January 2025

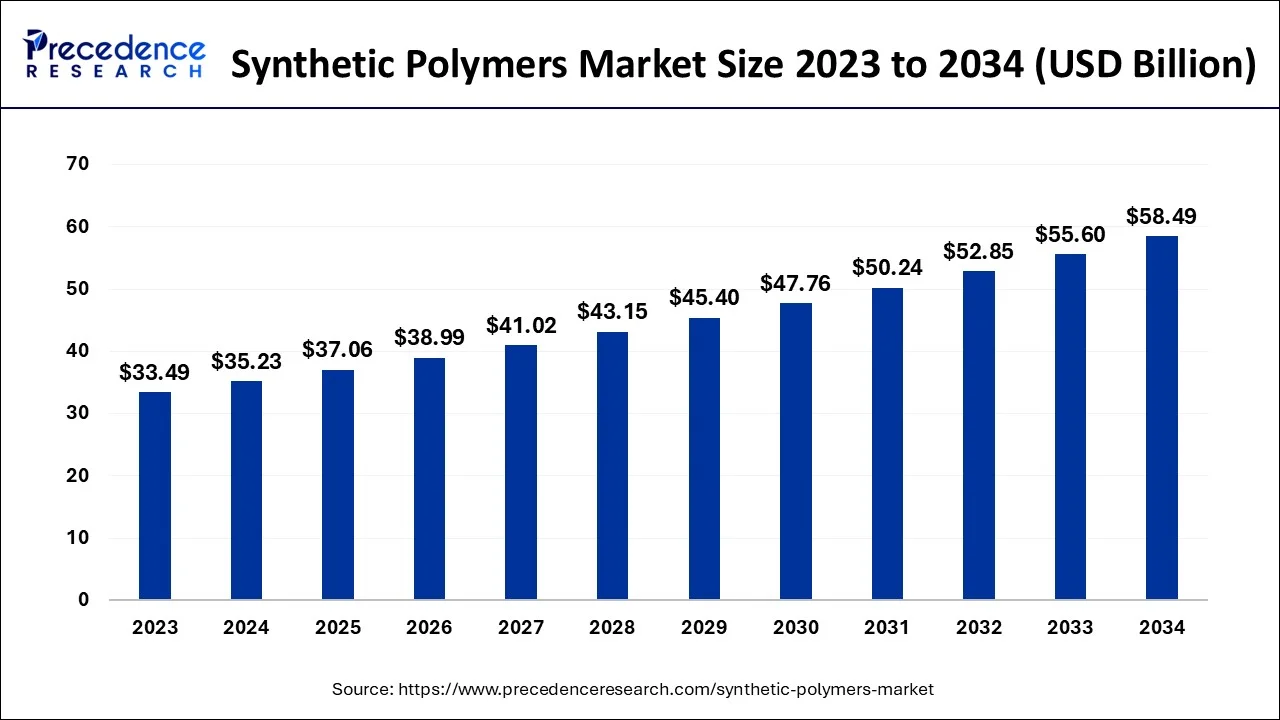

The global synthetic polymers market size accounted for USD 35.23 billion in 2024, grew to USD 37.06 billion in 2025 and is predicted to surpass around USD 58.49 billion by 2034, representing a healthy CAGR of 5.20% between 2024 and 2034.

The global synthetic polymers market size is estimated at USD 35.23 billion in 2024 and is anticipated to reach around USD 58.49 billion by 2034, expanding at a CAGR of 5.20% from 2024 to 2034.

The structural and chemical characteristics of the chain dictate the distinguishing properties of finished materials, which is why polymers are viewed as collections of monomer units in chains. Chemically produced synthetic latex is a material with outstanding strength, flexibility, and water resistance. Synthetic latex polymers can alter the mechanical properties and molecular weight of other substances. The primary industries using synthetic polymers include aircraft, architecture, healthcare, and automobiles, according to an examination of their basic applications. The recent increase in residential and commercial building drives the requirement for polymer paints and varnishes. A rise in viral and infectious diseases also increases demand for medical supplies such catheters, surgical gloves, wraps, bandages, and stethoscopes.

Fiber, latex, and rubber are examples of synthetic polymers, however recent developments indicate that synthetic latex polymers will soon rule the market. Styrene acrylics, a subtype of synthetic latex, are being used more frequently in building construction and roof coatings, which has raised their demand. The majority of the materials used in the electronic and architectural industries are made of synthetic latex, which is also used in paints, coatings, paper, adhesives & sealants, and carpets.

| Report Coverage | Details |

| Market Size in 2024 | USD 35.23 Billion |

| Market Size by 2034 | USD 58.49 Billion |

| Growth Rate from 2024 to 2034 | CAGR of 5.20% |

| Base Year | 2023 |

| Forecast Period | 2024 to 2034 |

| Segments Covered |

|

| Regions Covered |

|

The styrene acrylics category, which has previously controlled the market with the highest revenue share, is anticipated to have the largest market share in the upcoming years. This segment will also continue to expand well. This coating of styrene acrylic is utilized in building and construction to give concrete and roofing applications that are more flexible, heat sealable, salt stable, and water resistant. Chemically speaking, styrene acrylic is simply a modified acrylic polymer that has been added to boost the polymer's resistance to weathering. Roofs and other construction components that are directly exposed to the outside atmosphere have longer lifespans thanks to styrene acrylic coating. Buildings and homes covered in styrene acrylic are fashionable because to the acceleration of global warming. With the rise in demand for weatherproof coating, it is projected that the styrene acrylic market will expand over the course of the forecast period.

The increase in demand from the construction and automotive industries will drive the styrene butadiene market during the forecast period. Additionally, the increased demand for paper is fueling the styrene butadiene industry's expansion. Additionally, it is predicted that the market for styrene butadiene latex would grow in tandem with the expansion of the carpet sector. On the other hand, it is further projected that the concerns about the increase in feedstock costs will restrict the expansion of the styrene butadiene latex market in the timeframe period. In the upcoming years, the market for styrene butadiene latex may also experience development due to the increased demand for carpet and fiber products.

The paints and coatings category, which has dominated the market and will continue to expand strongly in terms of revenue, is anticipated to have the biggest market share by application in the upcoming years. Due to urbanization, the paints and coatings market is expanding rapidly. Indian paint producers keep expanding their plant capabilities to keep up with the rising demand. Asian Paints announced a $53 million investment to construct paint manufacturing facilities in 2018. Additionally, Kansai Nerolac intends to build two additional factories in India. One of the most important driving the expansion of the synthetic polymers market is the increasing demand for paints and coatings from different regions of the world.

Construction is predicted to have the largest market share by the end user in the upcoming years; historically, this segment has dominated the market with the highest revenue share and will continue to increase. The government's increased investment in infrastructure development projects has fueled the expansion of the construction industry. To speed up these initiatives, they are also utilizing private-public models, which is increasing demand in emerging markets. Construction polymers are being used more frequently as paints and coatings for building materials.

Geographically, Asia-Pacific is anticipated to remain one of the most enticing markets and will account for the bulk of the market's revenue share over the course of the projection period. Asia-Pacific nations have a competitive advantage over other regions because they have substantial supplies of the raw ingredients needed to make synthetic polymers. They also hold the biggest market share for synthetic polymers, and due to urbanization and rapid development, it is anticipated that they will continue to maintain their dominance in the years to come.

The cheap availability of raw materials used to make plastics will also help the synthetic polymers market grow in the region over the course of the projected period.

By Type

By Application

By End User

By Geography

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

January 2025

January 2025

November 2024

February 2025