March 2024

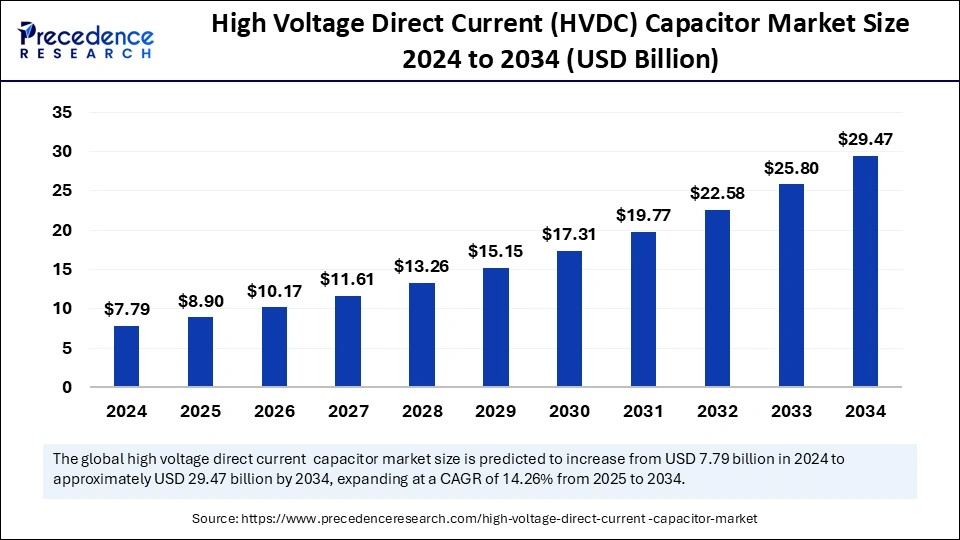

The global high voltage direct current (HVDC) capacitor market size is calculated at USD 8.90 billion in 2025 and is forecasted to reach around USD 29.47 billion by 2034, accelerating at a CAGR of 14.26% from 2025 to 2034. The Asia Pacific market size surpassed USD 3.19 billion in 2024 and is expanding at a CAGR of 14.38% during the forecast period. The market sizing and forecasts are revenue-based (USD Million/Billion), with 2024 as the base year.

The global high voltage direct current (HVDC) capacitor market size was estimated at USD 7.79 billion in 2024 and is predicted to increase from USD 8.90 billion in 2025 to approximately USD 29.47 billion by 2034, expanding at a CAGR of 14.26% from 2025 to 2034. The market growth is attributed to the increasing investments in HVDC transmission systems for renewable energy integration, long-distance power delivery, and grid modernization.

Artificial intelligence (AI) is changing the way energy storage and transmission technology functions. AI helps improve capacitor design through dataset analysis. It helps in improving the properties of dielectric materials and increases storage capacity, along with increased durability. Moreover, AI monitors capacitor performance in real-time, predicting potential failures and improving the overall efficiency of systems.

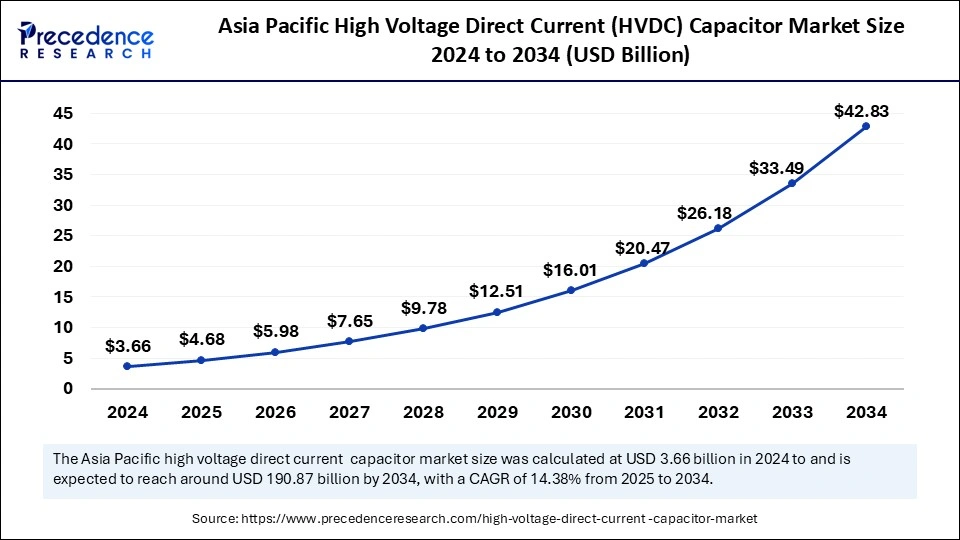

The Asia Pacific high voltage direct current (HVDC) capacitor market size was exhibited at USD 3.19 billion in 2024 and is projected to be worth around USD 12.23 billion by 2034, growing at a CAGR of 14.38% from 2025 to 2034.

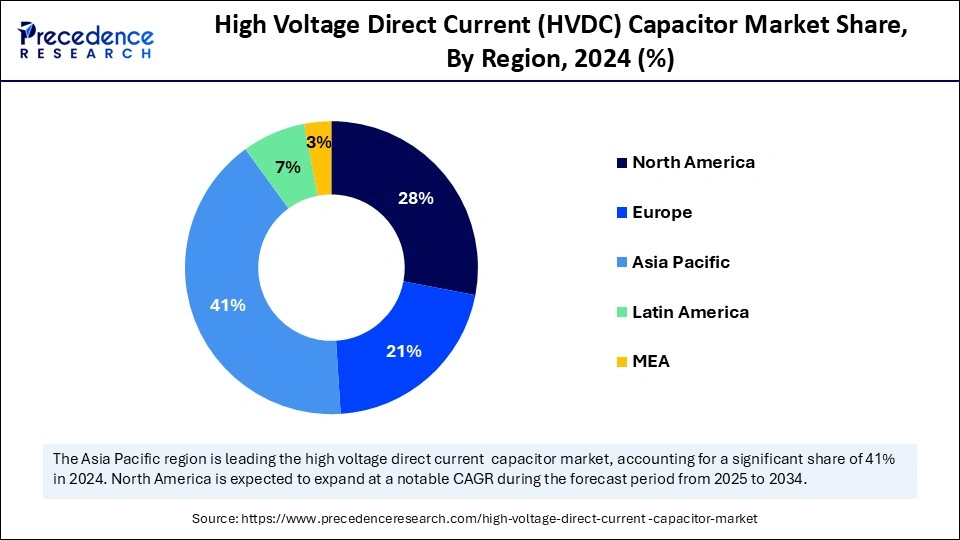

Asia Pacific dominated the high voltage direct current (HVDC) capacitor market with the largest share in 2024 and is expected to sustain its dominance in the coming years. This is mainly due to the rising government initiatives and funding toward expanding electricity infrastructure. Countries like China and India are focusing on improving power transmission infrastructure. State Grid Corporation of China initiated several ultra-high voltage direct current (UHVDC) transmission lines in 2023, with the Baihetan-Zhejiang project representing its main project and bridging 2,100 km to transfer 8,000 MW of electricity.

The governments of Japan and South Korea accelerated HVDC development for offshore wind farm connections, as they aim to reach carbon neutrality. In 2023, Tokyo Electric Power Company (TEPCO) implemented an HVDC network expansion for renewable energy transmission, which enhanced both energy security and nationwide power infrastructure. Furthermore, the rise in electricity demand and the rising focus on grid improvement support regional market growth.

North America is anticipated to witness the fastest growth in the market during the forecast period. This is due to substantial infrastructure projects and growing efforts toward renewable energy interconnection. The rising acceptance of HVDC technology for renewable energy integration in the region further supports market growth. In 2023, Hitachi Energy announced that it had been selected by Hydro-Québec for its high-voltage direct current (HVDC) technology for the transmission of electricity.

The high voltage direct current (HVDC) capacitor market is expanding rapidly due to the rising investments in renewable energy. As countries seek efficient transmission methods to deliver electricity over large distances, the demand for HVDC capacitors increases. Through HVDC technology, electricity travels long distances without substantial energy losses, allowing the connection of offshore wind farms with remote solar plants and enabling intercontinental power transmission. The rising initiatives to promote HVDC technology support market expansion.

| Report Coverage | Details |

| Market Size by 2034 | USD 29.47 Billion |

| Market Size in 2025 | USD 8.90 Billion |

| Market Size in 2024 | USD 7.79 Billion |

| Market Growth Rate from 2025 to 2034 | CAGR of 14.26% |

| Dominating Region | Asia Pacific |

| Fastest Growing Region | North America |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Product Type, Technology, Installation Type, Application, and Regions |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Rising Investments in HVDC Transmission Infrastructure

With the rapid shift toward renewable energy sources, investment in HVDC transmission infrastructure is increasing, which is a key factor driving the growth of the market. As the deployment of HVDC transmission systems continues to rise, the demand for high-performance capacitors increases. There is a high demand for efficient power transmission systems due to the rising electricity demand and growing concerns regarding power loss during transmission. As per the IEA report, the global electricity demand rose by 4.3% in 2024 as compared to the previous year, highlighting the need for efficient power transmission systems.

High Initial Investment

High upfront costs are anticipated to limit the adoption of HVDC systems, particularly in developing economies, which hinders the growth of the high voltage direct current (HVDC) capacitor market. HVDC infrastructure development requires substantial investments in converter stations, grid connections, and capacitor banks, which raises overall project expenses. This encourages the adoption of traditional AC transmission systems instead of investing in HVDC technologies. Moreover, manufacturing and deploying capacitors with high current and voltage ranges faces technical glitches that affect the potential for large-scale deployment, hindering market growth.

Focus on Grid Modernization

The rising focus on grid modernization creates immense opportunities in the high voltage direct current (HVDC) capacitor market. HVDC technology plays a crucial role in modernizing existing power grids. Several organizations are investing heavily in smart grid technologies, which creates lucrative growth opportunities for key players competing in the market. The worldwide grid investments reached approximately USD 300 billion in 2023, as advanced economies and China contributed to 80% of the total spending.

The International Energy Agency (IEA) warns that postponed investments in power grid infrastructure and reform lead to substantial carbon dioxide emissions that would obstruct energy transitions while damaging climate targets. The International Energy Agency emphasizes that utility companies must construct and upgrade 25 million kilometers of electricity grids by 2030 to handle renewable energy capacity growth since HVDC systems and their components, including capacitors, play a vital part in these objectives. Moreover, HVDC capacitors have become increasingly significant as they enhance power grid resilience and operational efficiency and serve to integrate renewable energy sources. Modernizing the existing grid with HVDC technology improves reliability and efficiency.

The plastic film capacitors segment led the high voltage direct current (HVDC) capacitor market with the largest share in 2024. These capacitors are widely used in HVDC systems because of their maximum energy-efficient performance, which plays a key role in energy dissipation reduction. Dielectric materials rooted in polypropylene films received improvements for better insulation abilities and heat tolerance, which expanded the capacitive voltage limits and operational efficiency. With the rise in renewable energy integration, the need for HVDC systems and plastic film capacitors has increased.

The ceramic capacitors segment is expected to grow at the fastest rate during the forecast period. These capacitors offer high stability and capacitive performance while maintaining integrity at elevated temperatures. The rising number of HVDC transmission projects for integrating renewable energy and strengthening grid interconnectivity further boosts the demand for ceramic capacitors. The development of ceramic materials became responsible for boosting the dielectric characteristics, which directly improves both capabilities and operational duration. Furthermore, the growing efforts in grid modernization and requirements for efficient long-distance power transmission influence the segment.

The line-commutated converter (LLC) segment held a considerable share of the market in 2024. HVDC transmission relies heavily on LCC technology as it provides enhanced capacity for lengthy power transmission applications. These systems use controlled firing and extinction angle operations to regulate active power transmission. LCC systems need reactive power support that amounts to 50-60% of their rated power, so AC side filters and capacitor banks must be extensive to fulfill this requirement.

The voltage-source converter (VSC) segment is anticipated to grow at the fastest rate over the studied period. The implementation of Insulated Gate Bipolar Transistor (IGBT) devices as fully controlled semiconductor components makes VSC technology an important development for HVDC systems. These converters give an immediate combined ability to manage active and reactive power, thereby strengthening power grid reliability while permitting weak networks to become integrated. The main grid benefits from this technology as it enables the successful connection of renewable power sources, including offshore wind farms. VSCs function without needing AC network commutation, as they eliminate commutation failures.

The open rack capacitor banks segment dominated the high voltage direct current (HVDC) capacitor market in 2024, owing to their improved design that provides protection to work in different indoor and outdoor setups, such as power generation plants, electrical substations, and cement factories. This installation is also suitable for chemical, iron, and steel manufacturing settings. Open rack capacitor banks improve power factor, transmission capacity, and grid stability and reduce network losses. The focus of industries on equipment dependability and operational lifetime boosted the demand for enclosed rack capacitor banks.

The pole-mounted capacitor banks segment is anticipated to grow at a significant rate in the coming years due to their simplicity in installation. Their versatile design makes them preferred for network power quality enhancement and voltage stability across distribution networks. Power companies heavily favor these capacitors, as they are installed or automated as a single integrated unit, which reduces both deployment and maintenance requirements.

Utilities adopted pole-mounted capacitor banks more frequently due to the rising power system decentralization needs and distribution network developments. According to the International Energy Agency, electricity usage worldwide increased by 2.4% in 2022, demonstrating the necessity of effective power distribution tools such as pole-mounted capacitor banks. Furthermore, the modernization of power distribution systems depends heavily on pole-mounted capacitor banks, fuelling the segment.

The energy and power segment held the largest share of the high voltage direct current (HVDC) capacitor market in 2024. This is mainly due to the continuous rise in the demand for electricity and grid-scale renewable energy integration. With the increasing power consumption, the need for efficient HVDC systems with advanced capacitors has increased for balancing power loads and keeping the grid stable. As per the IEA report, renewable energy capacity installations totaling approximately 3,700 GW will be added worldwide through 2028 as 130 countries endorse supporting policies. Furthermore, a strong focus on upgrading old power grid systems within developed regions through HVDC systems bolstered the segment.

The industrial segment is projected to grow at the fastest rate in the near future. The rising focus on improving industrial energy efficiency and reducing operation costs is prompting industries to adopt HVDC systems with high-performance capacitors. The advanced level of industrial automation and complex machinery requires trusted power sources that HVDC capacitors help create through their ability to manage voltage fluctuations while strengthening power quality.

By Product Type

By Technology

By Installation Type

By Application

By Region

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

March 2024

April 2025

November 2024

August 2024