August 2024

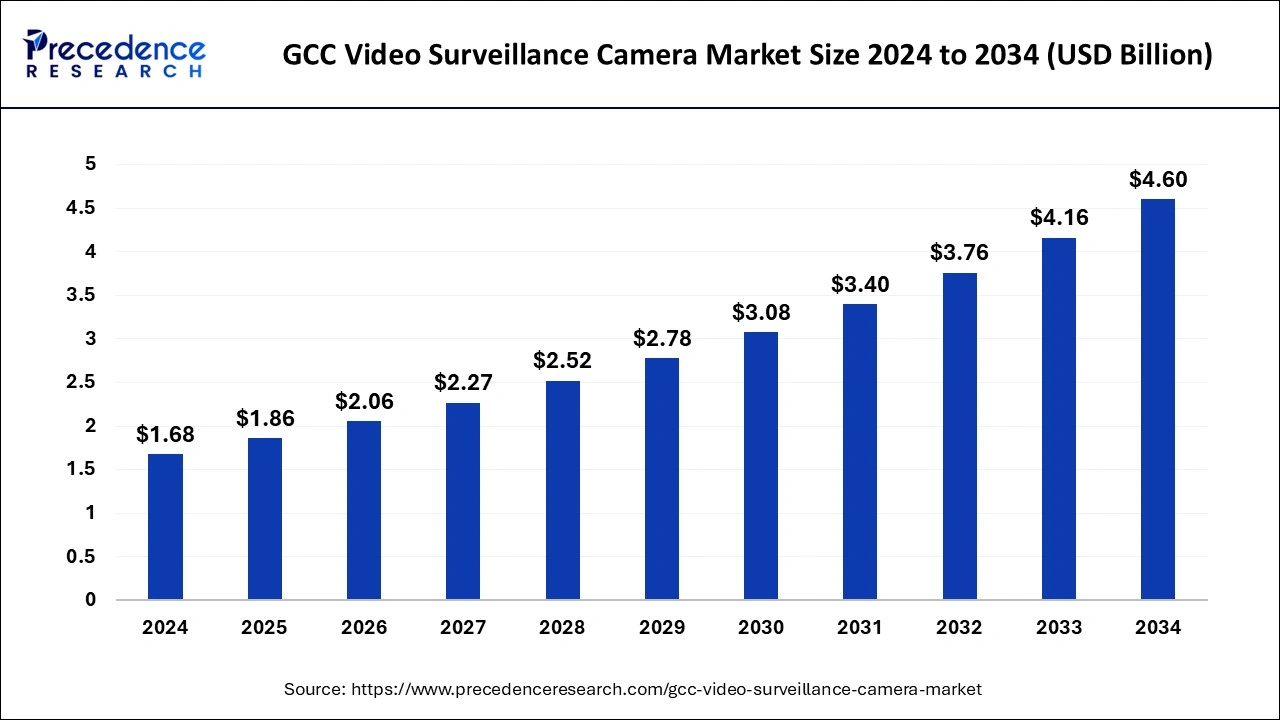

The GCC video surveillance camera market size is calculated at USD 1.86 billion in 2025 and is forecasted to reach around USD 4.60 billion by 2034, accelerating at a CAGR of 10.60% from 2025 to 2034.

The GCC video surveillance camera market size accounted for USD 1.68 billion in 2024 and is expected to exceed around USD 4.60 billion by 2034, growing at a CAGR of 10.60% from 2025 to 2034. The rising demand to improve security, provide evidence and real-time monitoring is gaining the adoption of the GCC video surveillance camera market.

Integration of artificial intelligence in the GCC video surveillance camera market offers threat detection in real-time, and quick detection of intrusion. A threat detection program requires constant monitoring of the cameras manually and studying to observe any activity. However, with AI, anomalies are detected and reported within seconds, without human fatigue which saves time for many useful and needed tasks. It is applicable at busy public locations such as airports, academic campuses, shopping areas, sports centers, and famous tourist sports.

The government is making an attempt to reshape the norms and practices of the GCC video surveillance camera market. Cameras with AI solutions have comprehensive datasets to analyze and identify intruders at exceptionally high speed. This is commonly used at sensitive zones such as bank vaults, classrooms, and other sensitive locations, which can be quickly sealed and protected. Additionally, the Arab Gulf region is approaching security and surveillance, including video analytics towards modern security infrastructure, powered AI, and deep learning solutions, reshaping crowd management and protection. The first line of defense for an organization or individual is a security setup through intrusion detection systems. Moreover, AI models help reduce false alarms.

Video surveillance cameras are devices used as security cameras to monitor and record ongoing activities for a specific location to maintain safety and security around the area. They are commonly implanted in several locations such as retail stores, parking lots, office buildings, industrial facilities, and many more. A surveillance camera helps in monitoring public actions by recording footage only. They are built in with alarms that turn on when criminal activity is detected.

| Report Coverage | Details |

| Market Size by 2024 | USD 1.68 Billion |

| Market Size in 2025 | USD 1.86 Billion |

| Market Size in 2034 | USD 4.60 Billion |

| Market Growth Rate from 2025 to 2034 | CAGR of 10.60% |

| Dominating Region | Saudi Arabia |

| Fastest Growing Region | UAE |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Product Type, Type, and Regions. |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa. |

Security concern

The ongoing attacks on the areas, including Hamas on Israel and the assault on the Gaza Strip, have drastically grown awareness regarding security considerations in the Gulf Cooperation Council (GCC) states. The GCC video surveillance camera market is evolving with a security landscape, protecting territorial borders, entering into transnational defense arrangements, and investing in drones and surveillance technology. The Gulf countries are advancing toward digital surveillance infrastructure by demonstrating and implementing it.

Physical and cyber security challenges

Video surveillance cameras are interconnected and reliant on internet access, which offers great advantages but also has a few drawbacks, one of which includes rising cyber security concerns. Internet access cameras are vulnerable to cyber-attacks. It is essential to secure the video-recorded data and surveillance network. Additionally, the physical damage can be distributed the surveillance monitoring. Cameras implanted on transportation vehicles, whether on roads or sea, must be able to withstand difficult conditions such as extreme temperatures, vibrations, shocks, and exposure to dust and moisture.

Increasing advancements

The future of the GCC video surveillance camera market is expected to witness an advancement in AI-based integration and leverage towards fully automated monitoring. This innovation has the potential to identify unusual activities, recognize faces, and even predict potential security breaches. Advanced levels of responsive monitoring systems can be achieved by the integration of the Internet of Things (IoT) and smart systems that send responsive alerts to the control system or mobile devices. The incorporation of data analytics will help in understanding the business behaviors of workers. This will improve safety measures and automatically recognize unwanted behaviors.

The dome camera segment contributed the highest GCC video surveillance camera market share in 2024. The dominance of this segment is observed due to their highly versatile design which can be used in both indoor and outdoor settings. They offer unparalleled coverage. The majority of the dome cameras are equipped with vandal-proof encasing, IR night vision, and sturdy metal bases that protect the camera from vandalism or tampering, providing reliable surveillance in harsh conditions.

The box-style camera segment is anticipated to grow at the fastest CAGR in the GCC video surveillance camera market during the forecast period. The expansion of the box-style camera segment is noted due to the flexible design which is best suited for security purposes. They can be easily replaced or upgraded which allows users to have a better angle of view without needing to change the entire camera.

The IP camera segment led the GCC video surveillance camera market in 2024. The segment is dominated by Gulf Cooperation Council (GCC) countries and must follow IP-based video surveillance systems according to all legislation and governmental standards. The region requires high reliability of IP-based video surveillance systems. The implantation of IP-based surveillance was initially observed in UAS such as Dubai, Abu Dhabi, and Qatar and then spread to the rest of the Gulf countries. It is commonly noticed in large facilities, including stadiums, hotels, campuses, and city surveillance cities, where the owner seeks a cost-effective way to have better coverage in a wide area.

The commercial segment accounted for the highest GCC video surveillance camera market share in 2024. Video surveillance has become an essential service in business sectors, and it includes monitoring and security on the premises. All the security surveillance for commercial places is designed to meet the Ministry of Interior (MoI) regulation. The service includes the installation of active surveillance components at the customer premise, active support, local storage at the customer site, management alerts, and many more. The commercial setting for comprehensive solutions includes hotels, banks, depart stores, exhibition centers, hospitals, residential complexes, education facilities, IT data centers, event operators, and utility companies.

The logistics and transportation segment is expected to grow at the fastest CAGR in the GCC video surveillance camera market during the forecast period. The expansion is noted due to modern surveillance, which efficiently enhances logistics and supply chain processes. For warehouse safety, an advanced surveillance system is used to always enhance facility safety and operational efficiency. The utilization of technology has made business safer and more sustainable.

Saudi Arabia dominated the GCC video surveillance camera market in 2024., with the largest shares credited to the increasing demand for robust security systems. Rising security concerns and technological advancements drive the market in Saudi Arabia. Key industry players constantly focus on novel innovation and strategic partnerships, which helps them offer support in various sectors. The GCC video surveillance cameras market is greatly driven by government rules. The Ministry of the Interior (MOI) is constantly updating the rules every year. The rules include where the cameras must be placed, several details about their specifications, and how to make sure they produce good-quality videos.

UAE will witness significant growth in the GCC video surveillance camera market during the forecast period. The country is advancing towards smart infrastructure and optimized security, which is ultimately increasing the demand for surveillance solutions for a safe and secure environment. UAE has recently integrated an Internet of Things-based home security system that has the ability to detect motion. This is a significant step towards transforming residential areas into a smart and secure environment. The Dubai Quality of Life Strategy 2033 is a practice towards proactive efforts to combat crime where the companies and police of the country are making an effort towards strategic partnerships to develop security and technical operations for a better community.

By Product Type

By Type

By End-User

By Country

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

August 2024

August 2024

January 2025

November 2024