January 2025

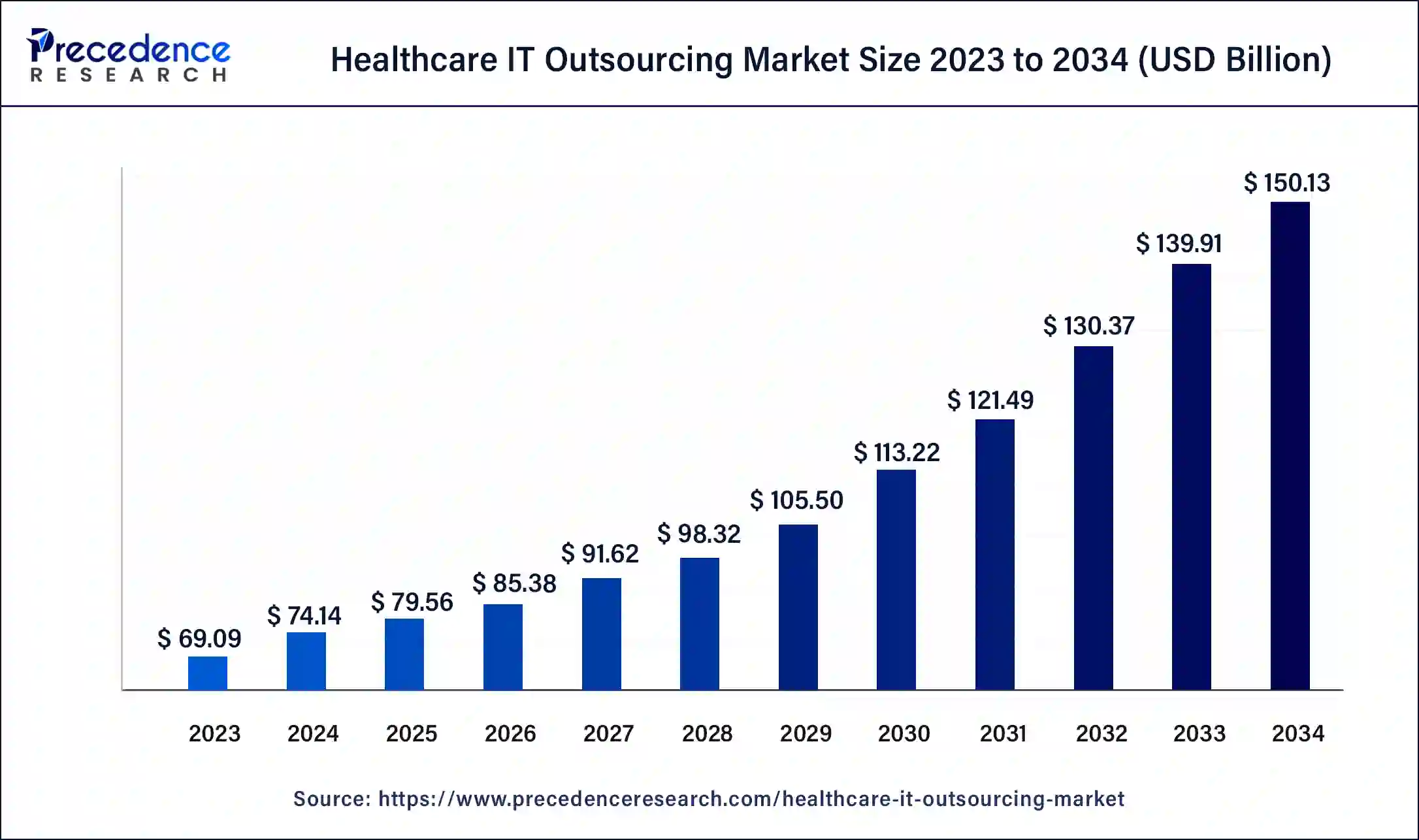

The global healthcare IT outsourcing market size surpassed USD 69.09 billion in 2023 and is estimated to increase from USD 74.14 billion in 2024 to approximately USD 150.13 billion by 2034. It is projected to grow at a CAGR of 7.31% from 2024 to 2034.

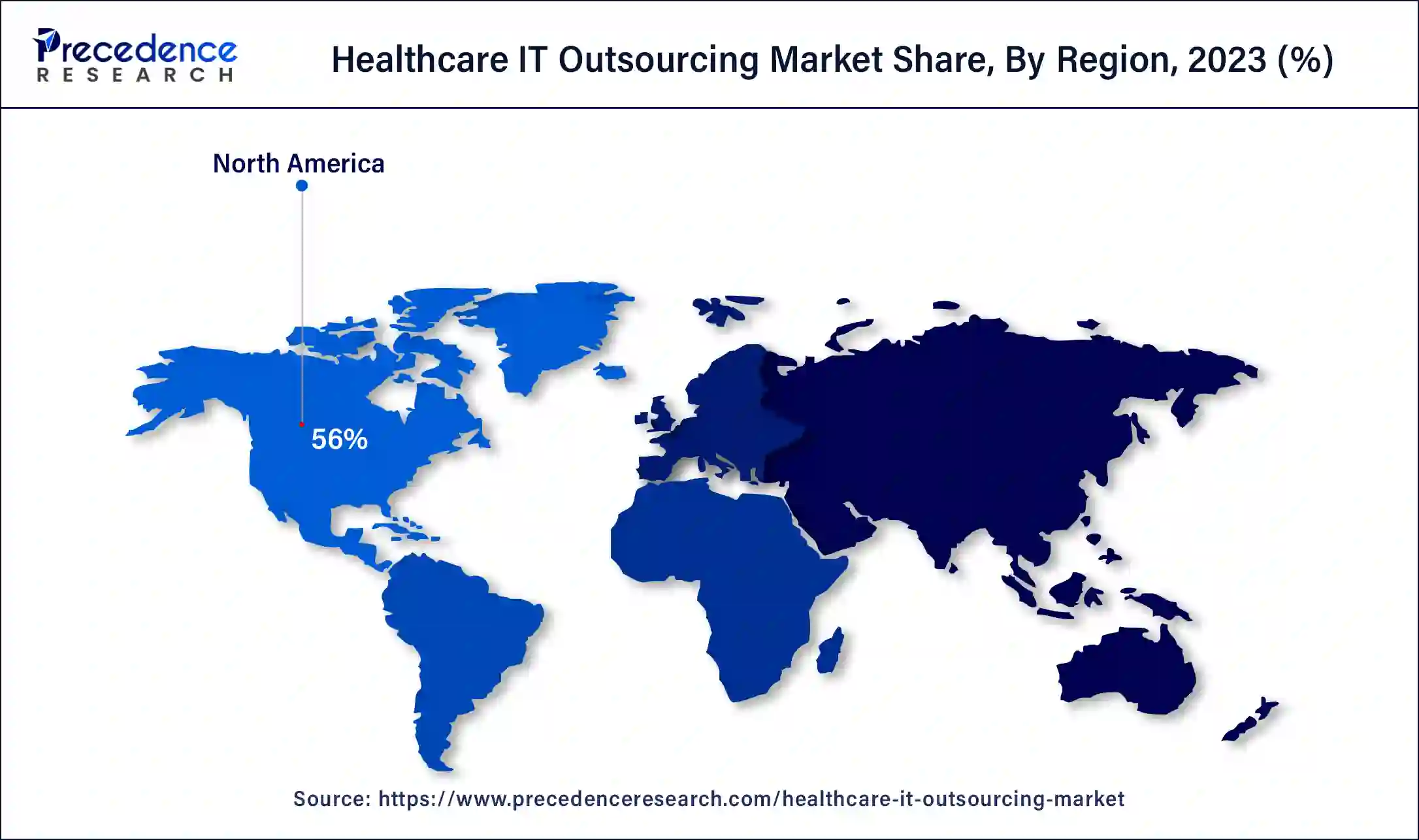

The global healthcare IT outsourcing market size is projected to be worth around USD 150.13 billion by 2034 from USD 74.14 billion in 2024, at a CAGR of 7.31% from 2024 to 2034. The North America healthcare IT outsourcing market size reached USD 39.38 billion in 2023. Increasing digitalization across healthcare system resulting into the need to manage vast amount of data so that to focus on core functionalities like patient centric management are the driving factors for healthcare IT outsourcing market.

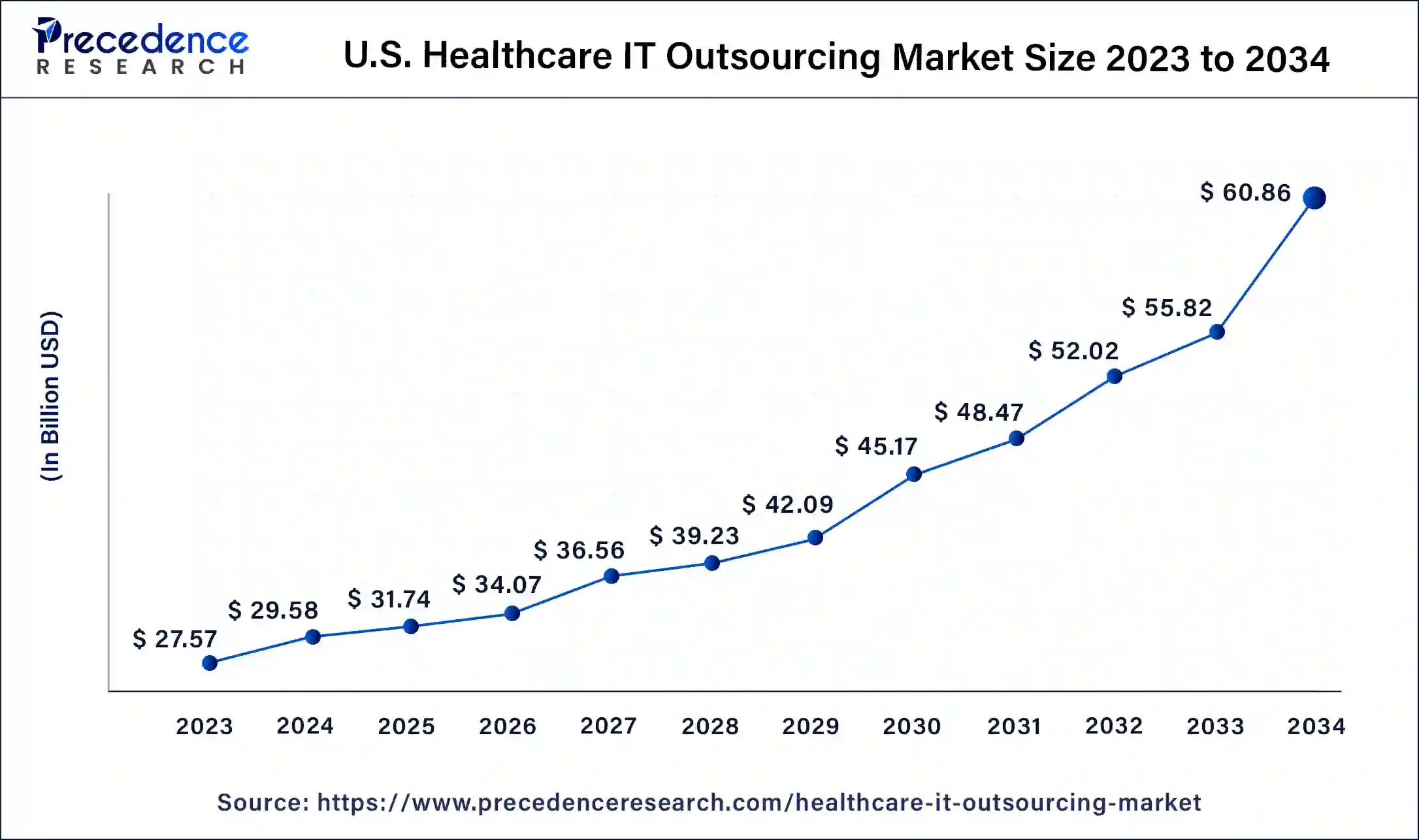

The U.S. healthcare IT outsourcing market size was exhibited at USD 27.57 billion in 2023 and is projected to be worth around USD 60.86 billion by 2034, poised to grow at a CAGR of 7.46% from 2024 to 2034.

North America accounted for the largest share of the healthcare IT outsourcing market in 2023. The region boasts and well-established healthcare system with significant investment in the cutting-edge technology. The United States in particular is a leading established healthcare market with high level of investments in health and strong demand for IT solutions to help manage vast dataset along with electronic health records management that requires telemedicine services from various companies.

Moreover, North America has the well-established brands in the healthcare IT outsourcing market, prompting demand of IT led solutions. Due to its capability in offering end to end outsourcing solutions such as data analytics, cyber security and cloud computing that are crucial for the healthcare providers operational efficiency to deliver high quality care for patients. Also, stringent regulations like HIPAA- health insurance portability and accountability act encourage healthcare organization to opt for outsourcing solutions to comply with these governments' regulations.

Top healthcare systems in the U.S.

| Healthcare system | No. of affiliated hospitals | Services provided |

| HCA Healthcare | 175 hospitals |

Diagnostic and imaging centres, radiation and oncology therapy centres, rehabilitation and physical therapy centres, |

| Encompass Health | 143 hospitals | Rehabilitation hospitals offering both facility-based and home-based patient care. |

| CommonSpirit Health | 140 hospitals | Academic health centres, teaching hospitals, critical access facilities, community health centres, and home health agencies |

| Ascension Health | 143 hospitals | Specialise in family medicine, internal medicine, obstetrics and gynaecology, paediatrics and urgent care, oncology, cardiology, neurology and orthopaedics. |

| Scion Health | 79 hospitals | Acute care and post-acute care hospital solutions |

Asia Pacific is expected to host the fastest growing healthcare IT outsourcing market over the forecasted period. The growth of this segment is due to the various reasons including developing countries like India and China have seen rapid economic development which has helped develop advanced healthcare infrastructure in the region. Hence in these countries we have witnessing increased use of some sophisticated IT solutions to improve healthcare services and bring low cost.

Rapidly increasing aged population in the region is further placing the pressure for improving healthcare management systems and following electronic health records, telemedicine services and data analytics among other needs. Additionally, Asia Pacific has highly skilled workforce and thus the healthcare IT outsourcing market is expected to proliferate with flexible pricing and top-notch services. Healthcare payers from all over the world finds it irresistible to outsource operations for efficiency.

The healthcare IT outsourcing market is proliferating due to the rising demand foe efficient and cost-effective healthcare solutions with increasing need for management and improved patient care. To manage the telemedicine, electronic health records and digital health services healthcare organizations are intentionally turning towards IT outsourcing which gives them a perfect blend of solutions. The shift is increasing due to various reasons such as to enhance overall efficiency of working, need to minimize operational cost and to adhere the regulatory needs for healthcare sector.

North America dominates the global healthcare IT outsourcing market owing the presence of significant key players and high technological advancements in the healthcare system. On the other hand, Asia Pacific is evolving as a fastest growing region, due to the factors such as rising focus on the digitalization in healthcare sector, strengthening the portfolio of major key players. Restraining factors like data privacy concerns and integration continue to rise the questions that affecting markets growth on a global scale. However, as the technology evolves with the passing time, the innovations in the market are expected to take over these challenges.

AI Impact on the Healthcare IT Outsourcing Market

AI is effectively changing the healthcare IT outsourcing market on a global level by minimizing operational cost, increasing efficiency while enhancing output specifically for patients. AI based solutions can aid automating administrative tasks such as scheduling visits of patients and billing to support clinical decision making with the help of predictive analytics offered by machine learning to further generate customized treatment plans. For the early detection of diseases, AI is excellent predictor since, it has the ability to analyse vast amount of data more precisely which helps in accurate data driven diagnosis of disease and provide improvement in patients care.

Additionally, AI-driven tools are developing to support telehealth services and remote monitoring by expanding the access of healthcare sector. Also, to manage the crucial and sensitive data about patient’s health, integration of AI systems in the healthcare IT outsourcing provides interoperability and enhance the overall security that is the prime concern in the healthcare IT outsourcing market.

| Report Coverage | Details |

| Market Size by 2034 | USD 150.13 Billion |

| Market Size in 2023 | USD 69.09 Billion |

| Market Size in 2024 | USD 74.14 Billion |

| Market Growth Rate from 2024 to 2034 | CAGR of 7.31% |

| Largest Market | North America |

| Base Year | 2023 |

| Forecast Period | 2024 to 2034 |

| Segments Covered | Type, End user, and Regions |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America and Middle East & Africa |

Inclination towards minimizing healthcare expenses

One of the significant drivers propelling the healthcare IT outsourcing market is the rising pressure on healthcare system to minimize the operational cost to make it budget friendly even for layman and to improve the quality of the patient care. Without compromising on the quality of the service, it is essential to provide best care and medical facilities to the patients. This is the significant cause that encouraging the increasing trend for outsourcing IT functions to make a room for healthcare providers to focus on core work to deliver the patient care and leveraging expertise for managing the complex system of IT.

Outsourcing allows healthcare providers to access the latest technology and make them leverage the specialized the skills required to treat patients with different background. By doing this method of managing the administrative work of IT, it helps reduces capital expenditure and ensures that IT systems are managed by the skilled workforce who can implement as well as managed them efficiently. Also the healthcare IT outsourcing market helps with the quick adoption for regulatory changes and allow to adhere it strictly.

Data security concern

A major restraint for the healthcare IT outsourcing market is the security and privacy concern for the data shared with the service provider. Since the healthcare organizations generates and handle vast amount of patient centric data which is therefore sensitive data and functions of outsourcing IT are providing this data to the operator from third party. Hence the risk of data loss or data breaches becomes doubled, including a possibility of unauthorised access by hackers.

Stringent regulations like HIPPA in United States charges substantial amount of penalties for mishandling the data which is sensitive in nature. This factor also hindering the healthcare IT outsourcing market growth as healthcare providers grows suspicious about the outsourcing vendors. To mitigate these risks, IT service providers should prioritise the data security by using various existing techniques which helps grow their business world widely.

Remote patient monitoring services

A significant opportunity for the healthcare IT outsourcing market is the ongoing advancement in remote patient monitoring system which fuels the rapid expansion of telemedicine services as well. The acceleration of this segment happened mainly in the phase of COVID-19 due to the severe outcomes of disease and thus, strict regulations for lockdown in those days. Therefore, telemedicine is seen as a most convenient option and cost-effective solution even for remote and suburban areas.

Since, patients and healthcare advisors are significantly inclining towards embracing the digital approach for numerous health solutions, the robust IT infrastructure to support this demand is surging prominently, which creating a lucrative opportunity for the healthcare IT outsourcing market. remote patient monitoring system is entirely based on internet connection, a viable solution is required to operate it efficiently. Again, it requires scalable and secure IT system to manage virtual meetings without distortions in between, fuelling the demand for the market.

The payer's HITC outsourcing segment dominated the global healthcare IT outsourcing market in 2023. Healthcare payers are insurance companies and management for care organizations are increasingly depending upon IT outsourcing for better operations with streamlining that enhance operational efficiency and helps reduce cost of administrative load. The rising need to comply with evolving healthcare regulations due to the complex nature of healthcare insurance fuelling the trend of outsourcing.

The healthcare provider system segment held the largest share of the global healthcare IT outsourcing market. The growth of this segment is due to the need to manage huge amount of patient's data effectively to enhance the interoperability between healthcare systems. Healthcare providers are hospitals, medical practises, clinics which are intentionally outsource their IT operation for better optimization and focus on core provisions. IT outsourcing helps in the data security, compliance with changing regulations for healthcare system and expertise in EHR systems further fuelling the growth of this segment on wider scale.

Segments Covered in the Report

By Type

By End user

By Geography

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

January 2025

December 2024

February 2025

April 2024