January 2025

The global healthcare contract sales organizations (CSOs) market size is calculated at USD 15.92 billion in 2024, grew to USD 17.23 billion in 2025, and is predicted to hit around USD 35.02 billion by 2034, poised to grow at a CAGR of 8.2% between 2024 and 2034. The North America healthcare contract sales organizations (CSOs) market size accounted for USD 6.69 billion in 2024 and is anticipated to grow at the fastest CAGR of 8.32% during the forecast year.

The global healthcare contract sales organizations (CSOs) market size is expected to be valued at USD 15.92 billion in 2024 and is anticipated to reach around USD 35.02 billion by 2034, expanding at a CAGR of 8.2% over the forecast period from 2024 to 2034.

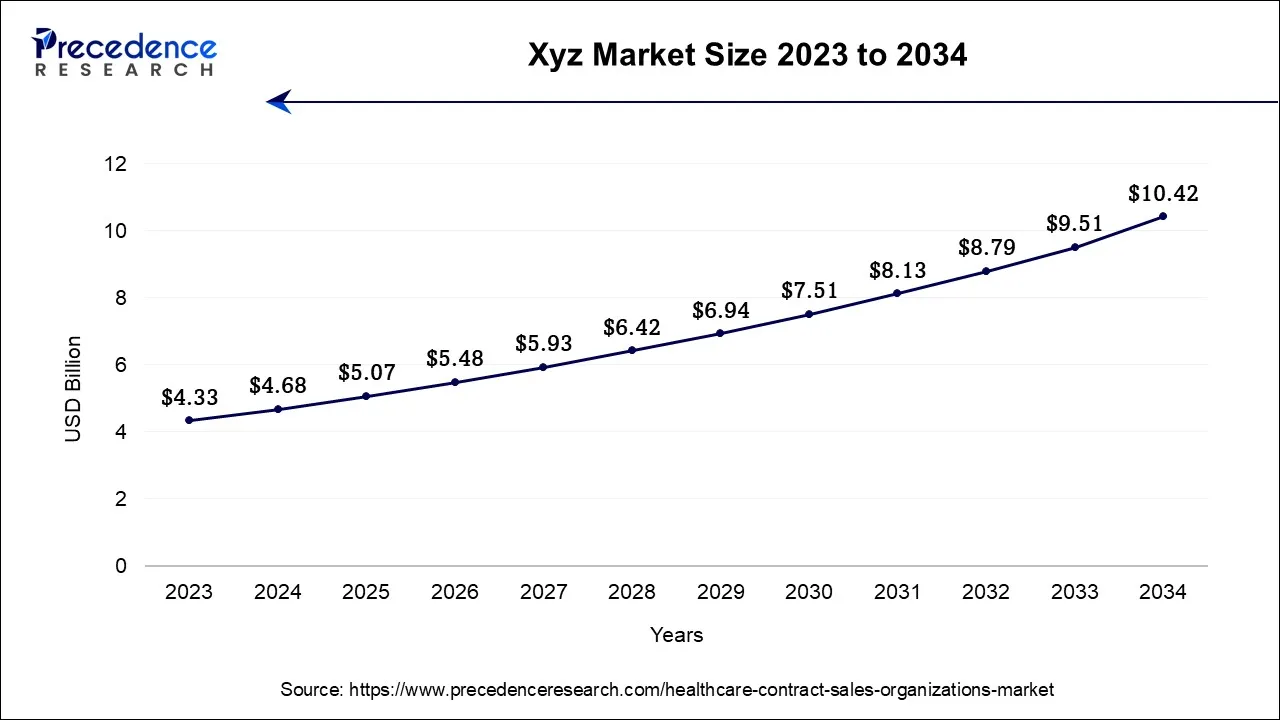

The U.S. healthcare contract sales organizations (CSOs) market size is accounted for USD 4.68 billion in 2024 and is projected to be worth around USD 10.42 billion by 2034, poised to grow at a CAGR of 8.33% from 2024 to 2034.

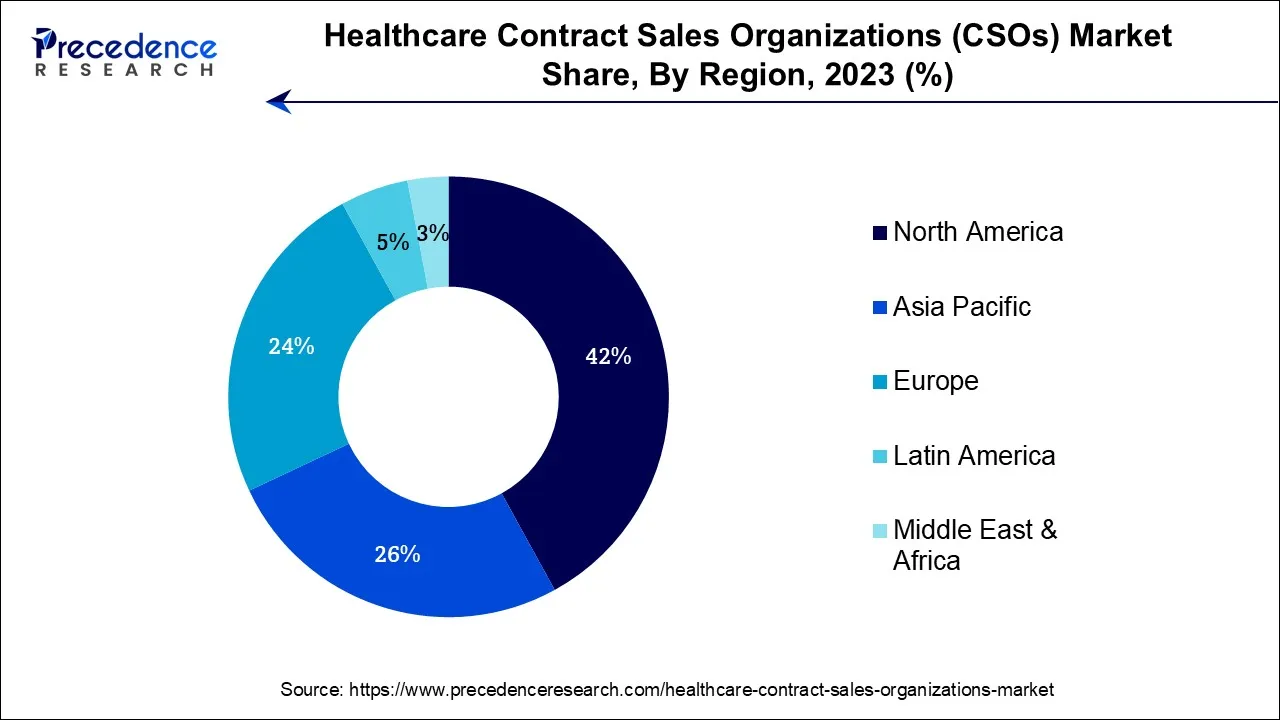

North America has held the largest revenue share 42% in 2023. In North America, the healthcare contract sales organizations (CSOs) market is witnessing trends such as increased demand for specialized sales teams in niche therapeutic areas, the integration of data analytics and AI into sales strategies, and a growing emphasis on compliance with healthcare regulations. The region's mature pharmaceutical industry and evolving healthcare landscape are driving the need for flexible and data-driven sales solutions, positioning North America as a key market for CSOs' growth and innovation.

Asia-Pacific is estimated to observe the fastest expansion In the Asia-Pacific region, the healthcare contract sales organizations (CSOs) market is witnessing notable trends. The growing pharmaceutical and biotechnology sectors, coupled with an increasing demand for specialized sales teams, are driving the expansion of CSOs. Additionally, as healthcare access and infrastructure improve across the region, CSOs are exploring opportunities to provide outsourced sales and marketing services to support the launch of new products and therapies, contributing to the market's growth in the Asia-Pacific healthcare landscape.

In Europe, the healthcare contract sales organizations (CSOs) market is witnessing notable trends. Increased regulatory complexities are driving pharmaceutical companies to seek specialized sales and marketing services. The adoption of advanced data analytics and digital technologies is reshaping sales strategies, emphasizing personalized engagement. Furthermore, the emphasis on patient-centric care is influencing CSOs to develop strategies that connect directly with patients. As Europe's healthcare landscape evolves, CSOs are adapting to meet the region's unique market demands and regulatory requirements.

Healthcare contract sales organizations (CSOs) are entities in the healthcare industry specializing in outsourced sales and marketing services. These organizations collaborate with pharmaceutical, biotechnology, medical device, and healthcare companies to provide dedicated sales teams and strategies. The nature of healthcare CSOs involves recruiting, training, and managing sales representatives who promote and sell the client's products or services to healthcare professionals. They play a crucial role in extending market reach, optimizing sales performance, and navigating complex regulatory environments, serving as valuable partners in the healthcare sales ecosystem.

The healthcare contract sales organizations market is a dynamic sector within the healthcare industry, offering outsourced sales and marketing services to pharmaceutical, biotechnology, medical device, and healthcare companies. This summary explores the market's nature, recent industry trends, key growth drivers, notable challenges, and emerging business opportunities. The Healthcare CSOs market is experiencing notable growth driven by several trends and growth drivers, including the increasing complexity of the healthcare landscape, including evolving regulations and market dynamics, is prompting pharmaceutical and healthcare companies to seek flexible and specialized sales solutions.

Healthcare CSOs provide the agility to adapt to changing circumstances, making them invaluable partners. Moreover, advancements in data analytics and digital technologies are reshaping sales and marketing strategies. Healthcare CSOs are leveraging data-driven insights and digital platforms to enhance targeting, engagement, and effectiveness in reaching healthcare professionals and patients. Furthermore, the rise of specialty medications and niche therapeutic areas is driving demand for specialized sales teams with deep industry knowledge. Healthcare CSOs with expertise in specific therapeutic areas are well-positioned to address this need, catering to clients' unique product portfolios.

Despite its growth, the Healthcare CSOs market faces challenges. Regulatory compliance and adherence to ethical standards are critical concerns, especially when marketing pharmaceutical products. Ensuring that sales representatives are well-trained and aligned with industry regulations remains a top priority. Additionally, the competitive landscape is intense, with multiple CSOs vying for contracts. This competition can lead to pricing pressures and challenges in differentiating services, which may affect profit margins.

The healthcare contract sales organizations (CSOs) market offers promising opportunities for growth and innovation. Including, the adoption of advanced analytics and artificial intelligence in sales and marketing strategies presents an avenue for differentiation. CSOs that can harness these technologies effectively can provide more efficient and personalized services to clients. The expansion of telehealth and virtual engagement in healthcare presents opportunities for CSOs to adapt their sales and marketing approaches to reach healthcare professionals and patients in new ways.

Furthermore, collaborations with emerging biotech companies and startups offer potential partnerships for CSOs, enabling them to tap into the innovation and growth potential of the pharmaceutical and healthcare industries.

The healthcare contract sales organizations market plays a vital role in helping healthcare companies navigate complex market dynamics. While facing challenges related to compliance and competition, CSOs also have significant opportunities to leverage technology and industry expertise to deliver effective sales and marketing solutions, contributing to the continued growth and evolution of the healthcare industry.

| Report Coverage | Details |

| Growth Rate from 2024 to 2034 | CAGR of 8.2% |

| Market Size in 2024 | USD 15.92 Billion |

| Market Size by 2034 | USD 35.02 Billion |

| Largest Market | North America |

| Base Year | 2023 |

| Forecast Period | 2024 to 2034 |

| Segments Covered | By Service and By End-use |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

The evolving healthcare landscape significantly boosts market demand for healthcare contract sales organizations (CSOs). As the healthcare industry undergoes dynamic changes in regulations, market dynamics, and treatment approaches, pharmaceutical and healthcare companies require adaptable and specialized sales solutions. CSOs offer the agility and expertise needed to navigate this complexity, making them indispensable partners. Their ability to flexibly align with evolving healthcare trends and regulations positions CSOs as valuable assets in helping clients optimize their sales and marketing strategies in an ever-changing environment.

Moreover, Pharmaceutical innovation is a significant driver of demand for healthcare CSOs. The continuous development and introduction of new pharmaceutical products and medical devices create a competitive landscape where CSOs play a pivotal role. As companies bring innovative therapies and treatments to market, they rely on CSOs to provide specialized sales teams that can effectively promote and educate healthcare professionals about these cutting-edge products. This demand for CSO services in supporting product launches and market expansion underscores their critical role in the pharmaceutical industry's growth and success.

Regulatory compliance places significant constraints on the healthcare contract sales organizations (CSOs) industry. The stringent healthcare regulations and ethical standards governing pharmaceutical sales and marketing require CSOs to invest heavily in compliance expertise and training. This increases operational costs and can deter potential clients who seek to avoid compliance-related risks. Additionally, the need for continuous monitoring and adaptation to evolving regulations adds complexity to CSO operations, impacting agility and potentially limiting market demand, especially among risk-averse clients.

Moreover, pricing presents a significant restraint on the market demand for healthcare contract sales organizations (CSOs). Intense competition among CSOs can lead to pricing pressures, compelling them to offer competitive rates to secure contracts. While cost-conscious pharmaceutical companies may benefit from lower service fees, this can impact CSOs' profitability and their ability to maintain the quality of services offered. Striking a balance between competitive pricing and delivering high-quality sales and marketing solutions becomes crucial to ensure sustained market demand for CSOs.

Telehealth expansion is driving increased demand for healthcare contract sales organizations (CSOs). As telehealth becomes a prominent mode of healthcare delivery, CSOs must adapt their sales and marketing strategies to reach healthcare providers in virtual settings. CSOs offering expertise in telehealth engagement and remote detailing services are poised to meet this demand. They ensure pharmaceutical and healthcare companies maintain a strong presence in the evolving healthcare landscape, sustaining market demand for their services as they facilitate effective virtual interactions between sales representatives and healthcare professionals.

Moreover, Data analytics and AI integration are pivotal in surging the market demand for healthcare contract sales organizations (CSOs). By harnessing these technologies, CSOs can provide more precise targeting and personalized engagement strategies. This enhances the effectiveness of sales efforts, leading to increased sales and improved client satisfaction. As pharmaceutical and healthcare companies seek more data-driven approaches, CSOs equipped with advanced analytics and AI capabilities become indispensable partners, driving the demand for their services in an increasingly competitive and data-centric healthcare landscape.

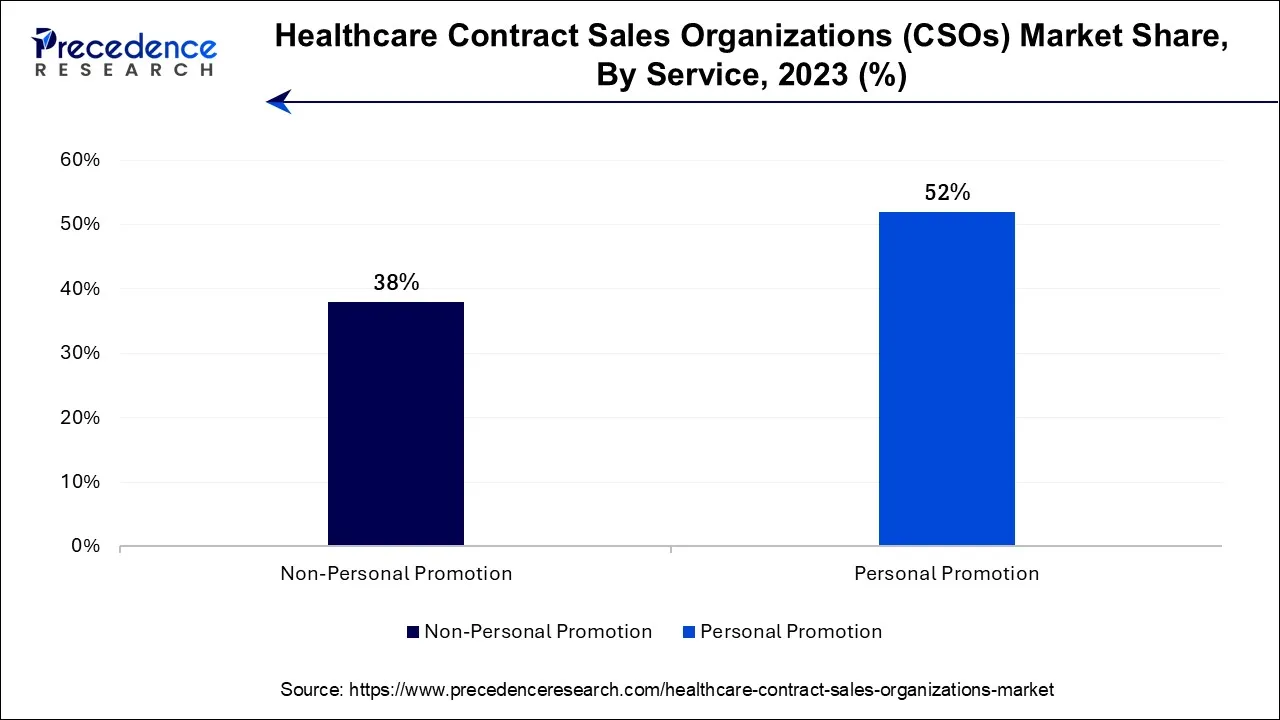

According to the Service, the personal promotion segment has held 62% revenue share in 2023. Personal promotion in the healthcare contract sales organizations (CSOs) market refers to the direct engagement of CSO sales representatives with healthcare professionals to promote pharmaceutical products and services. This involves face-to-face interactions, educational presentations, and product demonstrations.

Recent trends include an increased focus on digital tools to enhance personal promotion, such as virtual detailing and remote engagement. CSOs are also incorporating data analytics to customize their interactions, delivering more targeted and valuable information to healthcare professionals, and ultimately improving the efficiency and effectiveness of personal promotion efforts.

The non-personal promotion segment is anticipated to expand at a significant CAGR of 8.1% during the projected period. Non-personal promotion in the healthcare contract sales organizations (CSOs) market refers to marketing strategies that do not involve direct interaction with healthcare professionals or consumers. This includes digital advertising, email campaigns, webinars, and other promotional activities conducted remotely. Trends indicate a growing reliance on non-personal promotion due to advancements in digital technologies and the COVID-19 pandemic, which accelerated the adoption of virtual engagement. CSOs are increasingly incorporating data-driven non-personal promotion into their service offerings to reach healthcare professionals and patients effectively while complying with regulatory guidelines.

Based on the End-use, pharmaceutical segment is anticipated to hold the largest market share of 39% in 2023. In the healthcare contract sales organizations (CSOs) industry, pharmaceutical companies constitute a significant end-use segment. They rely on CSOs to provide specialized sales teams and strategies for promoting and marketing their pharmaceutical products. Recent trends indicate a growing demand for data-driven and digital sales approaches, increased specialization in niche therapeutic areas, and a focus on compliance with evolving regulations. Pharmaceutical CSOs play a crucial role in helping pharmaceutical companies navigate complex market dynamics and maximize their product reach.

On the other hand, the biopharmaceutical companies’ segment is projected to grow at the fastest rate over the projected period. Biopharmaceutical companies, as end users of healthcare CSOs, are firms specializing in the development and production of biologically derived drugs. A growing trend in the CSO market is the increasing reliance of biopharmaceutical companies on CSOs for specialized sales teams that can effectively promote their complex and innovative biologic products. This trend underscores the demand for CSOs with expertise in biopharmaceuticals and the unique sales strategies required to navigate this rapidly evolving and highly competitive sector.

Segments Covered in the Report

By Service

By End-use

By Geography

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

January 2025

December 2024

February 2025

April 2024