October 2024

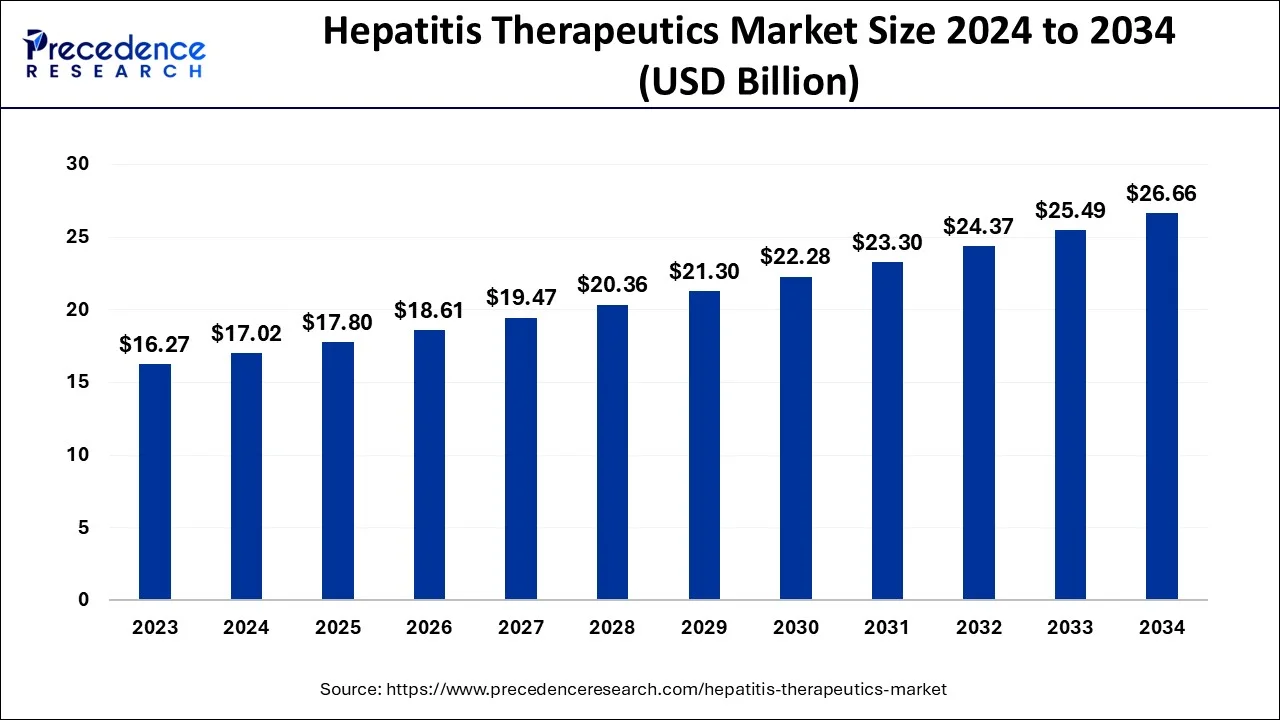

The global hepatitis therapeutics market size accounted for USD 17.02 billion in 2024, grew to USD 17.8 billion in 2025 and is predicted to surpass around USD 26.66 billion by 2034, representing a healthy CAGR of 4.59% between 2024 and 2034. The North America hepatitis therapeutics market size is calculated at USD 7.49 billion in 2024 and is expected to grow at a fastest CAGR of 4.69% during the forecast year.

The global hepatitis therapeutics market size is estimated at USD 17.02 billion in 2024 and is anticipated to reach around USD 26.66 billion by 2034, expanding at a CAGR of 4.59% from 2024 to 2034.

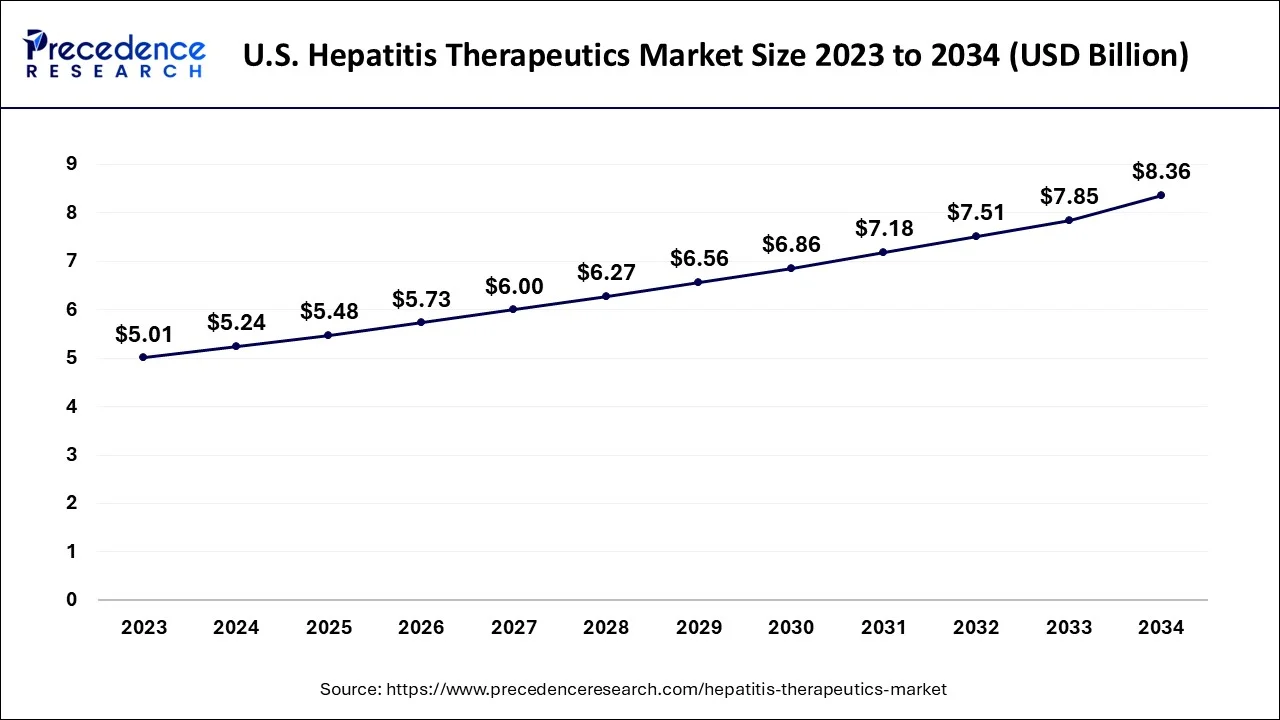

The U.S. hepatitis therapeutics market size is estimated at USD 5.24 billion in 2024 and is expected to be worth around USD 8.36 billion by 2034, rising at a CAGR of 4.76% from 2024 to 2034.

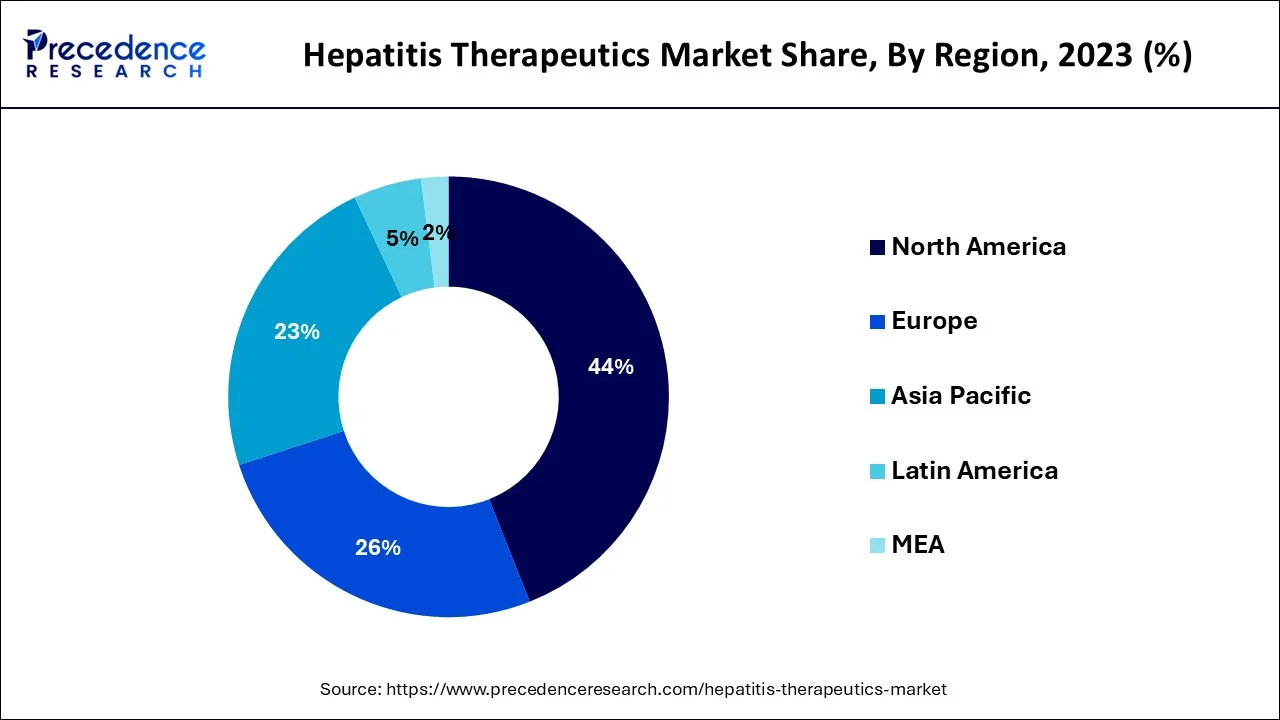

North America, followed by Europe and Asia Pacific, dominates the market for hepatitis treatments. The North American market accounted for 44% of total revenue in 2023, mostly because of the region's high awareness of advanced treatments and the U.S.'s strong demand for the products. Some of the key elements influencing the high share are the availability of a well-developed healthcare infrastructure, reimbursement, and access to the most cutting-edge medications.

Over the projected period, the Asia Pacific market is anticipated to grow at the quickest pace of 6.4%. The region's growth prospects are anticipated to be favorably reinforced by the high illness burden, expanding access to medications, improvements in healthcare and sanitation, and increased knowledge of hepatitis vaccination. To make it easier for more people to access high-quality healthcare, nations like India, China, Indonesia, and other South Asian economies are continually boosting their healthcare spending and reimbursement coverage.

Additionally, it is projected that the Asia Pacific area would benefit from the rising need for generic medications. Gilead has granted permission to seven Indian producers to export some of the hepatitis medications to several nations. More than half of the people who have HCV infection live in the countries that are included in this agreement.

The different licenses negotiated by the Medicine Patent Pool allow different manufacturers to release generic versions of these HCV medications even though the medications are still patented. This is expected to have an impact on the market over the course of the forecast period, as drug prices will decline, and consumption rates will rise. However, due to the high incidence rates and increase in the import of generic medications to treat various hepatitis disorders, MEA and Latin America are also predicted to have considerable growth.

Different manufacturers are growing their operations in MEA and Latin America areas to meet the significant unmet demands for improved treatment as the patient population in the U.S. and other developed countries is decreasing as a consequence of the benefits of taking HCV medications.

An inflammation of the liver is known as hepatitis. The use of narcotics, alcohol, or specific medical conditions can all cause hepatitis. However, viral hepatitis, of which the most prevalent kinds are hepatitis A, B, and C. Hepatitis B is quite prevalent and can cause severe liver cirrhosis, which can be deadly.

Hepatitis is liver inflammation brought on by a viral infection. Viruses such as virus A, virus B, virus C, virus D, virus E, and virus G are among those that cause hepatitis. The infection causes the liver's tissues to become inflamed, which can result in cancer and liver cirrhosis. The infection damages other bodily systems and decreases liver function. Acute and chronic hepatitis are both possible. Hepatitis B & C are the most dangerous and difficult to cure of all kinds. Hepatitis infection incidences are rising as a result of rising alcohol and drug use combined with large populations living in unclean settings.

On the basis of these reasons, the market for hepatitis treatments is predicted to see exponential expansion. The elimination of hepatitis is becoming increasingly important, and many nations and international organizations' rising understanding of this reality will be a major driver of the market's expansion for hepatitis therapies.

For instance, the WHO published a recommendation in 2016 calling for the eradication of viral hepatitis by 2030. Additionally, many campaigns like World Hepatitis Day aid governments in raising awareness about hepatitis. These programs act as market growth accelerators for hepatitis treatments.

Companies are funding R&D initiatives to create cutting-edge technology. The hepatitis therapeutics market is predicted to develop as a result of this aspect. As part of their expansion plans, players are also engaging in mergers, acquisitions, joint ventures, and partnerships. All of these factors ultimately aid in accelerating the market for hepatitis treatment growth rate. To ensure that their citizens receive top-notch care, many nations are concentrating on improving their healthcare regulations. The hepatitis therapeutics market is anticipated to grow as a result of favorable reimbursement policies adopted by numerous government bodies around the world.

| Report Coverage | Details |

| Market Size in 2024 | USD 17.02 Billion |

| Market Size by 2034 | USD 26.66 Billion |

| Growth Rate from 2024 to 2034 | CAGR of 4.59% |

| Base Year | 2023 |

| Forecast Period | 2024 to 2034 |

| Segments Covered | By Disease Type and By Distribution Channel |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America and Middle East & Africa |

Advancement in research and development activities

The rise in the prevalence of various hepatitis increased R&D efforts, clinical trials of hepatitis drugs, an increase in the number of product launches and item endorsements, and the development of new hepatitis drugs for the treatment of various hepatitis types are the main factors driving the growth of the hepatitis therapeutics market.

The market is growing rapidly due to increased, coordinated research activities for the pipeline development of potent drugs. Additionally, collaboration and association in important organizations increase persistent awareness of hepatitis therapeutics and the presentation of low-approximated hepatitis therapeutics are other factors that promote the market's growth.

Rising new medicine releases and hepatitis drug approvals from regulators

The worldwide market for hepatitis pharmaceuticals is anticipated to rise over the forecast period due to an increase in regulatory authority approvals for hepatitis drugs. A very effective and targeted NS5A inhibitor of the hepatitis C virus NS5A replication complex, Elbasvir was licensed by the U.S. FDA in 2016 for the treatment of hepatitis C. During the projected period, the introduction of innovative hepatitis medication therapies is anticipated to fuel market expansion. For instance, in India, Natco Pharma in 2018 introduced Hepcinat Plus, a fixed dosage combination of Sofosbuvir-Daclatasvir tablets for the treatment of Hepatitis C.

Hepatitis medications are quite expensive

Due to the high capital required for producing hepatitis pharmaceuticals, it is estimated that the market for hepatitis medications would expand slowly throughout the anticipated period. The cost of hepatitis medicines is costly since they are produced using pricy raw materials, such as active pharmaceutical ingredients (APIs) and pharmacological intermediates. The complex process of generating, separating, and utilizing raw materials for the production of pharmaceutical and biopharmaceutical treatments increases the cost of medicines as a whole since a skilled workforce is required.

Increasing hepatitis C disease prevalence

The hepatitis C virus is what causes the liver condition known as hepatitis C. The severity of hepatitis C can range from moderate to fatal. Acute hepatitis C develops within six months after being exposed to the hepatitis C virus, and if ignored, chronic hepatitis C can turn into lifelong hepatitis C. The World Health Organization (WHO) reported in July 2021 that an estimated 58 million individuals had chronic hepatitis C virus and that 1.5 million new infections take place every year.

The hepatitis C virus is a blood-borne disease, and exposure to tiny amounts of blood is the most typical way to become infected, claims the same source. This frequently occurs after receiving dangerous injections and medical treatment.

In the market for hepatitis therapies, the hepatitis C category holds a sizable market share. Due to the increasing incidence of hepatitis C in both emerging and developed nations as well as the expanding availability of efficient medications on the market, it is anticipated to exhibit a similar pattern over the course of the projected period. Additionally, the launch of various treatments by significant companies is anticipated to accelerate the growth of the hepatitis therapeutics market.

The hepatitis B virus (HBV) can cause both acute and chronic liver disease by infecting the liver. According to the WHO, there are an estimated 240 million individuals living with chronic hepatitis B, and more than 686,000 of them pass away each year as a result of its consequences. Blood and other bodily fluids from an infected individual can spread the virus. Due to the high prevalence of hepatitis B, the market was valued at USD 2.6 billion in 2016 and represented the second-largest revenue share.

HBV is required for the Hepatitis D Virus (HDV) to multiply and spread throughout the body. A ribonucleic acid virus is HDV. There are currently no viable treatments for HDV, which affects over 15 million individuals worldwide. As a result, vaccination against HBV is highly advised to avoid hepatitis B and D. This is one of the main factors influencing the market's current revenue share. Compared to hepatitis A and B, HCV causes a number of major side effects.

The WHO estimates that 130 to 150 million people throughout the world have HCV infection. Additionally, almost 700,000 individuals die from liver cancer and cirrhosis, both of which are common among HCV-infected patients. Over the projection period, the aforementioned reason will continue to fuel demand for HCV medications.

Growth has been significantly influenced by the advent of therapeutic treatments for the treatment of hepatitis that are technologically sophisticated. Hepatitis C was formerly incurable, but after the release of drugs like Sovaldi and Harvoni in 2013 and 2014, respectively, the treatment rate has considerably risen. These treatments allegedly generated sales of approximately USD 19.1 billion in 2015, and the demand for these medications is anticipated to be robust throughout the next years.

Due to the growing availability of both branded and generic medications, the pharmacy store and retail pharmacies category is predicted to see the highest growth throughout the projection period. Due to the tempting discount deals offered by online providers, which are anticipated to entice more clients to choose their services, online providers are also anticipated to see the quickest growth rate over the projection period.

By Disease Type

By Distribution Channel

By Geography

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

October 2024

November 2024

November 2024

September 2024