May 2024

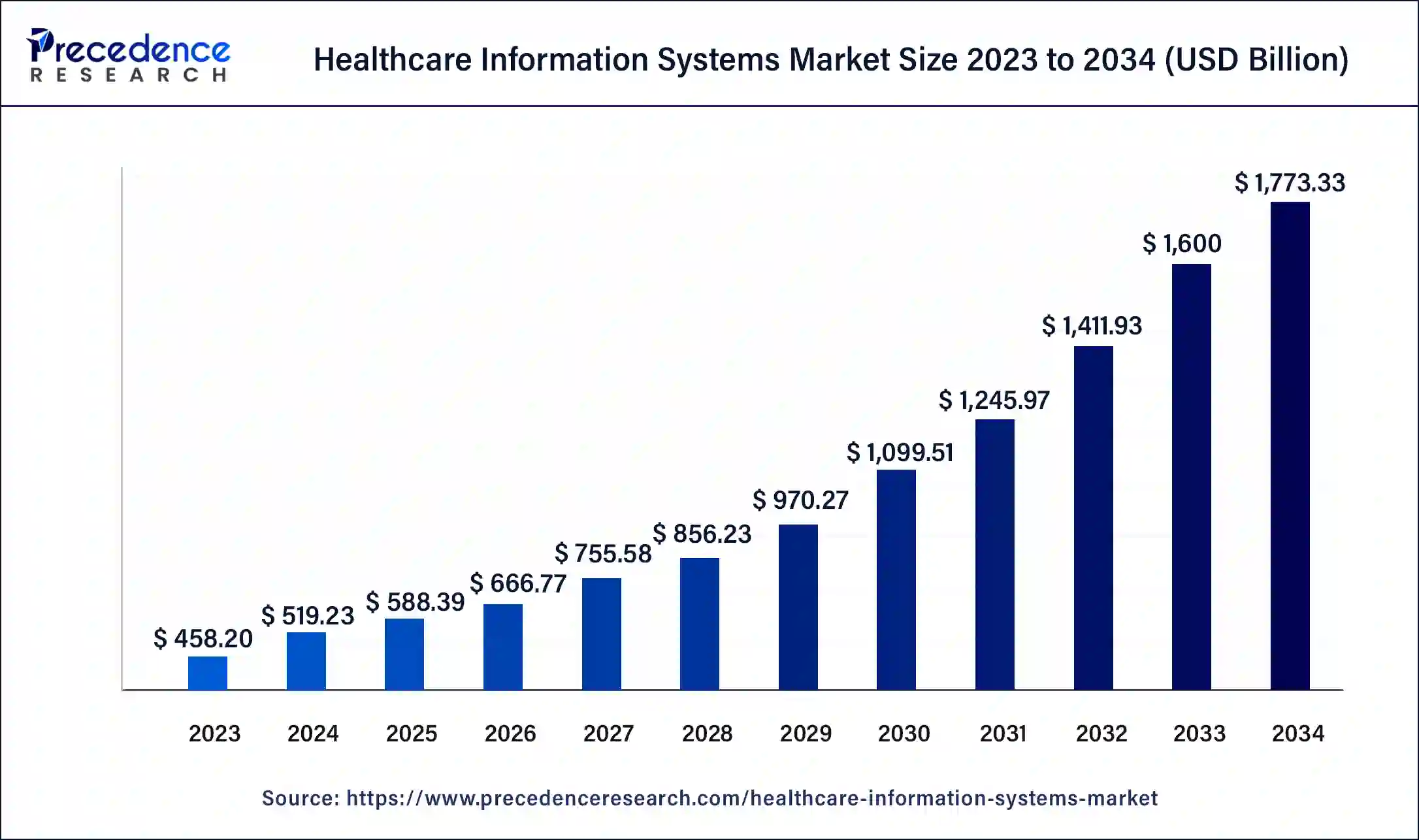

The global healthcare information systems market size was USD 458.20 billion in 2023, estimated at USD 519.23 billion in 2024 and is anticipated to reach around USD 1773.33 billion by 2034, expanding at a CAGR of 13% from 2024 to 2034.

The global healthcare information systems market size accounted for USD 519.23 billion in 2024 and is predicted to reach around USD 1773.33 billion by 2034, growing at a CAGR of 13% from 2024 to 2034.

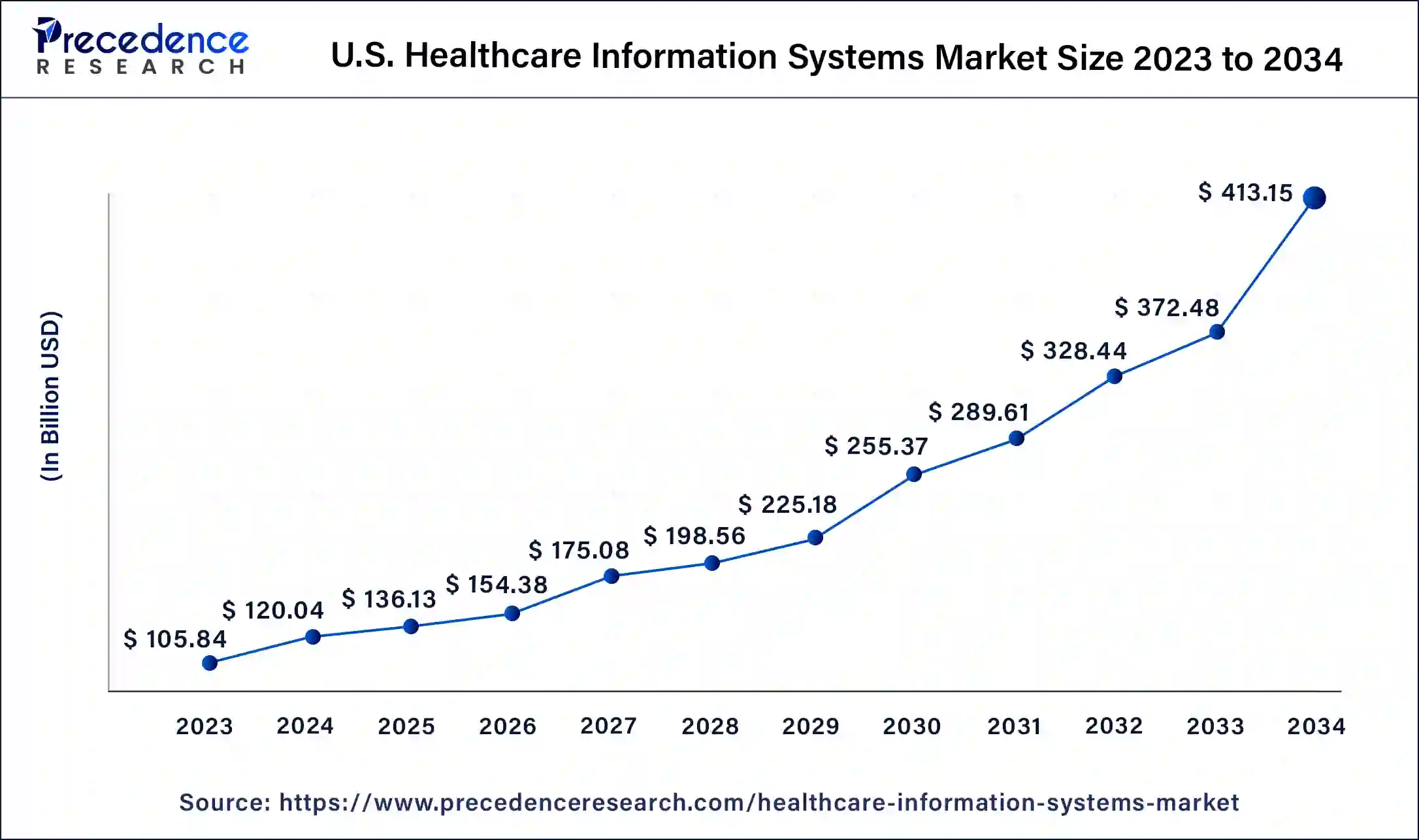

The U.S. healthcare information systems market reached USD 83.03 billion in 2022 and is projected to be worth around US$ 180.08 billion by 2032, at a CAGR of 8.10% between 2024 to 2034.

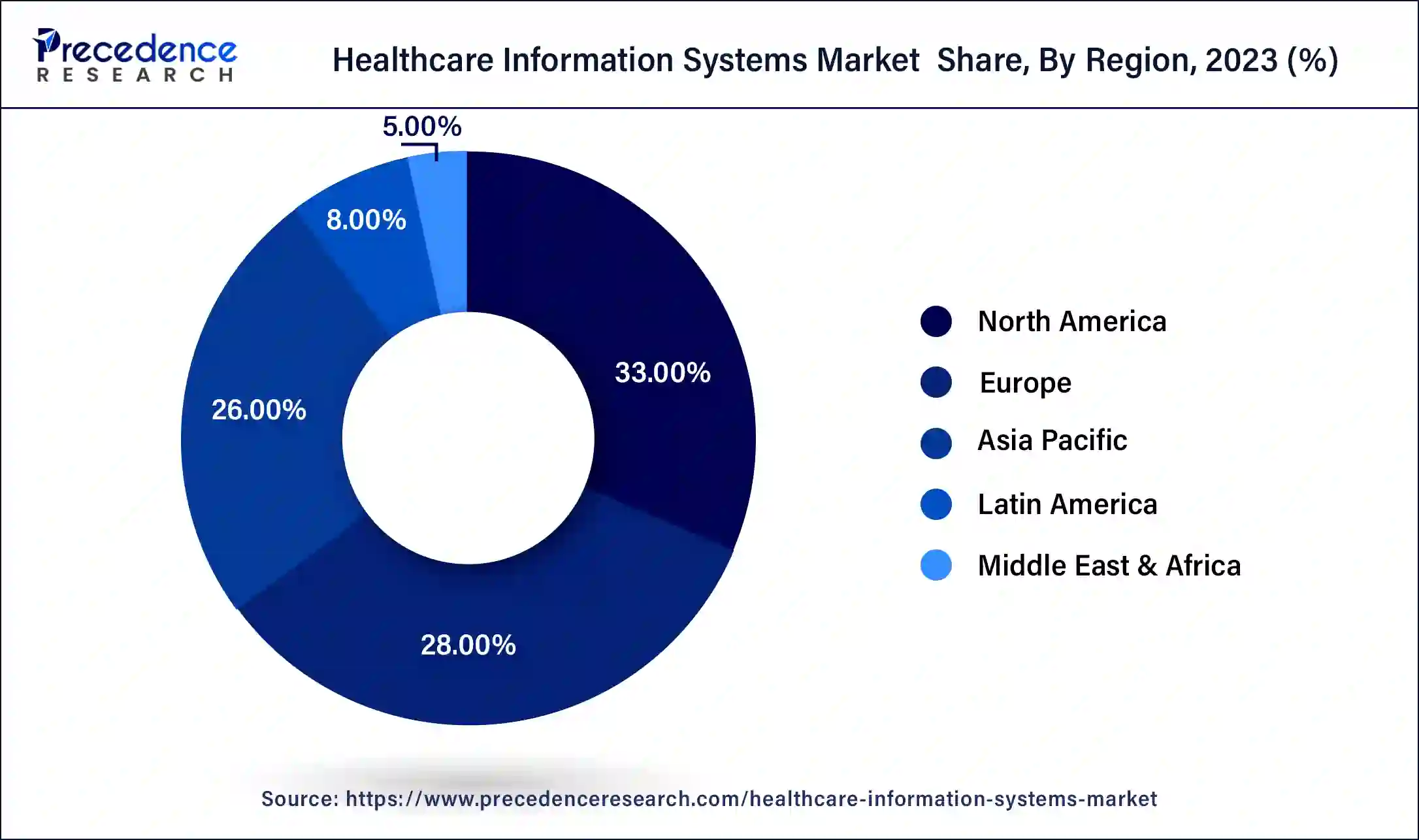

North America accounted for a significant market share of around 46% in 2023. The government initiatives in the North America to eliminate the paperwork and increase the use of digital technologies for storing data of the patients has significantly contributed towards the growth of the healthcare information systems market. The higher adoption rate of digital technologies and rising investments in the development of smart hospitals in the region are the prominent drivers of the North America healthcare information systems market.

On the other hand, Asia Pacific is estimated to be the most opportunistic market during the forecast period. The increasing investments of both the government and corporate sector in the advancements of the healthcare sector in the nations like China, Japan, India, and South Korea is exponentially driving the growth of the healthcare information systems market in Asia Pacific. The growing burden of diseases and increasing number of road traffic accidents is resulting in the rising number of hospital admissions, which in turn, is fueling the growth of the market.

The rising adoption of the information technology in the healthcare industry is the major driver of the global healthcare information systems market. The healthcare information systems offers data management and security of data related to the healthcare and exponentially influences the cost and quality of the healthcare operations. The most commonly used healthcare information systems includes electronic health records and personal health records. The increased government investments in the development and digitalization of the healthcare infrastructure have significant contributions towards the development of the global healthcare information systems market. For instance, My Health Record is a digital health record platform for the Australian citizens. These health records can enhance the patient care in the hospitals as the past medical and health records of a particular patient can be analyzed to provide better treatment to the patient. Thus, the government initiatives is boosting adoption of digital health record platforms among the hospitals, clinics, and diagnostic labs is expected to boost the growth of the global health information systems market.

The rising prevalence of chronic diseases, growing geriatric population, and rising incidences of road traffic accidents is resulting in the increasing number of hospital admissions. The huge volume of patient related data needs to be efficiently managed and economically stored. The growing need for eliminating paperwork is boosting the growth of the global healthcare information systems market. The government initiatives to digitalize the healthcare facilities are a major contributor to the growth of the market. Moreover, the developmental strategies such as new product launches, partnerships, and collaborations are major factors that influence the growth of the healthcare information systems market. For instance, Allscripts Healthcare Solutions entered into a strategic partnership with the US Orthopedic Alliance to introduce improved healthcare information system.

| Report Coverage | Details |

| Market Size by 2034 | USD 413.15 Billion |

| Market Size in 2023 | USD 105.84 Billion |

| Market Size in 2024 | USD 120.04 Billion |

| Market Growth Rate from 2024 to 2034 | CAGR of 13.16% |

| Largest Market | North America |

| Base Year | 2023 |

| Forecast Period | 2024 to 2034 |

| Segments Covered | Application, Component, End User, Region |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Based on application, the revenue cycle management segment accounted for more than 60% of the market share in 2023. The government’s role is considered to be crucial in the growth of this segment. For example, in US, the enactment of the Affordable Care Act, aims to provide reimbursements to the low income patients for their healthcare expenditure. The rising adoption of healthcare insurances is further expected to drive the growth of this segment in the upcoming years. The rising needs for the management of revenue cycles is estimated to positively impact the segment growth and hence, this segment is also anticipated to be the fastest growing segment during the forecast period. Furthermore, the healthcare units like hospitals are outsourcing the revenue cycle management tasks to the third party service providers in order to focus on its core operations and reduce their operational costs.

Based on component, the services segment accounted for around 46% of the market share in 2023. This is simply due to the lack of proper knowledge regarding the healthcare information systems amongst the healthcare professionals. Therefore, the third-party services are adopted for the efficient utilization of healthcare information services while achieving cost efficiency.

On the other hand, the software is estimated to be the most opportunistic segment during the forecast period. This is attributed to the increasing need to reduces the healthcare costs and improve the data management systems. Further, the increasing adoption of healthcare information systems like revenue cycle management and electronic health records is increasing the demand for the healthcare information software.

Based on end user, the hospitals segment accounted for around 76% of the market share in 2023. This can be attributed to the enhanced financial, clinical, and administrative services are offered by the healthcare information systems. The rising number of hospital admissions across the globe owing to various reasons, is generating a huge volume of data. These data is required to be stored and managed so that these data can provide useful insights during the treatment of the patient in future. This helps to improve the patient care services in the hospitals. Hence, the hospitals segment dominated the market owing to the increased adoption of the health information systems.

On the other hand, the diagnostic centers is expected to be the fastest-growing segment during the forecast period. This is attributed to the rising demand for the diagnostic services owing to the rising prevalence of chronic diseases among the global population. Further, the growing demand for the automation and integration of healthcare information for efficient patient care, and rising adoption of the laboratory information systems across the globe is expected to foster the growth of this segment.

Based on deployment, the web-based segment accounted for around 41% of the market share in 2023. This can be attributed to the increased adoption of the web-based segment in the medium and small healthcare units. The improved workflow process, low cost, easy installation, and remote access are the major features provided by the web-based systems that fosters its adoption among the small healthcare organizations across the globe.

On the other hand, the cloud-based is estimated to be the most opportunistic segment during the forecast period. The rapidly growing popularity of the cloud-based information systems owing to its enhanced storage spaces along with quicker access to the healthcare data in real-time, and rapidly growing penetration of internet connectivity across the globe. This type of deployment provides remote access to data through internet connection.

The market is moderately fragmented with the presence of several local companies. These market players are striving to gain higher market share by adopting strategies, such as investments, partnerships, and acquisitions & mergers. Companies are also spending on the development of improved products. Moreover, they are also focusing on maintaining competitive pricing.

In July 2020, Cerner launched a cloud-based electronic health record system the rural healthcare units to improve their operational efficiency and reduce costs.

The various developmental strategies like acquisition, partnerships, mergers, and government policies fosters market growth and offers lucrative growth opportunities to the market players.

Segments Covered in the Report

By Application

By Component

By End User

By Deployment

By Geography

For questions or customization requests, please reach out to us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

May 2024

March 2023

August 2024

April 2024