April 2025

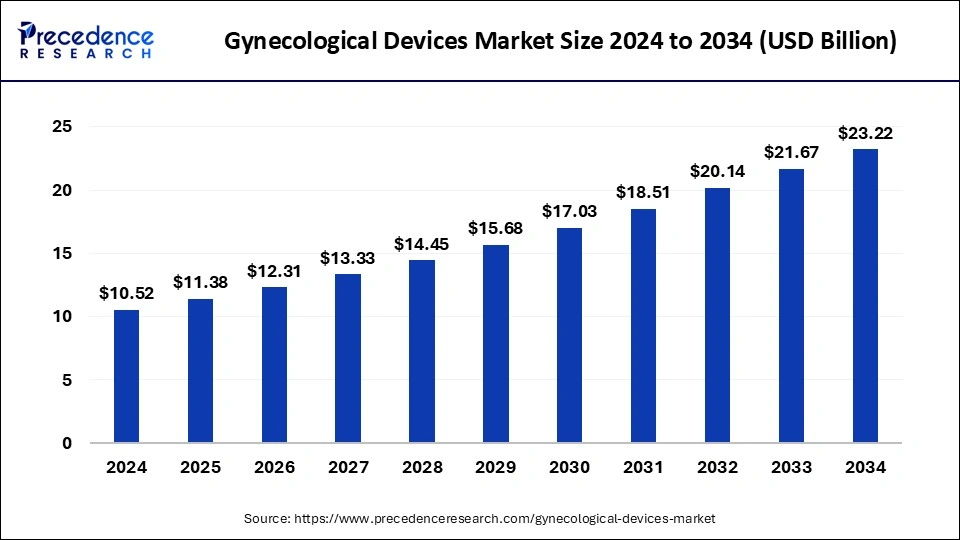

The global gynecological devices market size accounted for USD 11.38 billion in 2025 and is forecasted to hit around USD 23.22 billion by 2034, representing a CAGR of 8.25% from 2025 to 2034. The North America market size was estimated at USD 4.40 billion in 2024 and is expanding at a CAGR of 8.22% during the forecast period. The market sizing and forecasts are revenue-based (USD Million/Billion), with 2024 as the base year.

The global gynecological devices market size was calculated at USD 10.52 billion in 2024 and is predicted to increase from USD 11.38 billion in 2025 to approximately USD 23.22 billion by 2034, expanding at a CAGR of 8.25% from 2025 to 2034.

Gynecological devices are the instruments that are only used in gynecological procedures include assisted reproduction, uterine fibroid remobilization, colposcopy, hysteroscopy, pelvic floor electrical stimulation, female sterilization, pelvic organ prolapsed repair, endometrial resection, fluid management, and many others. A gynecological device is a piece of apparatus used at the time of surgery or an operation to perform certain tasks or attain some outcomes, such as altering biological tissue or providing access to monitor it.

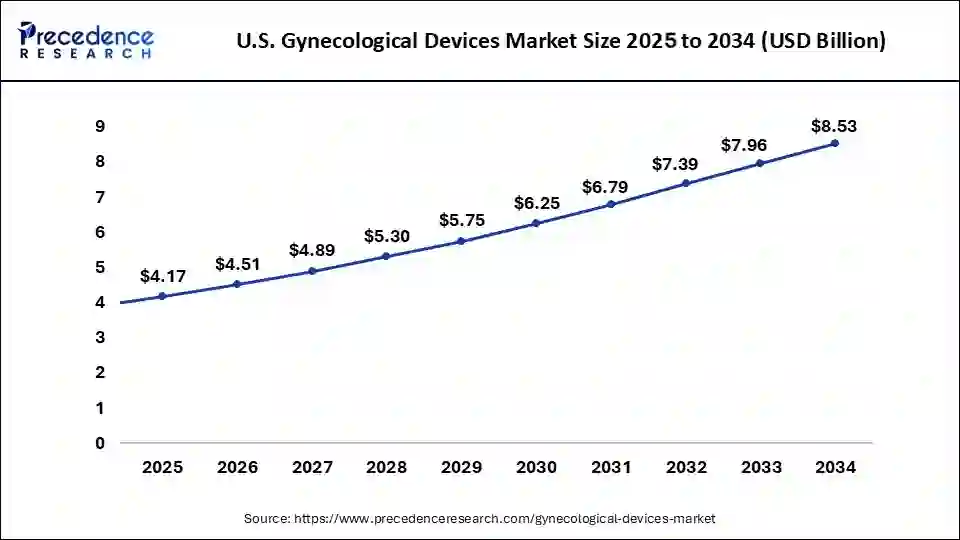

The U.S. gynecological devices market size was evaluated at USD 3.85 billion in 2024 and is projected to be worth around USD 8.53 billion by 2034, growing at a CAGR of 8.29% from 2025 to 2034.

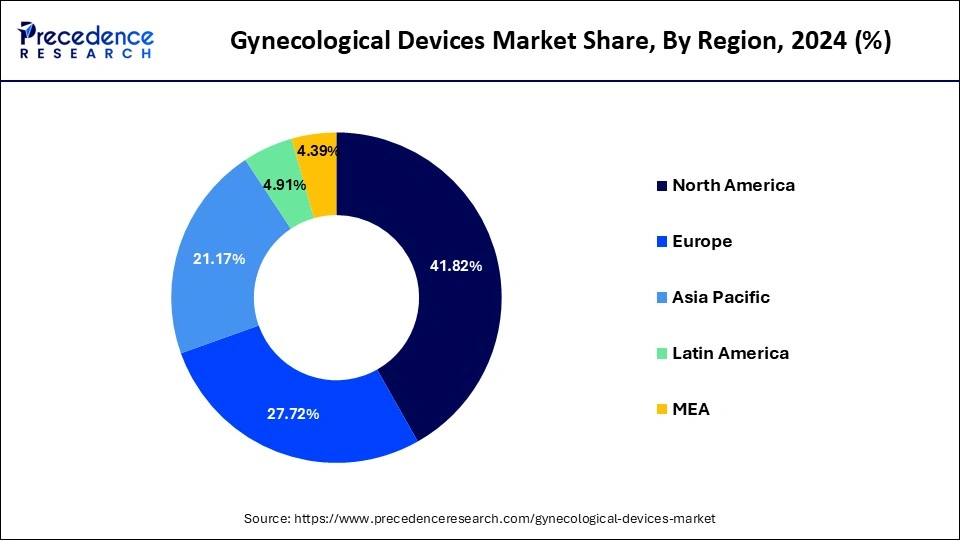

The greatest market share in 2024 belonged to North America, which generated around 41.82% of the global industry's revenue. It is predicted to maintain its dominance throughout the project due to the presence of established healthcare infrastructure, increased levels of knowledge regarding the accessibility of diagnostic tests & treatments, and improved reimbursement coverage.

Asia Pacific, on the other hand, is predicted to see the fastest growth rate over the forecast period. As a result of government initiatives to curb population growth, it is projected that increasing understanding of birth control and family planning will raise regional product demand. According to the United Nations Population Facts, the demand for modern contraception among women of reproductive age was approximately 90% in 2019 and is predicted to remain stable through 2034. China is also one of the countries having birth control legislation. The market in the area is expected to rise as a result of the increased number of surgical procedures and gynecological disorders. For instance, the Department of Gynecology in China performed 14,000 gynecological treatments, according to a report published in the journal of Gynecology and Pelvic Medicine.

The gynecology devices market is growing faster due to the rising incidence of gynecological illnesses. Over 90% of cervical cancer fatalities occur in low- and middle-income countries, according to the WHO. Both menstrual cramps and endometriosis abnormally positioned patches of tissue seen solely in the lining of the uterus are gynecological.

In addition, endometrial cancer, which accounts for around 2.5% of all cancer cases detected worldwide, is the most common kind of cancer in women. The sixth most common disease in women, accounting for 3% of all cancer cases among females, is ovarian cancer. As a result, it is anticipated that in the near future, the incidence of the aforementioned illnesses, especially those needing surgical intervention, will boost gynecological device adoption. The US Food and Drug Administration (FDA) has modified its pharmaceutical review procedures throughout the years to expedite the release of innovative drugs; nevertheless, the agency's clearance of medical devices appears to be the exact reverse. Strict paperwork and compliance requirements add to the development expenses that device manufacturers must bear by causing delays in approvals.

Additionally, it has been found that administrative delays rather than technology concerns account for non-pioneer entrants' average taking 34% longer, or 7.2 months, than pioneer entrants. If the clearance procedure takes longer, a manufacturer's costs for bringing a ground-breaking medical product to market might rise by US$6.7 million. Small-scale producers are less inclined to innovate due to the high costs. The delay prevents patients from receiving treatments that might save their lives. In the next years, the market for gynecology devices is anticipated to benefit from developments in therapies and equipment including robotic endoscopy and sub dermal contraceptive implants.

| Report Coverage | Details |

| Growth Rate from 2025 to 2034 | CAGR of 8.25% |

| Market Size in 2025 | USD 11.38 Billion |

| Market Size by 2034 | USD 23.22 Billion |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Largest Market | North America |

| Fastest Growing Market | Asia Pacific |

| Segments Covered | Product, and End Use |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America and Middle East & Africa |

Increase in Gynecological Disease Incidence

The need for healthcare payer services is being driven by the expanding insurance coverage of the world's population. It is also anticipated that emerging countries like India would experience an increase in health insurance coverage as a result of beneficial government initiatives. For instance, the Union Budget of 2021 increased the FDI threshold in insurance from 49 to 74%, and state-owned general insurance companies received a boost of USD 413.13 million to assist them become more solid financially. The significant losses brought on by the rise in healthcare fraud also increase the need for healthcare payer services, which propels the worldwide market's growth. The global market for gynecology devices is benefiting from a discernible rise in health insurance enrollment.

The expansion of the market would be hampered by worries regarding pelvic organ safety

Over the course of the projected period, worries regarding the safety of pelvic organ prolapse are anticipated to restrain market expansion. The vaginal mesh should only be used in difficult instances where there are no other effective therapies available in Europe. The growth of pelvic organ prolapses and the market as a whole may be constrained by the generally bad reputation surrounding litigation, regulatory scrutiny, and the use of meshes.

Government programs

Government programs to manage the region's expanding population are projected to raise knowledge of birth control and family planning, which will in turn fuel regional product demand. The demand for modern contraception among women of reproductive age was around 90.1% in 2019 and is anticipated to stay constant through 2030, according to UN Population Facts. China is also one of the nation’s having birth control laws. The region's market is anticipated to develop as a result of the increased incidence of gynecological problems and the rise in surgical procedures. A research that appeared in the journal Gynecology and Pelvic Medicine estimates that at China's Department of Gynecology in 2019, 13,934 gynecological procedures were carried out.

Use of robotics in gynecological equipment

One type of computer system that facilitates surgery is robotics. The demand for a wide variety of surgical devices rises as a result of skilled gynecologists using robots. Modern robotic technology can be used to successfully treat cancer and other gynecological conditions. Additionally, in order to boost profits, manufacturers of medical devices are committed to utilizing robotic operations. As a result, the market for gynecological devices is anticipated to grow due to the quick adoption of automation technologies like robotics in the treatment of gynecological diseases.

Gynecological Devices Market, By Product, 2022-2024 (USD Million)

| By Product | 2022 | 2023 | 2024 |

| Surgical Devices | 4,794.93 | 5,178.60 | 5,598.2 |

| Handheld Instruments | 1,299.72 | 1,404.02 | 1,518.1 |

| Diagnostic Imaging Systems | 2,935.35 | 3,160.75 | 3,406.6 |

In 2024, the surgical devices market segment led the sector and captured more than 53% of the total revenue. Throughout the projected period, it is predicted that widespread use of endoscopic devices and female contraceptives will sustain the segment's leadership. To give one example, CooperSurgical had a 26% rise in net sales for surgical equipment used by obstetricians or gynecologists in hospitals. Additionally, as surgical procedures increase internationally, there is a growing demand for surgical tools that are simple to autoclave and extremely durable. Growing public knowledge of birth control procedures and technologies is predicted to boost sector expansion. Additionally, the market's expansion is being significantly influenced by the rise in female sterilization operations. According to the United Nations' 2019 report on contraceptive usage by technique, around 840 million women worldwide out of 1.99 million women of reproductive age use contemporary methods of contraception. Female sterilization and intrauterine devices are the two contraceptive techniques most often used by women of reproductive age, at rates of 11.5% and 8.4%, respectively.

During the projection period, the diagnostic imaging systems sector is expected to grow at a profitable CAGR. The rise is due to an increase in both planned and unplanned pregnancies throughout the world. The United Nations Population Fund estimates that about half of all pregnancies worldwide or around 100 million conceptions annually are unintended. Imaging techniques such as magnetic resonance imaging, ultrasound, computed tomography, or even plain radiography are used to explore and diagnose pregnancy-related issues.

Gynecological Devices Market, By End-Use, 2022-2024 (USD Million)

| By End-Use | 2022 | 2023 | 2024 |

| Hospital & Clinics | 5,883.95 | 6,353.65 | 6,867.2 |

| Ambulatory Surgery Centers (ASCs) | 3,146.05 | 3,389.72 | 3,655.6 |

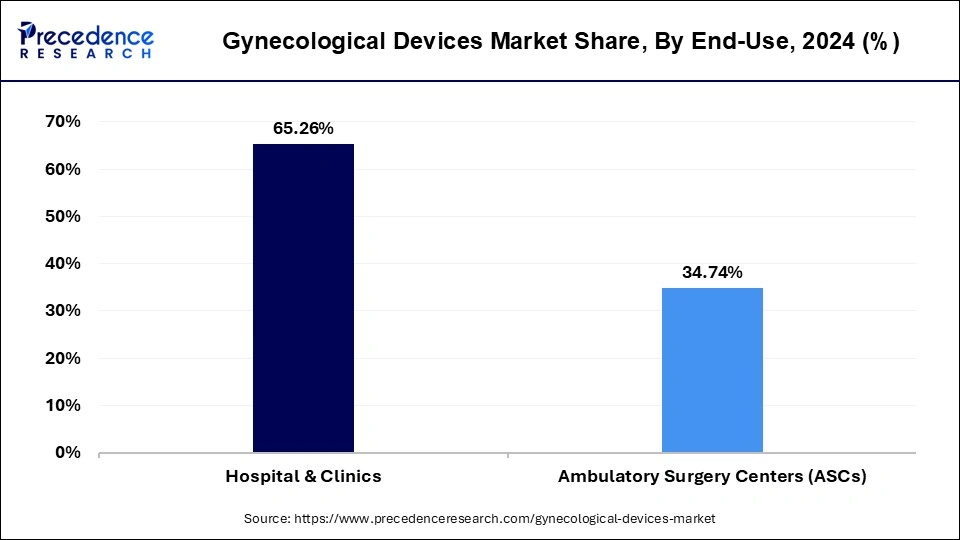

The hospitals & clinics segment has generated around 65.16% of the total revenue share in 2024. In hospitals and clinics, the use of cutting-edge medical equipment and the growth in demand for gynecological surgery are mostly to blame for the high proportion. Modern surgical substitutes are efficient and offer a superior experience.

For instance, in January 2024, the Hominis Surgical System, a robotic surgical system created by Memic Innovative Surgery, was put to use at The Women's Hospital at Jackson Memorial, Kendall Region Medical Center of HCA Florida Healthcare, and AdventHealth Celebration.

The device, which is FDA-approved, provides less invasive therapy options for gynecological surgeries. Throughout the forecast period, the end-use sector for ASC is predicted to grow at the fastest rate. The segment's growth may be attributed to the fact that these institutions are less costly than some other healthcare facilities like clinics and hospitals. Gynecological treatments, such as laparoscopic procedures, hysterectomy, oophorectomy, and others, were among the most commonly performed major ambulatory procedures among younger females in the U.S., according to the Nationwide Ambulatory Surgery Sample database. In the United States, about 420,000 major ambulatory gynecological operations were performed in 2019.

By Product

By End Use

By Geography

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

April 2025

January 2025

January 2025

February 2025