September 2024

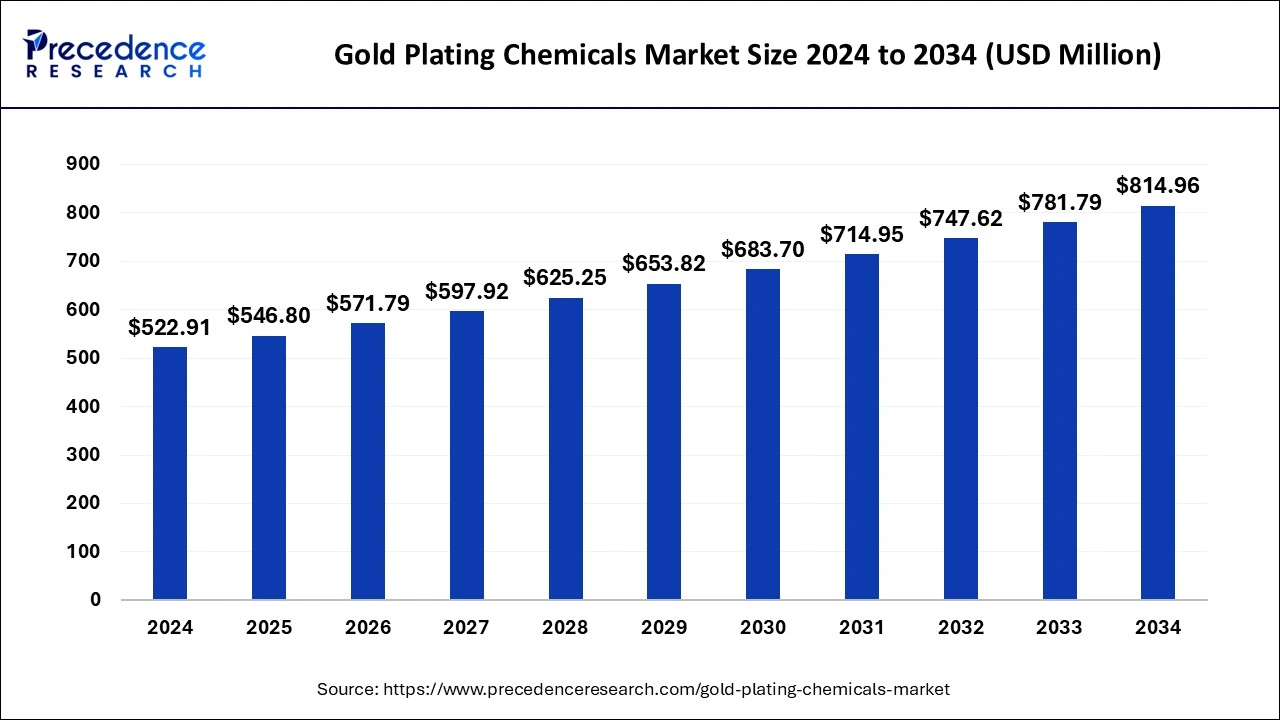

The global gold plating chemicals market size is calculated at USD 546.80 million in 2025 and is forecasted to reach around USD 814.96 million by 2034, accelerating at a CAGR of 4.54% from 2025 to 2034. The North America gold plating chemicals market size surpassed USD 172.56 million in 2024 and is expanding at a CAGR of 4.69% during the forecast period. The market sizing and forecasts are revenue-based (USD Million/Billion), with 2024 as the base year.

The global gold plating chemicals market size was estimated at USD 522.91 million in 2024 and is predicted to increase from USD 546.80 million in 2025 to approximately USD 814.96 million by 2034, expanding at a CAGR of 4.54% from 2025 to 2034. The increase in substance abuse and lifestyle behaviors like cigarette smoking and alcohol consumption will ultimately lead to the growth of the gold plating chemicals market.

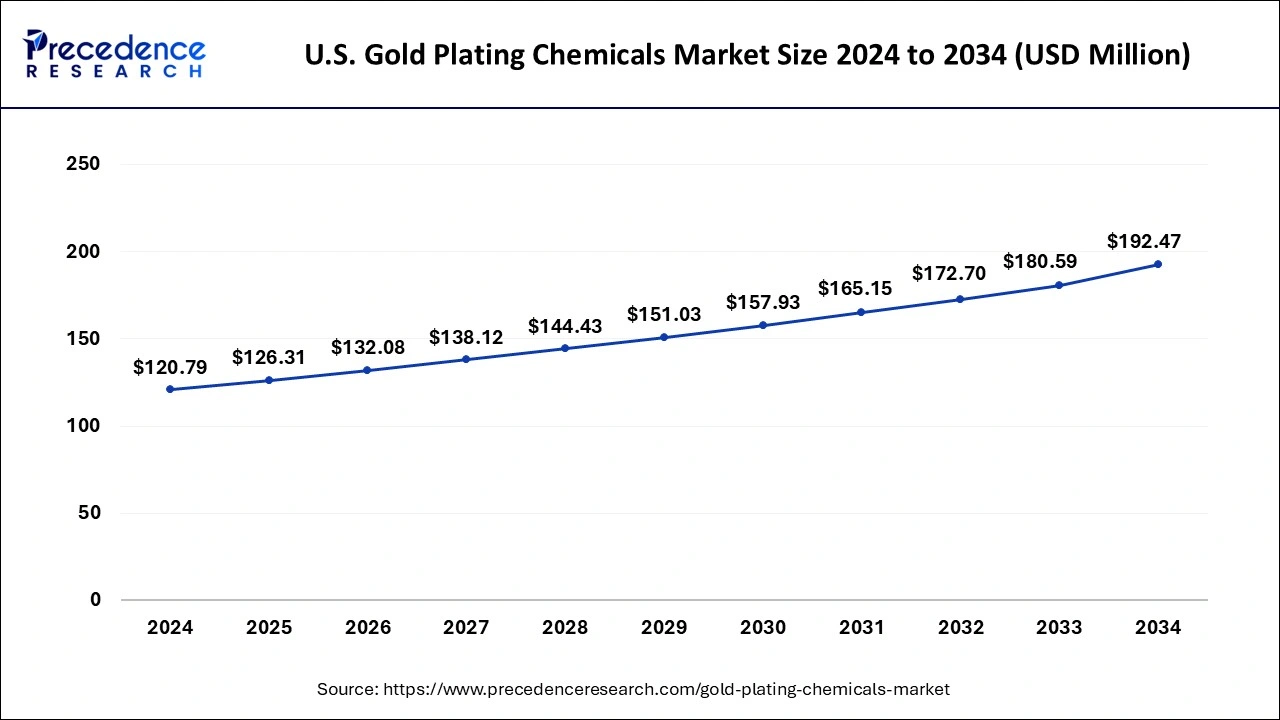

The U.S. gold plating chemicals market size was valued at USD 120.79 million in 2024 and is anticipated to reach around USD 192.47 million by 2034, poised to grow at a CAGR of 4.77% from 2025 to 2034.

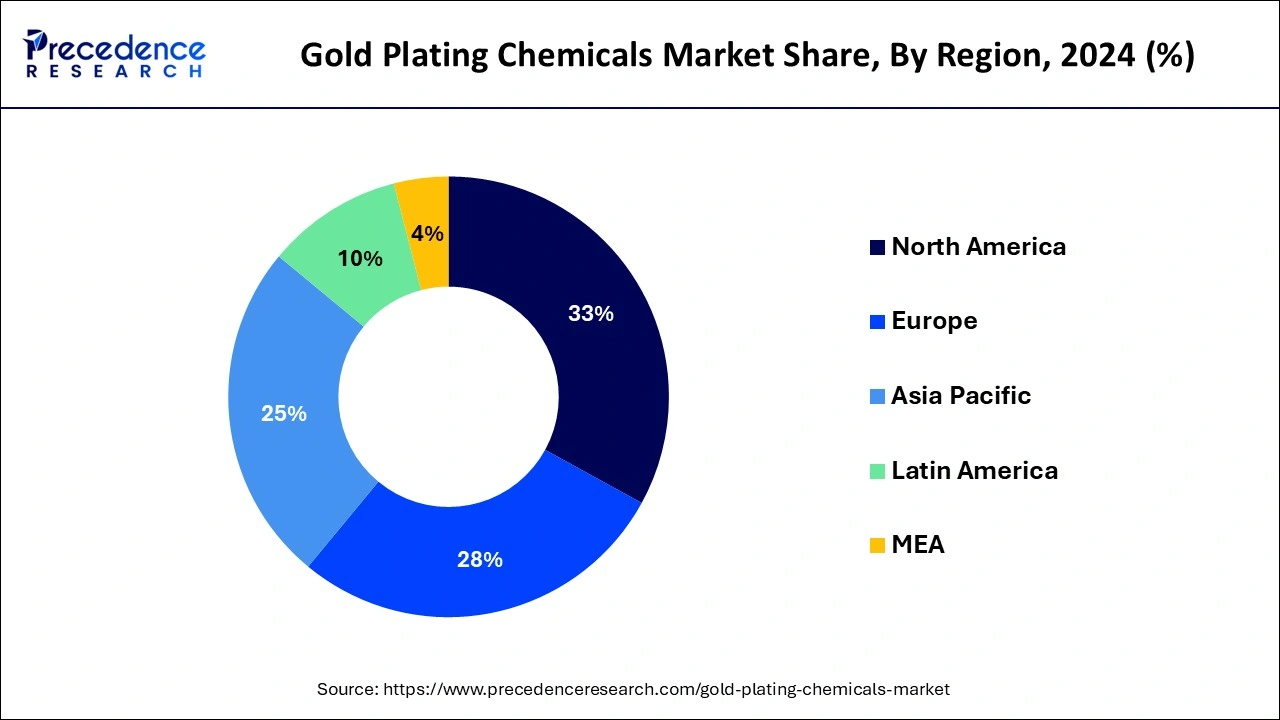

North America dominated the gold plating chemicals market with revenue share of 33% in 2024 and the region is observed to witness an impressive growth rate during the forecast period. North America is a leading region in electronics, aerospace, automotive, and telecommunications. All these sectors utilize electronic devices that require gold plating for enhanced performance and longevity.

Asia-Pacific will be the fastest-growing region during the forecast period. Asia-Pacific region consists of countries like Japan, China, India and South Korea, which are among the top countries for using technology. When it comes to India, in 2023, the electronics market of India contributed 3.4% to the total GDP with a revenue of US$ 29 billion.

A surge is seen in the gold plating chemicals market due to the increasing demand for gold plating in different sectors. The deposition of a thin layer of gold on another metal is called gold plating. It is usually done on silver or copper with the help of electrochemical or chemical plating techniques. Different chemicals that are used in gold plating include aqua regia, potassium gold cyanide, gold sulfite, and gold chloride.

Gold plating is used in various sectors, including jewelry, electronics, space applications, and decorative items. There are several applications of gold plating. It can be used to make cheap metal look better, which is usually done in jewelry and decorative items. Gold is not susceptible to corrosion and, hence, can be used on corrosive metals to increase their longevity. Due to gold’s high electrical conductivity, it is majorly used in electronics.

Gold is highly malleable, which allows it to be used appropriately, and a very small amount of gold is sufficient in many applications. The non-magnetic quality of gold is useful in applications where magnetic fields can hinder the processes. MRI is one of the applications of gold plating to avoid magnetic field interference.

Eco-friendly alternatives

A new trend that can be seen in the gold plating chemicals market is the utilization of eco-friendly alternatives that will reduce the use of harmful chemicals needed in the process. During the gold plating process, many chemicals are used in different steps. From cleaning the primary metal to applying gold late, each step requires a lot of chemicals, which results in pollution and causes environmental harm.

During the electroplating process, a lot of toxic air pollutants are released, including cyanide and heavy metals. During the cleaning process, toxic compounds and volatile organic compounds are realized. The gold plating chemicals market is focusing on sustainability, and some of the significant integrations include the utilization of biodegradable substrates, water-based solutions, and the recycling of precious metals.

| Report Coverage | Details |

| Market Size in 2025 | USD 546.80 Billion |

| Market Size by 2034 | USD 814.96 Billion |

| Market Growth Rate from 2025 to 2034 | CAGR of 4.54% |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | By Chemicals, By Type, and By Application |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

High demand for gold plating in electronics

Gold plating is commonly used in electronics. Via the process of electroplating, a thin layer of gold is plated on connection points. Compared to other metals, gold does not oxidize and lose electrons, and therefore, a smooth surface that provides a reliable connection is created. Gold is soft and deforms under pressure, which is useful for increasing the contact area and generating long-term and better connections. In electric boards, gold plating is beneficial in enhancing electrical conductivity. According to the World Gold Council, 80% of gold utilized in technology sectors goes into electronics. Therefore, gold plating in electronics is a key driver of the gold plating chemicals market.

A limited-edition flagship digital audio player was launched by Astell&Kern in December 2023. The A&ultima SP3000 was coated with 24K pure gold using a wet process. First, nickel coating was done, followed by gold plating, which enhanced the audio quality and gave the audio player a premium look.

Use of gold plating in jewelry

Gold is a costly metal due to its rarity and physical and chemical properties, making it an ideal metal for different uses. Gold jewelry is in high demand as it is a form of investment. Due to the high prices of gold, it cannot be afforded by everyone; hence, the gold-plated technique is also in high demand. It reduces the prices significantly and provides the beautiful appearance of gold jewelry. Gold plating is also useful in hiding welding points and achieving different colors, such as rose gold, yellow gold, and so on, based on fashion or market trends. With an increased demand for gold-plated jewelry, the demand for gold-plating chemicals has also increased, which is beneficial for driving the growth of the gold plating chemicals market.

The harmful effect of chemicals on the environment

The chemicals used in the gold plating chemical market are very harmful to the environment and can cause severe problems. A large amount of toxic chemicals like cyanide is released into the air, which creates an ozone layer (smog), a lower atmospheric layer that affects health. There are various steps in gold plating in which chemicals are used. Due to the harmful effects, people are switching to alternatives to the chemicals used in the gold plating technique, which are more environmentally friendly and sustainable.

High-cost of gold

Gold is used as an investment opportunity. Not only is gold rare, but it is also difficult to extract. Gold has various physical and chemical properties that make it an ideal choice in different sectors. Because gold plating utilizes real gold for coating, the high cost of gold impacts the gold plating chemicals market.

Increased demand for electric vehicles

As discussed above, the gold plating chemicals market is driven by the use of gold plating in electronics to improve conductivity. Similarly, gold plating is used in electric vehicles for coating connectors and contacts in the electrical systems of the cars. It improves the longevity of the system along with enhancing performance. In the long run, when more electric vehicles are used, the market for gold plating chemicals will also boost.

Potassium gold cyanide dominated the gold plating chemicals market in 2024 and is expected to dominate the market in the forecasting period. It is the most commonly used chemical for depositing a thin layer of gold on metal surfaces. While gold plating is used in all electronics, potassium gold cyanide is used in almost all appliances, and electronics are dominating the market, increasing the demand for potassium gold cyanide.

The electrolyte solutions segment dominated the gold plating chemicals market in 2024. It is expected this segment is going to sustain its dominance in the market in the forecast period. Electroplating is the most common technique used for plating gold on other chemicals. Therefore, the demand for electrolyte solutions is high in the market. The solutions have different components, including additives, gold salts, and other elements that are essential for the proper deposition of gold on other metals. Electrolyte solutions play a crucial role in gold plating as the solutions are responsible for determining the thickness, quality, and overall performance of the components utilized in gold plating.

In the gold plating chemicals market, the electronics segment dominated the market due to an increase in the number of electronic gadgets utilization and electric vehicles. It is expected that the electronics segment will dominate the market in the forecast period. It is anticipated the global consumer electronic market will surpass $1264.52 billion by 2032 and will become the greatest consumer of gold plating consumers.

The jewellery segment is expected to witness the fastest rate of expansion during the forecast period. The rising popularity of gold-plated ornaments, especially in women category plays a significant factor for the segment’s expansion. The affordability and easy accessibility of gold-plated jewellery act as another factor to supplement the segment’s growth.

By Chemicals

By Type

By Application

By Geography

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

September 2024

April 2025

April 2025

January 2025