September 2024

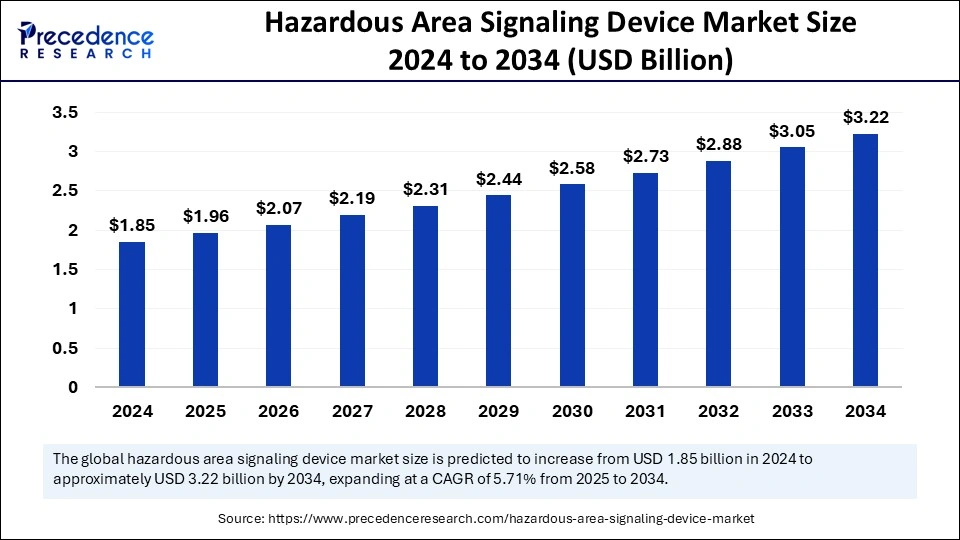

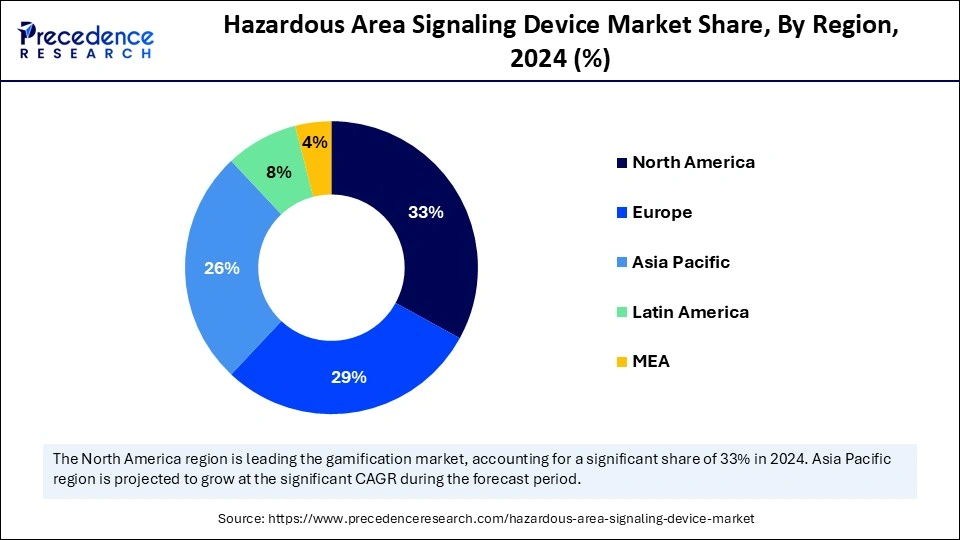

The global hazardous area signaling device market size is calculated at USD 1.96 billion in 2025 and is forecasted to reach around USD 3.22 billion by 2034, accelerating at a CAGR of 5.71% from 2025 to 2034. The North America market size surpassed USD 610 million in 2024 and is expanding at a CAGR of 5.87% during the forecast period. The market sizing and forecasts are revenue-based (USD Million/Billion), with 2024 as the base year.

The global hazardous area signaling device market size accounted for USD 1.85 billion in 2024 and is predicted to increase from USD 1.96 billion in 2025 to approximately USD 3.22 billion by 2034, expanding at a CAGR of 5.71% from 2025 to 2034. The growth of the market is driven by the increasing focus on safety regulations and standards in industries that are susceptible to hazardous conditions, including the oil and gas, chemical, and mining sectors. The growing awareness of workplace safety and the necessity to avert industrial incidents have greatly increased the demand for durable and trustworthy signaling equipment. Businesses are also consistently investing in cutting-edge technologies to enhance their safety measures.

Artificial Intelligence is transforming the hazardous area signaling device market by improving real-time monitoring, predictive maintenance, automation, and emergency response abilities. Conventional signaling devices used in dangerous environments, such as oil and gas facilities, chemical processing plants, mining locations, and power generation sites, are now being fitted with AI-enhanced smart technologies to boost safety, efficiency, and adherence to stringent regulations. One significant use of AI in hazardous area signaling devices is predictive maintenance.

AI-driven machine learning algorithms evaluate historical failure data, operational metrics, and environmental factors to foresee equipment failures before they happen. This is especially vital in hazardous industries where equipment breakdowns could result in disastrous accidents, explosions, or toxic leaks. By integrating Internet of Things sensors with AI-enabled analytics, operators can receive early warning notifications regarding potential device failures, allowing for timely maintenance and decreasing unplanned downtimes. AI is also advancing real-time threat detection and response systems in hazardous locations.

Furthermore, AI is enhancing connectivity and automation in hazardous area signaling devices through AI-powered control systems and wireless communication networks. AI-based signaling systems can be monitored and managed remotely, enabling plant operators to modify alert levels, tailor warning signals, and automate shutdown processes in response to changing risk conditions. This is particularly advantageous in remote or offshore settings, where physical intervention is difficult or delayed.

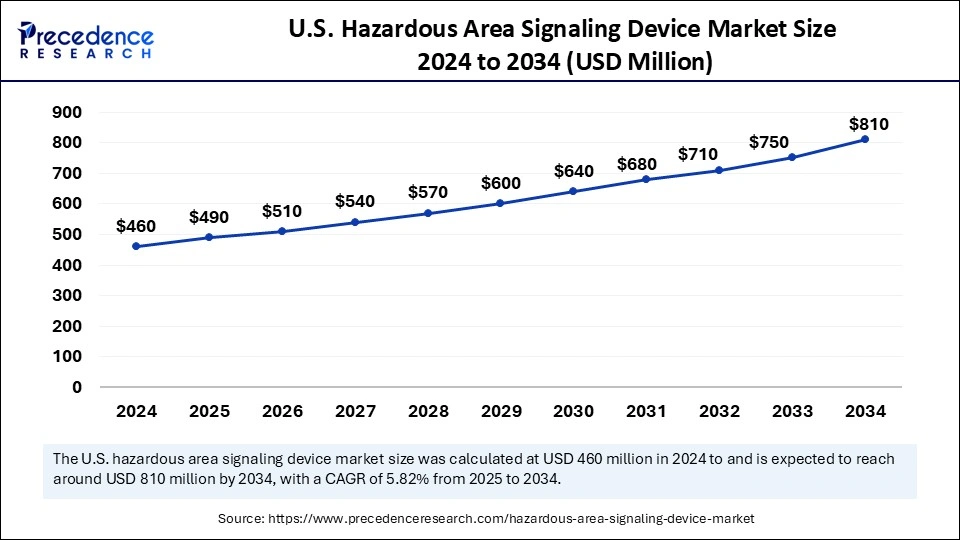

The U.S. hazardous area signaling device market size was exhibited at USD 460 million in 2024 and is projected to be worth around USD 810 million by 2034, growing at a CAGR of 5.82% from 2025 to 2034.

North American Market Trends

North America dominated the hazardous area signaling device market with the largest share in 2024, largely due to stringent safety regulations in industries, the widespread adoption of cutting-edge safety technologies, and the presence of significant market players. The region is home to well-established sectors such as oil and gas, chemical processing, pharmaceuticals, mining, and power generation, all of which rely on hazardous area signaling devices for risk management and adherence to regulations.

Regulatory bodies like the Occupational Safety and Health Administration, the National Fire Protection Association, and Atmospheres Explosibles impose strict safety requirements, boosting the demand for explosion-proof alarms, fire alarms, and visual warning systems. The swift integration of AI-driven safety solutions, IoT-connected monitoring systems, and automated hazard detection technologies has further solidified North America's dominance in this market.

Companies are increasingly channeling investments into smart industrial safety infrastructures, incorporating real-time hazard alerts and predictive maintenance frameworks to improve workplace safety. Moreover, the presence of top manufacturers such as Eaton Corporation, Rockwell Automation, and Honeywell International has spurred innovation and growth in the market.

United States

The United States represents the largest segment of the hazardous area signaling device market in North America, propelled by strict safety regulations, swift advancements in industrial automation, and a heightened focus on employee safety. Notably, the nation’s oil and gas, mining, and power generation industries are among the largest users of hazardous area signaling devices. The expansion of offshore oil exploration in the Gulf of Mexico and the increasing demand for explosion-proof warning systems in chemical facilities have further driven market growth.

The U.S. Department of Labor's OSHA guidelines enforce stringent safety measures, mandating sectors to install certified hazardous area signaling devices in high-risk environments. Furthermore, innovations in AI-based emergency response mechanisms, wireless communication technologies, and self-regulating alarms have enhanced hazard mitigation strategies, leading to an increased demand for intelligent signaling options.

Canada

Canada plays a vital role in North America’s market, particularly as its oil and gas, mining, and chemical sectors continue to grow. The country’s activities in the Alberta oil sands and mining operations in Ontario and British Columbia necessitate the deployment of robust explosion-proof signaling solutions to safeguard workers.

Regulations from Canada’s Workplace Safety and Insurance Board and provincial safety laws have strengthened the utilization of advanced safety systems in industrial areas, ensuring compliance with strict workplace hazard mitigation standards. In addition, the government’s emphasis on renewable energy initiatives and industrial automation has led to the integration of IoT-enabled safety monitoring systems, amplifying the demand for smart hazardous area signaling devices.

Europe Market Trends

Europe is expected to host the fastest-growing hazardous area signaling device market from 2025 to 2034, fueled by rigorous safety regulations, an increase in industrial automation, and a heightened emphasis on workplace safety. European safety standards, particularly the ATEX directives and IECEx certifications, require the use of certified explosion-proof and intrinsically safe signaling devices in hazardous industrial environments, accelerating market development.

Europe hosts substantial oil refineries, chemical processing facilities, pharmaceutical companies, and renewable energy undertakings, all of which necessitate advanced signaling solutions to mitigate fire risks, toxic gas leaks, and equipment failures. Moreover, technological innovations in AI-powered predictive safety systems and intelligent alarm networks have further propelled the demand for high-performance hazardous area signaling devices.

Germany

Germany stands out as a major contributor to Europe’s hazardous area signaling device market, mainly attributed to its robust industrial sector, stringent safety regulations, and substantial investments in automation technologies. The country’s petrochemical, automotive production, and power generation industries have spurred the use of intelligent signaling systems for real-time hazard identification.

Companies in Germany are increasingly incorporating AI-driven industrial safety solutions, which include remote monitoring systems, intelligent alarm customization, and wireless hazard detection technologies to enhance workplace safety and ensure regulatory compliance. Furthermore, Germany’s emphasis on Industry 4.0 and smart manufacturing has intensified the demand for IoT-enabled hazardous area safety solutions.

United Kingdom

The United Kingdom is experiencing swift growth in the hazardous area signaling device market, bolstered by government initiatives aimed at enhancing workplace safety standards and increasing investments in the offshore oil and gas sector. The North Sea oil fields are a significant catalyst for explosion-proof safety devices, necessitating sophisticated signaling solutions to address fire hazards, toxic gas exposure, and equipment failures.

The Health and Safety Executive in the UK enforces rigorous safety regulations in chemical plants, energy facilities, and mining operations, leading to the widespread implementation of ATEX-certified hazardous area signaling systems. Moreover, the UK’s shift toward renewable energy sources and smart industrial automation is driving demand for AI-driven safety solutions, predictive maintenance alarms, and interconnected industrial warning systems.

Asia Pacific Market Trends

Asia Pacific is considered to be a significantly growing area in the hazardous area signaling device market, propelled by fast-paced industrial growth, rising safety regulations, and increased infrastructure investments. Nations within this region, particularly China, India, Japan, and South Korea, are seeing growth in their oil and gas, chemical processing, and mining sectors, leading to a need for high-performance safety solutions for hazard prevention and adherence to international safety standards.

Governments in Asia Pacific are implementing stricter workplace safety regulations that compel industries to adopt AI-enhanced emergency response systems, remote hazard monitoring, and IoT-enabled warning devices. Additionally, the advancement of smart manufacturing and Industry initiatives has amplified the demand for automated and AI-powered hazardous area signaling solutions.

China

China ranks among the largest consumers of hazardous area signaling devices in Asia Pacific. The Chinese government has reinforced industrial safety laws, leading to a higher uptake of explosion-proof alarms, gas leak detectors, and emergency signaling systems. As China’s chemical processing sector and infrastructure development continue to expand rapidly, the demand for certified hazardous area safety solutions is on the rise. Furthermore, Chinese manufacturers are focusing on AI-powered industrial automation, integrating smart safety alarms and real-time hazard detection systems to boost workplace security and reduce industrial accidents.

India

India is witnessing notable growth in the market, driven by the expansion of oil refineries, increased chemical production, and heightened safety compliance initiatives. The Make in India initiative has stimulated investments in manufacturing, industrial automation, and smart safety solutions, leading to greater demand for advanced hazardous area signaling devices.

India’s Directorate General of Mines Safety and Oil Industry Safety Directorate enforces stringent safety regulations that mandate the implementation of hazardous area signaling solutions in mining operations, petrochemical facilities, and energy plants. Additionally, the growing utilization of IoT-enabled industrial safety systems and AI-powered predictive maintenance technologies is facilitating swift market expansion in India.

Hazardous area equipment serves as vital safety components designed for environments where explosive gases, vapors, combustible dust, or other hazardous materials may exist. These devices possess several essential features that ensure reliability and compliance with safety regulations. A fundamental characteristic is explosion-proof design, where the device is housed in a reinforced casing that can contain any internal ignition, thus preventing it from igniting surrounding hazardous materials. Many devices are also intrinsically safe, functioning on low power to mitigate the risks of sparks or heat generation. These devices alert individuals to potential dangers, safeguard worker safety, and protect essential infrastructure.

These signaling devices, commonly utilized in industries like oil and gas, chemical processing, mining, and manufacturing, are engineered to withstand extreme temperature conditions while minimizing the risk of combustion in volatile environments. The main role of hazardous area signaling devices is to provide prompt alerts in scenarios where standard equipment might fail due to explosive threats. These devices reduce accidents by notifying workers of dangers such as gas leaks, equipment failures, or unsafe working conditions. Their robust design ensures reliability in challenging settings, including high temperatures, humidity, and corrosive environments. Additionally, these devices are built to surpass stringent safety standards, ensuring they do not become sources of ignition in perilous areas.

| Report Coverage | Details |

| Market Size by 2034 | USD 3.22 Billion |

| Market Size in 2025 | USD 1.96 Billion |

| Market Size in 2024 | USD 1.85 Billion |

| Market Growth Rate from 2025 to 2034 | CAGR of 5.71% |

| Dominated Region | North America |

| Fastest Growing Market | Europe |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Product Type, Zone, End-Use Industry, and Regions |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America and Middle East & Africa |

Escalating stringent industrial safety regulations

A significant factor driving the hazardous area signaling device market is the heightened enforcement of strict safety regulations in industries that function in high-risk environments. Regulatory bodies, including the Occupational Safety and Health Administration, National Fire Protection Association, International Electrotechnical Commission, and ATEX directives, have enforced the use of certified signaling devices to safeguard workplace safety and minimize industrial hazards. Industries like oil and gas, chemical manufacturing, pharmaceuticals, mining, and power generation are intrinsically vulnerable to explosions, fire incidents, and gas leaks.

Regulatory organizations mandate that companies in these fields install hazardous area signaling devices such as explosion-proof alarms, strobe lights, and gas leak detectors to reduce risks and provide early warnings to personnel. Furthermore, the increase in workplace incidents has prompted businesses to enhance their safety systems with advanced, AI-integrated signaling solutions that facilitate real-time hazard detection, automated emergency responses, and remote monitoring features. As regulatory frameworks tighten and penalties for non-compliance rise, industries are swiftly investing in certified signaling devices.

High initial costs and complicated installation requirements

Despite the rising demand, a principal constraint limiting the growth of the hazardous area signaling device market is the substantial initial cost and intricate installation process. These signaling devices necessitate specialized materials, explosion-proof enclosures, and adherence to rigorous certification standards, resulting in higher expenses compared to standard signaling devices. Industries operating in hazardous environments are required to ensure that all safety equipment meets intrinsic safety and explosion-proof ratings, adding to the engineering, testing, and certification costs.

Installing signaling devices in dangerous areas is challenging, often involving specialized workforce training, compliance audits, and tailored system integration, further escalating overall costs and project timelines. For small and medium-sized enterprises, the significant capital expenditure associated with implementing these advanced signaling systems can act as a barrier to adoption. Although large-scale industries with strict regulatory requirements are investing in these technologies, budget-conscious businesses may postpone or restrict their expenditure on hazardous area safety infrastructure, hindering market penetration in cost-sensitive regions.

Integration of newer technologies in the existing systems

The hazardous area signaling device market presents a substantial growth prospect through the incorporation of artificial intelligence and the Internet of Things into intelligent signaling systems. The evolution of AI-powered predictive analytics, real-time monitoring, and remote-control functionalities is revolutionizing how industries identify, react to, and avert hazards in high-risk settings. Businesses focusing on digital transformation and intelligent industrial safety solutions are likely to propel the adoption of AI-based hazardous area signaling systems, resulting in new revenue streams for manufacturers and contributing to a more interconnected and smart safety ecosystem.

Smart alarms and signaling devices that utilize AI can evaluate environmental conditions, forecast possible malfunctions, and initiate automated safety measures autonomously. With IoT-enabled hazard monitoring, organizations can remotely track safety device performance, monitor gas leaks, detect unusual temperature changes, and adjust alert levels according to current risk assessments. In isolated or offshore sectors, like oil rigs, chemical plants, and underground mining operations, AI-integrated wireless signaling devices enhance reliability, reduce downtime, and improve workforce safety.

The audible signaling devices segment dominated the hazardous area signaling device market in 2024 due to its essential function in high-risk industrial settings where immediate attention is vital for accident prevention. Audible signaling devices, including horns, sirens, bells, and alarms, are critical for delivering immediate alerts during dangerous situations such as gas leaks, fires, equipment malfunctions, or chemical spills. These devices see widespread use in sectors that experience high background noise levels, like oil and gas, mining, and power generation, ensuring alerts reach workers even in loud operational environments.

The increasing regulatory demands for workplace safety, along with compliance requirements from agencies like OSHA, NFPA, and ATEX, have further boosted the demand for high-decibel audible alarms. Moreover, innovations in AI-driven smart alarms now facilitate adaptive volume regulation and real-time response automation, enhancing their efficiency in hazardous industrial zones. As industries emphasize employee safety and regulatory compliance, the need for high-performance audible signaling devices is anticipated to remain robust across various sectors.

The combination signaling devices segment is expected to grow with a notable CAGR from 2025 to 2034 as industries transition toward integrated safety solutions that merge audible, visual, and wireless alerting systems. Combination signaling devices, which include strobe lights, sirens, and voice alerts, are especially advantageous in environments where both auditory and visual warnings are essential for ensuring comprehensive awareness and rapid emergency response.

The increasing requirement for multifunctional safety solutions is driving more investments into combination signaling devices, particularly in modern industrial sites, automated manufacturing facilities, and offshore oil rigs, where various alert mechanisms bolster safety. Furthermore, the integration of IoT, AI-enhanced alarm personalization, and wireless connectivity is accelerating the uptake of sophisticated combination signaling devices, making them the preferred option for industries looking to enhance hazard response protocols.

The zone 1 segment accounted for the largest hazardous area signaling device market share in 2024, as it includes areas where hazardous gases or vapors exist during normal operations, presenting a moderate to high risk of explosions. Industries like oil refineries, chemical manufacturing plants, and gas processing facilities often function in Zone 1 settings, necessitating reliable explosion-proof signaling devices to warn personnel of potential dangers. Regulatory standards enforce the installation of approved signaling devices featuring flameproof enclosures and intrinsically safe designs in these Zone 1 locations.

Technological progress such as intelligent beacons, high-decibel alarms, and gas-detection-based warning systems has greatly enhanced safety monitoring and hazard management in these zones. As businesses continue to focus on minimizing risk and safeguarding workers, the need for signaling devices in Zone 1 remains elevated.

The zone 0 segment is expected to grow at the fastest rate during the forecast period, driven by the increasing use of specialized explosion-proof signaling solutions in areas where hazardous gases, vapors, or dust are always present. Such environments include underground mining operations, offshore oil rigs, and high-risk chemical storage sites, where even a slight ignition source can lead to devastating explosions.

To meet the heightened risks in Zone 0, manufacturers are designing advanced signaling devices equipped with AI-based real-time hazard detection, fail-safe emergency response systems, and predictive maintenance features. The rising adoption of wireless, remotely monitored, and self-adjusting signaling solutions is also fueling the growth of Zone 0-certified devices, which have become vital to industrial safety initiatives around the world.

The oil and gas segment dominated the hazardous area signaling device market in 2024, as this industry operates in highly volatile settings where flammable gases, vapors, and explosive substances pose ongoing dangers. Signaling devices are essential for monitoring equipment failures, identifying gas leaks, and delivering emergency notifications to avert fires and explosions.

With the global advancement of oil exploration and refining activities, safety guidelines mandated by regulatory organizations such as OSHA, IECEx, and API compel companies to install certified hazardous area signaling devices in crucial locations like offshore platforms, drilling rigs, and gas processing facilities. The incorporation of AI-driven early warning systems and real-time hazard monitoring technologies has further improved safety and compliance within oil and gas operations, ensuring that workers receive timely alerts and can evacuate during emergencies.

The food and beverage segment is growing at the fastest rate from 2025 to 2034 as manufacturers invest in advanced safety technologies to maintain hazard-free production environments. While the food and beverage industry is not commonly linked with hazardous areas, it does involve risk factors such as combustible dust buildup, high-temperature processing, and chemical exposure, which necessitate specialized signaling solutions to avert industrial mishaps.

Signaling devices in food processing facilities, breweries, distilleries, and cold storage units are increasingly utilized to monitor equipment malfunctions, identify contamination threats, and notify workers of possible hazards. Moreover, the use of smart signaling devices integrated with automated quality control systems is helping manufacturers enhance workplace safety, reduce product recalls, and adhere to strict hygiene standards. As the sector continues to modernize its production capabilities, the demand for hazardous area signaling devices in the food and beverage industry is poised to grow rapidly in the years ahead.

By Product Type

By Zone

By End-Use Industry

By Region

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

September 2024

October 2024

July 2024