April 2025

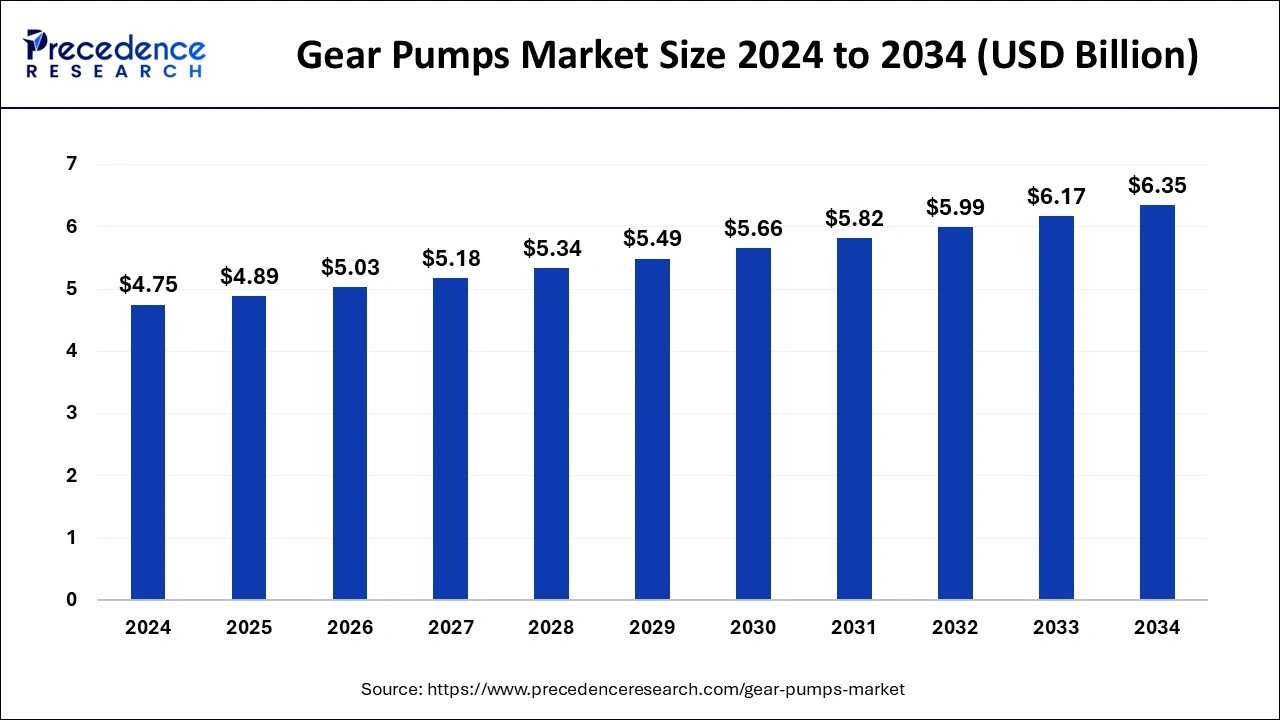

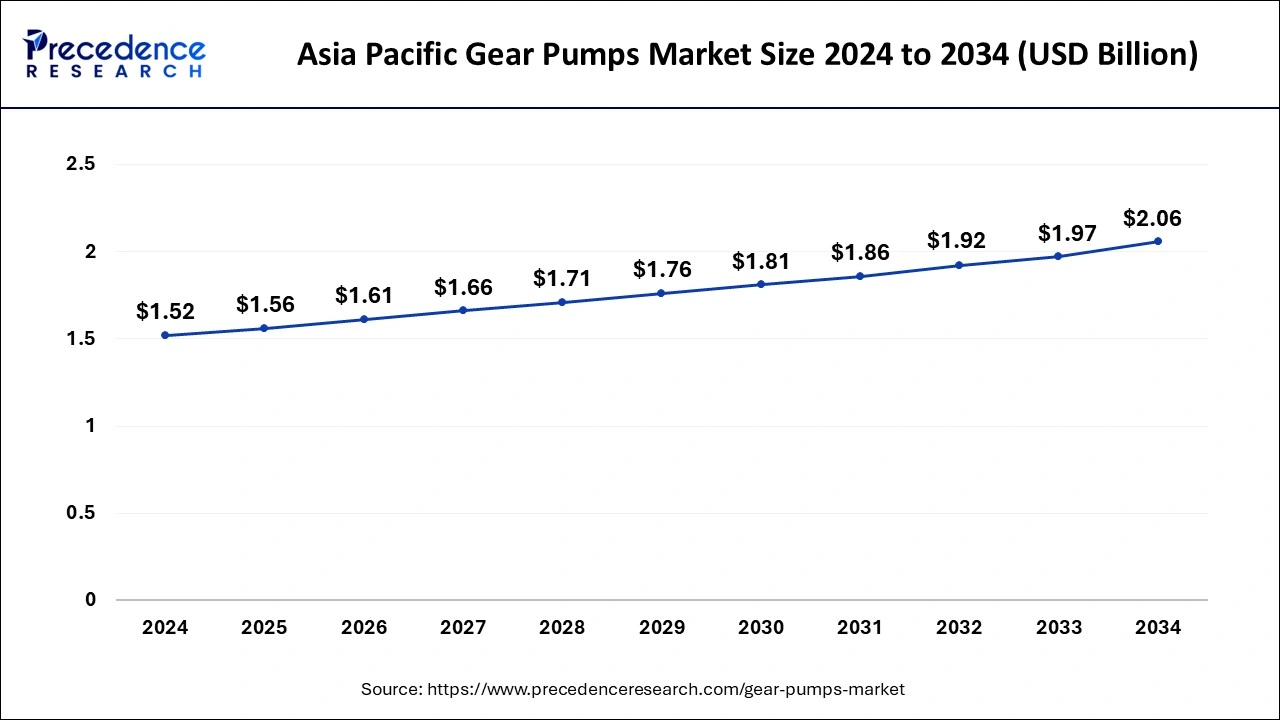

The global gear pumps market size is calculated at USD 4.89 billion in 2025 and is forecasted to reach around USD 6.35 billion by 2034, accelerating at a CAGR of 2.95% from 2025 to 2034. The Asia Pacific gear pumps market size surpassed USD 1.56 billion in 2025 and is expanding at a CAGR of 3.09% during the forecast period. The market sizing and forecasts are revenue-based (USD Million/Billion), with 2024 as the base year.

The global gear pumps market size was estimated at USD 4.75 billion in 2024 and is predicted to increase from USD 4.89 billion in 2025 to approximately USD 6.35 billion by 2034, expanding at a CAGR of 2.95% from 2025 to 2034.

The asia pacific gear pumps market size was valued at USD 1.52 billion in 2024 and is predicted to increase USD 2.06 billion by 2034, expanding at a CAGR of 3.09% from 2025 to 2034.

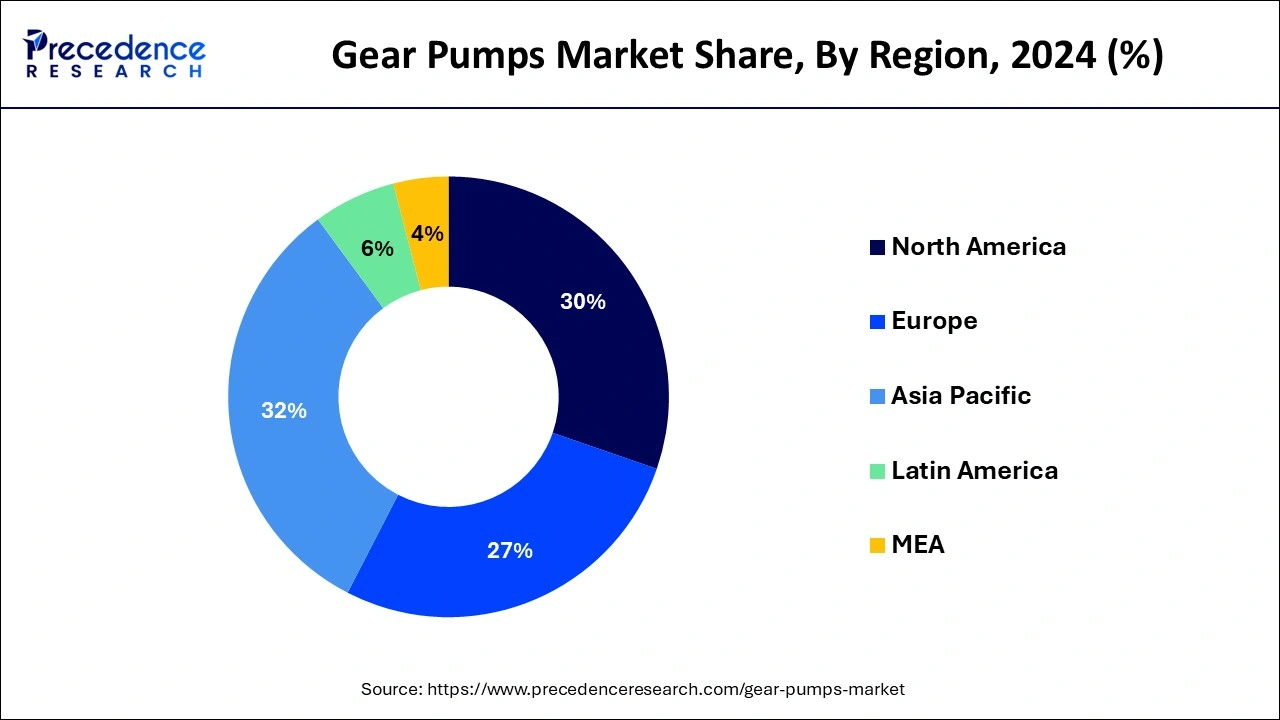

Asia-Pacific dominated the gear pumps market and is poised for rapid growth in the gear pumps market due to the rapid industrialization, infrastructure development, and economic growth in countries within this region. The robust industrial growth in countries like China, India, Japan, South Korea, and others has led to increased demand for gear pumps. These pumps play a crucial role in various industries, including manufacturing, construction, mining, and automotive.

North America has a mature and well-established industrial sector, contributing to a significant demand for gear pumps across various industries. The manufacturing sector in the United States, Canada, and Mexico is a major consumer of gear pumps. These pumps are used in various industrial applications, including machinery, hydraulics, lubrication systems, and material handling.

Meanwhile, Europe has a well-established and diverse industrial landscape, and the gear pumps market in the region is influenced by various factors across different countries. Europe hosts a strong manufacturing sector, contributing to a substantial demand for gear pumps. These pumps are used in various industrial applications, including machinery, hydraulics, and lubrication systems.

The gear pumps market is a segment within the broader industrial pump industry that focuses on the production, distribution, and utilization of gear pumps. Gear pumps are positive displacement pumps that use intermeshing gears to transfer fluids by displacing a fixed amount of fluid with each revolution. These pumps are widely employed in various industries due to their reliability, simplicity, and efficiency in handling a diverse range of liquids, including oils, fuels, chemicals, and viscous fluids.

The gear pumps market is driven by the increasing demand from sectors such as oil and gas, automotive, chemical processing, and manufacturing. In the oil and gas industry, gear pumps play a crucial role in transferring lubricating oils and other fluids, while in automotive applications, they are used for engine lubrication and transmission systems. The chemical processing industry relies on gear pumps for precise fluid metering, and manufacturing processes often require these pumps for tasks such as hydraulic power transmission.

Gear Pumps Market Data and Statistics

| Report Coverage | Details |

| Market Size in 2025 | USD 4.89 Billion |

| Market Size by 2034 | USD 6.35 Billion |

| Growth Rate from 2025 to 2034 | CAGR of 2.95% |

| Largest Market | Asia Pacific |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | By Product Type, By Operating Pressure, and By End-User |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

High efficiency

As industries strive for increased productivity and cost-effectiveness, the need for efficient pumping solutions has become paramount. Gear pumps, known for their simplicity, reliability, and smooth operation, have emerged as a preferred choice for many applications. Their ability to handle a wide range of viscosities and deliver consistent flow rates makes them versatile in various industrial processes.

The high efficiency of gear pumps is a key factor fueling their demand. These pumps minimize energy losses and deliver a reliable and consistent flow of fluids, contributing to overall system efficiency. Industries such as manufacturing, oil and gas, automotive, and chemical processing are increasingly adopting gear pumps to optimize their fluid transfer and lubrication processes. Additionally, the compact design and ease of maintenance of gear pumps make them attractive for applications where space is a critical factor.

Noise generation

Gear pumps are valued for their efficiency and reliability, the inherent meshing of gears during operation can result in elevated noise levels. This noise can pose challenges in industries where a quiet working environment is essential, such as in precision manufacturing or applications where noise reduction is a regulatory requirement. The concern over noise generation becomes particularly pronounced as industries increasingly prioritize workplace comfort, adhere to stringent noise regulations, and focus on creating sustainable and environmentally friendly processes. Thus, the concerned factor acts as a major restraint for gear pumps market.

In instances where noise pollution is a critical consideration, gear pumps may encounter reluctance from users seeking quieter alternatives. Manufacturers are recognizing this challenge and are actively investing in research and development to address noise-related issues associated with gear pumps. Innovative solutions, such as advanced damping technologies and noise reduction materials, are being explored to mitigate the impact of noise generation without compromising the pump's efficiency.

Rising demand in oil & gas and chemical industries

The gear pumps market is experiencing a surge in demand propelled by the thriving oil & gas and chemical industries. As these sectors undergo substantial expansion globally, the need for reliable and efficient fluid transfer mechanisms has intensified, contributing significantly to the growing demand for gear pumps. In the oil & gas industry, gear pumps are integral for various applications such as lubrication, hydraulic systems, and fuel transfer, ensuring the smooth operation of machinery in exploration, extraction, and refining processes.

Similarly, in the chemical industry, gear pumps play a crucial role in handling and transferring chemicals with precision, contributing to the efficiency and safety of manufacturing processes. The increasing global demand for energy and chemicals, driven by population growth and industrialization, underscores the pivotal role gear pumps play in facilitating fluid transfer within these critical sectors. Manufacturers in the gear pumps market are poised to capitalize on this rising demand by providing innovative and reliable solutions, aligning with the evolving needs of the oil & gas and chemical industries as they continue to expand and evolve.

The external gear pumps segment dominated the gear pumps market in 2024. External gear pumps consist of two gears, one is a driving gear (rotor), and the other is a driven gear (idler). These gears operate externally and mesh outside the pump housing. As the gears rotate, fluid is trapped in the spaces between the gear teeth and is transported from the inlet to the outlet. External gear pumps are known for their simplicity, efficiency, and ability to handle a wide range of viscosities. It finds applications in various industries, including automotive, chemical processing, and hydraulic systems, where a reliable and cost-effective solution for fluid transfer is required.

The internal gear pump segment is expected to grow at a significant rate throughout the forecast period. Internal gear pumps consist of an external gear (rotor) and an internal gear (idler) that meshes inside the pump housing. The fluid is trapped between the teeth of the gears and is displaced from the inlet to the outlet as the gears rotate. Internal gear pumps are recognized for their compact design, efficiency, and the ability to handle both high and low viscosities. It is commonly used in applications where precise fluid control is crucial, such as in chemical processing, food and beverage, and pharmaceutical industries. Their design makes them suitable for handling sensitive or abrasive fluids.

Concentric AB received a contract worth 7 million Swedish Krona (SEK) to provide electro-hydraulic steering (EHS) pump to an European electric bus OEM. The EHS units are equipped with Concentric’s internal gear pump (IGP), which is optimized to offer low-noise steering system requirements.

The 100-300 bar segment held the largest share of the gear pumps market in 2024. Gear pumps operating in the 100-300 bar pressure range cater to applications that demand intermediate pressure levels. They are designed to handle more challenging tasks that require a higher level of pressure compared to lower-pressure systems. Industries like manufacturing, automotive, and certain hydraulic systems benefit from gear pumps within this pressure range, providing the necessary force for efficient fluid transfer in moderately demanding environments.

The above 300 bar segment is expected to generate a notable revenue share in the market. pumps capable of operating above 300 bar is engineered to handle high-pressure applications. These pumps are well-suited for industrial processes where substantial force is required to move fluids through the system at elevated pressures. High-pressure gear pumps find application in heavy industries such as oil and gas, construction, and some advanced hydraulic systems. They play a crucial role in applications demanding precise and powerful fluid transfer under challenging conditions.

The construction segment dominated the gear pumps market in 2024. Gear pumps in the construction sector are used for various applications, including hydraulic systems in heavy equipment such as excavators, loaders, and cranes. These pumps contribute to the efficient operation of construction machinery.

The oil & gas segment is expected to generate a notable revenue share in the market. The oil and gas industry relies on gear pumps for tasks such as crude oil transfer, lubrication, and hydraulic systems. These pumps contribute to the smooth operation of equipment in upstream, midstream, and downstream oil and gas processes.

By Product Type

By Operating Pressure

By End-User

By Geography

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

April 2025

January 2025

October 2024

January 2025