January 2025

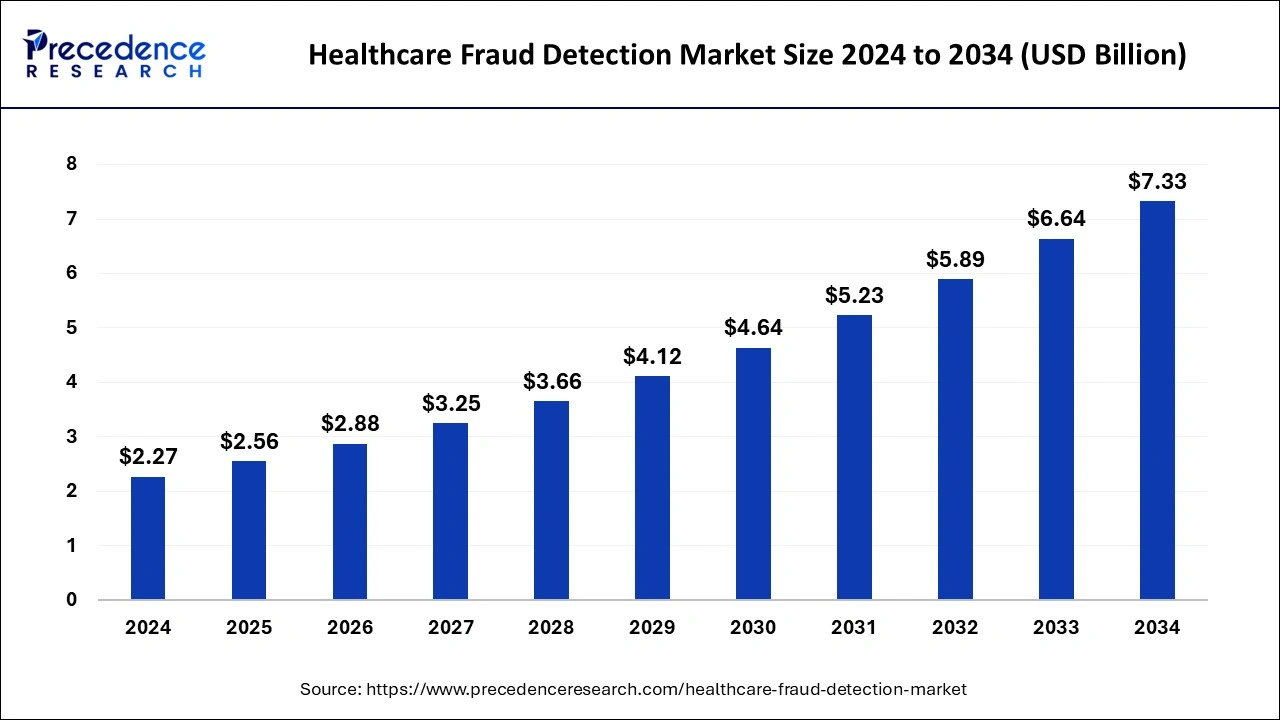

The global healthcare fraud detection market size is calculated at USD 2.56 billion in 2025 and is forecasted to reach around USD 7.33 billion by 2034, accelerating at a CAGR of 12.44% from 2025 to 2034. The North America healthcare fraud detection market size surpassed USD 890 million in 2024 and is expanding at a CAGR of 12.46% during the forecast period. The market sizing and forecasts are revenue-based (USD Million/Billion), with 2024 as the base year.

The global healthcare fraud detection market size was estimated at USD 2.27 billion in 2024 and is predicted to increase from USD 2.56 billion in 2025 to approximately USD 7.33 billion by 2034, expanding at a CAGR of 12.44% from 2025 to 2034. Rising cases of health insurance claim fraud contributed to the growth of the healthcare fraud detection market.

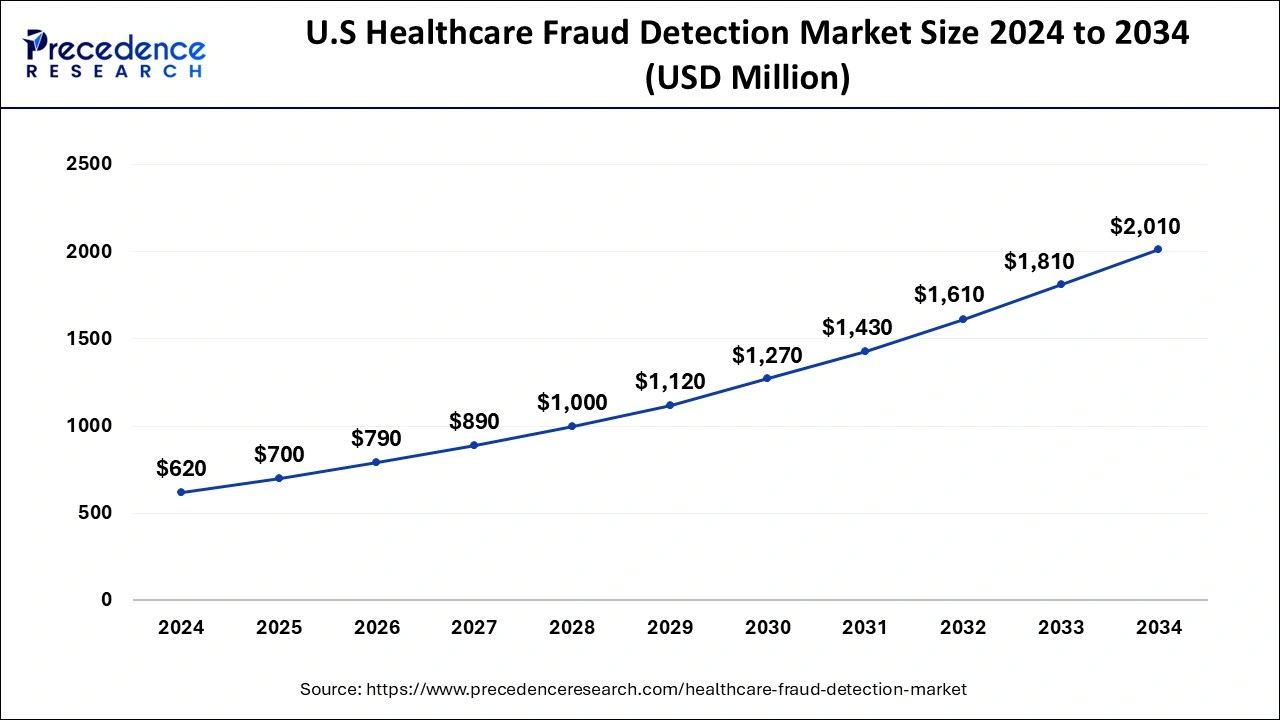

The U.S. healthcare fraud detection market size was valued at USD 620 million in 2024 and is anticipated to reach around USD 2,010 million by 2034, poised to grow at a CAGR of 12.48% from 2025 to 2034.

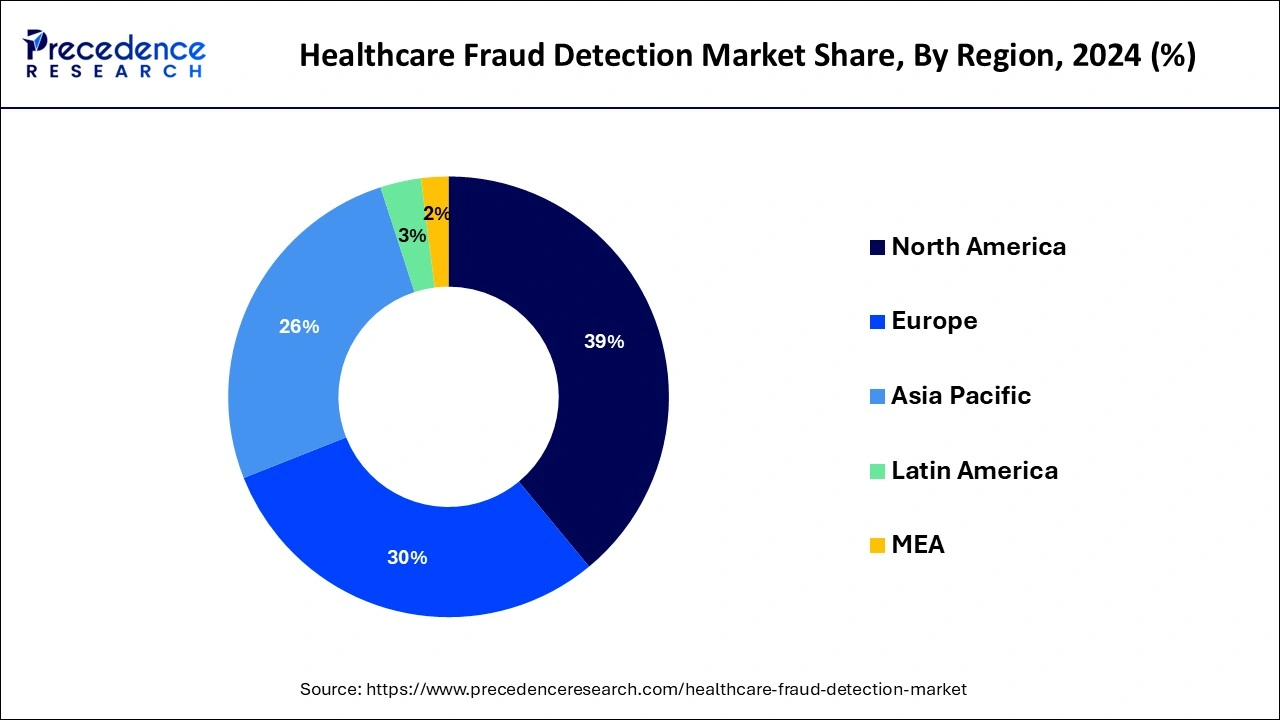

North America dominated the healthcare fraud detection market in 2024. The growth of the market in the region is attributed to the rising healthcare infrastructure and increased expenditure on medical facilities, resulting in the rising number of health insurance companies, which contributed to the growth of the market. Developed economies like the United States and Canada have increasing per capita income and rising spending on healthcare infrastructure, which drives the growth of the market in the region. The region is the early adopter of technologies in every sector as compared to the other regions, and the increasing presence of the major market players is collectively contributing to the growth of the healthcare fraud detection market.

Asia Pacific is expected to significantly increase its presence in the healthcare fraud detection market during the forecast period. The growth of the region is expected to grow in the market owing to its continuously rising population in countries like China and India, and the rising healthcare expenditure from these countries is driving the healthcare market in the region. The increasing healthcare cost is one of the major factors of growing health insurance companies in the region, and the increasing fraud rates in healthcare are driving the demand for fraud prevention solutions, which accelerated the growth of the healthcare fraud detection market across the region.

Healthcare fraud is the type of fraud associated with the healthcare system by medical providers, individuals, or the insurance company. Healthcare fraud includes medical claim auditing, accounts auditing, and auditing of healthcare funds. Healthcare fraud does not seem like a crime that can hurt another individual, but it does have negative impacts on others. Healthcare fraud is commonly the act of intentionally interpreting the symptoms or diseases to receive more advantages or benefits from insurance companies. The U.S. insurance companies are estimated to lose billions of dollars every year to this kind of healthcare fraud. Healthcare fraud prevention works on reducing healthcare fraud, abuse, and waste. The rising number of patients opting for health insurance is boosting the growth of the healthcare fraud detection market.

| Report Coverage | Details |

| Growth Rate from 2025 to 2034 | CAGR of 12.44% |

| Market Size in 2025 | USD 2.56 Billion |

| Market Size by 2034 | USD 7.33 Billion |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | By Type, By Application, and By End-user |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Technological advancement in the market

Predictive modeling can use predictive analytics, data mining, and quantitive analysis to identify patterns in provider behavior and fraud. Blockchain can make it impossible to change the data for fraudulent practices and enables detailed asset tracking. AI-based pattern recognition technology can allow, automate, and learn about the process of identifying billions of coding errors, leading to saving money, time, and resources. Such integration of technologies is observed to create a significant driver for the healthcare fraud detection market.

Predictive modeling can use predictive analytics, data mining, and quantitive analysis to identify patterns in provider behavior and fraud. Blockchain can make it impossible to change the data for fraudulent practices and enables detailed asset tracking. AI-based pattern recognition technology can allow, automate, and learn about the process of identifying billions of coding errors, leading to saving money, time, and resources.

Lack of knowledge about the service

The healthcare fraud detection market is observed to get hampered due to the lack of knowledge and awareness regarding the services offered for fraud detection in the healthcare sector. Multiple underdeveloped areas lack professionals that can manage such services with the integration of technology.

Investments in ICT

The rapidly growing amount of healthcare data is predicted to be accompanied by a steady growth in the usage of new technologies, such as artificial intelligence (AI). Investing in ICT to boost fraud management efficacy is a crucial component of fraud detection. This entails making investments in personnel and systems that are specifically designed to detect and prevent fraudulent activities, which are rapidly changing in a digital setting.

The creation of a web-based online pharmacy system is explained by the need to create a system for more effective billing and medication delivery. It enables the development of an interoperable system with partner pharmacies and enhancements to the billing process. The rising number of on-time claim submissions, efficiency gains, and fraud reduction are all significantly impacted by the system.

The descriptive analytics segment dominated the healthcare fraud detection market in 2024. Descriptive analytics is often called the simplest form of data analysis because it explains relationships and trends. It is the process of analyzing the historical and current data for the identification of trends and relationships. Descriptive analytics are one of the essential parts of the healthcare sector. It is an essential application in the healthcare sector for enabling the trends, patterns, and benchmarks of the patient's data. Descriptive analysis helps extract knowledge from healthcare for the understanding of history, and that helps facilitate informed decision-making in the upcoming period.

The predictive analytics segment is observed to expand at a rapid pace during the forecast period. Predictive analytics is the advanced technology of data analytics used in future prediction by analyzing historical data. The advancements in big data machine learning contribute to the expansion of predictive analytics. The predictive analysis process uses machine learning, data analysis, statistical models, and artificial intelligence to find the pattern that may predict future behavior. Predictive analytics technology is highly beneficial for the healthcare industry, where it can predict future forecasts and help identify high-risk patients.

Predictive analytics helps to improve patient outcomes, and data analysis makes personal treatment plans and optimizes resource allocation. Predictive analytics in insurance fraud detection uses statistical techniques and data for the identification of fraud patterns and to disclose fraudulent items. Predictive analytics collect data from various sources like self-service apps, customer portals, telematics, customer relationship management (CRM) systems, etc., and predict accurate insights.

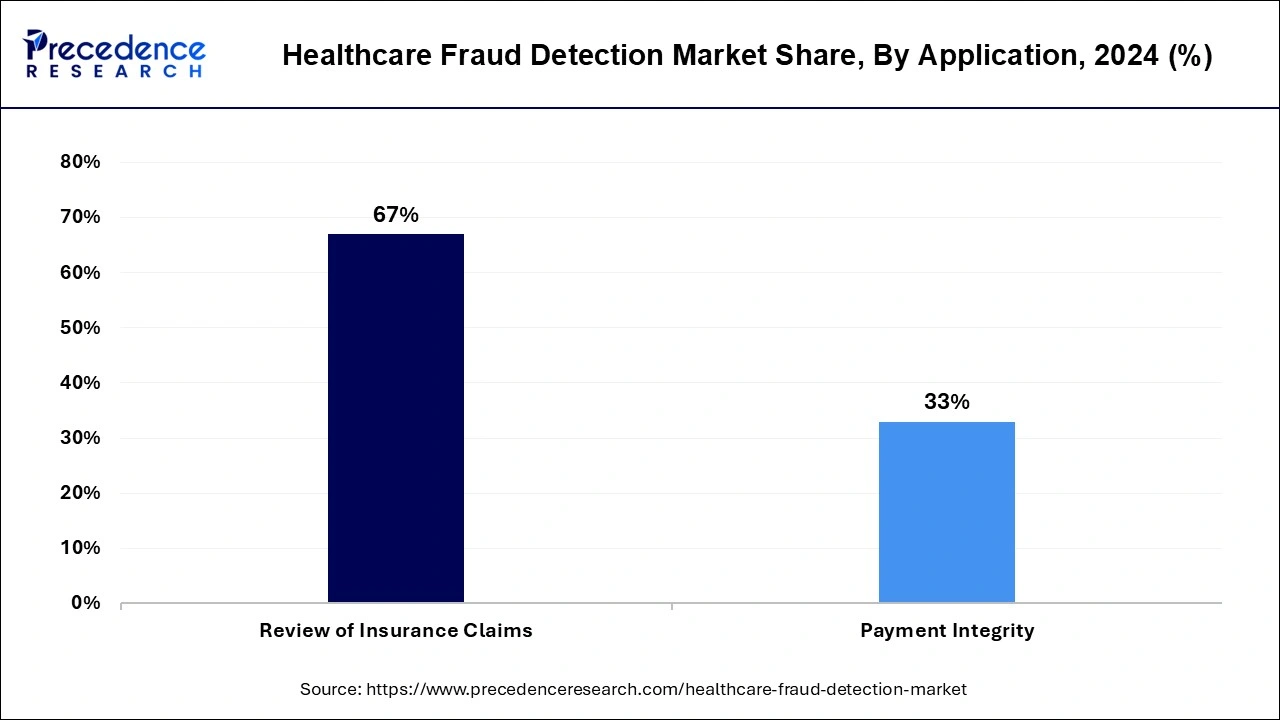

The review of the insurance claim segment dominated the healthcare fraud detection market share of 67% in 2024. The segment is further divided into the post-payments review and prepayment review. The rising acceptance of health insurance by the population and the rising number of fraud activities are boosting the growth of the market. There are various benefits associated with fraud prevention in the insurance claim fraud will be more accurately recognized in every claim that is deemed to be fraudulent and requires very little time for data processing.

The payment integrity segment is expected to grow at a significant rate in the healthcare fraud detection market during the anticipated period. Payment integrity for healthcare payers traditionally features fraud detection and provider audits to ensure the healthcare procedures are precisely coded for reimbursement. There are various functions that are included in payment integrity, such as claim accuracy or editing, coordination of benefits, and clinical validation.

In claim accuracy, claims are reviewed to find omissions, errors, and questing data against a larger database that includes government and industrial rules and regulations and the policies governing medical claims. Coordination of benefits ensures that the same person is not paid many times when one person has many insurance policies. Hospital bill audit, clinical review and resolution, DRG validation, and outpatient audit are all part of the clinical validation.

The healthcare payers segment held the largest share in the healthcare fraud detection market in 2024. The growth of the segment is attributed to the increasing number of insurance agencies that are adopting the healthcare fraud prevention solution for analyzing misleading claims or false information to get payers to the ineligible medical procedures. Several insurance companies used the fraud management system to automate and streamline the overall investigation process to identify and filter the flag suspicious claims. Investigation of the entire process manually takes more time and cannot be done efficiently, though the fraud management system is a reliable source for managing the process and saving more time, money, and resources.

By Type

By Application

By End-user

By Geography

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

January 2025

December 2024

February 2025

April 2024