February 2025

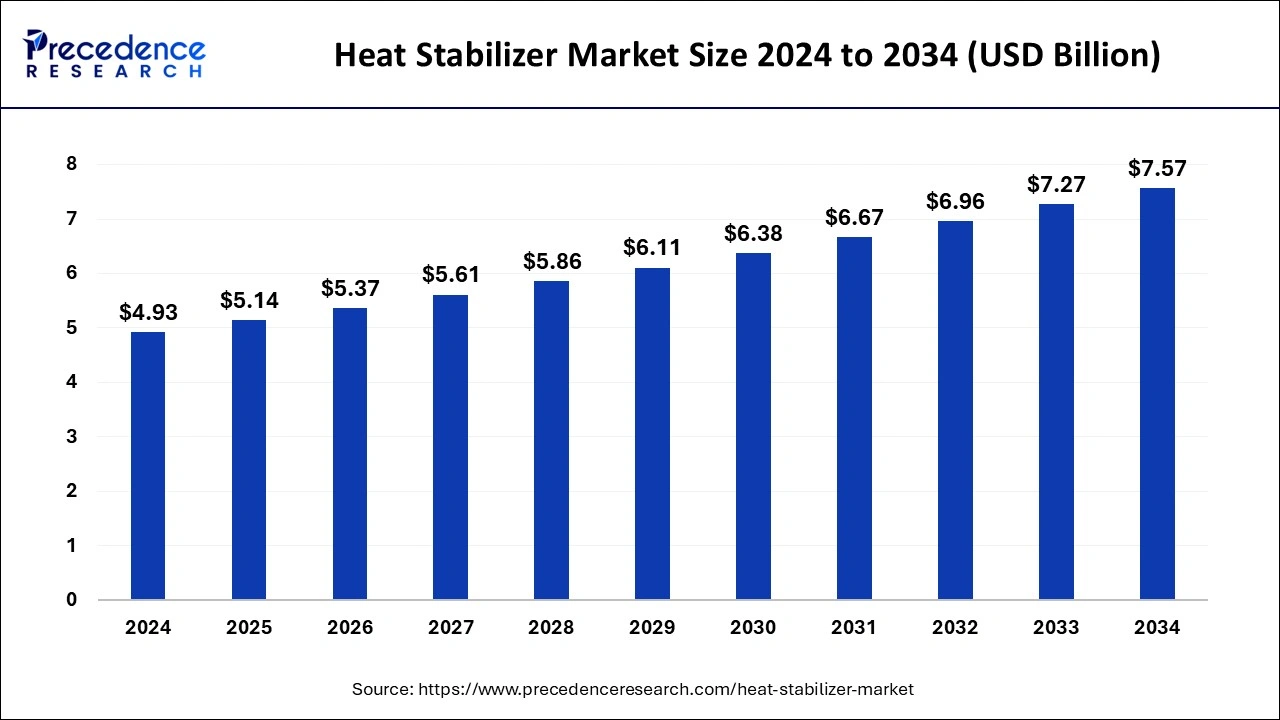

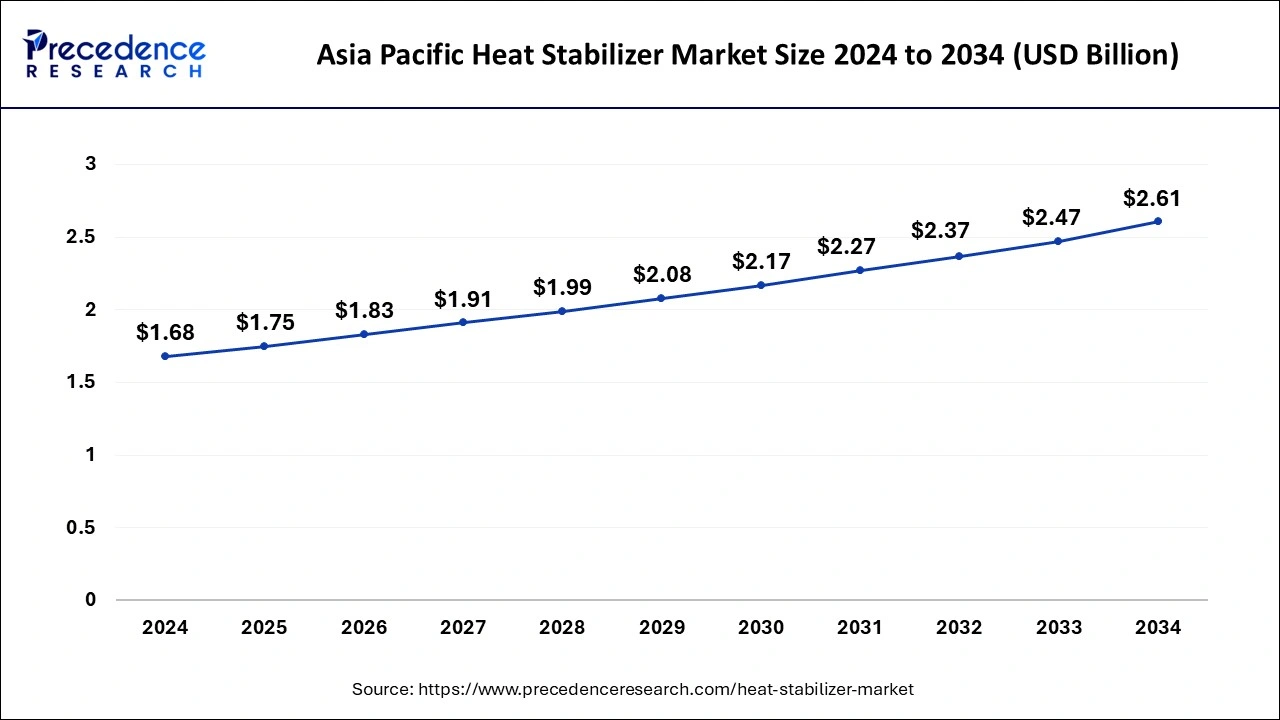

The global heat stabilizer market size is calculated at USD 5.14 billion in 2025 and is forecasted to reach around USD 7.57 billion by 2034, accelerating at a CAGR of 4.38% from 2025 to 2034. The Asia Pacific heat stabilizer market size surpassed USD 1.75 billion in 2025 and is expanding at a CAGR of 4.50% during the forecast period. The market sizing and forecasts are revenue-based (USD Million/Billion), with 2024 as the base year.

The global heat stabilizer market size was estimated at USD 4.93 billion in 2024 and is predicted to increase from USD 5.14 billion in 2025 to approximately USD 7.57 billion by 2034, expanding at a CAGR of 4.38% from 2025 to 2034.

The Asia Pacific heat stabilizer market size was estimated at USD 1.68 billion in 2024 and is predicted to be worth around USD 2.61 billion by 2034 at a CAGR of 4.50% from 2025 to 2034.

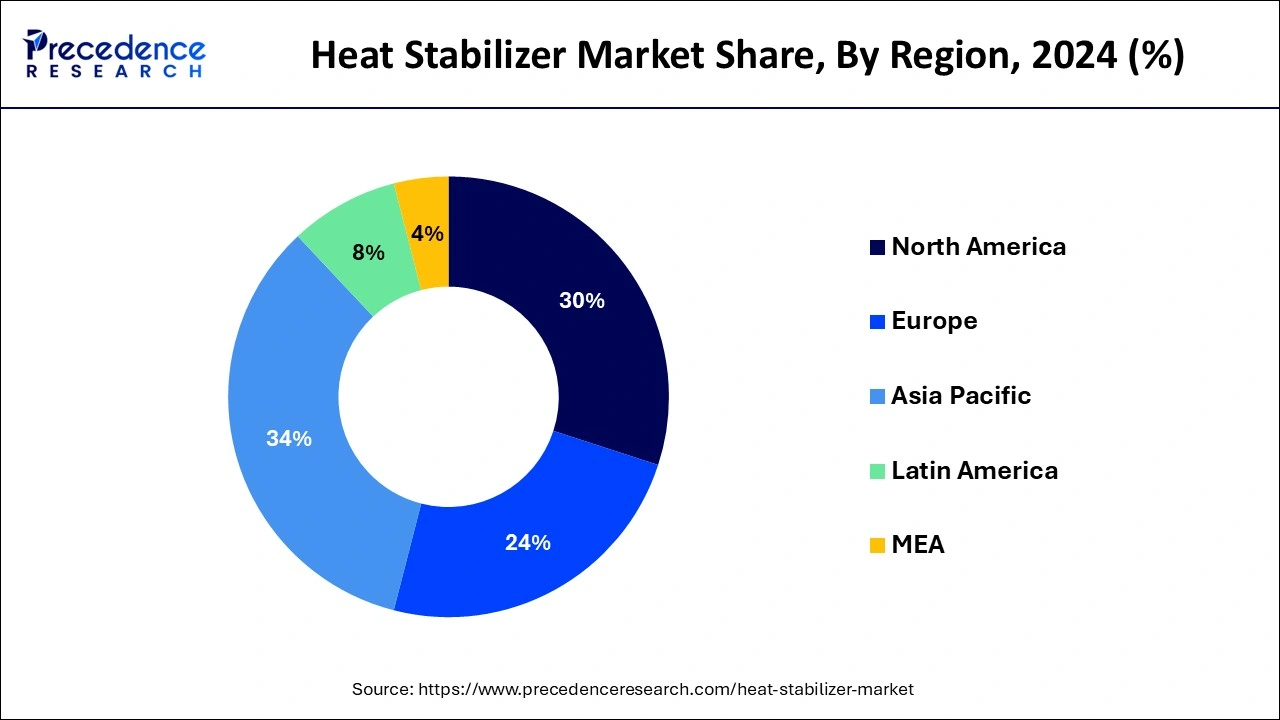

Asia Pacific led the heat stabilizer market with the largest share owing to the rise in the large-scale application of PVC in the building & construction industry. The surge in the population coupled with rising urbanization and industrialization, is expected to boost the demand for plastic items. In the Asia Pacific region, Countries such as India, China, Japan, and South Korea are the major contributors to the market owing to the market owing to the rapidly developing and evolving economies, which significantly increases the demand for innovative and lightweight heat stabilizer solutions. Moreover, mergers and acquisitions among major companies are anticipated to assist them in enhancing their product portfolio and retaining a strong presence in the market. Thus, this is expected to propel the market growth in the region during the forecast period.

North America is observed to grow at a significant rate in the heat stabilizer market during the forecast period. The region is observed to witness prolific growth during the forecast period. The growth of the region is attributed to the rise in infrastructure initiatives, the increasing use of PVC in the automotive sector, the rise in food delivery services, and the increasing demand for wires & cables.

In addition, the rapidly growing demand for heat stabilizers in sectors such as construction, automotive, packaging, and others in the region is the major driver that contributes towards the overall growth of the market. Furthermore, the increasing demand for lightweight, and less harmful heat stabilizer solutions is likely to drive growth for the market in the region during the forecast years.

Heat stabilizers are a type of additive that prevents polymer degradation processes from occurring when it is exposed to high temperatures during material processing. Heat stabilizers work by interfering with the degradation reactions that are triggered by heat, UV radiation, or other environmental factors. They prevent or mitigate the degradation processes during the lifetime of the product, which provides a uniform color of finished products. To obtain the best results, heat stabilizers are used in combination with other types of stabilizers.

Heat stabilizers are widely used in PVC to prevent degradation caused by high temperatures. Polyvinyl chloride (PVC) is the most versatile polymer which is more susceptible to heat damage. A heat stabilizer assists in stabilizing the heat for better resistance during the process of manufacturing or the lifetime of the product.

| Report Coverage | Details |

| Market Size in 2025 | USD 5.14 Billion |

| Market Size by 2034 | USD 7.57 Billion |

| Growth Rate from 2025 to 2034 | CAGR of 4.38% |

| Largest Market | Asia Pacific |

| Base Year | 2024 |

| Forecast Period | 2025to 2034 |

| Segments Covered | Product, Application, and Regions |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Increasing applications of polyvinyl chloride (PVC)

The increasing application of PVC is expected to boost the growth of the heat stabilizer market during the forecast period. The market has observed the growing demand for PVC for crucial applications in electronics, packaging, electrical, construction, medical and healthcare, automotive, furniture, packaging, and other industries. These are the prime drivers spurring the demand for heat stabilizers as additives. PVC is a high-strength thermoplastic material. It is most commonly used in applications including medical devices, pipes, and wire & cable insulation. Therefore, the rising use of polyvinyl chloride (PVC) is driving the growth of the market during the forecast period.

Stringent government regulations

Stringent government regulations are anticipated to hamper the growth of the market. Strict government regulations are imposed for the use of toxic materials including dibutyltin, lead, cadmium, and others which are harmful to humans and the environment. Such factors may limit the adoption and restrict the expansion of the global heat stabilizer market during the forecast period.

Increasing consumption of plastic

The growing consumption of plastic is projected to offer a lucrative opportunity for the growth of the heat stabilizer market during the forecast period. The rise in population along with urbanization across the globe increases the demand for plastic products which in turn drives the demand for heat stabilizers. Heat stabilizers offer high compatibility and lasting heat stability. Heat stabilizers are USED on synthetic polymer plastics such as polyvinyl chloride (PVC) for preventing or mitigating the negative effects of UV light and heat on them. When heat stabilizers are added to plastics it offers protection against the mechanical deterioration of polymer during the time of processing and use.

Additionally, the heat stabilizers market has grown due to the introduction of the technology called chromatography analysis, which assists in determining the quantity of stabilizers in plastics and polymers and also provides clarity on how the additives affect the performance of the product and physical characteristics. Thereby, driving the market’s growth.

The metal soaps segment accounted for the dominating share in the heat stabilizer market in 2024. Metal soaps find applications across various industries due to their distinct properties. Metallic soaps find applications as heat stabilizers to improve the longevity and thermal stability of plastic products which helps in extrusion processes and enables the production of high-quality plastic components.

The organotin segment is expected to witness a significant share during the forecast period. Organotin stabilizers are a range of butyltin, methyltin, and octyltin heat stabilizers. Organotin stabilizers are the most efficient for PVC due to their excellent thermal performance. Organotin stabilizers are well suited for all rigid PVC processing applications including PVC pipe and fittings, PVC siding, and window profile extrusions. Thus, bolstering the segment’s growth during the forecast period.

The pipes & fittings segment held the largest share of the heat stabilizer market in 2024 owing to infrastructure development, particularly in developing nations. The growth of the segment is driven by the growing demand for polyvinyl chloride (PVC) pipes and fittings in the construction industry. PVC pipes and fittings are extensively used in multiple applications such as sewage, drainage, water supply, and gas distribution which increase the demand for heat stabilizers during the forecast period. The requirement for pipes and fittings has substantially increased for plumbing and drainage systems as a result of rising construction activities for residential and commercial buildings. Additionally, pipes and fittings are widely utilized to transport hydrocarbons over long distances in the oil and gas industry has led to an increase in the demand for heat stabilizers. Thereby, the segment experiences growth.

The wires & cables segment is expected to grow at the fastest rate during the forecast period owing to the increasing use of PVC in electrical cable construction for bedding insulation and sheathing. It is durable, cost-effective, and a good insulator. Polyvinyl chloride (PVC) wires and cables have excellent aging properties and can last up to a longer period. Hence, such factors are likely to support the growth of the segment.

By Product

By Application

By Geography

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

February 2025

October 2024

December 2024

February 2025