March 2024

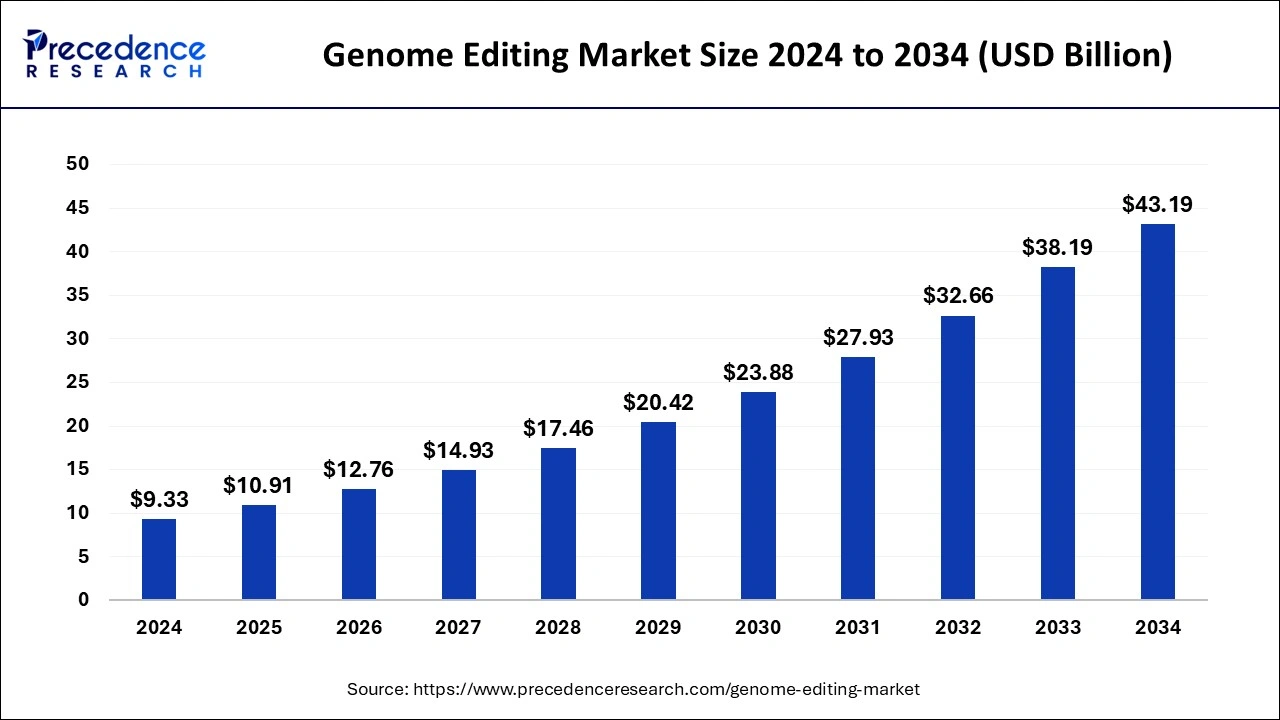

The global genome editing market size is calculated at USD 10.91 billion in 2025 and is forecasted to reach around USD 43.19 billion by 2034, accelerating at a CAGR of 16.56% from 2025 to 2034. The North America genome editing market size surpassed USD 4.48 billion in 2024 and is expanding at a CAGR of 16.56% during the forecast period. The market sizing and forecasts are revenue-based (USD Million/Billion), with 2024 as the base year.

The global genome editing market size was estimated at USD 9.33 billion in 2024 and is predicted to increase from USD 10.91 billion in 2025 to approximately USD 43.19 billion by 2034, expanding at a CAGR of 16.56% from 2025 to 2034. The rising prevalence of down syndrome and cystic fibrosis across the world is driving the growth of the genome editing market.

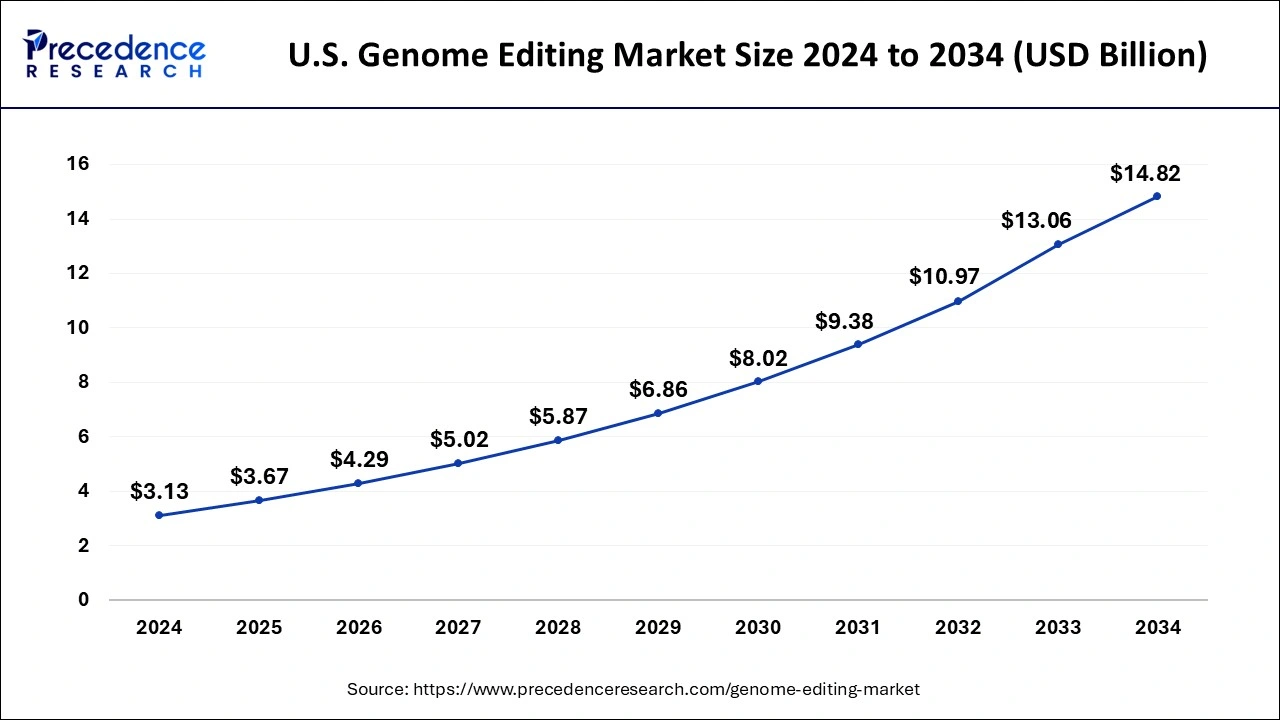

The U.S. genome editing market size was exhibited at USD 3.13 billion in 2024 and is projected to be worth around USD 14.82 billion by 2034, poised to grow at a CAGR of 16.82% from 2025 to 2034.

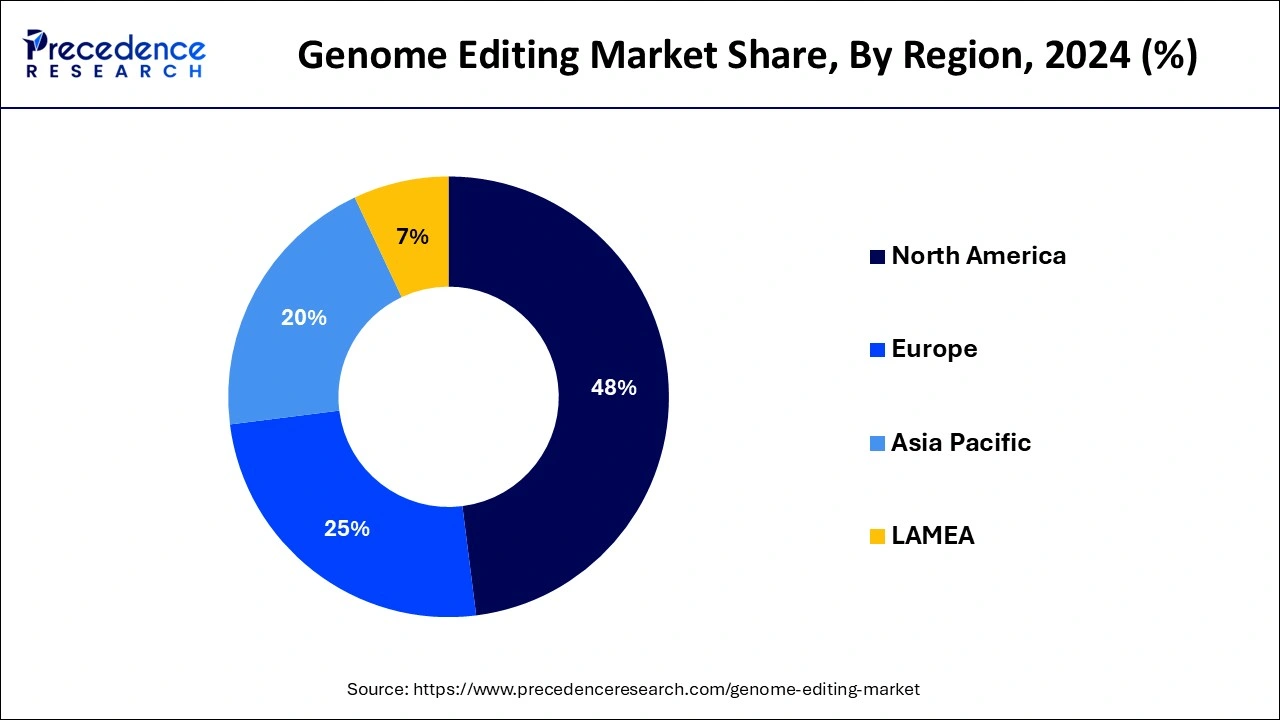

North America held the largest genome editing market share in 2024. The growth of this region is mainly driven by rising government initiatives in countries such as the U.S., Canada, Mexico, and others to strengthen the biotechnology sector. For instance, in July 2021, the government of Canada invested around US$ 1.2 billion in developing its therapeutics, vaccine, and biomanufacturing capacity across the country. The rising developments in the healthcare industry, along with the presence of a well-established biotechnology sector, drive the market growth. Also, the rising advancements in science and technology, along with the establishment of several biotechnology research institutions and innovation centers, are likely to drive market growth.

Moreover, the presence of several market players such as Mission Bio, Danaher, Merck, and some others are constantly engaged in developing high-quality genome editing tools and adopting several strategies such as launches, collaborations, and acquisitions, which in turn drive the growth of the respiratory antiviral treatment market in this region.

Asia Pacific is expected to be the fastest-growing region during the forecast period. The growth of this segment is mainly driven by the rising prevalence of cancer among the people in this region. According to the Ministry of Health (MOH) of Singapore, in 2022, the number of recorded deaths in Singapore was 26,891, and around 23.9 % of these deaths were caused by cancer. Also, rising investments by public and private sector entities in developing the genetic engineering sector are boosting market growth. The rising incidences of genetic disorders, along with the growing demand for gene editing technologies for manufacturing effective therapeutics, drive the market growth in this region. Moreover, the presence of biotechnology companies such as BioRay, Genkore, Cyrus Therapeutics, Takara Bio, and some others are adopting strategies such as product development and collaborations, which in turn drives the growth of the genome editing market.

The genome editing market is one of the most important industries in the biotechnology sector. This industry mainly deals with altering genetic materials in a living organism to treat any genetic disorder. Genome editing works in the principle of inserting, deleting, or replacing DNA sequences in a cell of a living organism. It involves various technologies that mainly include (CRISPR)/Cas9, ZFN, Meganuclease, TALENs/MegaTALs, and some others. There are two delivery methods of gene transfer in different cells: ex-vivo and in-vivo.

The main applications of genome engineering include cell line engineering, plant genetic engineering, animal genetic engineering, and other clinical applications. There are several end users of this industry, mainly including biotechnology and pharmaceutical companies, contract research organizations, and academic and government research institutes. This industry is expected to grow exponentially with the growth in the biotech and healthcare industries.

| Report Coverage | Details |

| Market Size by 2034 | USD 43.19 Billion |

| Market Size in 2025 | USD 10.91 Billion |

| Market Growth Rate from 2025 to 2034 | CAGR of 16.56% |

| Largest Market | North America |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Technology, Delivery Method, Application, Mode, End-use, and Regions |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Rising applications of CRISPR technology

The drastic evolution of CRISPR/CAS9 tools has played an important role in the development of the genome editing industry. The rising application of CRISPR technology for manipulating genomic DNA from host organisms to develop effective therapeutics has gained prominent attention from different industry verticals. The growing demand for CRISPR-based genetic editing technology in research of cardiovascular disease along with growing use of CRISPR-Cas systems in precise genome editing including base editing and prime editing has impacted the market growth positively. Moreover, biotech companies are constantly developing advanced CRISPR therapies for the treatment of rare diseases, which is likely to drive the growth of the genome editing market during the forecast period.

Ethical concerns of genomic engineering

The application of genome editing has gained utmost importance in recent times. Although there are several advantages of gene editing, it comes with several problems that mainly include ethical issues. The ethical issue arises due to the adoption of germline gene therapies for altering genes in the present generation to prevent future generations from any genetic disorders that may not be liked by some families. Thus, growing ethical concerns in genetic editing are likely to restrain the growth of the genome editing market.

Development of AI-based CRISPR technology

Advancements in AI have played an important role in the development of the genome editing industry. The rising integration of AI in genome engineering has gained popularity. The development of AI-based CRISPR therapies has been found to be effective in treating several rare diseases. Thus, the rising development of AI-based CRISPR technology is expected to create ample growth opportunities for the market players in the future.

The CRISPR/Cas9 segment held the largest market share in 2024. The growth of this segment is generally driven by the rise in advancement in genetic engineering. Also, rising development in genome editing technologies, along with the increasing investments in research and development activities of CRISPR technology, is expected to drive the market growth. Moreover, the growing demand for innovative gene editing tools, along with rising R&D activities of CRISPR technology by biotech companies for manufacturing advanced genetic tools, is also likely to boost the growth of the genome editing market.

The ZFN segment is expected to be the fastest-growing segment during the forecast period. This segment is generally driven by the rising demand for artificial restriction enzymes. Also, rising application of Zinc-finger nuclease technology for manufacturing therapeutics for genetic diseases. Moreover, the rise in the number of patients suffering from HIV and Hunter’s Syndrome has increased the demand for ZFN technology for manufacturing effective drugs to treat these diseases. This, in turn, drives the growth of the genome editing market.

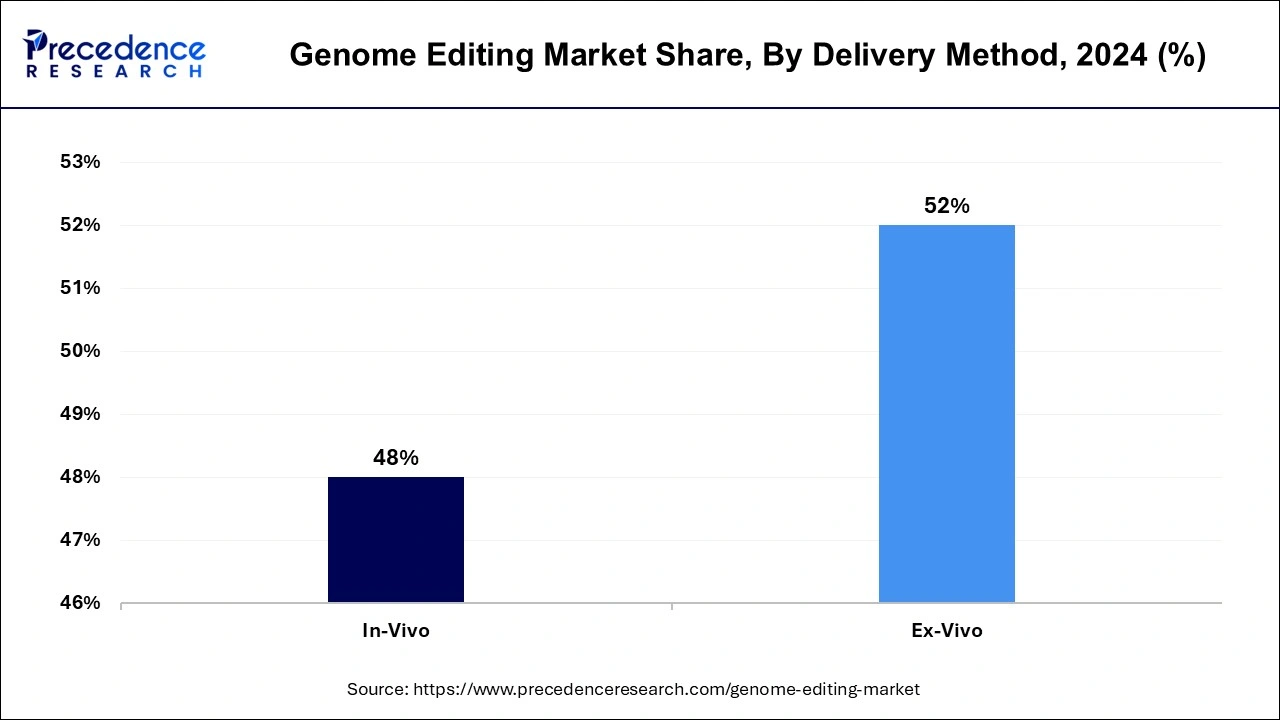

The ex-vivo segment dominated the market in 2024. The growth of this segment is generally driven by the growing developments in gene therapy. Also, the rising trend of gene harvesting for treating blood disorders, along with growing development in CAR-T cell therapies, is likely to boost the growth of the genome editing market. Moreover, ongoing research by scientists on the use of ex-vivo gene therapies to treat fatty liver and obesity among patients across the world is further driving market growth.

The in-vivo segment is expected to be the fastest-growing segment during the forecast period. This segment is generally driven by rising developments in viral vector-mediated gene transfer and epigenome editing strategies. Also, the rising application of in-vivo gene therapies for manufacturing medicine to treat liver and nerve diseases boosts the market growth. Moreover, the ongoing trend of inserting new genes into host organisms is driving the growth of the genome editing market during the forecast period.

The genetic engineering segment held the largest market share in the genome editing market in 2024. The growth of this segment is generally driven by the rising developments in cell line engineering. Also, rising advancements in modern sciences related to plant and animal genetic engineering are likely to boost market growth. Moreover, rising investments by governments of several countries to strengthen the genetic engineering sector have driven the growth of the genome editing market.

The clinical applications segment is expected to be the fastest-growing segment during the forecast period. The growth of this segment is generally driven by the rise in the number of genetic disorders among people across the world. Also, the rising emphasis on developing genetic therapies for the treatment of AIDS and cancer boosts the market growth. Moreover, rising demand for clinical applications such as diagnostics and therapy development has driven the growth of the genome editing market during the forecast period.

The contract segment held the largest share of the genome editing market. The growth of this segment is driven by rising outsourcing activities in genome editing along with the rise in the number of biotech companies providing flexible and low-cost outsourcing offers. Also, growing strategic activities by outsourcing providers of genomic engineering have driven the growth of the genome editing market during the forecast period.

The in-house segment is estimated to be the fastest-growing segment during the forecast period. This segment is generally driven by the growing ownership of supply chains, superior troubleshooting capabilities, and higher potential for developing in-house activities related to genomic engineering. Moreover, the ongoing R&D activities related to the development of in-house genetic therapies to derive maximum profits are likely to drive the growth of the genome editing market.

The biotechnology and pharmaceutical companies segment held the largest share of the market in 2024. This segment is generally driven by the rise in government initiatives to strengthen the biotechnology and pharmaceutical sectors. Moreover, the rise in the number of research activities for developing novel therapeutics, along with advancements in genetic engineering technologies such as CRISPR and ZFN, is likely to drive market growth. Moreover, several collaborations are taking place among the biotech companies to manufacture drugs for treating genetic diseases, further boosting the market growth. For instance, in June 2022, Precision BioSciences collaborated with Novartis. This collaboration aimed to develop potentially curative treatments for several types of disorders, such as sickle cell disease and some others.

The academic and research institutions segment is expected to witness the fastest growth rate during the forecast period. This segment is generally driven by the rise in the number of biotechnology research and academic institutions across the world. Moreover, the rising interest of students in taking up biotechnology for higher studies, along with rising research activities by scientists to derive new therapeutics for treating serious diseases, has increased the demand for biotech research institutions, thereby driving market growth.

By Technology

By Delivery Method

By Application

By Mode

By End-use

By Geography

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

March 2024

February 2025

February 2025

March 2025