May 2025

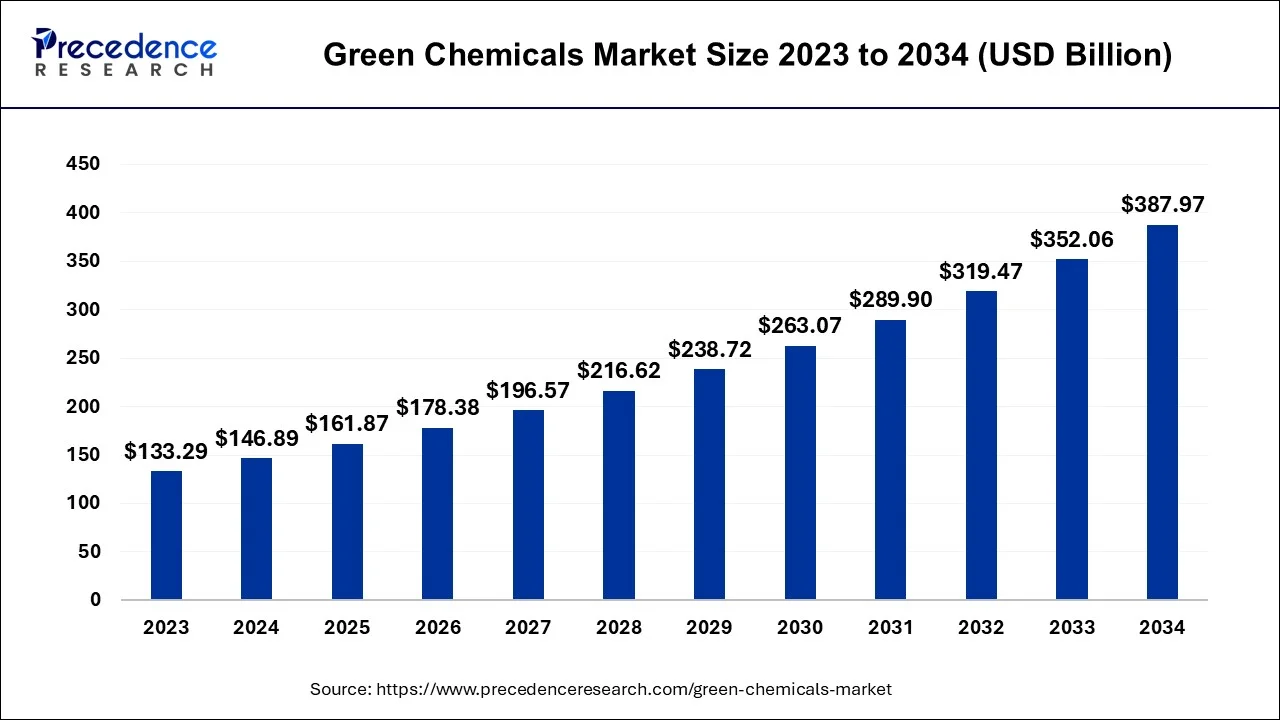

The global green chemicals market size accounted for USD 146.89 billion in 2024 and is anticipated to reach around USD 387.97 billion by 2034, expanding at a CAGR of 10.20% between 2024 and 2034.

The green chemicals market encompasses environmentally friendly chemical products and processes designed to minimize the environmental impact of chemical manufacturing. It includes bio-based chemicals, renewable feedstock, and sustainable production methods that reduce greenhouse gas emissions, energy consumption, and waste. Green chemicals aim to replace or enhance traditional chemical products that may pose environmental or health risks. They play a crucial role in various industries, including agriculture, manufacturing, and consumer goods, by promoting cleaner and more sustainable practices, thereby contributing to a greener and more environmentally responsible future.

The market is driven by the growing awareness of environmental concerns, regulations promoting sustainability, and increasing consumer demand for eco-friendly products. Green chemicals are used in various industries, including agriculture, packaging, automotive, and cosmetics, and are a pivotal component of the global shift towards more sustainable and responsible chemical manufacturing practices.

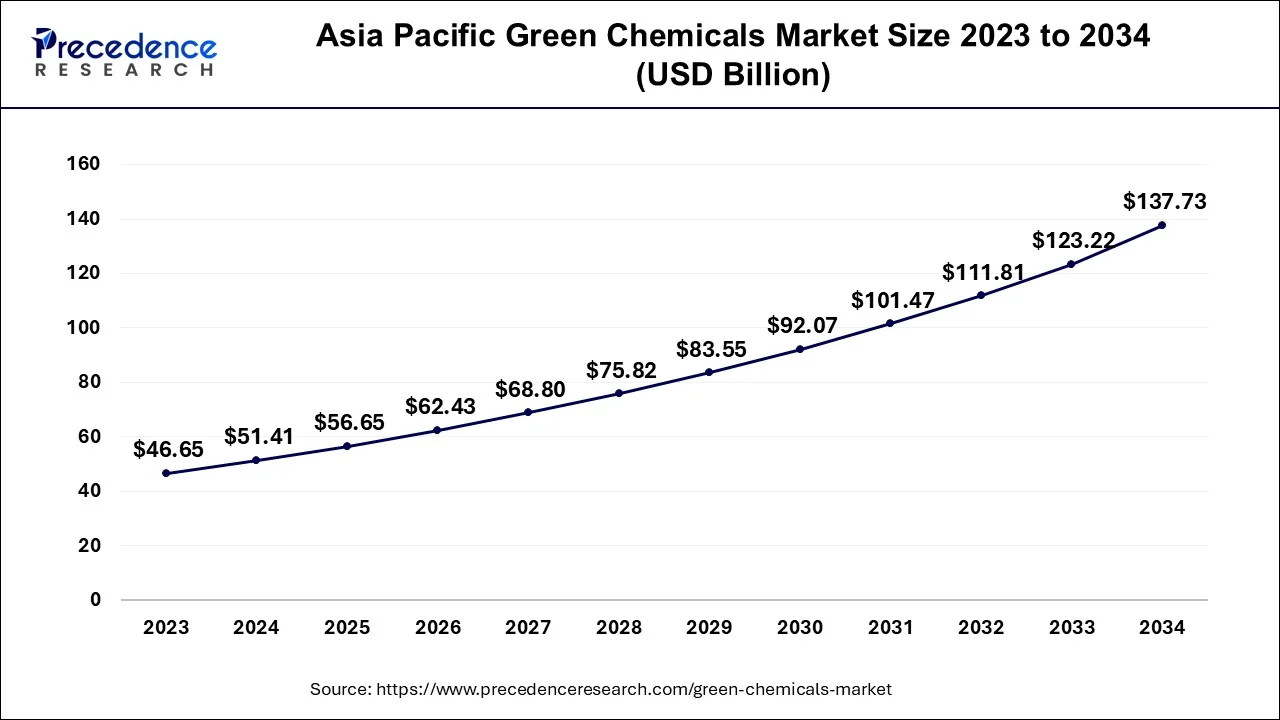

The Asia Pacific green chemicals market size is estimated at USD 51.41 billion in 2024 and is expected to be worth around USD 137.73 billion by 2034, growing at a CAGR of 10.35% between 2024 and 2034.

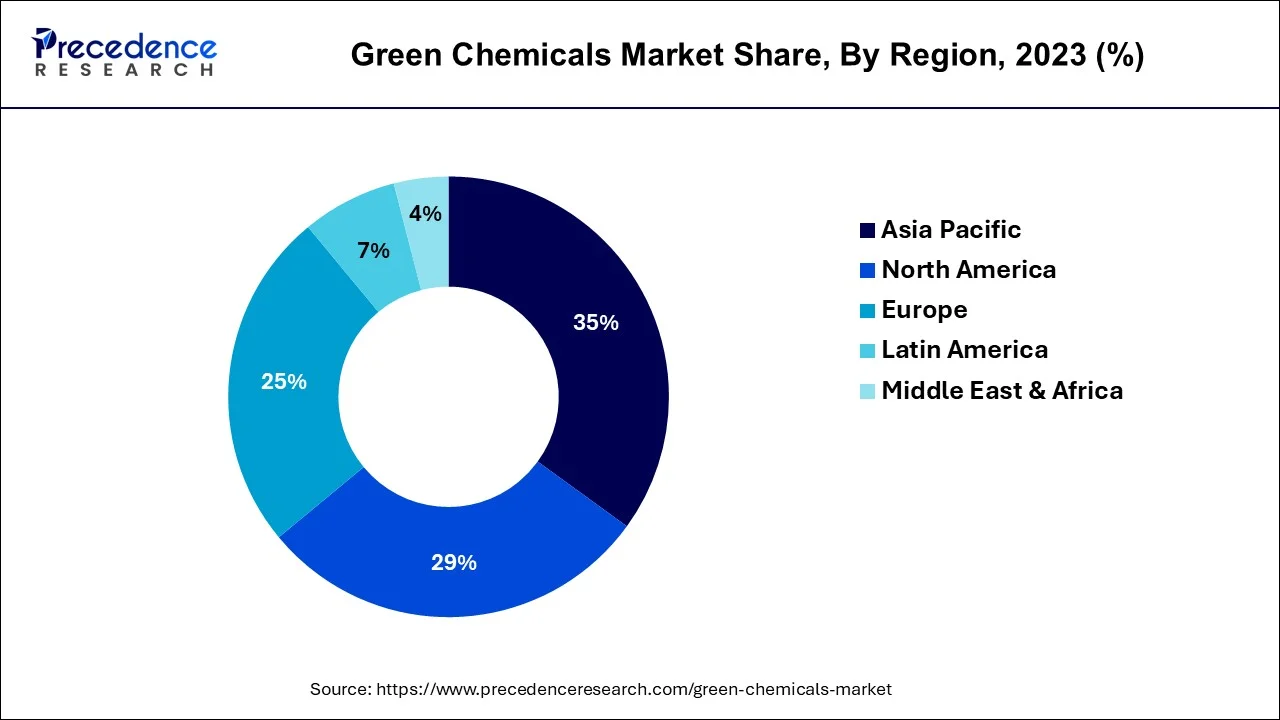

Asia Pacific has held the largest revenue share 35% in 2023. Asia Pacific is experiencing robust growth in the green chemicals market, driven by increasing awareness of environmental sustainability and government initiatives to promote cleaner alternatives. Key trends include a rising emphasis on bio-based and renewable feedstock, which aligns with the region's commitment to reduce carbon emissions. Additionally, the burgeoning middle-class population is showing a preference for eco-friendly products, further propelling the demand for green chemicals in various industries, from manufacturing to agriculture.

Europe is estimated to observe the fastest expansion. Europe has been at the forefront of green chemical adoption, with stringent regulations promoting sustainability. The region is witnessing a transition towards circular economy models, focusing on recycling and reducing waste. Bio-based polymers, eco-friendly packaging materials, and sustainable solvents are gaining traction. Furthermore, European consumers and businesses are increasingly mindful of their carbon footprint, pushing for greener chemical solutions in the automotive, construction, and healthcare sectors. As Europe continues to champion eco-consciousness, the green chemicals market here is expected to thrive.

In North America, the green chemicals market is flourishing due to a growing emphasis on environmental stewardship. The region is witnessing a surge in bio-based chemicals, renewable feedstock, and sustainable manufacturing practices. With a focus on reducing carbon emissions and transitioning to greener alternatives, North American industries are driving innovation in sustainable chemicals, catering to the demands of eco-conscious consumers and regulations favoring cleaner solutions.

| Report Coverage | Details |

| Growth Rate from 2024 to 2034 | CAGR of 10.20% |

| Market Size in 2024 | USD 146.89 Billion |

| Market Size by 2034 | USD 387.97 Billion |

| Largest Market | Asia-Pacific |

| Base Year | 2023 |

| Forecast Period | 2024 to 2034 |

| Segments Covered | Type, Application, and Region |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Sustainability initiatives and growing consumer awareness

Government sustainability initiatives, as well as efforts from corporations and industries, have led to more stringent requirements for eco-friendly practices. These mandates promote the utilization of green chemicals to reduce pollution, conserve resources, and decrease greenhouse gas emissions. Consequently, the market is witnessing an upsurge in innovative approaches to developing and applying green chemicals, particularly in sectors like agriculture, manufacturing, and consumer goods. These green chemical solutions play a pivotal role in addressing environmental concerns and aligning industries with the growing global commitment to sustainability.

Moreover, consumer awareness and preferences are shifting towards environmentally responsible products. With greater access to information and heightened concern for environmental issues, consumers are actively choosing products that incorporate green chemicals. This consumer-driven demand not only encourages companies to adopt sustainable practices but also fosters the development of new and improved green chemical solutions that align with both environmental goals and customer expectations. The synergy between sustainability initiatives and informed consumers creates a dynamic environment in which green chemicals play a pivotal role in shaping a more eco-conscious and sustainable future.

Regulatory hurdles and higher production costs

Regulatory hurdles and higher production costs pose significant challenges to the green chemicals market. While regulations promote the adoption of eco-friendly chemical solutions, they also impose stringent compliance requirements and certification processes, increasing the complexity of manufacturing and distribution. Meeting these regulations often demands substantial investments in research, testing, and documentation, which can deter some companies from transitioning to green alternatives.

Moreover, green chemicals often come with higher production costs, primarily due to the need for advanced technologies, sustainable sourcing of raw materials, and eco-friendly production processes. These elevated costs can make green chemicals less attractive to businesses seeking to maximize profitability in the short term. However, the initial investments and ongoing operational costs often prove daunting, particularly for smaller businesses with limited financial resources. To address these challenges, the green chemicals sector must foster collaborative relationships with regulatory authorities, explore inventive, cost-effective production techniques, and undertake extensive educational efforts to underscore the enduring benefits of adopting eco-friendly chemical solutions.

Renewable energy chemicals and bio-based polymers

The green chemicals market is experiencing a surge in demand due to the integral role that renewable energy chemicals play in the transition toward a sustainable future. Green chemicals are essential in energy storage and conversion processes, like batteries and solar panels, as the world transitions to renewable energy sources. This surges demand for chemicals that improve the sustainability and efficiency of these technologies. For instance, advanced electrolyte materials in batteries, a green chemical innovation, are crucial for storing energy from renewable sources and powering electric vehicles. This drives both the development and adoption of green chemicals.

Another significant driver is the rise of bio-based polymers. These environmentally friendly alternatives to traditional plastics are derived from renewable resources like plant-based feedstock, reducing the reliance on fossil fuels. As consumers and industries increasingly seek sustainable packaging solutions, bio-based polymers are in high demand, transforming the plastics market. The use of these polymers results in reduced carbon emissions and decreased environmental impact. Together, renewable energy chemicals and bio-based polymers fuel the growth of the green chemicals market, providing essential building blocks for a more sustainable and eco-friendly future.

Impacts of COVID-19

The COVID-19 pandemic had a significant impact on the green chemicals market. While it temporarily disrupted supply chains and production, it also highlighted the importance of sustainable practices and eco-friendly products. Amid the pandemic, there was a notable surge in the demand for green chemicals, driven by an increased emphasis on health, hygiene, and sustainable solutions. Both businesses and consumers actively pursued alternatives that not only delivered effective results but also aligned with eco-friendly principles.

This shift in preferences accelerated the adoption of green chemicals, creating opportunities for innovation and market expansion. As societies globally navigate the path to recovery, the green chemicals market is positioned for sustained growth in the wake of heightened awareness of sustainability and environmental responsibility.

This shift in mindset accelerated the adoption of green chemicals, offering opportunities for innovation and growth in the market. As economies recover and society becomes increasingly aware of the need for sustainable living, the green chemicals market is poised for long-term expansion.

According to the type, the bio-alcohols segment has held a 48% revenue share in 2023. Bio-alcohols, which include ethanol, methanol, and butanol produced from bio-based feedstock, have gained traction in the green chemicals market. Their eco-friendly nature and applicability in a range of industries, from fuel production to cosmetics, make them sought-after alternatives. The trend in bio-alcohols involves continuous research to enhance production efficiency and expand applications, particularly in the automotive sector for biofuels and in sanitizing products due to their disinfectant properties.

The bio-ketones segment is anticipated to expand at a significant CAGR of 10.1% during the projected period. Bio-ketones, like acetone and butanone, are ketones derived from bio-based sources. They are gaining importance in green chemistry due to their applications in sustainable solvents, resin production, and pharmaceuticals. The market trend is focused on developing greener routes for ketone production and exploring new applications, such as in the growing cosmetics and personal care industry. As sustainability becomes a focal point, these bio-based ketones are expected to witness increasing demand across various sectors.

Based on the application, the industrial & chemicals segment is anticipated to hold the largest market share of 62% in 2023. In the industrial & chemicals sector, green chemicals find extensive applications as raw materials, solvents, and catalysts. The trend here is an increasing transition toward sustainable manufacturing processes. Manufacturers are embracing eco-friendly chemicals to reduce their environmental footprint and comply with stringent regulations. This shift towards green practices is driven by the growing awareness of the environmental impact of chemical processes.

On the other hand, the packaging segment is projected to grow at the fastest rate over the projected period. In the packaging segment, there is a rising demand for green chemicals to create environmentally friendly packaging materials. From biodegradable polymers to sustainable inks and coatings, the focus is on reducing waste and pollution associated with packaging. Consumers' increased eco-consciousness and stringent environmental regulations are pushing companies to adopt green chemicals in their packaging solutions, making it an evolving and promising market.

Segments Covered in the Report

By Type

By Application

By Geography

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

May 2025

January 2025

May 2025

July 2025