January 2025

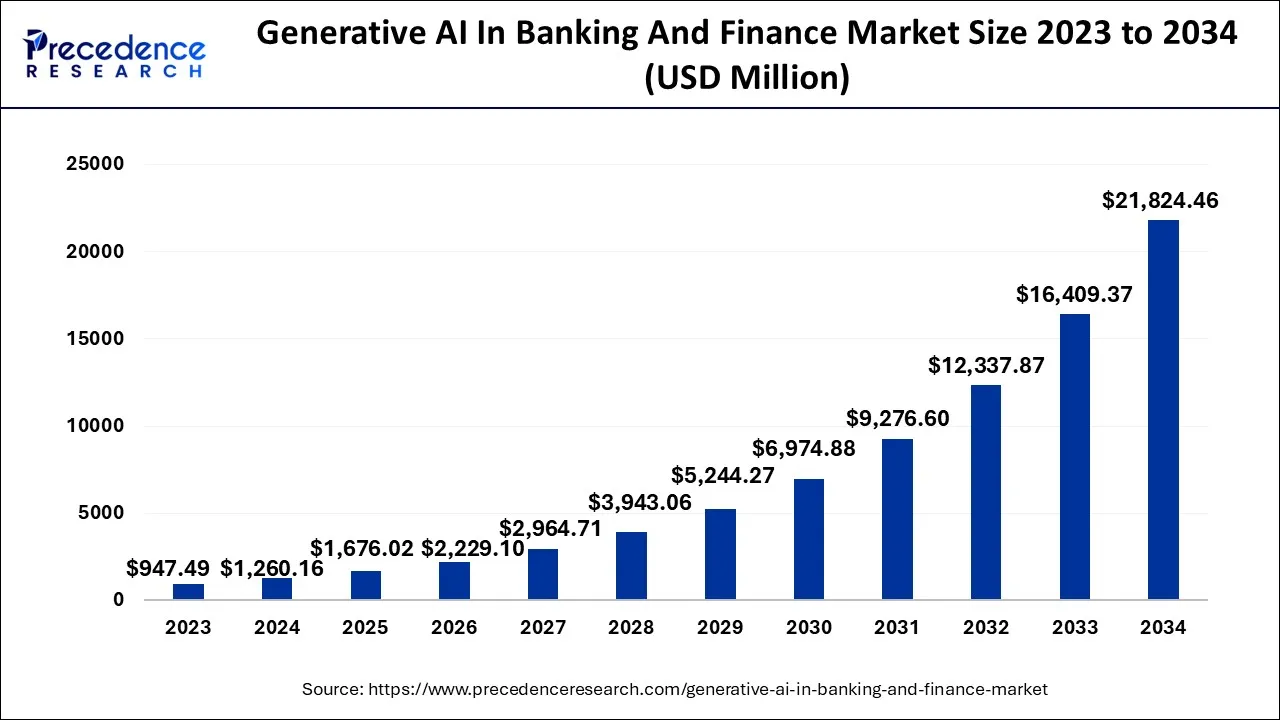

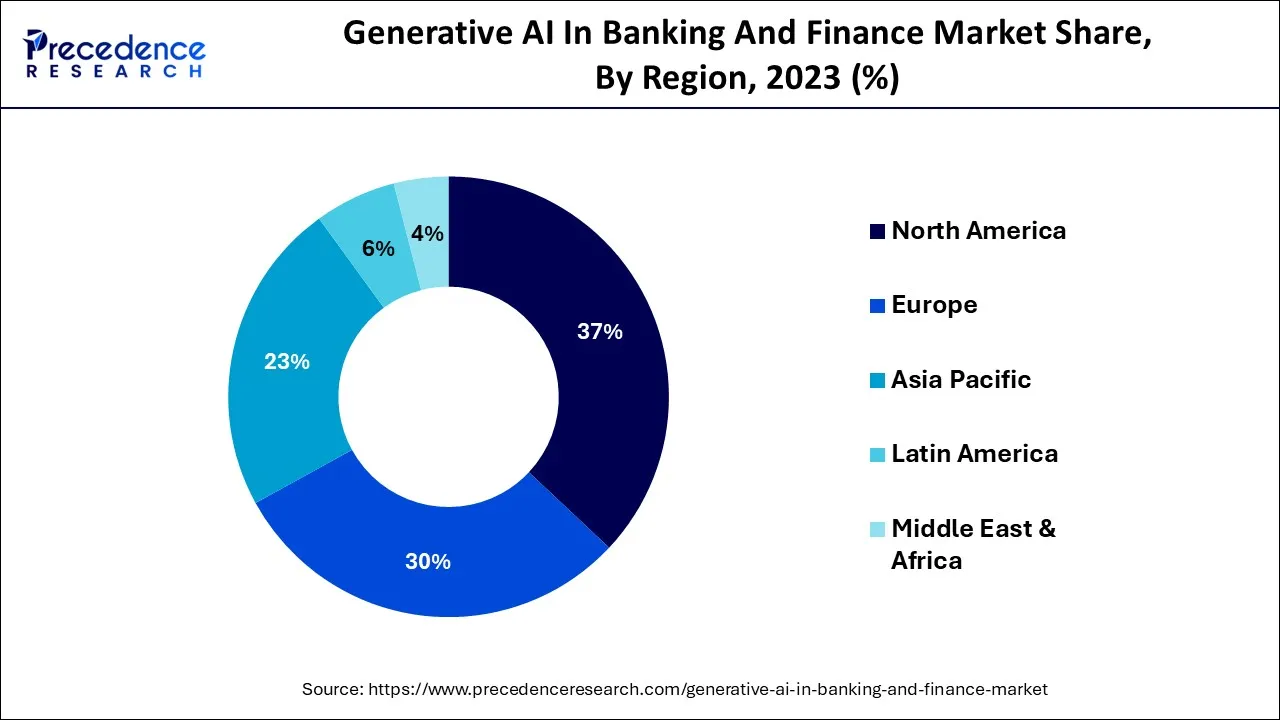

The global generative AI in banking and finance market size is calculated at USD 1,260.16 million in 2024, grew to USD 1,676.02 million in 2025, and is predicted to hit around USD 21,824.46 million by 2034, expanding at a CAGR of 33% between 2024 and 2034. The North America generative AI in banking and finance market size accounted for USD 466.26 million in 2024 and is anticipated to grow at the fastest CAGR of 33.18% during the forecast year.

The global generative AI in banking and finance market size is worth around USD 1,260.16 million in 2024 and is anticipated to reach around USD 21,824.46 million by 2034, growing at a CAGR of 33% over the forecast period from 2024 to 2034.

North America is expected to dominate the market over the forecast period. The region is known for its technological advancements and innovation in the field of artificial intelligence. Major financial centers, such as New York and San Francisco, are home to a thriving fintech ecosystem, where startups and established companies are actively developing and implementing generative AI solutions for banking and finance. In addition, they have a well-established regulatory framework for banking and finance, which drives the need for robust risk assessment and fraud detection systems. Generative AI, with its ability to generate synthetic data and simulate various scenarios, helps financial institutions comply with regulations such as anti-money laundering (AML) and fraud prevention guidelines. Moreover, the willingness to adopt advanced and automated solutions Therefore, the aforementioned facts support the market expansion in the region.

Europe is expected to grow at a significant rate over the forecast period. European financial institutions are actively embracing digital transformation to enhance their competitiveness and meet evolving customer expectations. Generative AI plays a crucial role in this transformation by enabling personalized customer experiences, automating processes, and improving operational efficiency. Banks and financial institutions are utilizing generative AI to offer innovative services, such as virtual assistants and chatbots, for customer support and engagement. Moreover, they have a thriving startup ecosystem and attract significant investments in AI technologies. Venture capital firms and investors are actively funding European fintech startups that specialize in generative AI applications for banking and finance. This investment activity contributes to the growth and development of the generative AI market in the region.

Asia Pacific is expected to grow at the fastest rate over the forecast period. The region is witnessing rapid technological advancements and digital transformation across various industries, including banking and finance. Countries like China, Japan, and Singapore are at the forefront of AI innovation and are investing heavily in research and development related to generative AI. Moreover, they have a thriving fintech ecosystem, with numerous startups focusing on leveraging AI technologies for banking and finance applications. Fintech companies are embracing generative AI to enhance risk assessment, fraud detection, customer experience, and financial forecasting. These startups often bring innovative solutions to the market, disrupting traditional financial institutions. Thereby, driving the market growth in the region.

Banking and finance are a few of the domains where generative artificial intelligence (AI) has become an extremely powerful tool. Generative AI offers creative ways for addressing difficult problems in the financial sector since it may produce new data samples that match current datasets. Banks, financial organizations, and fintech firms may boost fraud detection, optimize portfolios, generate useful insights, and improve financial forecasts by utilizing generative AI approaches.

The uses of generative AI in banking and finance are many and include several important domains. A key component of financial operations is risk assessment, which may be improved by creating artificial data that simulates prospective threats. Institutions are now better able to assess risks and reduce them. By using massive datasets of fraudulent and non-fraudulent transactions to train models, generative AI can help fraud detection systems. These algorithms may produce synthetic data that closely matches fraudulent activity by learning patterns from the data, which makes fraud detection more precise. Additionally, investment portfolio optimization is another potential use of generative AI.

Financial institutions can evaluate the possible results and risks associated with alternative techniques by creating synthetic market situations and modeling various investment strategies. By evaluating past data and producing hypothetical future financial scenarios, generative AI may also help with financial forecasting. This makes it possible for businesses to forecast stock prices, market trends, and consumer behavior more accurately, which results in better decision-making. The market is being driven by various factors including increasing investment in AI, growing product launches, increasing collaboration among the market players, technological advancements and the benefits offered by these techniques.

| Report Coverage | Details |

| Market Size in 2024 | USD 1,260.16 Million |

| Market Size in 2034 | USD 21,824.46 Million |

| Growth Rate from 2024 to 2034 | CAGR of 33% |

| Largest Market | North America |

| Base Year | 2023 |

| Forecast Period | 2024 to 2034 |

| Segments Covered | By Technology and By Application |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

The increasing utilization of generative AI in fraud detection

The banking and financial services sector has serious concerns about fraud detection and prevention. For institutions looking to secure their systems and defend their consumers, the continuously changing nature of fraudulent operations presents major obstacles. The advanced methods that fraudsters use frequently make it difficult for traditional rule-based systems and static fraud detection models to stay up. The vast amount of financial transactions and data created also makes it challenging to manually spot fraudulent tendencies quickly. To improve fraud detection and prevention skills, it is necessary to examine cutting-edge technologies like generative AI. Therefore, the growing utilization of generative AI in fraud detection is expected to drive market growth over the forecast period.

Technical complexities

There may be technical difficulties when implementing generative AI models in banking and finance. Significant computing resources and experience are needed to create accurate and trustworthy generative models. Acquiring the appropriate computer equipment, qualified AI personnel, and enough training data may prove difficult for financial organizations. It can take a lot of time and resources to solve these technological problems and successfully incorporate generative AI into current systems and workflows. Thus, technological complexity is expected to hamper the market growth over the forecast period.

The rising role of chatbots and virtual assistants in banking and financial services

Virtual assistants and chatbots have become quite popular in the banking and financial services sector as tools to improve client engagement and assistance. These conversational AI bots communicate with consumers using a natural language interface while offering automatic help and answering questions. Chatbots and virtual assistants are always on hand to help clients and offer round-the-clock accessibility and assistance. They have developed into priceless resources for financial institutions, enabling them to provide individualized experiences, boost operational effectiveness, and raise customer satisfaction. Thus, the increasing role of chatbots and virtual assistants in banking and financial services is expected to offer a lucrative opportunity for market expansion over the forecast period.

Based on the technology, the global generative AI in banking and finance market is segmented into natural language processing, deep learning, reinforcement learning, generative adversarial networks, computer vision and predictive analytics. The natural language processing segment is expected to grow at a significant rate over the forecast period. NLP plays a significant role in generative AI applications within the banking and finance sector. It enables systems to understand and process human language, facilitating interactions between users and AI models. NLP techniques are employed to extract meaningful information from financial documents, customer queries, and market news, which can then be used to train generative models. Generative AI models, combined with NLP, are utilized to analyze vast amounts of financial data, identify patterns, and generate synthetic data for risk assessment. This aids in evaluating and mitigating potential risks and improving fraud detection systems. By generating synthetic data that closely resembles fraudulent behavior, financial institutions can enhance their ability to identify and prevent fraudulent activities. Therefore, the increasing utilization of generative AI in various applications of the banking and finance sector is expected to flourish the segment expansion over the forecast period.

Based on the application, the global generative AI in banking and finance market is segmented into fraud detection, customer service, risk assessment, compliance and trading and portfolio management. The fraud detection segment is expected to grow at a significant rate over the forecast period. Financial institutions, including banks, credit card companies, and insurance companies, form a significant segment of the market. These organizations face substantial risks related to fraud and require advanced fraud detection systems to protect their customers' assets and maintain their reputations.

Generative AI models, integrated with fraud detection systems, help financial institutions identify patterns and generate synthetic data that closely resembles fraudulent behavior, enabling more accurate detection and prevention of fraudulent transactions. In addition, regulatory bodies and agencies play a crucial role in shaping the generative AI market for fraud detection in banking and finance. Compliance with regulations such as anti-money laundering (AML) and Know Your Customer (KYC) requirements is essential for financial institutions to prevent fraudulent activities. Generative AI, combined with data analytics and NLP techniques, helps organizations ensure compliance by identifying suspicious patterns, generating synthetic data for training compliance models, and facilitating risk assessments. Thereby, driving the segment expansion during the forecast period.

On the other hand, the customer service segment is expected to witness a considerable rate of growth during the forecast period. Banks and financial institutions are investing in generative AI technologies to improve customer service, streamline interactions, and provide personalized experiences. Generative AI-powered chatbots and virtual assistants enable financial institutions to offer 24/7 support, address customer queries in real-time, and provide tailored recommendations for financial products and services. Thereby, driving the segment expansion over the forecast period.

Segments Covered in the Report:

By Technology

By Application

By Geography

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

January 2025

July 2024

September 2024

January 2025