January 2025

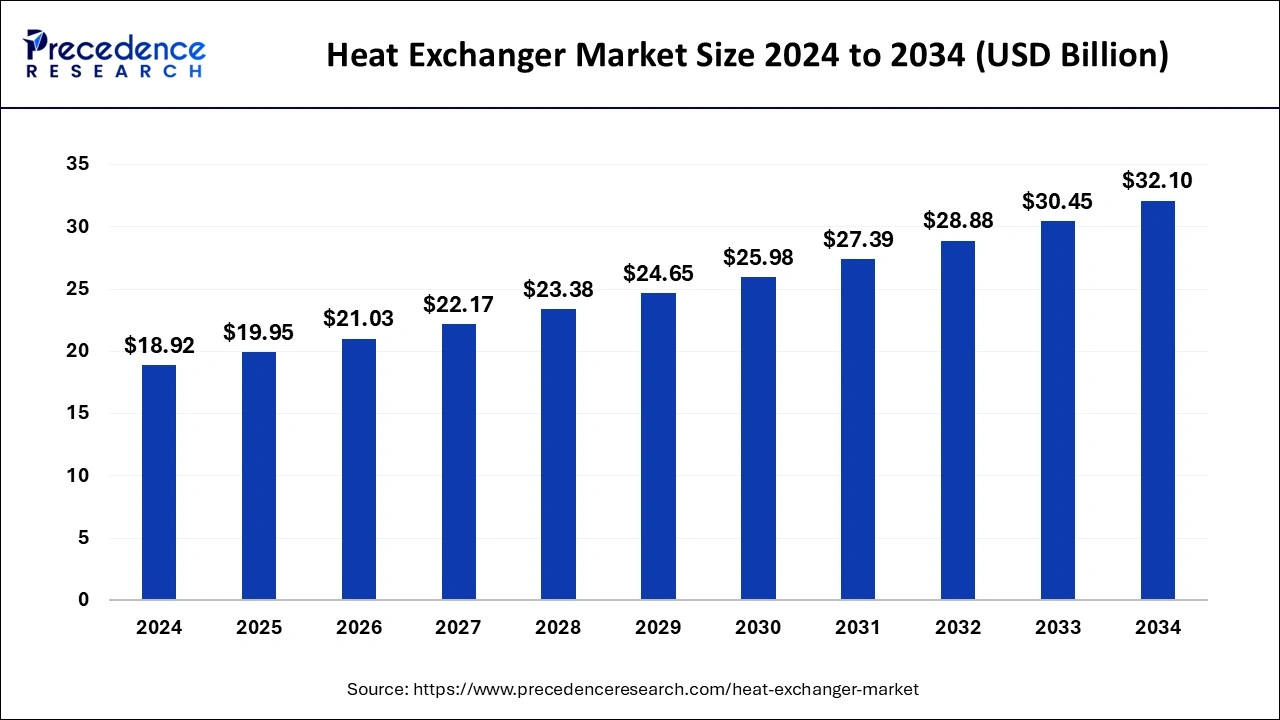

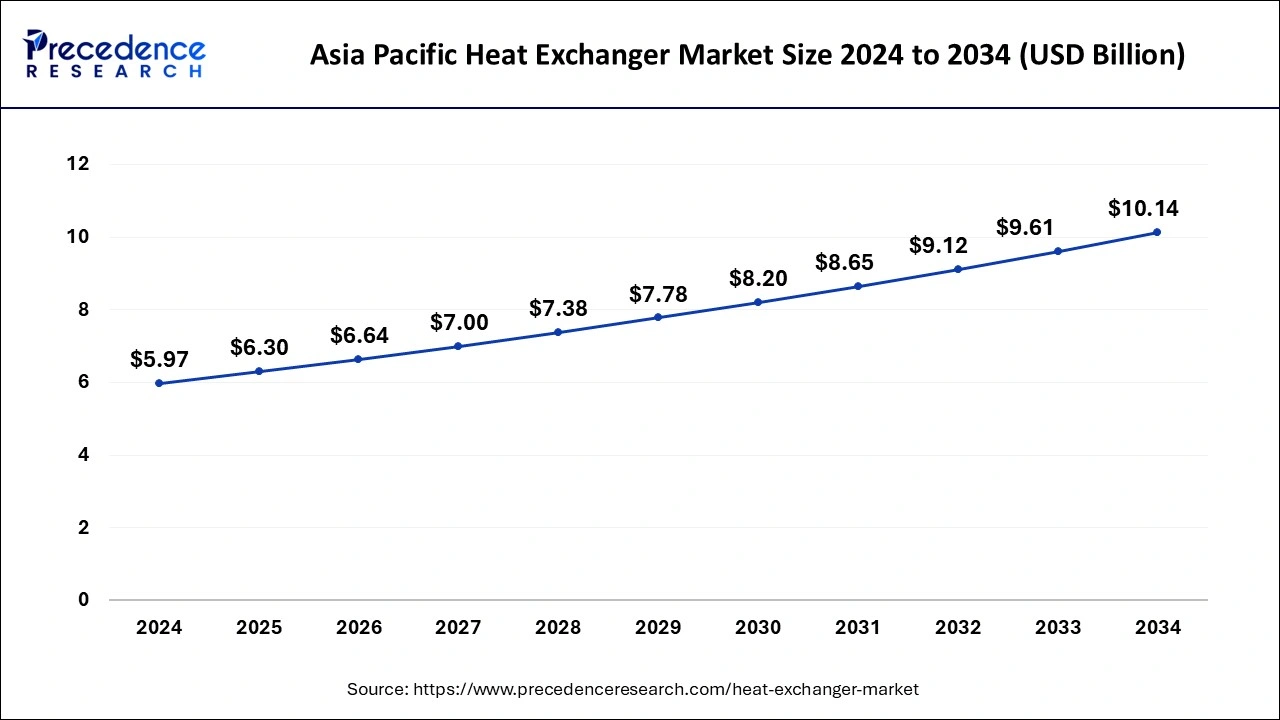

The global heat exchanger market size is calculated at USD 19.95 billion in 2025 and is forecasted to reach around USD 32.10 billion by 2034, accelerating at a CAGR of 5.43% from 2025 to 2034. The Asia Pacific heat exchanger market size surpassed USD 6.30 billion in 2025 and is expanding at a CAGR of 5.44% during the forecast period. The market sizing and forecasts are revenue-based (USD Million/Billion), with 2024 as the base year.

The global heat exchanger market size was estimated at USD 18.92 billion in 2024 and is anticipated to reach around USD 32.10 billion by 2034, expanding at a CAGR of 5.43% from 2025 to 2034.

The Asia Pacific heat exchanger market size was evaluated at USD 5.97 billion in 2024 and is predicted to be worth around USD 10.14 billion by 2034, rising at a CAGR of 5.44% from 2025 to 2034.

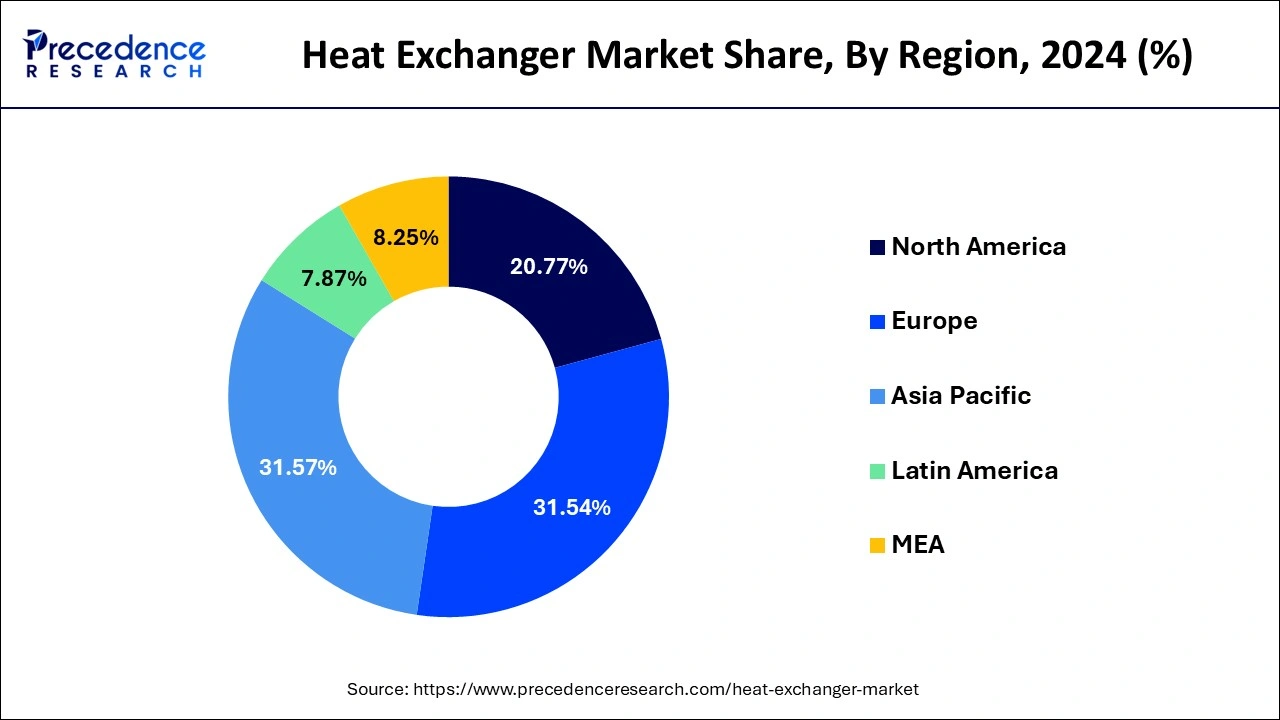

Asia Pacific dominated the global heat exchanger market with the largest market share of 31.57% in 2024. This can be attributed to the quick urbanization and industrialization of nations like China, Japan, and India. In 2020, Asia-Pacific had a GDP of 5.67 billion USD.

Europe's market for advanced heat exchangers is anticipated to increase significantly between 2025 and 2034, supported by the presence of strict environmental rules that place a premium on reducing carbon emissions.

In the future years, North America is anticipated to see exponential expansion. This may be attributed to elements like the existence of well-established players in a variety of industry sectors including aircraft, HVAC, aerospace, and automobiles.

Heat exchanger demand was lower than expected in all regions compared to levels prior to the global COVID-19 epidemic, which has been unprecedented and catastrophic. Our research shows that the global market will have a loss of -5.5% in 2020 compared to 2019.

The increase in HVAC installation and other industrial operations are contributing to the expansion of the global market. Increased use of heat exchangers in a variety of applications and increasing use of renewable energy sources will promote growth.

The working temperature of a system is controlled by a heat exchanger, which also recovers the heat from the wastewater. The machinery operates with two fluids or gas and fluid mixtures at various heat levels and temperatures. The primary methods of transferring heat between fluids or air are often tubes or pipes. One passes over the pipes, while the other passes through them. These are utilized in a number of different processes, including chillers, vaporizers, reboilers, evaporators, and condensation. These are crucial components for applications like air conditioning, refrigeration, chemical processing, power production, and automobiles.

This industry was threatened by the COVID-19 epidemic. The extraordinary measures required to stop the virus' spread have made working conditions difficult in several industries. As a result of the industry shutdowns caused by the illness epidemic, product demand has changed. Due to constraints from the government, the production facilities for these exchangers were shut down in various places. Even when some of the requirements were relaxed, output has been hampered by the lack of personnel. The market is anticipated to respond favorably to the pandemic with a greater desire for total district energy and renewable energy objectives as well as the requirement to meet HVAC demand. For instance, the United Kingdom's government has said that by 2030, district heating networks would be able to meet 17% of the country's heating demands.

The heat exchanger is mostly utilized as cooling technology across several sectors. These exchangers can efficiently control a system's operating temperature, which is what is driving the market's expansion. The minimum temperature range for water-cooled, steam-heated, and air-cooled heat exchangers, respectively, should be about 15 degrees Fahrenheit, 20 degrees Fahrenheit, and 25 degrees Fahrenheit, according to a research study.

To avoid mixing, the medium may be in close proximity to one another or isolated from one another by a complete wall. Thermal management is becoming more and more in demand across a variety of industries, including HVAC, power generation, chemicals, and petrochemicals.

| Report Coverage | Details |

| Market Size in 2025 | USD 19.95 Billion |

| Market Size by 2034 | USD 32.10 Billion |

| Growth Rate from 2025 to 2034 | CAGR of 5.43% |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Product , End-Use, Material of Construction |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Extensive economic growth and technological advancements would drive the market

Emerging economies' industrial sectors are expanding quickly to support market expansion

Installation, operational, and maintenance costs will limit market expansion

In order to support growth, renewable energy sources for power generation should be expanded and more applications should use them

In 2024, the industry's top-performing segment, shell & tube held the highest revenue share. Products made of shells and tubes are composed of a collection of tubes arranged in a cylindrical shell with the tube axis parallel to the shell's axis.

Applications requiring a wide temperature and pressure range, as well as transfer between two liquids, between liquids & gases, or between two gases, employ shell & tube products. These simple heat exchangers are excellent for transferring heat from steam to water. But because they take up a lot of room, it's expected that throughout the projected period, segment growth would be constrained.

Plate-type construction consists of either smooth or corrugated plates. Depending on the level of leak tightness required, these items are categorized as brazed, welded, or gasketed. At low to medium pressures, plate & frame products are commonly utilized for liquid-liquid exchange.

Products that use air cooling, commonly referred to as air coolers, include a tube bundle, an air pumping mechanism like a blower or an axial flow fan, and a support structure. Petrochemical plants, refineries, compressor stations, gas treatment plants, power plants, and other facilities utilize these items. Products that use air cooling can be mounted either vertically, horizontally, or at an angled slope.

Chemical and petrochemical products dominated the market in 2024, making for 23.4% of total revenue demand. The petrochemical industry's expansion is projected to be aided by the increasing demand for textiles, plastics, digital gadgets, packaging, and medicinal and agricultural products.

The demand for heat exchangers in the oil and gas end-use industry will increase at a CAGR of 4.9%. The need for heat exchangers is anticipated to rise as shale gas is used more often in the manufacturing and energy sectors and as shale gas exploration operations increase as a result of technical developments in exploration.

HVAC systems would not function without heat exchangers. The need for heat exchangers in the HVAC sector is anticipated to increase as people become more conscious of the need to conserve energy and lower their energy costs. In the heat recovery procedure, which uses steam, water, air, and refrigerants, the products are employed. The market for the product is expected to increase due to the growing demand for effective heat recovery systems with excellent corrosion resistance.

By Product

By End-Use

By Material of Construction

By Geography

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

January 2025

December 2024