Contract Research Organization (CRO) Market Size and Growth 2025 to 2034

The global contract research organization (CRO) market size was estimated at USD 65.06 billion in 2024 and is predicted to increase from USD 69.56 billion in 2025 to approximately USD 126.17 billion by 2034, expanding at a CAGR of 6.85% from 2025 to 2034. As the pharmaceutical and biotechnology industries continue to advance, the demand for the contract research organization (CRO) market is likely to grow further.

Contract Research Organization (CRO) Market Key Takeaways

- In terms of revenue, the market is valued at 69.56 billion in 2025.

- It is projected to reach 126.17 billion by 2034.

- The market is expected to grow at a CAGR of 6.85% from 2025 to 2034.

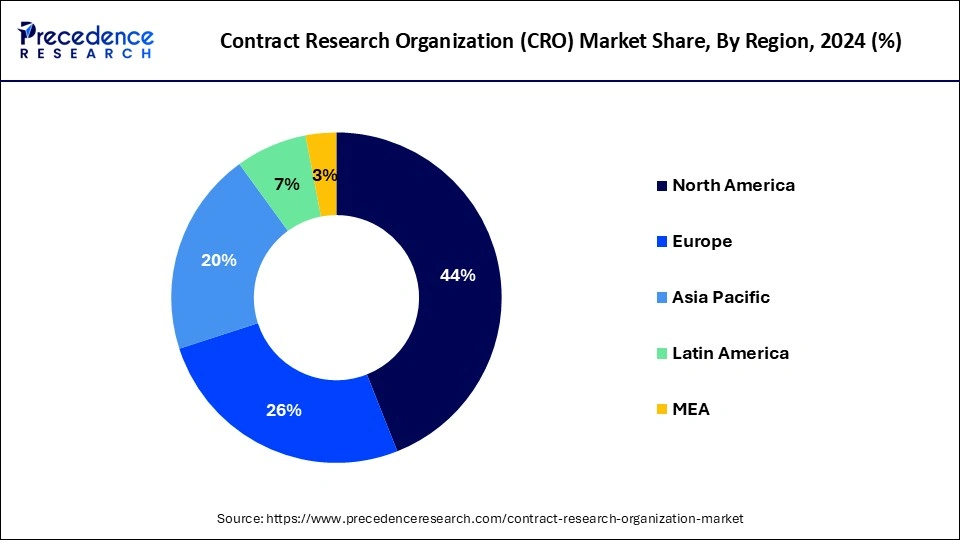

- North America dominated the Contract Research Organization (CRO) Market with largest revenue share of 44% in 2024.

- Asia Pacific is expected to show the fastest growth during the forecast period.

- By type, the clinical segment held a significant share of the market in 2024.

- By type, the early phase development services segment is expected to grow at a rapid pace over the forecast period.

- By application, the oncology segment dominated the market in 2024.

- By application, the CNS disorder segment is expected to show significant growth during the forecast period.

- By end user, the pharmaceutical & biotech companies segment dominated the market in 2024.

- By end user, the CROs for the medical device segment is projected to experience the fastest growth in the market over the studied period.

U.S. Contract Research Organization (CRO) Market Size and Growth 2025 to 2034

The U.S. contract research organization (CRO) market size was estimated at USD 20.04 billion in 2024 and is predicted to be worth around USD 39.76 billion by 2034 with a CAGR of 7.09% from 2025 to 2034.

North American dominated the Contract Research Organization (CRO) Market in 2024. The growth of the market in North America is primarily driven by the expanding pharmaceutical and biotechnology sectors in the region. The United States holds the largest share of the market, followed by Canada. Factors contributing to the growth of the CRO market in the U.S. include its robust pharmaceutical and biotechnology industries, a high concentration of clinical research facilities, and advanced infrastructure and technology. Canada ranks as the second-largest CRO market in North America.

- In October 2022, The PPD clinical research business and Thermo Fisher Scientific Inc., the world leader in science service, announced the establishment of the PPD DCT Network to support global investigators and research sites participating in decentralized clinical trials (DCTs) for pharmaceutical and biotech customers.

Asia Pacific is expected to show the fastest growth in the Contract Research Organization (CRO) Market during the forecast period. Asian countries, particularly China and India, have experienced a significant increase in clinical trial activities. Furthermore, Diverse patient populations and lower operational costs have attracted pharmaceutical and biotech companies to conduct trials in the region, hence boosting the demand for CRO services. This growth is driven by the expanding presence of pharmaceutical and biotechnology firms in Asia, along with the rising number of clinical trials being conducted in the region. The large population in Asia is also a key factor contributing to the CRO market's growth.

- In March 2024, Veeda Clinical Research, a contract research organization based in India, announced that they had finalized the acquisition of Heads, a European CRO specializing in oncology trials, for an undisclosed sum. This move is aimed at strengthening Veeda's position in the global CRO market, offering clients a wider range of services and geographic reach.

Market Overview

A contract research organization (CRO) provides clinical trial services to the pharmaceutical, biotechnology, and medical device industries. Typical services offered by CROs in the medical device sector include regulatory affairs, clinical trial planning, site selection and initiation, trial logistics, biostatistics, recruitment support, clinical monitoring, data management, medical writing, and project management. Sponsors seeking to conduct clinical trials often engage CROs to avoid the need for full-time staff and to leverage the CRO's expertise on an as-needed basis.

The CRO is responsible for the safe and effective planning, coordination, execution, and management of the clinical trial's lifecycle. Acting as the primary liaison between the sponsor and other stakeholders, the CRO interacts with suppliers, medical professionals, research coordinators, regulatory staff, ethical and compliance committees, and vendors throughout the trial. Various types of CROs cater to different specific needs within the industry.

Technological Advancement

The contract research organization market implements technological transformations to enhance clinical trial operations through data-driven methods for both superior patient services and research improvements. Private technology platforms based on artificial intelligence and data analytics systems revolutionize the approaches to designing studies and running them, and analyzing data in clinical research.

Through data analytics platforms, CROs improve their ability to handle large clinical data sets, which yields better data stability and allows stakeholders to access real-time information. Modern clinical research technology integrates remote monitoring tools, wearable devices, and telemedicine to engage patients better and track their health metrics, and boost their trial compliance. Technology advancements create adaptable clinical trials that minimize site visit requirements and extend participation opportunities to various patient demographics.

Key Factors Influencing Future Market Trends

- Increasing R&D investment: The contract research organization market receives its growth momentum from increased research and development investments. The increasing investment in new drug development from pharmaceutical companies and their focus on biotech innovations create an expanded need for clinical trial services, which CROs will capitalize upon to drive market expansion as well as technological progress.

- Growing patient populations: Global demographics are undergoing change, and the increasing incidence of chronic diseases creates a growing necessity for clinical trials targeting multiple healthcare areas. The CROs utilize rising patient numbers to deliver wider service offerings, including complex healthcare needs, particularly within oncology and cardiovascular diseases, and rare disease groups who need extensive patient trials.

- Increasing complexity of drug development: The market requires specialized CROs to manage complex trials for advanced therapies, along with personalized treatments that need new regulatory standards to drive industry evolution.

Contract Research Organization (CRO) Market Growth Factors

- Pharmaceutical companies are seeking in-house research and development activities, which are expected to fuel the Contract Research Organization (CRO) Market growth.

- The drug development processes became more tedious and time-consuming hence the shift towards outsourcing is increasing which can boost market growth.

- The Contract Research Organization (CRO) Market provides different services in clinical trial management, which is likely to help in market expansion.

- Globalization of clinical trials is one of the key factors that will grow the contract research organization (CRO) market further.

Market Scope

| Report Coverage | Details |

| Market Size by 2034 | USD 126.17 Billion |

| Market Size in 2025 | USD 69.56 Billion |

| Market Size in 2024 | USD 65.06 Billion |

| Growth Rate from 2025 to 2034 | CAGR of 6.85% |

| Largest Market | North America |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Type, Service, End-user, and Regions |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Market Dynamics

Drivers

Need for cost-effective drugs

The contract research organization (CRO) market is experiencing exponential growth during the forecast period due to several key factors, including the availability of research funds, government support for R&D, a well-developed healthcare sector, and rising healthcare expenditures. The increasing global patient population also contributes significantly to market expansion. Key drivers of growth in the CRO industry include the need for cost-effective drug development processes, the rising prevalence of chronic diseases, and the surge in outsourcing to expedite R&D activities. Additionally, the growing adoption of virtual trials, remote monitoring, and telemedicine is further boosting the demand for contract research organization services.

- In December 2023, AstraZeneca unveiled a new standalone company, Evinova, aimed at providing contract research organizations and pharmaceutical companies with access to its established digital solutions for conducting clinical trials. With a team of 300 members drawn from AstraZeneca and spanning nine countries, Evinova will offer a drug development suite based on proven trial solutions employed across AstraZeneca's disease areas.

Restraint

Issues surrounding intellectual property rights

When a drug development company or pharmaceutical firm collaborates with a contract research organization, the CRO gains access to critical information related to drug research and patented products. This access increases the risk of data leakage or intellectual property infringement. Although legal contracts are in place to prevent such incidents, sharing confidential information with a third party inherently involves certain risks. Therefore, pharmaceutical companies must ensure the safety of their intellectual property to prevent data loss when utilizing the Contract Research Organization (CRO) Market services.

Opportunity

Tech-enabled patient recruitment and management

Patient recruitment and management pose significant challenges for clinical research organizations, sites, and sponsors. Traditionally, patient recruitment relied on manual methods such as fliers, newspaper ads, and physician referrals. However, with the advent of new technology, CROs increasingly use digital channels to reach a larger pool of potential participants. One major technological advancement is electronic data capture (EDC), which collects clinical trial data electronically instead of using paper forms. EDC solutions enhance data accuracy and completeness while streamlining the data collection process. With EDC, CROs can manage data from multiple sites, gather patient data remotely, and fix better data integrity throughout the trial. Moreover, the Contract Research Organization (CRO) Market leverages other technologies like social media and mobile apps to boost patient engagement and recruitment.

- In April 2024, Lindus Health, the ‘anti-CRO' running radically faster, more reliable clinical trials for life science pioneers, launched an ‘All-in-One Respiratory' package of contract research organization services specifically designed for clinical research into respiratory diseases.

Type Insights

The clinical segment held a significant share of the Contract Research Organization (CRO) Market in 2024. A CRO is a specialized entity that provides essential support to pharmaceutical, biotechnology, and medical device companies in clinical research and development processes. The demand for these CROs is increasing as they focus on ensuring compliance with regulatory standards. These organizations offer a range of services, including patient recruitment, data management, protocol development, regulatory submissions, and site monitoring. As regulatory requirements become more stringent, the role of CROs in maintaining high-quality standards in clinical research is becoming increasingly vital.

- In October 2023, Curavit Clinical Research, a virtual contract research organization (VCRO) that specializes in decentralized clinical trials (DCTs) for digital therapeutics, launched a new Health Economics and Outcomes Research (HEOR) Practice. Curavit will incorporate HEOR services in clinical trials to capture evidence of the health economics value of novel pharmaceutical products.

The early phase development services segment is expected to grow at a rapid pace in the Contract Research Organization (CRO) market over the forecast period. PPD's early development services can conduct absorption, distribution, metabolism, and excretion (ADME) studies to understand how a drug is processed in the human body, assessing its safety and effectiveness. This capability is due to the growing investment in developing life-saving drugs.

Application Insights

The oncology segment dominated the Contract Research Organization (CRO) Market in 2024. The oncology segment is driven by factors such as the growing elderly population, rising cancer incidence, early cancer diagnosis and screening, and increased R&D for cancer treatments. Additionally, promising late-stage pipeline drugs and high potential in emerging markets contribute to this growth.

The CNS disorder segment is expected to show significant growth in the Contract Research Organization (CRO) Market during the forecast period. The rising prevalence of CNS disorders, including Parkinson's disease, Alzheimer's disease, multiple sclerosis, depression, epilepsy, and schizophrenia, is expected to drive the segment's growth. This increasing prevalence is boosting the demand for effective treatments for CNS disorders, thereby fueling the segment's expansion.

End-user Insights

The pharmaceutical & biotech companies segment dominated the Contract Research Organization (CRO) Market in 2024. The growth of this sector is driven by the rising prevalence of chronic illnesses, the expanding elderly population, and the increasing adoption of new therapies. These factors have a positive impact on the market growth of Contract Research Organizations (CROs).

The CROs for the medical device segment is projected to experience the fastest growth in the Contract Research Organization (CRO) Market over the studied period. Collaborations among medical device manufacturers, healthcare providers, research institutions, and technology firms promote innovation and the creation of new devices. These partnerships allow companies to utilize their expertise, resources, and market influence, contributing to the expansion of the segment.

Contract Research Organization (CRO) Market Companies

- Catalent, Inc.

- Celerion

- Cerner Corporation

- Charles River Laboratories International, Inc.

- Cognizant

- GVK Biosciences Private Limited

- ICON plc

- IQVIA Holdings Inc.

- Laboratory Corporation of America Holdings

- Medpace Holdings, Inc.

- Parexel International Corporation

- Pharmaceutical Product Development, LLC

- Syneos Health, Inc.

- Thermo Fisher Scientific Inc.

- Wuxi AppTec

Recent Developments

- In June 2024, Lindus Health presented their total contract research organization (CRO) and technology solution to the world while maintaining their “anti-CRO” brand identity, which focuses on rapid and dependable clinical trials for pioneering life science researchers.

- In January 2024, Ichor Life Sciences introduced its clinical trial services division to support clients from preclinical studies through late-stage trials up to regulatory approval. Ichor Clinical emerged as the new division to deliver clients protein and pharmacology, along with discovery and consulting services as part of the company's expanding clinical trial domain.

- In February 2024, ICON plc acquired HumanFirst, a cloud-based technology company specializing in precision measurement for patient-centered clinical research. The integration of HumanFirst's unique technology with ICON enabled more precise measurement of patient results, which delivered better clinical trial accuracy and efficiency.

- In October 2023, IQVIA, a leading global provider of advanced analytics, technology solutions, and clinical research services to the life sciences industry, announced a strategic collaboration with Argenx (Netherlands) to advance treatment for patients suffering from rare autoimmune diseases by utilizing innovative and integrated technology-enabled pharmacovigilance (PV) safety services and solutions.

- In October 2022, the retail giant Walmart launched a new healthcare research organization to drive higher-quality, more equitable healthcare. The Walmart Healthcare Research Institute will initially focus on driving greater equity in clinical trials for drugs that treat chronic conditions.

- In July 2022, Labcorp, a global leader in life sciences, expanded its automated clinical trial kit production line in Mechelen, Belgium. The new, automated line will be used to produce specimen collection kits for clinical trial investigator sites in Europe, the Middle East, and Africa.

Segments Covered in the Report

By Type

- Pre-clinical

- Drug Discovery

- Clinical

- Others

By Service

- Medical Writing

- Project Management

- Clinical Monitoring

- Phase i

- Phase ii

- Phase iii

- Phase iv

- Others

- Biostatistics

- Quality Management

- Regulatory/ Medical Affairs

- Data Management

- Others

By End-user

- Pharmaceutical & Biopharmaceutical Companies

- Medical Device Companies

- Others

By Region

- North America

- Asia Pacific

- Europe

- Latin America

- Middle East & Africa

Get a Sample

Get a Sample

Table Of Content

Table Of Content