January 2025

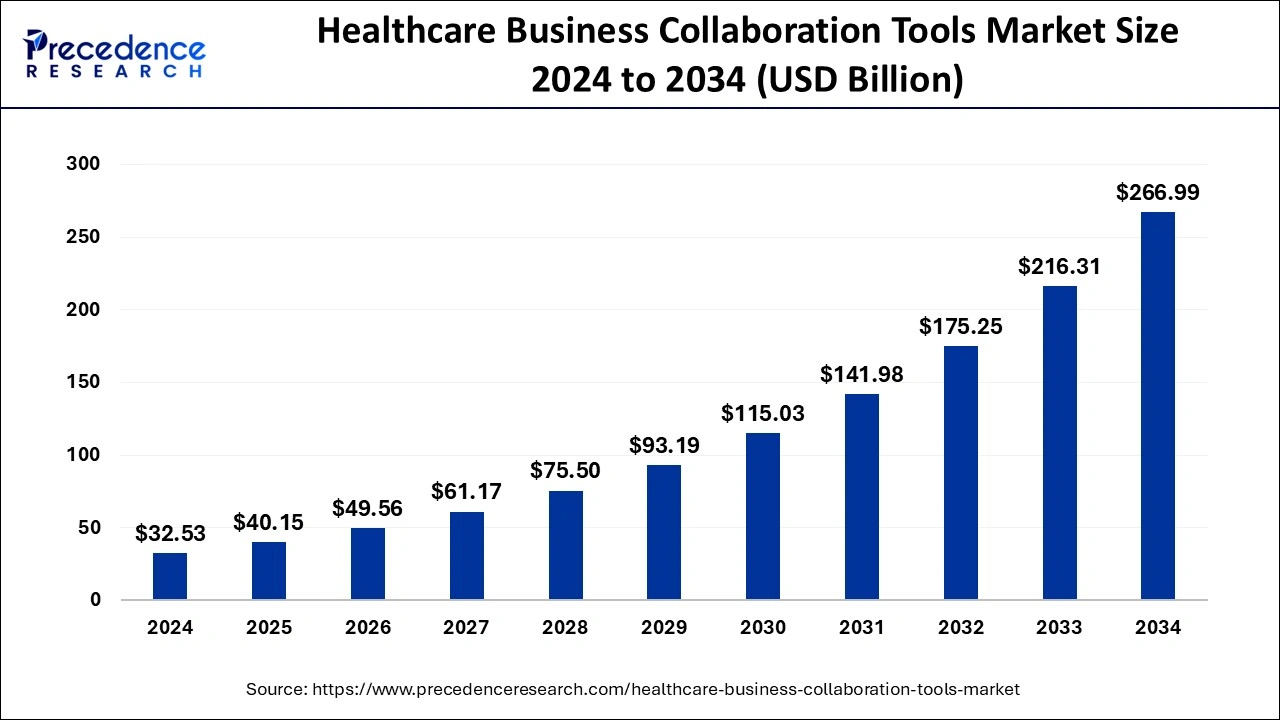

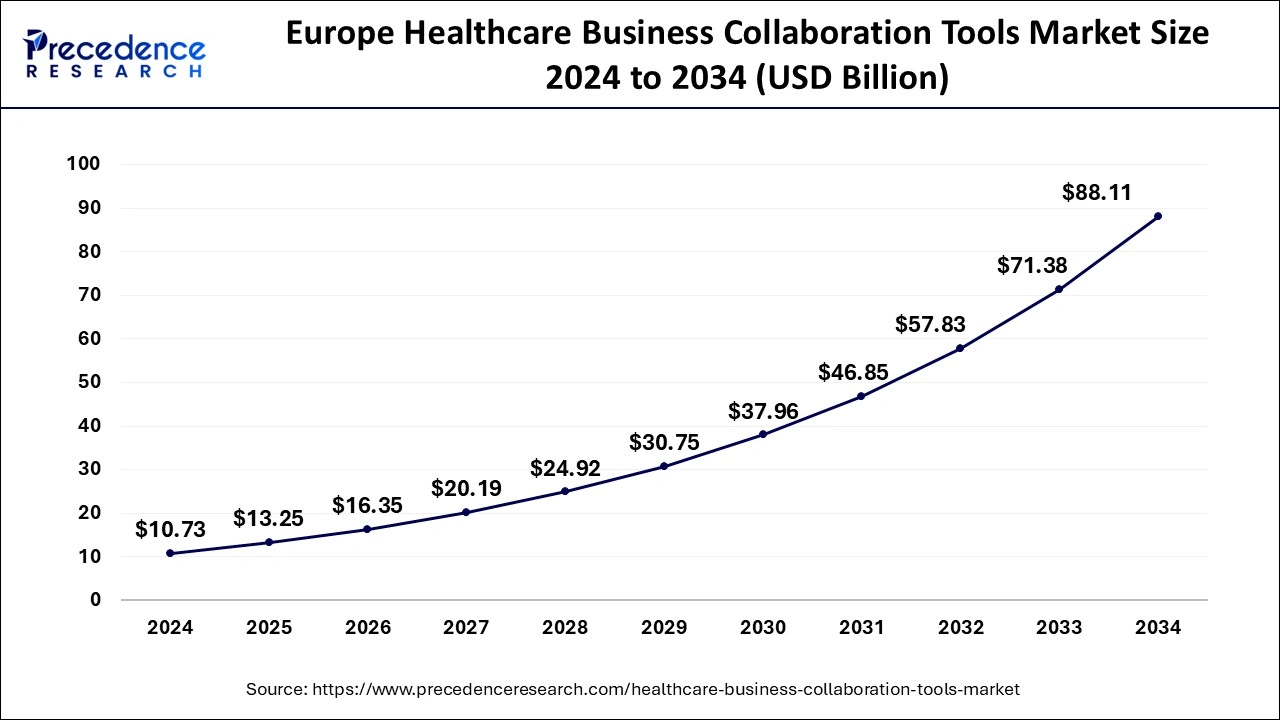

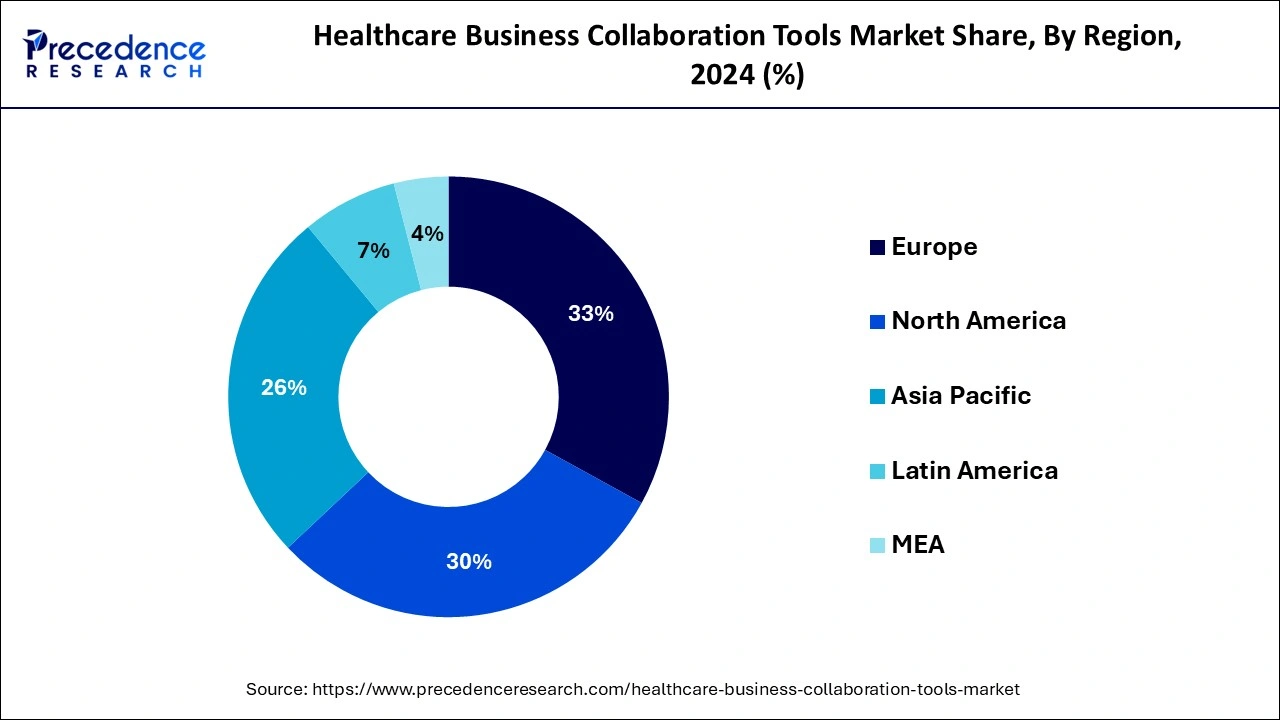

The global healthcare business collaboration tools market size was calculated at USD 32.53 billion in 2024, grew to USD 40.15 billion in 2025 and is predicted to hit around USD 266.99 billion by 2034, expanding at a CAGR of 23.43% between 2025 and 2034. The Europe healthcare business collaboration tools market size is evaluated at USD 10.73 billion in 2024 and is expected to grow at a CAGR of 23.44% during the forecast year.

The global healthcare business collaboration tools market size was worth around USD 32.53 billion in 2024 and is expected to hit around USD 266.99 billion by 2034, growing at a CAGR of 23.43% from 2025 to 2034. The growth in the healthcare business collaboration tools market is because of factors such as increased demand for remote business services and healthcare services, increased use of digital technologies, and the demand for patient care management.

Artificial intelligence and machine learning are integrated into the healthcare business collaboration tools market systems that offer capabilities to predict the patient’s outcome, self-scheduling appointments, and natural language processing. Such AI-integrated components improve workflow and support data-driven decision-making. AI-enabled chatbots to improve the level of interaction with patients. The application of AI, especially machine learning, complements these tools, which contribute to predicting resources and improving customer engagement through solutions based on artificial intelligence.

The Europe healthcare business collaboration tools market size was evaluated at USD 10.73 billion in 2024 and is projected to be worth around USD 88.11 billion by 2034, growing at a CAGR of 23.44% from 2025 to 2034.

Europe accounted for the largest share of the healthcare business collaboration tools market in 2024. European countries are experiencing integration of advanced technologies, and healthcare providers and emerging healthcare needs require the optimization of patient care. Southern European countries are catching up with the digital health trend, focusing on improving collaboration tools for both healthcare providers and patients. France is rapidly embracing telemedicine, particularly in rural areas where access to healthcare professionals is limited, driving the need for digital collaboration tools. Healthcare collaboration tools are increasingly incorporating AI for scheduling, administrative tasks, patient triage, and automated data analysis, improving efficiency.

North America is anticipated to witness the fastest growth in the healthcare business collaboration tools market during the forecasted years. North America’s developed healthcare system, as well as high technological adoption, contribute to this significant share. These bodies are adopters of collaboration tools to streamline workflows, improve patient care, and encourage medical research and innovation.

The North American government pays special attention to the integration with digital health, where telemedicine services and electronic health records (HER) are successfully introduced along with a favorable collaboration environment. In addition, the area has some rigorous regulations of data privacy, like HIPAA in the United States, that permit the safe use and exchange of patient data.

Healthcare business collaboration tools are digital platforms that aid healthcare providers and administrative teams in communicating, coordinating, and managing workflows. In the healthcare industry, it is used to support communication between healthcare providers, facilitate patient flow, and cooperate while sharing information. They also improve care and reduce time spent on tasks and paperwork, while also keeping the patient information safe. Effective tools of communication allow healthcare teams to communicate effectively, especially in critical and sensitive areas.

Furthermore, the use of healthcare business collaboration tools market solutions also rose after the pandemic, because of proper communication and cooperation between the healthcare workforces. Telehealth and remote patient monitoring systems have increased the need for safe and real-time communication platforms allowing clinicians to collaborate across geographical locations.

| Report Coverage | Details |

| Market Size by 2034 | USD 266.99 Billion |

| Market Size in 2025 | USD 40.15 Billion |

| Market Size in 2024 | USD 32.53 Billion |

| Market Growth Rate from 2025 to 2034 | CAGR of 23.43% |

| Largest Market | Europe |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Type, Facility Size, Deployment, and Regions |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Increase in telemedicine and remote healthcare services

As the use of telemedicine rises, the collaboration tools improve with a specific focus on patient interactions and remote medical consultation. Such tools are file sharing, video calling, and various self-diagnostic options, which allow telemedicine to render healthcare business collaboration tools market services. The shift towards the approval and use of telemedicine services across the world means that collaboration solutions are a massive opportunity. The advancements in the use of telecommunication in the provision of healthcare services have been primarily responsible for the increasing demand for these tools. Telemedicine relies on effective communication systems to put patients in touch with the healthcare givers for consultation, diagnosis, and treatment.

Cost constraints

The use of sophisticated communication and cooperation tools in healthcare organizations entails initial major capital costs such as IT infrastructures and licenses, as well as human capital costs. These costs could be a huge restraint to smaller clinics and rural hospitals that do not have adequate funds to invest. A significant number of healthcare organizations experience financial challenges that do not allow the implementation of solutions to support the healthcare business collaboration tools market. This high initial investment for integration and the subsequent recurring cost of maintenance and support pose a problem to providers.

Innovation in healthcare collaboration tools

The healthcare business collaboration tools market is considered to have a high degree of modernization due to the increase in the acceptance of digital technologies or tools for communication and the rising adoption of several strategies by market players to develop healthcare business collaboration tools. The trend of mergers and acquisitions (M&A) continues to shape the business environment as companies look forward to partnerships and acquisitions to improve market presence.

The communication & coordination software segment noted the largest share of the healthcare business collaboration tools market in 2024. There is increased adoption of new technologies within the healthcare industries, such as rolling out software that enhances instant messaging and task assignments. These tools provide solutions for rapid information exchange, care team collaboration, appointment scheduling, and patient engagement, eventually leading to enhanced clinical outcomes and improved patient experiences. Such software platforms create a safe for caregivers to share crucial patient data within a short period. The need for effective communication and coordination solutions has surged as healthcare evolves towards value-based care models and telehealth services.

The conferencing software segment is projected to witness the fastest growth in the healthcare business collaboration tools market during the forecast period. These tools enable credential and real-time communication between healthcare professionals across geographical regions. Telecommunication platforms focus on applications such as telemedicine, remote consultations, and virtual meetings as consumer adoption of conferencing software grows throughout the healthcare sector. These tools are important for healthcare organizations to maintain operational continuity and deliver quality care in remote or hybrid care delivery models due to features such as support for video, voice, and chat and tools such as screen and document sharing, hence driving the growth of the segment. Expanded functionality, such as the live display of screens and the simultaneous editing of documents, makes medical conversation and decision-making with healthcare teams more effective.

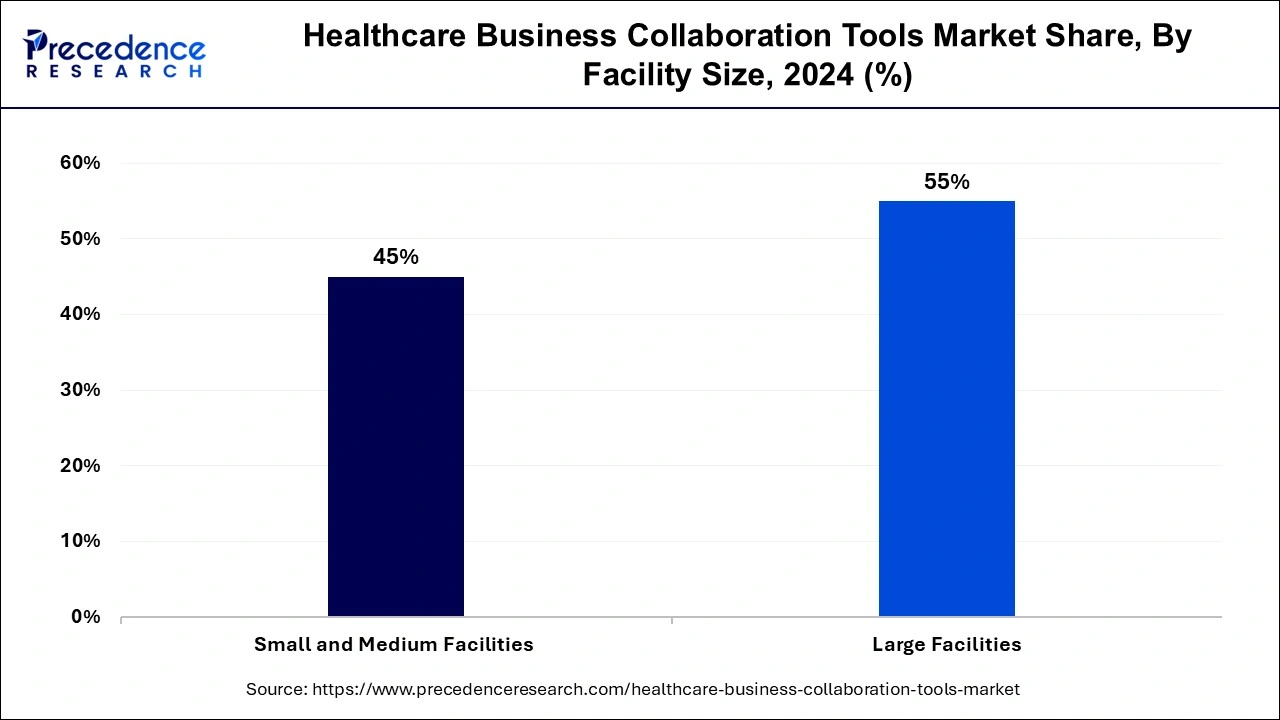

By facility size, the large facilities segment contributed the dominant share of the healthcare business collaboration tools market in 2024. These organizations treat a high patient load and are thus characterized by extended care teams that require frequent and timely communication to support workflow and deliver good patient care. They require efficient and stable collaboration solutions that can be widely applicable to handle almost any aspect of healthcare operations efficiently. Scheduling, patient management, and case management of large numbers of patients are the key things for which collaboration tools can be beneficial and for which waiting time needs to be optimized. Also, large organizations have the financial capabilities to invest in thorough collaboration solutions.

The small and medium facilities segment is projected to witness the fastest growth in the healthcare business collaboration tools market during the forecast period. The anticipated growth is driven by adaptability, cost-effective cloud-based solutions, the urgent need for telehealth and remote care, scalability, recognition of competitive advantages, commitment to quality patient care, and the necessity of regulatory compliance. Business collaboration tools have been adopted in small and medium-sized healthcare facilities as the operational demands of the organizations in patient care and communication require improvements, especially in small teams. Collaboration tools tailored for small and medium-sized setups are intended for ease of use, rapid deployment, and cost-effectiveness.

The on-premises segment has contributed the largest share of the healthcare business collaboration tools market in 2024. On-premises software has better flexibility along with better integration and customization facilities and can protect data that includes sensitive information. On-premises deployment, preferred for its localized control and customization options, permits healthcare institutions to host collaboration tools within their physical infrastructure. On-premises solutions in software provide better interface compatibility and configurability, as well as better security and control over data and information, especially for compliance with standard industrial regulations.

The cloud segment is projected to witness the fastest growth in the healthcare business collaboration tools market during the forecast period. Accessibility and efficiency are boosted by data access from any location that has web connectivity through cloud solutions. With the ever-continuing need for resourceful, agile, and cheap methods of communication, cloud-based systems are becoming more and more used in the healthcare sector. Cloud deployment standardizes the use of collaboration tools, with flexibility for healthcare providers to use these tools at remote locations. This growth trend has put great pressure on the advancement and implementation of collaboration solutions tailored for the healthcare sector with an emphasis on real-time communication, information sharing, or enhanced clinical processes.

By Type

By Facility Size

By Deployment

By Geography

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

January 2025

December 2024

February 2025

April 2024