May 2024

Green Logistics Market (By Business Type: Warehousing, Distribution, Value Added Services; By Mode of Operation: Storage, Roadways Distribution, Seaways Distribution, Others; By End use: Healthcare, Manufacturing, Automotive, Banking and Financial Services, Retail and E-Commerce, Others) - Global Industry Analysis, Size, Share, Growth, Trends, Regional Outlook, and Forecast 2024-2034

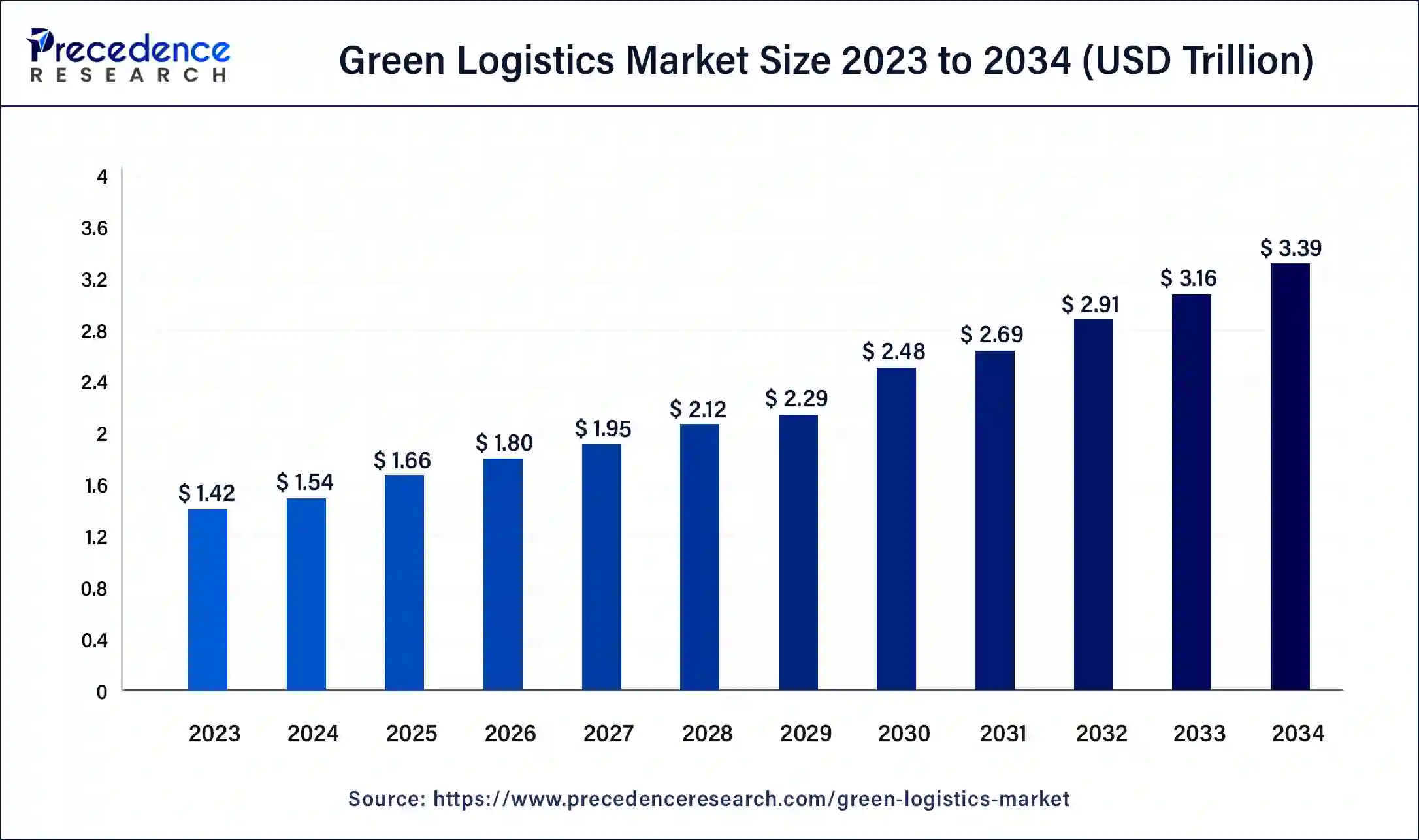

The global green logistics market size was USD 1.42 trillion in 2023, calculated at USD 1.54 trillion in 2024 and is expected to reach around USD 3.39 trillion by 2034, expanding at a CAGR of 8.32% from 2024 to 2034. The green logistics market is driven by the growing use of electric cars (EVs) in the transportation industry.

Reducing the environmental impact of delivery and logistics procedures is known as "green logistics." Shippers need to do more to reduce their carbon dioxide emissions, manage trash disposal and general waste management, use recyclable products, and more, as more and more customers prefer green businesses. To reduce environmental impact, green logistics focuses on environmentally friendly distribution, warehousing, and transportation. It involves eco-friendly methods, including route optimization, driving electric cars, and effective garbage disposal. This strategy benefits firms worldwide by balancing environmental responsibility and economic efficiency.

Businesses are adopting green logistics as a strategic tool to gain an advantage over competitors and satisfy growing consumer demand. This environmentally conscious paradigm shift affects how different business processes, organizational structures, and supply chain components are configured in addition to trying to lessen its detrimental effects on the environment.

Companies are adopting green logistics techniques because of legislation that governments throughout the world are enacting around emissions, fuel efficiency, and waste management. By encouraging businesses to lower their carbon footprint and increase market adoption, these measures assist them in avoiding potential repercussions and propelling market growth for cutting-edge technologies and solutions.

Country wise initiatives towards green logistics.

| S.No. | Country name | Initiatives |

| 1. | Japan | Japanese automakers are leading the charge in creating effective, useful, and visually beautiful EVs. |

| 2. | India | A government-led Unified Logistics Interface Platform (ULIP) program attempts to lower emissions from logistics activities. ULIP accomplishes this by giving logistics firms a forum to exchange knowledge and work together to cut emissions. |

| 3. | South Korea | According to survey data, 71% of South Koreans would be prepared to pay an increased income tax to assist lower-income households in covering the costs associated with the green transition. 14% would consent to 5–10% of their income, whereas 57% would consent to paying an additional 1-2%. |

| 4. | Germany | The modification aims to align German toll laws with Directive (EU) 2022/362. By doing this, the nation is dedicated to preserving a reliable and environmentally friendly transportation network inside the European Union. |

| 5. | China | Alibaba's logistics division, Cainiao, was established in 2013 to provide a platform for online retailers to ship their products to customers. Its objective is to deliver items in 24 hours to locations in China and in 72 hours to locations worldwide. |

| Report Coverage | Details |

| Market Size by 2034 | USD 3.39 Trillion |

| Market Size in 2023 | USD 1.42 Trillion |

| Market Size in 2024 | USD 1.54 Trillion |

| Market Growth Rate from 2024 to 2034 | CAGR of 8.32% |

| Largest Market | Asia Pacific |

| Base Year | 2023 |

| Forecast Period | 2024 to 2034 |

| Segments Covered | Business Type, Mode of Operation, End-use, and Regions |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Rapid advancement in the technology

IoT devices make real-time tracking of products, vehicles, and equipment possible. Sensors fastened to shipments provide live updates on location, temperature, humidity, and other factors. This openness lowers fuel usage by optimizing routes and reducing idle time. IoT sensors on machinery and cars can anticipate maintenance requirements before a malfunction happens. This guarantees that machinery operates at peak efficiency, cutting down on unneeded emissions and downtime. This drives the growth of the green logistics market.

Growing concerns regarding environmental pollutions

Consumers nowadays are more concerned about the environment and would rather support businesses dedicated to sustainability. Logistics companies are under pressure to implement green practices due to consumer preference. Sustainability is also a top priority for investors, who base their choices on a company's environmental record. Because of this, logistics companies often incorporate green logistics into their business plans to draw in and keep investors.

Significant capital expenditures

It costs money to implement advanced IT systems for tracking, monitoring, and streamlining logistical processes. These systems are essential for increasing productivity and cutting emissions, but they come with a hefty price tag for software and hardware. Implementing automation and artificial intelligence for inventory control, route optimization, and warehousing is expensive. This limits the growth of the green logistics market.

Increased environmental consciousness among end-use industries

Green logistics frequently entail better routing and more energy-efficient modes of transportation. This can lower fuel consumption and increase overall logistics efficiency, resulting in significant cost savings for end-use industries. Green logistics techniques can boost operational effectiveness, cut waste, and minimize disposal expenses. Reusable packaging materials, for instance, can reduce the requirement for single-use packaging, saving money over time. This opens an opportunity for the growth of the green logistics market.

The distribution segment dominated the green logistics market in 2023. One of the most important phases of logistics management is the distribution stage. At this point, environmentally friendly modes of transportation ought to be prioritized, and logistics operations ought to be made more efficient. Using less harmful railway and sea transportation options in addition to vehicle transit is advisable.

Furthermore, environmental considerations should be considered when developing routes and packaging. Recycling and waste management are essential components of sustainable distribution plans. In conclusion, firms can lessen their environmental effect and use resources effectively by using sustainable distribution techniques and ecologically friendly logistics management.

The warehousing segment is observed to be the fastest growing in the green logistics market during the forecast period. Advances in technology have greatly improved the sustainability and efficiency of warehouse operations. Robotics, automation, and the Internet of Things (IoT) allow for improved space efficiency, energy savings, and inventory management. Warehouses can reduce their carbon footprint by implementing improved climate control systems, solar panels, and energy-efficient lighting. To lower the energy usage of a warehouse, sensors are fitted where appropriate. These consist of submeters on appliances, machines, and other equipment and motion-sensing lights. Installing sensors makes tracking and cutting energy consumption and saving costs simpler.

The materials chosen to construct or finish a warehouse may occasionally affect its sustainability. For example, non-toxic paints, sealants, wood products, adhesives, and carpets contribute to a warehouse's improved air quality.

The storage segment dominated the green logistics market in 2023. Green logistics entails making the most of warehouse space for storage. As a result, there are fewer machine movements and needless activities performed by the business, which lowers the number of pollutants produced. Additionally, it makes operator work easier and expands the warehouse's storage capacity. For businesses that store at a controlled temperature, optimizing storage space also minimizes the area that needs to be kept at a set temperature, lowering operational costs and air pollution from air conditioning.

The roadways distribution segment shows a significant growth in the green logistics market during the forecast period. The road transportation industry is changing thanks to the invention and widespread use of electric and hybrid trucks. Road logistics have a smaller carbon footprint thanks to these vehicles because they produce less CO2 than conventional diesel-powered trucks. Fleet management uses telematics and the Internet of Things (IoT) to track and improve routes.

As a result, logistics operations become more environmentally friendly by using less fuel and increasing efficiency. Route optimization is a significant difficulty that allows for cost reduction with an effective route design concerning the number of customer deliveries, mileage, vehicles utilized, and the working hours of each driver. By implementing eco-friendly practices, we can calculate the carbon footprint of logistical activities.

The manufacturing segment dominated the green logistics market in 2023. More and more manufacturers are working with suppliers who value sustainable practices. This entails obtaining raw materials from vendors who practice environmental responsibility and ensuring that logistics companies follow green logistics guidelines. Recyclable and biodegradable materials make reducing waste and packaging's carbon footprint easier. Integrating environmentally friendly transportation is essential to eco-friendly logistics. Businesses are adding more electric and hybrid cars to their fleets to cut pollution. Urban logistics can reduce its carbon footprint by using delivery vans driven by electricity or a combination of electricity and conventional fuels.

The retail and e-commerce segment are observed to be the fastest growing in the green logistics market during the forecast period. Customers are pressing merchants and online retailers to adopt more sustainable business methods as they grow more conscious of how their purchases affect the environment. This shift in consumer preferences pushes businesses to implement green logistical techniques.

Significantly lowering emissions is achieved in logistics through the development and use of electric and hybrid vehicles. Retailers and e-commerce businesses find these cars an appealing alternative as they become more economical and efficient. Among the few industries that experienced unheard-of growth during the pandemic is e-commerce. The widespread use of the internet, digital payments, consumer awareness, and e-commerce accessibility have all contributed to a radical change in how people shop today.

Asia Pacific dominated in the green logistics market in 2023. With numerous nations pledging to pursue sustainable and green growth, the Asia-Pacific region has made notable strides in sustainable development in recent years. However, more work must be done to guarantee a sustainable future for the area. Renewable energy is crucial to mitigating climate change and reducing greenhouse gas emissions. Asian governments can stimulate investment in renewable energy by providing incentives for companies and individuals to embrace clean technology and invest in renewable energy infrastructure.

Reducing greenhouse gas emissions and advancing sustainable development require sustainable production and consumption patterns. Governments can promote environmentally friendly goods and services and pass laws allowing companies to use sustainable practices to promote sustainable consumption and production.

Green logistics has received significant support from the Philippine government through several programs and laws. Examples include investing in renewable energy, offering incentives to companies that adopt environmentally friendly practices, and building the necessary infrastructure to accommodate electric cars. Such actions inspire more businesses to use green logistics techniques and advance sustainability.

North America shows a significant growth in the green logistics market during the forecast period. An estimated 133 billion pounds of edible food are wasted annually in the United States alone. Food waste makes up 21% of the waste stream in American landfills, lume of material. Food waste costs Canadians $31 billion annually, or around 2% of the nation's GDP. They find local food and sustainable biodiesel, forgo single-use water bottles at live music events, and make meaningful and doable changes to green the industry.

The UN Alliance for Sustainable Fashion was established during the UN Environment Assembly's fourth session (UNEA-4) to end the fashion industry's harmful environmental and societal effects. It establishes sustainability goals, protects workers, especially women, by cutting waste, and capping carbon emissions.

Segments Covered in the Report

By Business Type

By Mode of Operation

By End-use

By Geography

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

May 2024

July 2024

October 2024