April 2025

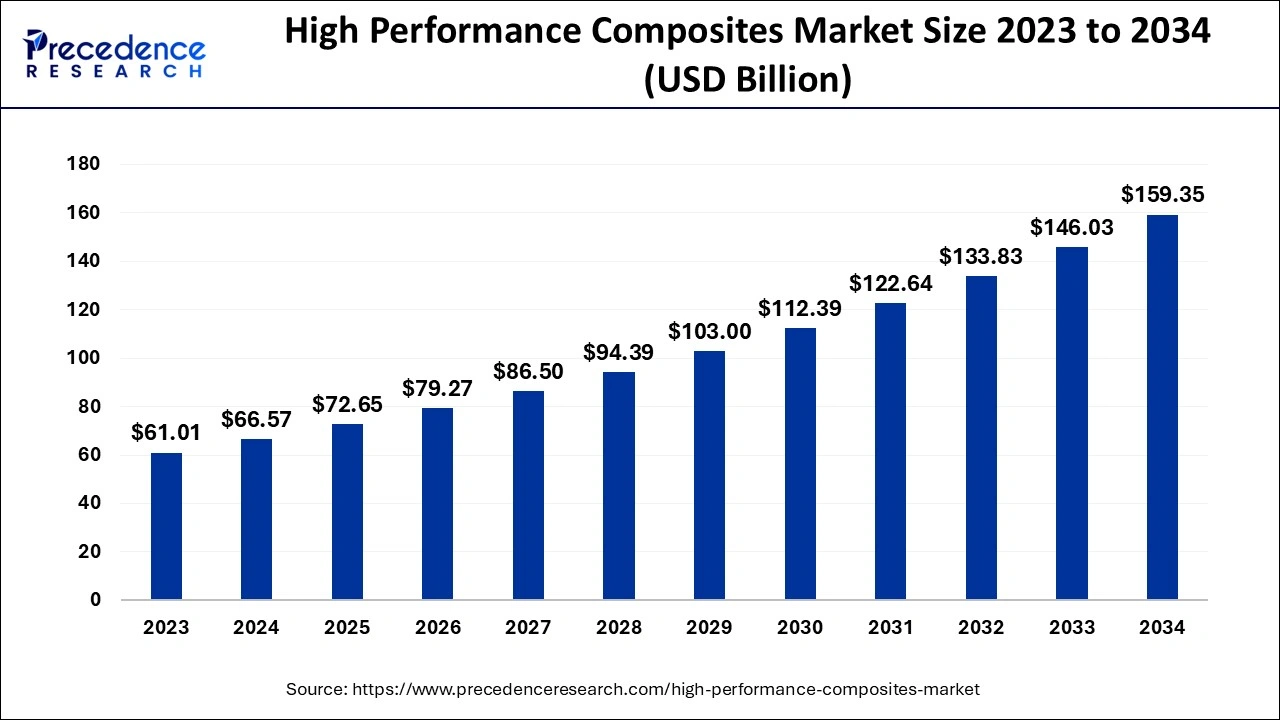

The global high performance composites market size accounted for USD 66.57 billion in 2024, grew to USD 72.65 billion in 2025 and is expected to be worth around USD 159.35 billion by 2034, registering a CAGR of 9.12% between 2024 and 2034. The Asia Pacific high performance composites market size is evaluated at USD 27.96 billion in 2024 and is estimated to grow at a CAGR of 9.23% during the forecast period.

The global high performance composites market size is calculated at USD 66.57 billion in 2024 and is projected to surpass around USD 159.35 billion by 2034, expanding at a CAGR of 9.12% from 2024 to 2034. The high performance composites market is rapidly gaining prominence owing to increased usage in aerospace, automotive products, and construction fields.

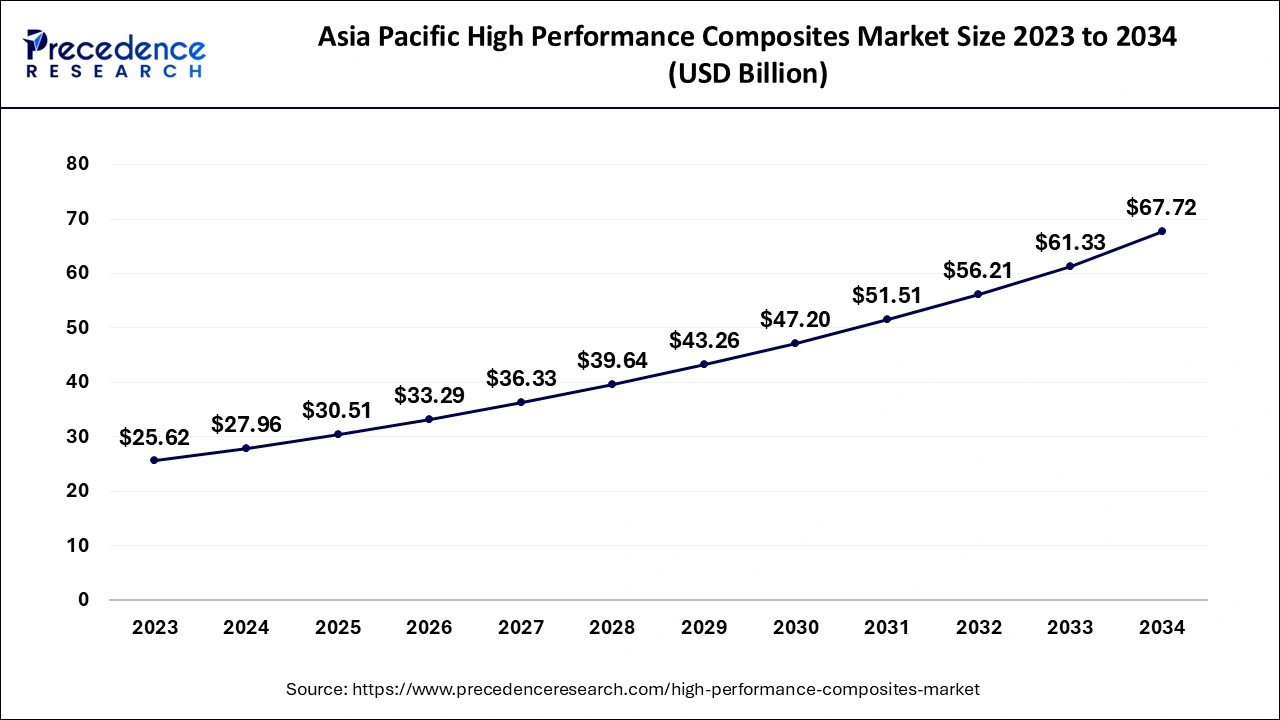

The Asia Pacific high performance composites market size is exhibited around USD 27.96 billion in 2024 and is predicted to reach around USD 67.72 billion by 2034, growing at a CAGR of 9.23% from 2024 to 2034.

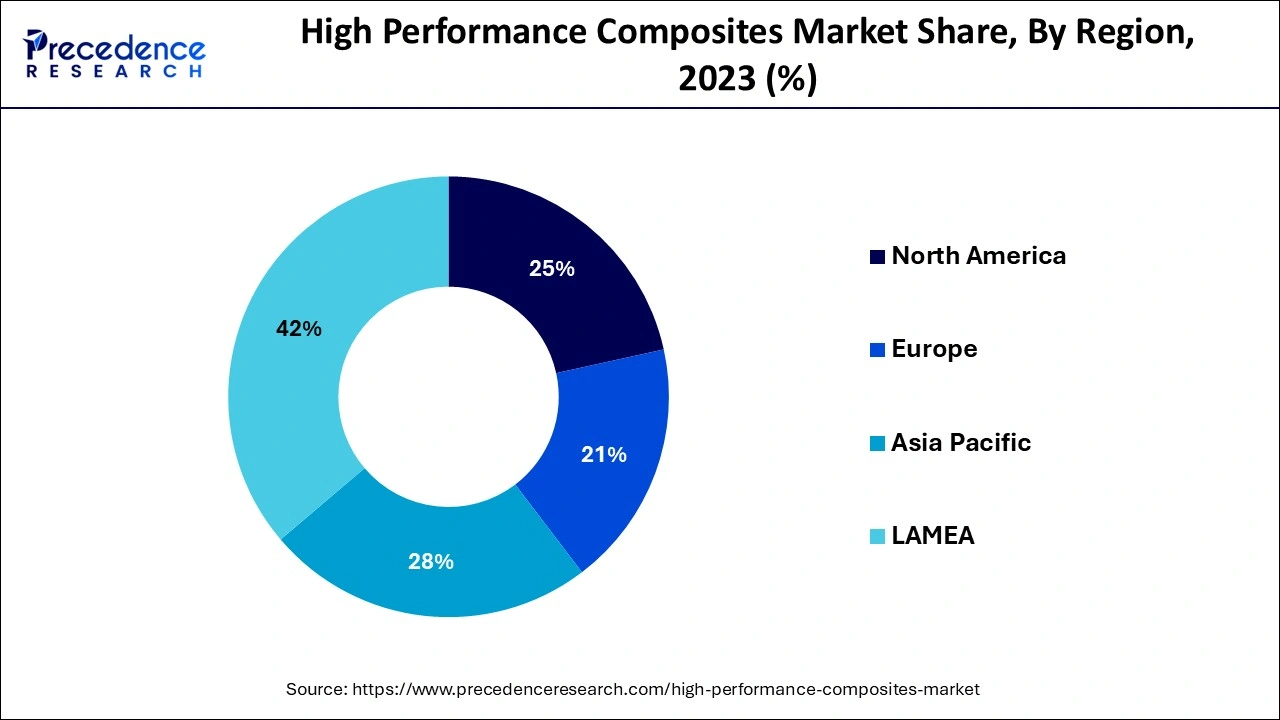

Asia Pacific held the largest share of the high performance composites market in 2023. Asia Pacific market is expected to rise in the aerospace industry, automobiles as well as construction business. The market is growing due to rapid industrialization, advanced technology, and concerns about lightweight materials with high strength. This amplified the need for interest in the business for complex and compact designs, increasing material requirements, cost constraints, and trends to drive the demand for composite materials.

North America is expected to showcase notable growth in the high performance composites market in the upcoming period. North America has experienced a recent increase in aerospace manufacturing opportunities. Air traffic has increased, necessitating high-performance composites in aircraft to meet strength, lightness, shape constancy, and erosion protection coating requirements.

High-performance composites (HPC) are superior types of materials that are applied in most industries due to their strength, durability, and light nature. HPCs are comprised of a matrix and reinforcement. The matrix comprises polymers, metal, or ceramics, while the reinforcement comprises fibers, particles, or filler. It has progressively substituted some traditional materials, including some metals and alloys of the metals. The key applications of composite products include the domestic, automotive, aerospace, and renewable energy industries because of their characteristics, lightweight, and low cost.

AI Impact on the High Performance Composites Market

The adoption of AI-driven material discovery, specifically in the high performance composites market. It is widely accelerated that AI could significantly help push forward the development of new composite materials, and researchers and engineers are employing AI for materials discovery. They witness discoveries that will bring positive changes, such as enhanced stiffness, strength, durability, and more efficient architecture. Challenges can be addressed by AI through machine learning algorithms, such as the use of data-driven material optimization methods and generative models of material composition.

| Report Coverage | Details |

| Market Size by 2034 | USD 159.35 Billion |

| Market Size in 2024 | USD 66.57 Billion |

| Market Size in 2025 | USD 72.65 Billion |

| Market Growth Rate from 2024 to 2034 | CAGR of 9.12% |

| Largest Market | Asia Pacific |

| Base Year | 2023 |

| Forecast Period | 2024 to 2034 |

| Segments Covered | and Regions |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America and Middle East & Africa |

Rising demand in the aerospace industry

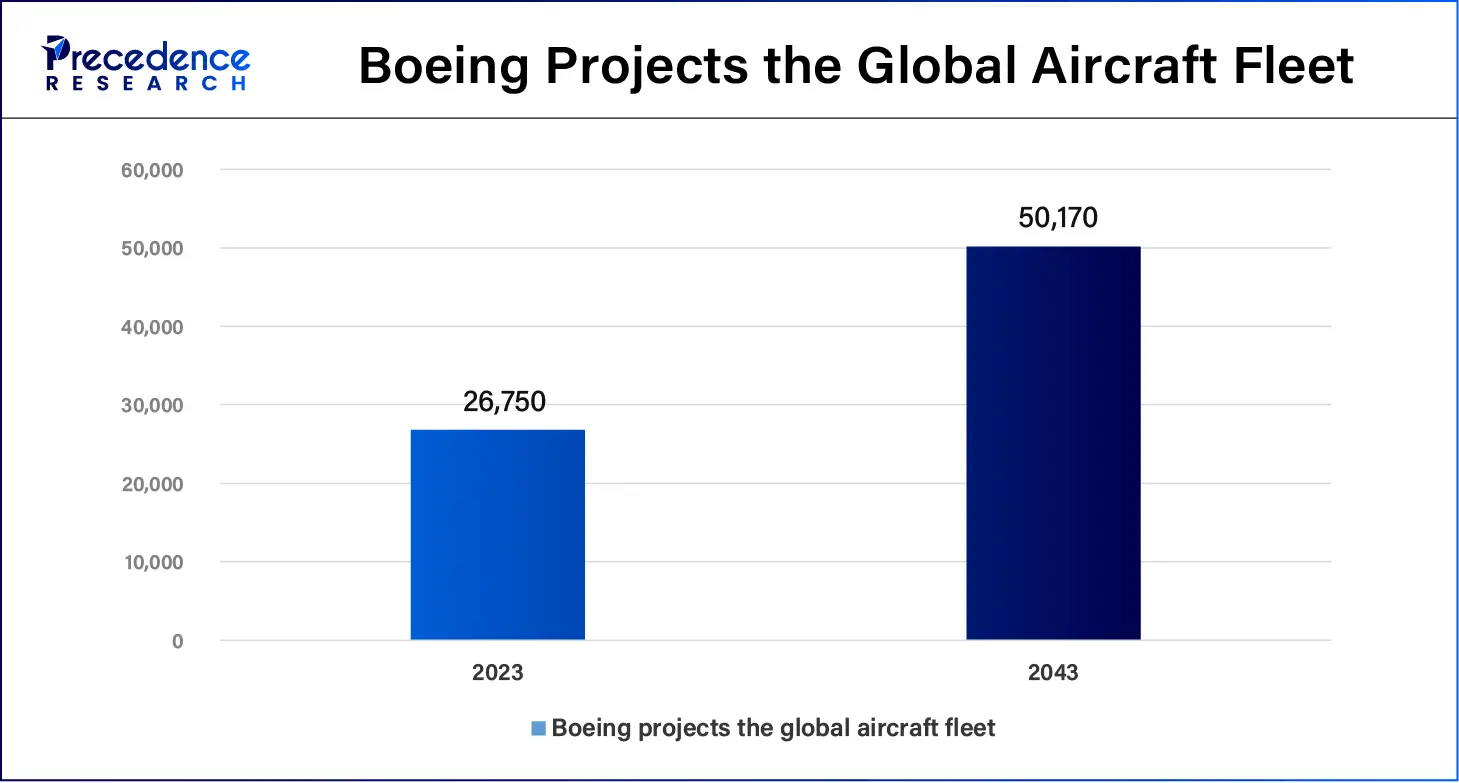

The advanced electronics and aerospace industries depend on high-performance composites for the fabrication of lightweight components for home electronics, cars & mobile phones that drive the high performance composites market. Composites have been deployed in aerospace, including aspects such as engine blades, brackets, interiors, nacelles, propellers/rotors, single aisle wings, and wide-body wings. Composites are important for constructing light, stiff structures for aerospace vehicles such as airplanes and space shuttles containing attributes that are most effective for efficiency and productivity.

High cost and environmental impact

The manufacturing cost, R&D expenditures, and advanced manufacturing affect the growth of the high performance composites market. The essential functions of standardization and maintenance technology have additional costs that limit its use and market demand. Furthermore, the fiber metal matrix composite is non-biodegradable and accumulates waste and environmental problems due to non-decomposition. The weakness that is evident here is that fiber composites like ceramic, carbon, glass, and others are not biodegradable and hence, experience slow growth due to government regulations.

Growing demand for sustainable and eco-friendly materials

Rising environmental awareness among customers and businesses impacts buying ranges, leading to a higher demand for products with minimal environmental impact. The fabrics are derived from fibers, resins, and oils that are environmentally friendly and biodegradable materials. It can be applied in the construction industry, aerospace industry, automobile manufacturing industry, electronic industry, etc.

Green composites are newer generation and highly appreciated multipurpose composites that are biodegradable and environmentally stable materials. Stringent regulations and government support for carbon emission reduction drive the use of eco-friendly composites. Natural fibers, resins, and oils are embedded in the synthesis of green composite materials that lead to sustainable environments compared to conventional composite materials.

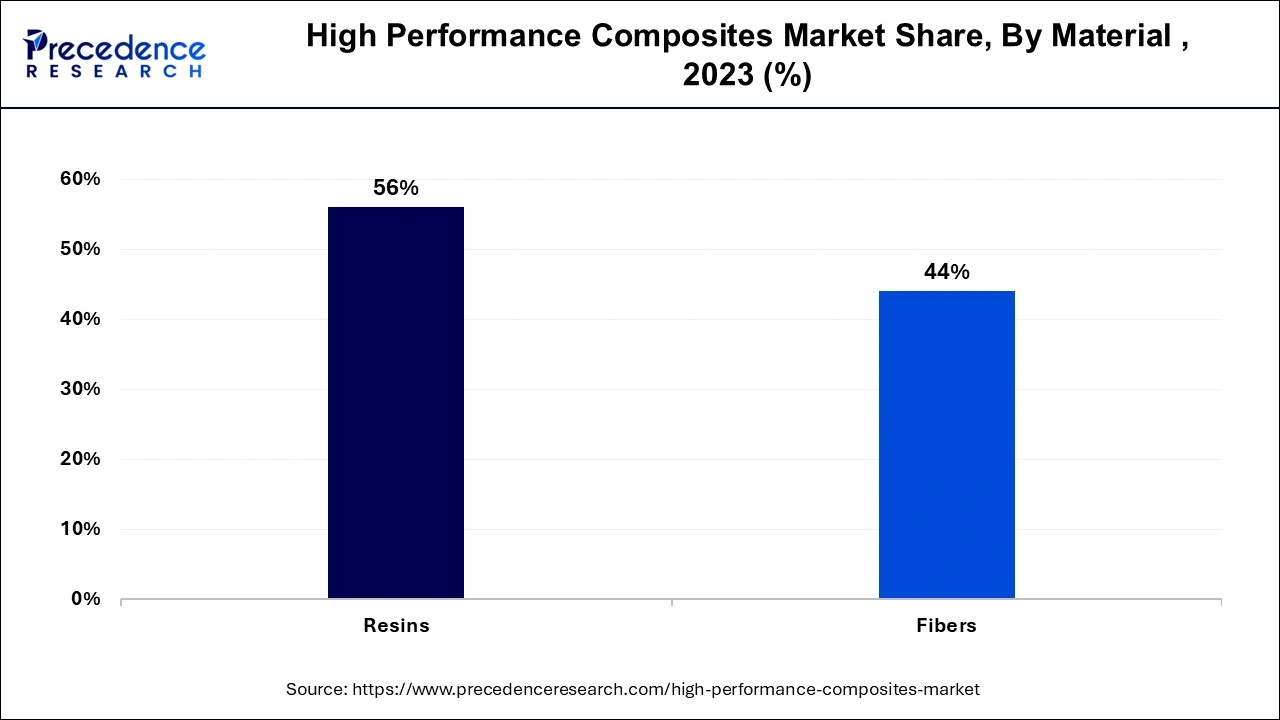

The resins segment accounted for the largest share of the high performance composites market in 2023. Fibre reinforced resins, referred to as composite resins, have features such as corrosion, chemical attack, and high temperature. New generation composite resins used widely in aerospace, automobile, and sporting goods sectors have been specifically developed. High-performance resins have enhanced chemical, solvent, and corrosive tendencies. They have a low affinity for absorbing liquids, and they are resistant to harsh chemicals with minimal swell or deterioration.

The fibers segment will register the fastest growth in the high performance composites market during the foreseeable period. High-performance composites are defined as materials formed of fibers, particles, and fillers supported in a matrix of polymers, metals, or ceramics. The fibers in HPCs are the main determinant of the strength and modulus of the resulting composites. Carbon, aramid, or glass are the most outstanding fibers that are used in HPCs. Fibers, such as carbon fiber, glass fiber, and others, are expected to have better growth rates than resins because of characteristics such as fabrication flexibility, resistance, and strength. It provides excellent mechanical properties like high thermal and chemical resistance conductivity. The aerospace industry requires fibers like this due to features like high durability, high rigidity, and low density.

The automotive segment held the largest share of the high performance composites market in 2023. These composites are used actively in the automotive industry, especially for the building of lightweight materials. The benefits offer high strength-to-weight, enhancing fuel efficiency and vehicle performance. ACP Composites has been specializing in the engineering, manufacturing, and testing of good, efficient, durably strong, and lasting composite auto parts for the automotive industry as well as for other industries. The increasing demand and use of automotive vehicles have boosted the need for better-performance composites in exhaust systems, auto parts, and others. As a result, the high-performance composites industry has steadily grown through this demand.

The energy segment is expected to grow significantly in the high performance composites market during the forecast period. High-performance composite materials are superior energy storage materials in energy conversion devices and systems. In the worldwide electricity consumption scenario, demand is outpacing the availability of renewable resources. Wind turbines utilize composite blades, other types of renewable energy such as hydroelectric and tidal turbine blades, and some types of solar panels. New technologies and materials have emerged to replace the diminishing supply of traditional composite materials.

Segments Covered in the Report

By Material

By Application

By Geography

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

April 2025

November 2024

February 2024

July 2024