March 2025

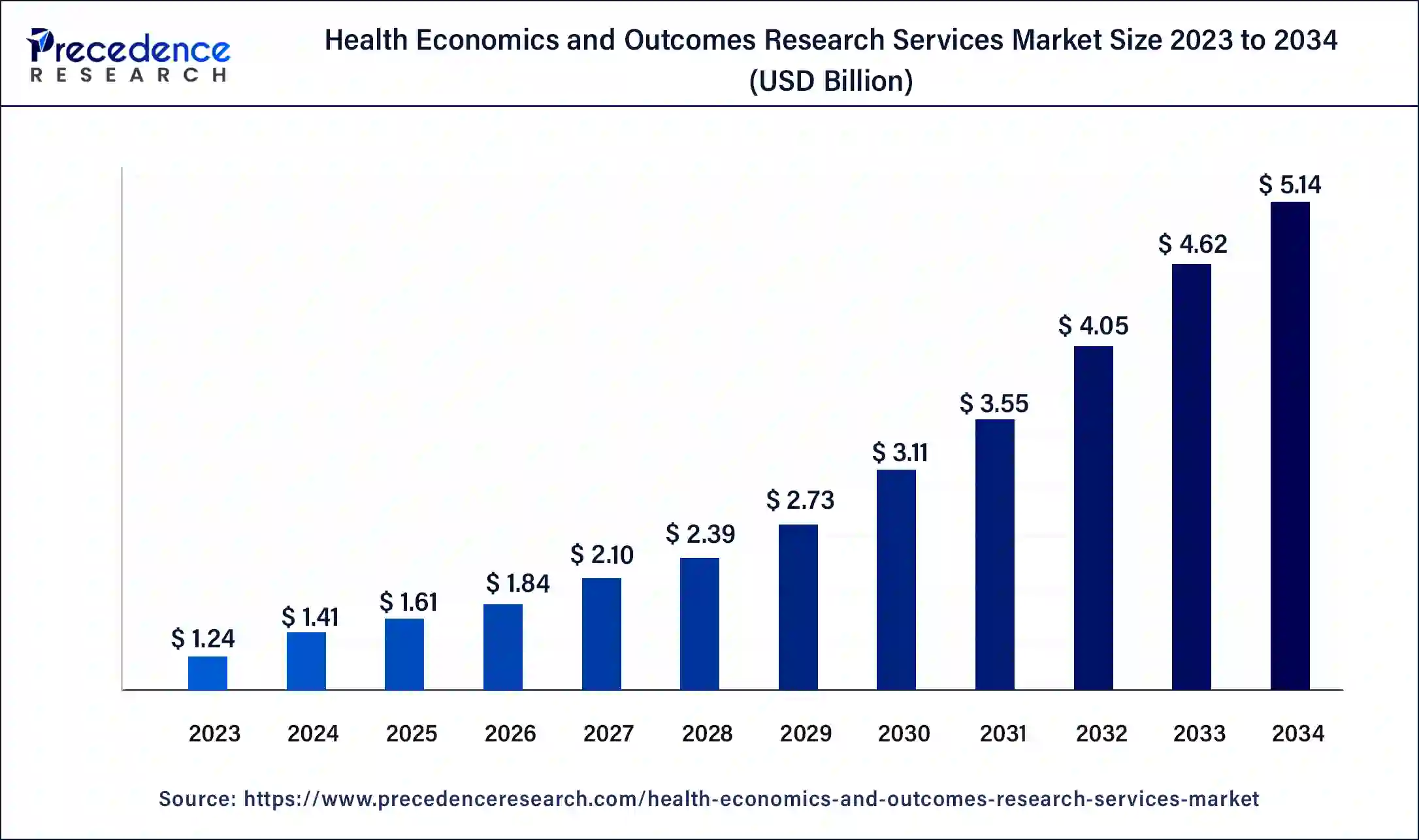

The global health economics and outcomes research (HEOR) services market size was USD 1.24 billion in 2023, estimated at USD 1.41 billion in 2024 and is expected to reach around USD 5.14 billion by 2034, expanding at a CAGR of 13.82% from 2024 to 2034.

The global health economics and outcomes research (HEOR) services market size accounted for USD 1.41 billion in 2024 and is expected to reach around USD 5.14 billion by 2034, expanding at a CAGR of 13.82% from 2024 to 2034. The number of drug approvals and high expenditure on research and development in the pharmaceutical sector are driving the health economics and outcomes research (HEOR) services market globally at a higher pace.

Health Economics and Outcomes Research (HEOR) stands for health economics and outcomes research. The field of HEOR has emerged to provide perceptible insights to healthcare professionals and the sector. Health Economics and Outcomes Research (HEOR) is a combination of two sectors working together with powerful data insights, and it is helpful in crucial decision-making related to the human healthcare system. Scientists working on Health Economics and Outcomes Research (HEOR) analysis use many proven methodologies, including analytic tools, economic models, and real-time data fetching processes. Such studies need to conserve data from medical insurance claims by patients, medical records of treatments, and overall spending on medicinal requirements by the whole healthcare unit.

Health economics deals explicitly with the output of healthcare interventions by measuring and valuing outcomes, while outcomes research is packaged with a set of scientific rules and regulations that evaluate how the healthcare intervention has impacted a number of patients across the area, which is surveyed by a team of professionals. For instance, HTA is a health technology assessment tool that helps in comparing the pricing of health interventions and how they will affect patients' recovery in a beneficial way. Such tools can bring transparency in the treatment efficacy for society and economic reviews for individuals and, eventually, to the community.

| Report Coverage | Details |

| Growth Rate from 2024 to 2034 | CAGR of 13.82% |

| Global Market Size in 2023 | USD 1.24 Billion |

| Global Market Size in 2024 | USD 1.41 Billion |

| Global Market Size by 2034 | USD 5.14 Billion |

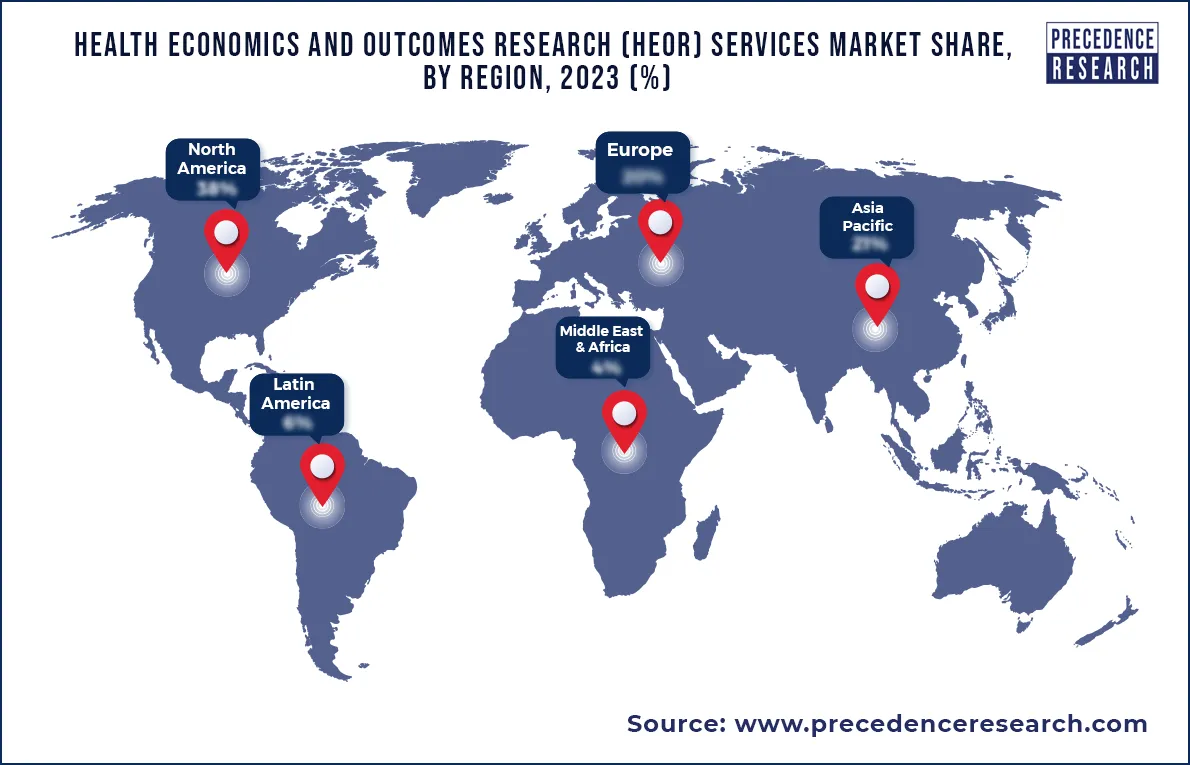

| Largest Market | North America |

| Base Year | 2023 |

| Forecast Period | 2024 to 2034 |

| Segments Covered | By Service, By Service Provider, and By End user |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Real-world evidence

Regulatory bodies in the pharma sector, such as the US FDA, have now permitted the involvement of real-world evidence data for analysis. Real-world data can be an excellent support for new drug approval, making approval decisions easier. Therefore, HEALTH Health Economics and Outcomes Research (HEOR) is playing a central role rather than just a support system in the healthcare sector. While conducting the analysis, Health Economics and Outcomes Research (HEOR) went through several steps that involved identifying data loopholes to understand economic interpretation for market access. It requires clinical trial data to decide the value of medical products. Primary and secondary data sources continuously generate these real-world datasets. All these methods conclude about budget models for help in the pricing process. These factors are observed to promote the Health Economics and Outcomes Research (HEOR) services market’s growth.

Lack of skilled professionals

There is a constant need for skillful professionals to analyze a vast amount of data generated by the healthcare sector. As data is vast and technically advanced, it requires several professionals to perform data analyses and gain insights from it. However, the Health Economics and Outcomes Research (HEOR) services market has faced resistance regarding highly qualified professionals, particularly in developing and underdeveloped countries. Due to this, Health Economics and Outcomes Research (HEOR) services market growth can be impeded.

Opportunity

Integration of Artificial Intelligence (AI)

Artificial Intelligence (AI) can be implemented to analyze large amounts of clinical data by using machine learning algorithms. Machine learning can be applied to data that can be viewed in different ways and aid researchers in gaining helpful insight into safety and treatment aftereffects. In the Health Economics and Outcomes Research (HEOR) services, machine learning algorithms can yield improved decisions by organizing high-volume data of the healthcare sector from different sources. ML algorithms can also be used to create diagnostic tools that can monitor human work and its quality. These can be some future visions that AI could create in the healthcare sector. And it will build numerous possibilities in the future.

The Health Economics and Outcomes Research (HEOR) service market is segmented into clinical outcomes, real-world data analysis with information, market access solutions with reimbursement processes, and others. Among these, the market access solution and reimbursement segment held the largest share of the market in 2023. The segment consists of various tools and services for the generation of evidence and providing drugs to the patient at reasonable prices. The ongoing therapies and new medicines launches are also expanding the global Health Economics and Outcomes Research (HEOR) services market growth with the market access solutions and reimbursement segment.

The contract research organizations segment led the market in 2023. Contract Research Organizations have extensive experience and expertise in conducting clinical trials, real-world evidence studies, and health economic evaluations. They employ a diverse team of researchers, statisticians, health economists, and clinical experts who are well-equipped to design and execute Health Economics and Outcomes Research (HEOR) studies across various therapeutic areas and healthcare settings.

The consultancy segment is expected to grow at a significant rate in the Health Economics and Outcomes Research (HEOR) services market during the forecast period. Consultants require advice and innovative ideas to assist and grow businesses as per the regulatory requirements to avoid imprudent situations. Also, business owners prefer consultancy services for decision-making and to provide proper guidance and insight for business solutions. Such a demand for consultancy services stabilizes the Health Economics and Outcomes Research (HEOR) services market and creates a wave of business expansion.

The pharma and biotech companies segment led the Health Economics and Outcomes Research (HEOR) services market in 2023. Pharmaceutical and biotech companies are under growing pressure to demonstrate the value and effectiveness of their products to payers, healthcare providers, and regulators. HEOR services play a crucial role in generating real-world evidence (RWE) and conducting health economic evaluations to inform pricing, reimbursement, and market access decisions for pharmaceuticals and biologics.

Regarding the end user, the healthcare providers segment is expected to witness market growth in the Health Economics and Outcomes Research (HEOR) services market during the forecast period. Various customized therapies increase the usage of specialty medicines to target needy patients, thereby supporting healthcare payers in accepting and implementing Health Economics and Outcomes Research (HEOR) analysis. The development of many analytical tools that aid in analyzing healthcare data is pushing the healthcare IT field across many platforms, and it is impacting the market positively. For instance, In May 2022, Moses & Singer launched its premium consulting firm name as, MS Strategic Solutions LLC, to provide various strategic as well as advisory services to clients in digital health-science and other industries.

North America dominated the health economics and outcomes research (HEOR) services market in 2023. Increasing expenditure by pharmaceutical and biotechnology companies on research and development is the primary reason for a growing market. The frequency of clinical trials and new launches of drugs and their approvals, especially across countries like the United States, are driving factors of the health economics and outcomes research (HEOR) services market in North America. Every consecutive year passes with the new approval for medicinal drugs, which increases the rampancy of clinical trials coupled with drug approvals in the US.

Most drugs are expensive in terms of costs, which contributes to rising healthcare costs for both the private and government healthcare sectors. For instance, in April 2021, nearly 83 billion USD was spent by the US pharmaceutical industry, merely for research and development purposes. Health economics and outcomes research (HEOR) services aid in addressing unpredictable costs during the development stages of clinical drugs. Hence, such rising expenditure drives the market in the country.

Moreover, strategic activities by the primary key players are a significant factor that fuels market growth. For instance, in April 2022, Optum and Change Healthcare extended their agreement until December 31, 2022. According to this agreement, Optum and Change Healthcare will connect to simplify the payment process for healthcare providers and payers along with core clinical and administrative processes to serve patients. Hence, owing to these factors, the health economics and outcomes research (HEOR) services market is proliferating in the North American region.

The health economics and outcomes research (HEOR) services market is projected to witness vital growth and tremendous opportunities in Asia Pacific. This region preferentially includes precision medicine in hospital settings with the new feature, which is equipped with technological tools. Such changes can attract patients, further expanding market growth in the Asia Pacific region. For instance, India is increasing its testing capacity to control fatal diseases. During COVID-19, as per the data published on February 13, 2021, around 8.2 million doses were administrated in India.

Segments Covered in the Report

By Service

By Service Provider

By End user

By Geography

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

March 2025

January 2025

January 2025

January 2025