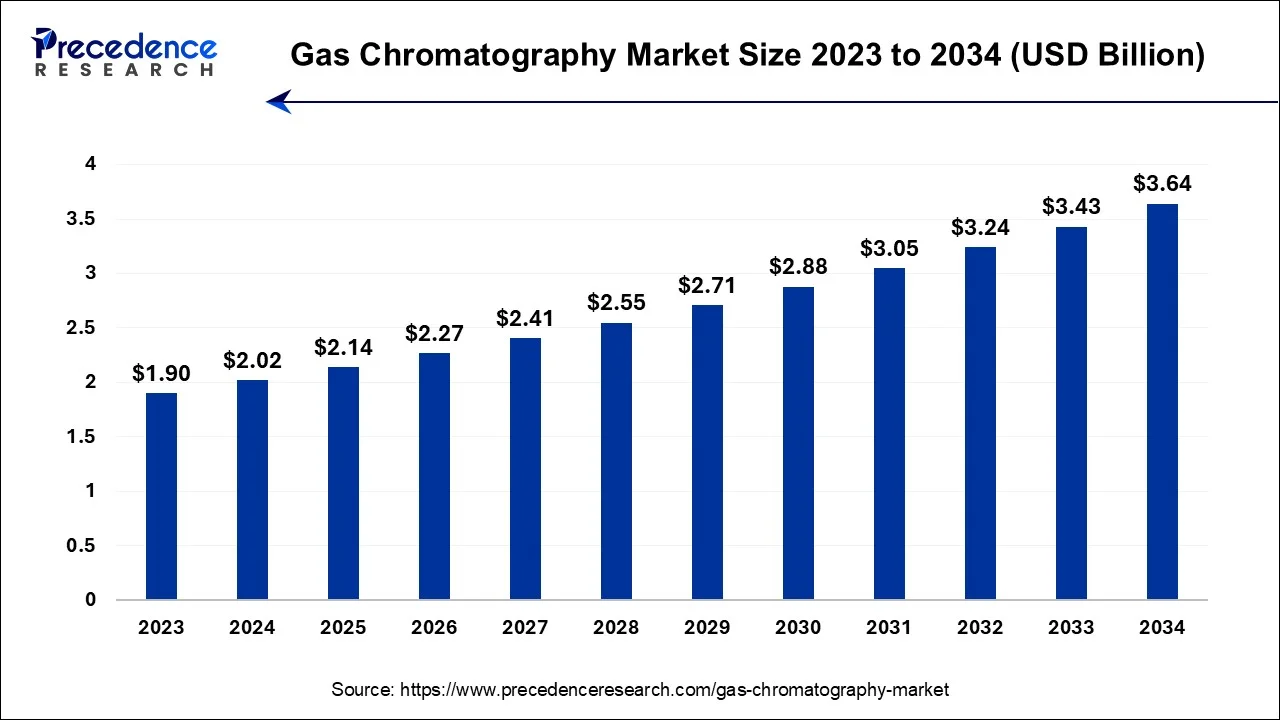

The global gas chromatography market size is estimated at USD 2.02 billion in 2024, grew to USD 2.14 billion in 2025 and is predicted to surpass around USD 3.64 billion by 2034, expanding at a CAGR of 6.10% between 2024 and 2034.

The global gas chromatography market size accounted for USD 2.02 billion in 2024 and is anticipated to reach around USD 3.64 billion by 2034, expanding at a CAGR of 6.10% between 2024 and 2034.

The gas chromatography (GC) market represents a thriving landscape wherein GC instrumentation is harnessed for the meticulous partitioning and quantification of compounds across diverse domains, including pharmaceuticals, petrochemicals, gastronomy, environmental scrutiny, and scientific exploration. Its enduring ascent can be attributed to its exceptional precision and heightened sensitivity in discerning intricate amalgams and minute constituents, rendering it indispensable for meticulous quality assurance and pioneering research ventures.

Ongoing technological breakthroughs have yielded swifter, more efficient, and user-centric GC systems, thereby amplifying their global market footprint. This is hallmarked by fierce competition and relentless innovation, underscoring its pivotal role in contemporary analytical chemistry.

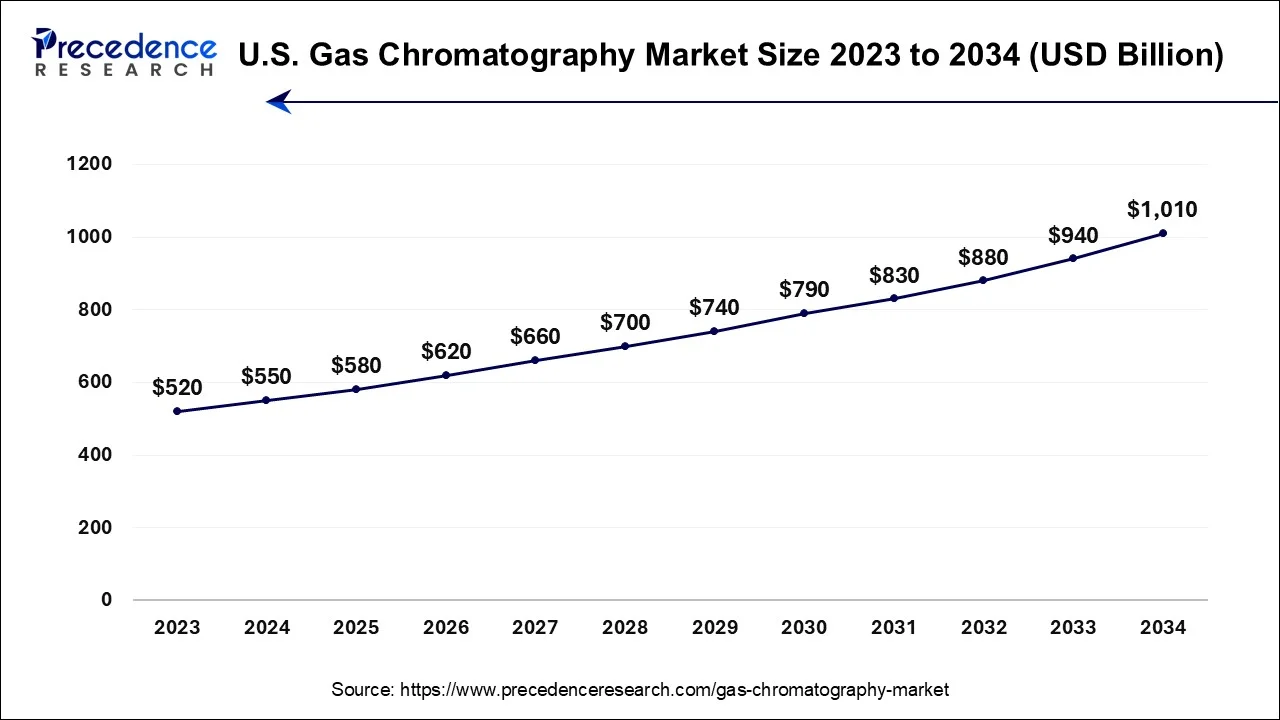

The U.S. gas chromatography market size ie estimated at USD 550 million in 2024 and is expected to reach USD 1,010 billion by 2034, at a CAGR of 6.26% from 2024 to 2034.

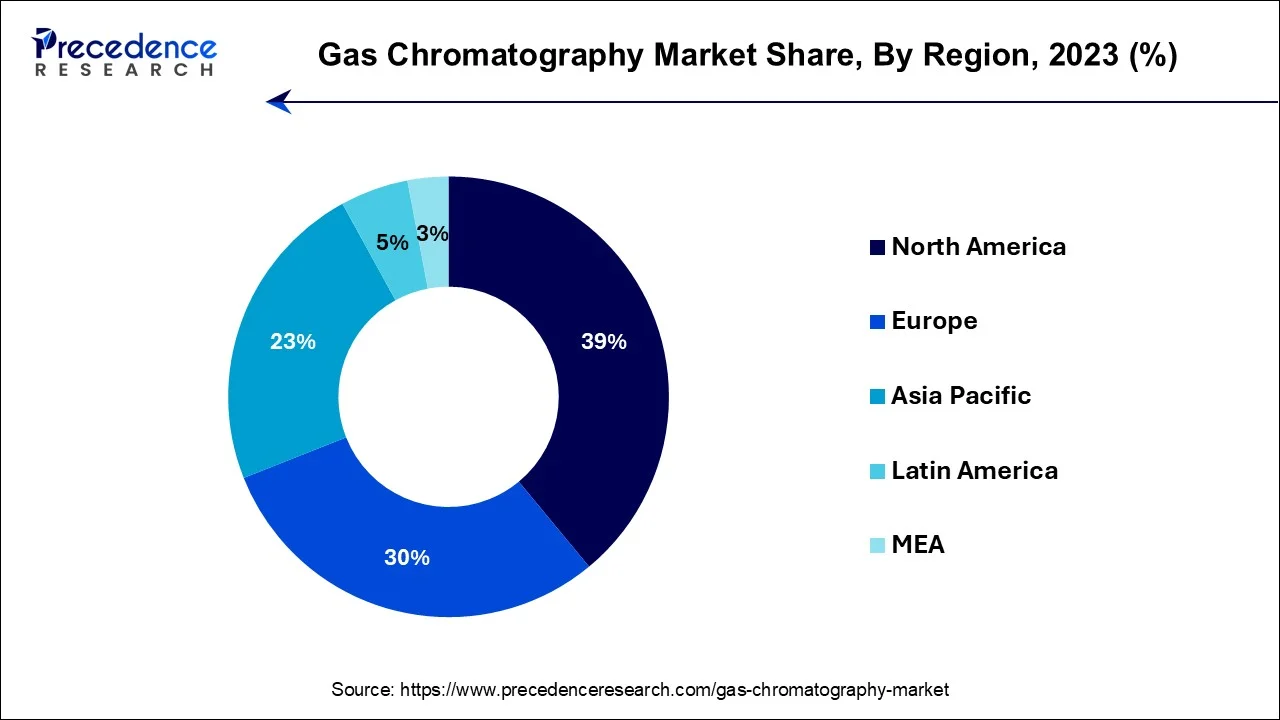

North America has held the largest revenue share 39% in 2023. North America commands a significant share in the gas chromatography (GC) market due to several factors. The region boasts a well-established industrial landscape, including pharmaceuticals, petrochemicals, and environmental testing, which rely heavily on GC for quality control and research. Additionally, North America is a hub for cutting-edge research and innovation, driving the demand for advanced GC systems. The presence of numerous key GC manufacturers, well-developed healthcare infrastructure, and stringent regulatory requirements further solidify the region's dominance in the GC market, making it a major contributor to the industry's global market share.

Asia-Pacific is estimated to observe the fastest expansion. Asia-Pacific has emerged as a significant player in the gas chromatography (GC) market due to its rapid industrialization, expanding pharmaceutical and petrochemical sectors, and increasing focus on environmental regulations. The region's economic growth has driven demand for quality control and research, bolstering GC adoption. Furthermore, Asia-Pacific's burgeoning healthcare industry relies on GC for drug development and clinical diagnostics. The presence of both local and international GC manufacturers and a growing emphasis on innovation positions Asia-Pacific as a major contributor to the GC market share, underscoring its pivotal role in the global industry.

| Report Coverage | Details |

| Growth Rate from 2024 to 2034 | CAGR of 6.1% |

| Market Size in 2024 | USD 2.02 Billion |

| Market Size by 2034 | USD 3.64 Billion |

| Largest Market | North America |

| Base Year | 2023 |

| Forecast Period | 2024 to 2034 |

| Segments Covered | Product, End User, and Region |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Quality control requirements

The impetus behind the burgeoning gas chromatography (GC) market lies in the exacting demands of quality control protocols. Industries such as pharmaceuticals, culinary arts, petrochemicals, and environmental stewardship prioritize the meticulous scrutiny of their products and processes. GC, renowned for its ability to meticulously segregate, identify, and quantify intricate compound mixtures, assumes a pivotal role in certifying the integrity of raw materials, intermediates, and final outputs.

The regulatory bodies governing these sectors impose stringent benchmarks to safeguard public well-being and environmental harmony. Conformity to these standards compels organizations to invest in advanced GC instrumentation, ensuring compliance and the detection of minute impurities and contaminants that could undermine product quality. This technology's proficiency in discerning trace-level anomalies proves instrumental in preempting quality discrepancies.

The pharmaceutical sector, specifically, leans on GC for the development and quality assessment of pharmaceuticals. With the continuous introduction of novel drugs and the large-scale manufacturing of established ones, the demand for GC-driven quality control escalates. The rigorous quality control standards, thus, act as a dynamic force propelling the expansion of the GC market, underscoring its indispensable role in certifying the effectiveness and safety of products.

Skilled operator requirement

The need for skilled operators in gas chromatography (GC) presents a significant constraint on the growth of the GC market. Efficient operation and maintenance of GC equipment as well as accurate data interpretation, require a high level of technical expertise. This skilled workforce is essential to ensure the precise functioning of the system and the reliability of results. The scarcity of adequately trained personnel can impede the widespread adoption of GC, especially in smaller laboratories and emerging markets. Hiring and retaining skilled technicians can be costly and challenging, which may limit the accessibility of GC technology to a broader range of industries and organizations.

Moreover, as the existing pool of experienced GC operators ages or transitions to other fields, there is a risk of a knowledge gap. This scenario underscores the necessity for comprehensive training programs to bridge the skills deficit and promote the continued growth of the GC market. Overcoming this constraint will require investments in education and training initiatives to cultivate a skilled workforce capable of harnessing the full potential of GC technology.

Diverse applications

The diverse applications of gas chromatography (GC) are a key driver of opportunities within the market. GC's versatility enables its utilization across a broad spectrum of industries, including pharmaceuticals, petrochemicals, food and beverage, environmental monitoring, forensics, and more. This adaptability continually creates new prospects for growth as industries discover novel uses for GC and expand existing applications.

Whether it's analyzing complex mixtures in drug development, ensuring product quality and safety in the food industry, or quantifying environmental pollutants, GC's capacity to provide precise and reliable results makes it an invaluable tool. As these sectors evolve, so does the demand for advanced GC solutions, offering manufacturers the chance to develop tailored systems and services, thereby enhancing their market presence and contributing to the ongoing expansion of the gas chromatography market.

Impact of COVID-19

According to the product, the consumables and accessories segment has held 55% revenue share in 2023. The consumables & accessories segment holds a significant share in the gas chromatography market due to its recurring and essential nature. GC systems require a continuous supply of consumables like columns, detectors, and gases, which need periodic replacement. Moreover, the demand for accessories such as injection systems and detectors for specialized applications remains high. This recurring need for consumables and accessories ensures a steady revenue stream for manufacturers and service providers, making it a substantial and reliable component of the GC market while also offering opportunities for innovation and customization to meet diverse user requirements.

The instruments segment is anticipated to expand at a significantly CAGR of 6.1% during the projected period. The instruments segment holds a major share in the gas chromatography market due to its pivotal role in the analytical process. Gas chromatography relies heavily on sophisticated instruments, including gas chromatographs and associated equipment, to separate and quantify compounds. These instruments are essential for the precise analysis of complex mixtures in various industries such as pharmaceuticals, petrochemicals, and environmental testing. As the demand for accurate and efficient compound analysis continues to grow, so does the significance of the Instruments segment, making it a dominant component of the gas chromatography market.

Based on the end user, pharmaceutical & biotechnology company segment held the largest market share of 31% in 2023. The pharmaceutical and biotechnology company segment commands a substantial share in the gas chromatography market due to its pivotal role in drug development, quality control, and research. Gas chromatography is indispensable for analyzing compounds, quantifying drug formulations, and ensuring compliance with stringent regulatory standards. In pharmaceuticals, GC is used extensively in formulation analysis, impurity profiling, and pharmacokinetics. Additionally, it is vital for biotechnology firms in monitoring bioprocesses and characterizing biomolecules. As these industries continue to expand, the demand for precise, reliable, and high-throughput analytical techniques like GC remains consistently high, cementing its dominant position in this market segment.

On the other hand, the other segment is projected to grow at the fastest rate over the projected period. The others segment holds a significant share in the gas chromatography market primarily due to its diverse and extensive user base encompassing various industries and research fields beyond the more dominant sectors such as pharmaceuticals and petrochemicals.

This category includes smaller niche industries, research institutions, and specialized applications where GC is indispensable, such as food and beverage, environmental monitoring, forensics, and academia. These diverse end users have recognized GC's versatility and reliability, contributing to the substantial share held by the others segment, reflecting its pivotal role in analytical chemistry across a wide spectrum of applications.

Segments Covered in the Report

By Product

By End User

By Geography

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

February 2025

October 2024

February 2025

May 2024