May 2025

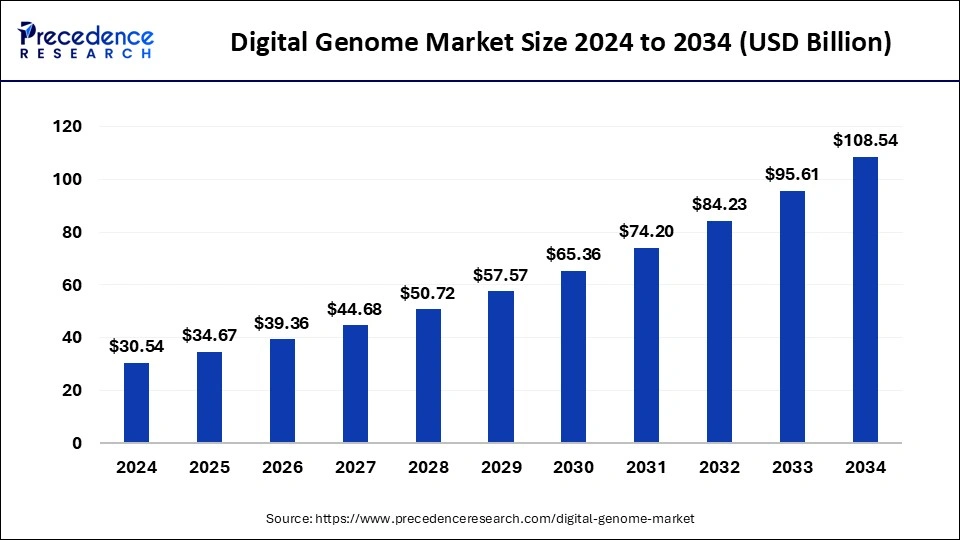

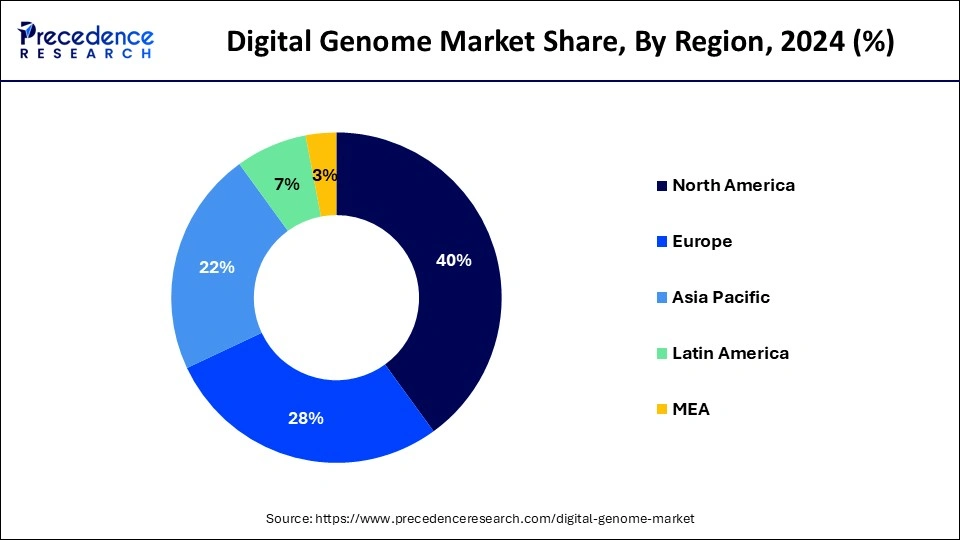

The global digital genome market size accounted for USD 34.67 billion in 2025 and is forecasted to hit around USD 108.54 billion by 2034, representing a CAGR of 13.52% from 2025 to 2034. The North America market size was estimated at USD 12.22 billion in 2024 and is expanding at a CAGR of 13.66% during the forecast period. The market sizing and forecasts are revenue-based (USD Million/Billion), with 2024 as the base year.

The global digital genome market size was calculated at USD 30.54 billion in 2024 and is predicted to increase from USD 34.67 billion in 2025 to approximately USD 108.54 billion by 2034, expanding at a CAGR of 13.52% from 2025 to 2034. The increasing demand for precision medicines and the ongoing technological advancements are driving the growth of the market.

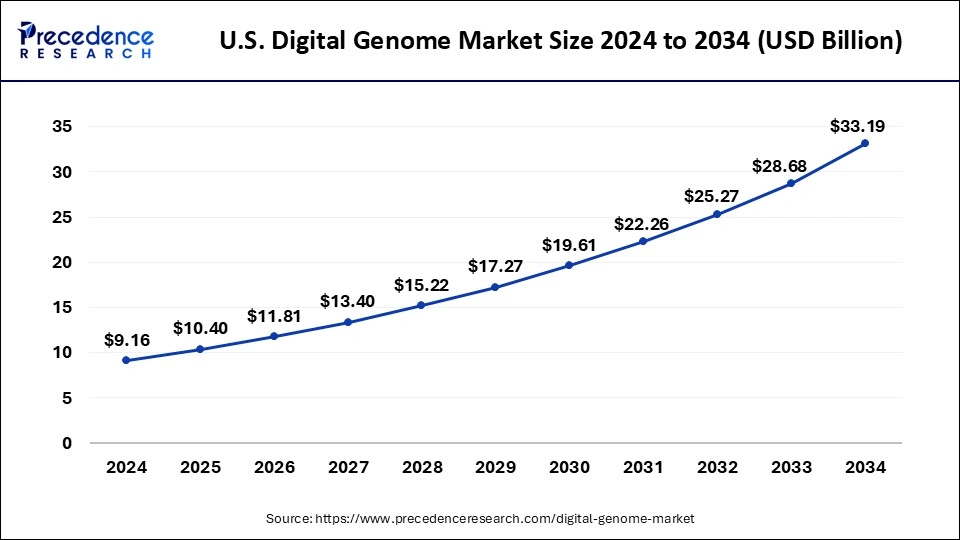

The U.S. digital genome market size was exhibited at USD 9.16 billion in 2024 and is projected to be worth around USD 33.19 billion by 2034, growing at a CAGR of 13.74% from 2025 to 2034.

North America dominated the digital genome market in 2024. The growth of the market in the region is increasing due to the rising healthcare and pharmaceutical infrastructure in the region. The increasing prevalence of chronic diseases like cancer, diabetes, etc. is driving the demand for genome studies for an effective treatment plan with more accuracy. The rising investments in research and development activities on innovations in the pharmaceutical industry are driving the growth of the market in the region. The increasing collaboration, high-end technology, and the launches of innovative products are contributing to the growth of the digital genome market in the region.

The region is home to many prominent biotechnology companies specializing in genomics, personalized medicine, and molecular diagnostics. These companies drive innovation in digital genome technologies, develop cutting-edge products, and collaborate with healthcare providers and research organizations to advance genomic medicine. Government agencies and regulatory bodies in North America provide substantial support for genomic research and innovation. Funding initiatives, grants, and regulatory frameworks promote the development and commercialization of digital genome technologies, encouraging investment and growth in the market.

Asia Pacific is expected to witness the fastest rate of growth in the digital genome market during the forecast period. The growth of the market in the region is expected to be boosted due to the rising investments by the public and private sectors in the development of research institutes and the pharmaceutical industry is contributing to the growth of the market. With a large and diverse population, Asia Pacific countries are experiencing a rising demand for personalized medicine solutions tailored to individual genetic profiles. Digital genome technologies enable the analysis of vast amounts of genomic data to provide personalized insights into disease risk, treatment efficacy, and preventive strategies, aligning with the region's healthcare priorities.

Many Asia Pacific governments are actively promoting genomic research and precision medicine initiatives through funding support, regulatory reforms, and strategic partnerships. National genomics projects, research consortia, and genomic data repositories are fostering collaboration among academia, industry, and healthcare organizations to accelerate the adoption of digital genome technologies.

Asia Pacific countries, particularly China and India, have emerged as major hubs for biotechnology and pharmaceutical research and manufacturing. The region's vibrant life sciences ecosystem, coupled with a skilled workforce and supportive regulatory environment, facilitates innovation and commercialization in the digital genome space, attracting investments from global biotech and pharma companies.

The digital genome market refers to the industry involved in the development, implementation, and commercialization of technologies and solutions aimed at analyzing, storing, and utilizing digital representations of genomes. These technologies enable the comprehensive digitization of genomic information, including DNA sequences, genetic variations, gene expression profiles, and other molecular data. Bioinformatics algorithms and computational tools are essential for processing, analyzing, and interpreting digital genomic data. These tools encompass a wide range of software applications and databases for sequence alignment, variant calling, genome assembly, pathway analysis, and predictive modeling.

| Report Coverage | Details |

| Growth Rate from 2025 to 2034 | CAGR of 13.52% |

| Market Size in 2025 | USD 34.67 Billion |

| Market Size by 2034 | USD 108.54 Billion |

| Largest Market | North America |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Product, Application, and End-user |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Rising adoption of personalized medicine

Personalized medicine relies on the integration of genomic data with clinical information to identify biomarkers, therapeutic targets, and predictive indicators for disease susceptibility, progression, and treatment response. Digital genome technologies, such as next-generation sequencing (NGS) platforms, bioinformatics tools, and data analytics algorithms, play a crucial role in processing, interpreting, and visualizing complex genomic data sets for clinical decision-making.

Personalized medicine encompasses pharmacogenomics, which involves the study of how an individual's genetic variations influence drug metabolism, efficacy, and toxicity. Digital genome technologies facilitate pharmacogenomic testing and implementation of genotype-guided prescribing practices to optimize drug selection, dosing, and patient management, reducing the risk of adverse drug reactions and treatment failures. Thereby, the rising adoption of personalized medicine is observed to act as a driver for the digital genome market.

Lack of skilled workforce

Digital genome technologies generate vast amounts of complex genomic data that require sophisticated analysis and interpretation. However, there is a shortage of professionals with specialized skills in bioinformatics, computational biology, and genomic data analysis. Without adequately trained personnel, there is a risk of inaccurate or incomplete data analysis, leading to unreliable results and interpretations. Thereby, the lack of skilled professionals acts as a restraint for the digital genome market.

Digital genome research and applications span multiple disciplines, including genetics, molecular biology, computer science, and bioinformatics. Skilled professionals with interdisciplinary knowledge and expertise are essential for integrating diverse data types, interpreting complex genomic information, and applying computational methods to biological problems. The lack of professionals with cross-disciplinary training and experience can impede innovation and collaboration in the digital genome field.

The increasing adoption of the digital genome in various applications

The digital genome is widely accepted by various applications like research centers for providing beneficial insights into complex genetic systems, that is observed to open lucrative opportunities for the digital genome market. Digital genome is further used in applications like forensics, research and development, agriculture & livestock, reproductive and genetic, transplantation microbiology, etc. The technological advancements in the digital genome aim to help in the early diagnosis and the accuracy in the treatment of diseases like cancer, hyperactivity disorders, and diabetes. The emerging technological development in the digital genome is further propelling the growth of the market in the upcoming period.

The sequencing and analyzer instruments segment dominated the digital genome market in 2024. Sequencing and analyzer instruments are essential components of digital genome analysis, enabling the decoding and analysis of genetic information with high precision and throughput. These instruments play a pivotal role in various genomic applications, including next-generation sequencing (NGS), polymerase chain reaction (PCR), microarray analysis, and other high-throughput techniques.

Continuous advancements in sequencing and analyzer instrument technologies, such as improved sequencing platforms, higher throughput capabilities, enhanced sensitivity and accuracy, and reduced costs per base pair, drive their widespread adoption and dominance in the digital genome market. These innovations enable researchers and clinicians to generate vast amounts of genomic data rapidly and cost-effectively, facilitating breakthrough discoveries and applications in genomics.

The DNA/RNA analysis kits segment is observed to witness the fastest rate of expansion in the digital genome market during the forecast period. With advancements in genomic research and personalized medicine, there is a growing demand for DNA/RNA analysis kits to analyze genetic material and uncover insights into an individual's genetic makeup, gene expression, and disease risk. These kits enable researchers, clinicians, and healthcare professionals to perform a wide range of genomic analyses, including sequencing, genotyping, gene expression profiling, and biomarker discovery.

DNA/RNA analysis kits offer a cost-effective solution for genomic analysis compared to traditional laboratory techniques, such as Sanger sequencing or microarray-based assays. These kits often provide high-throughput capabilities, multiplexing options, and automation features that reduce labor and material costs associated with genomic analysis, making them an attractive option for research laboratories, academic institutions, and clinical settings.

The microbiology segment had the largest share of the digital genome market in 2024. Microbiology encompasses the study of a vast array of microorganisms, including bacteria, viruses, fungi, and protozoa, which play crucial roles in various industries such as healthcare, agriculture, environmental science, and biotechnology.

The diverse nature of microbial species and their genetic makeup drives the demand for digital genome technologies capable of analyzing and characterizing microbial genomes at scale. Microbial genomics serves as a cornerstone in biotechnological and industrial applications, including biofuel production, bioremediation, enzyme production, and pharmaceuticals. Digital genome technologies facilitate genetic engineering, metabolic engineering, and synthetic biology approaches aimed at enhancing microbial strains for improved performance, productivity, and sustainability in various industrial processes.

The academic research institutes segment dominated the digital genome market in 2024. Academic research institutes foster collaboration and knowledge sharing among scientists, clinicians, and industry partners, facilitating collaborative research projects and consortiums focused on digital genome analysis. These collaborative networks enable access to diverse datasets, resources, and intellectual capital essential for advancing digital genomics research.

Many academic research institutes have a dual mandate of conducting cutting-edge research and educating the next generation of scientists and healthcare professionals. As such, these institutes invest in genomic training programs, graduate education, and postdoctoral fellowships to cultivate talent and expertise in digital genomics. Academic research institutes often take a long-term perspective on scientific discovery and innovation, focusing on fundamental questions and blue-sky research that may not have immediate commercial applications. This long-term orientation allows academic researchers to explore novel concepts, methodologies, and technologies that could shape the future of digital genomics.

By Product

By Application

By End-user

By Geography

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

May 2025

May 2025

January 2025

May 2025