August 2024

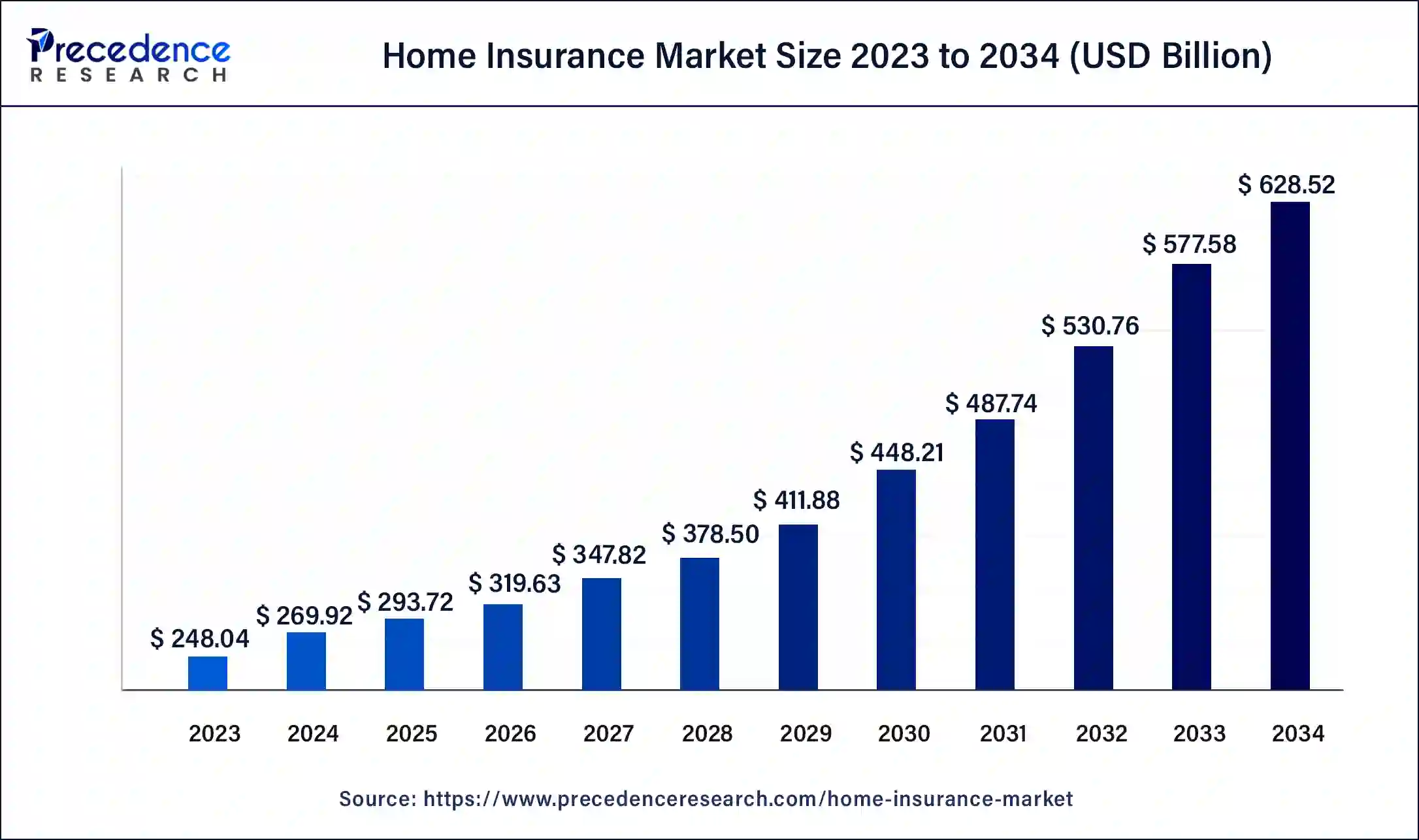

The global home insurance market size was estimated at USD 248.04 billion in 2023 and will hit from USD 269.92 billion in 2024 to approximately USD 628.52 billion by 2034. It is projected to grow at a CAGR of 8.82% from 2024 to 2034.

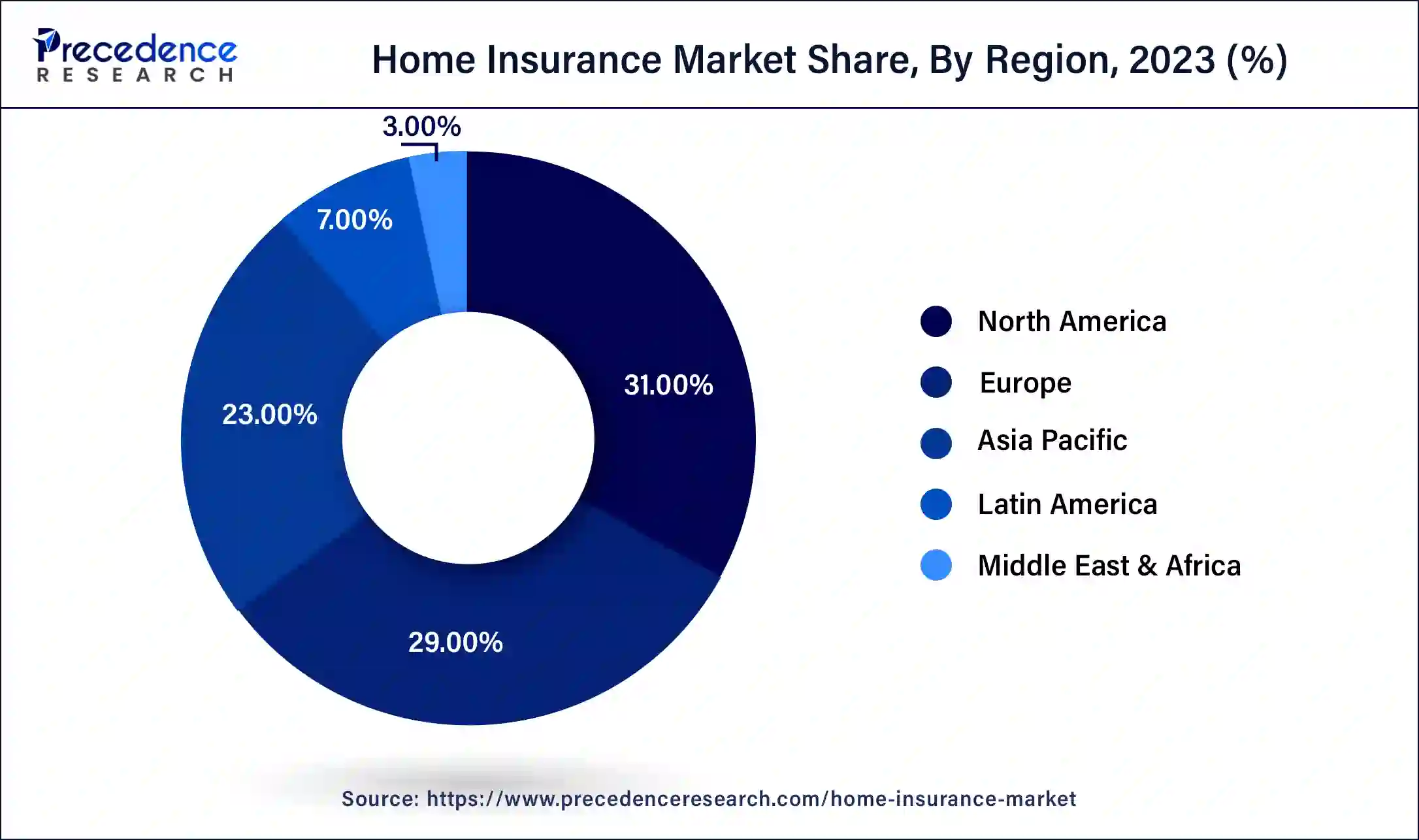

The global home insurance market size is projected to reach around USD 628.52 billion by 2034 increasing from USD 269.92 billion in 2024, at a CAGR of 8.82% between 2024 and 2034. The North America home insurance market size reached USD 197.98 billion in 2023. Increasing global population and rapid urbanization are leading to more home ownership. Globally, governments are also working to promote insurance knowledge, driving growth in the home insurance market.

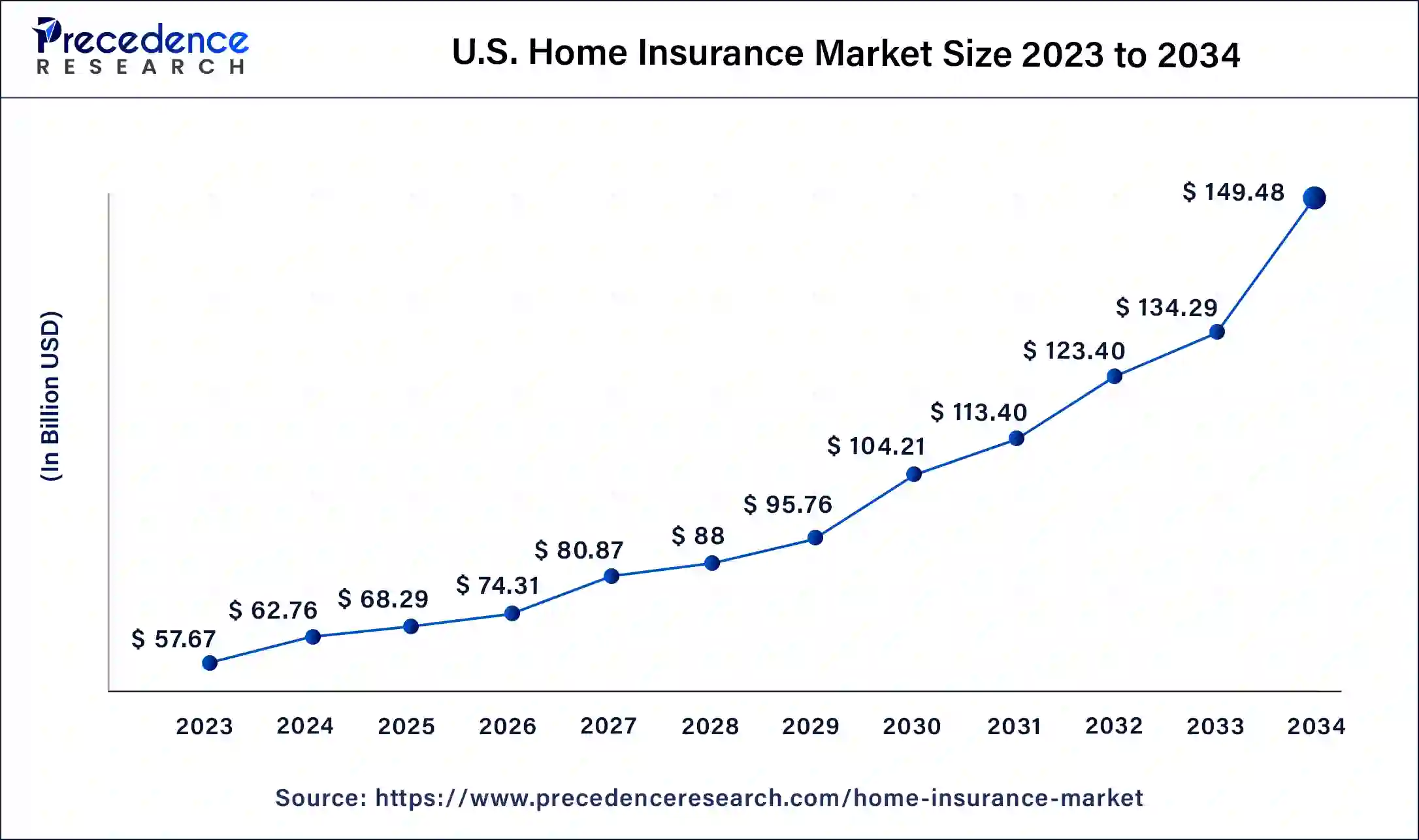

The U.S. home insurance market size was exhibited at USD 57.67 billion in 2023 and is projected to be worth around USD 149.48 billion by 2034, poised to grow at a CAGR of 9.04% from 2024 to 2034.

North America dominated the home insurance market in 2023. The market in the region has seen steady growth due to rising home ownership and the frequent occurrence of natural disasters. The insurance industry is highly established in the region, spilling over into the home insurance sector. Government regulation and mandatory insurance policy requirements in certain states in the United States have been a major contributor to growth. Technological advancements and increasing awareness around insurance products, along with robust distribution channels, are driving growth in the North American home insurance market. The U.S. market is also expected to grow significantly in the forecast period.

Asia Pacific is expected to grow significantly between 2024 and 2033. Rising disposable income and increasing awareness about insurance benefits are leading to more homeowners opting for home insurance policies. The integration of smart technologies and the rise of digital insurance platforms are making obtaining insurance easier than before. Economic prosperity in the region has led to an environment where individuals feel confident in making long-term financial commitments that come with owning property.

The European home insurance market is also set to see substantial growth in the forecast period. Many governments in the region are mandating insurance policies for homeowners. The robust regulatory frameworks and increasing adoption of smart home technologies, especially focused on sustainability, are driving growth in the region.

Homeowners insurance is a type of property insurance that covers damages and losses to your home. It covers damage to any furnishings, fittings, and other assets in the home. Home insurance also covers liability against accidents or injuries that take place on the property but does come with a liability limit. Phenomena such as earthquakes and floods are typically not covered by home insurance policies since they are classified as ‘Acts of God.’ If the property is in an area prone to natural disasters, homeowners need special coverage. Home insurance is not the same as warranty or mortgage insurance.

The home insurance market is growing due to a rise in per capita disposable income worldwide and growing urbanization. Homeownership rates have gone up significantly. As a result, driving the demand for homeowners’ insurance. Economic downturns are one of the major restrictions on the market. Financial instability causes homeowners to cut down on discretionary spending and prioritize other expenses over insurance coverage. The integration of new technologies like AI, big data, blockchain, data analytics, and geolocation are innovative opportunities for future growth in the home insurance market.

| Report Coverage | Details |

| Market Size by 2034 | USD 628.52 Billion |

| Market Size in 2023 | USD 248.04 Billion |

| Market Size in 2024 | USD 269.92 Billion |

| Market Growth Rate from 2024 to 2034 | CAGR of 8.82% |

| Largest Market | North America |

| Base Year | 2023 |

| Forecast Period | 2024 to 2034 |

| Segments Covered | Coverage, Distribution Channel, End Use, and Regions |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Climate change and the need for mandatory home insurance

Climate change and the rise of global natural disasters have prompted many homeowners to increasingly opt for home insurance. The increasing incidences of floods, earthquakes, landslides, and other natural disasters are driving homeowners to take up insurance policies to protect against such losses. Rapid urbanization and industrialization have substantially driven up demand for home ownership, especially in Asia Pacific. As home ownership grows, so does the need for insurance protection. In many developed countries, banks require compulsory residential insurance as part of their mortgage lending contracts. This boosts the demand for residential insurance.

Lack of consumer awareness around home insurance policies

One of the major restraints to the home insurance market is the lack of awareness and understanding of home insurance coverage. Many consumers are unaware of the ambit of home insurance and misunderstand premium rate calculations. There are also rising incidences of fraudulent claims. This increases overall costs for insurance companies and leads to higher premiums for policyholders. This has led to companies adding stricter underwriting and verification processes, which makes it difficult for potential policyholders to purchase homeowners’ insurance. These factors are limiting growth in the home insurance market.

The advent of AI and geolocation

There are several opportunities for growth in the home insurance market due to the advent of artificial intelligence and related technologies. High smartphone penetration and the rising use of application program interfaces have made property insurance more accessible to underinsured populations. Big data analytics and geolocation programs make the calculation of premiums easier than before. The digital transformation of the home insurance industry also helps businesses cater to individual customer needs.

An essential task for insurance businesses is risk assessment. Big data enables businesses to examine vast amounts of historical and current data to get meaningful insights into risk factors from socioeconomic indicators, demographic data, geographic data, and data from the Internet of Things devices. Insurance companies can create precise prediction models with the help of these insights. Using the collected data, machine learning algorithms can also be used to develop more precise predictive models for fraud detection, identity theft, and claim probability. In the end, these more sophisticated tools for risk assessment will help both the insured and the insurer by reducing losses.

Based on coverage, the comprehensive coverage segment dominated the home insurance market in 2023. Comprehensive coverage policies insure against a broad spectrum of potential losses, including belongings in the home that may be damaged or stolen. Protection is also extended to natural disasters, fire, vandalism, and more. Comprehensive policies cover everything by default, with the exception of those few that are specifically excluded. This broad coverage makes it a popular option for policyholders.

The dwelling coverage segment is expected to grow the fastest between the forecast period of 2024 and 2033. Rising disposable income has not only led to higher ownership rates for residents but has also led consumers to look at home ownership as an investment. Dwelling coverage usually includes the home's walls, roof, floors, built-in appliances, furnishings, and permanent fixtures attached to the home. However, there are some exceptions, as this type of insurance does not cover personal possessions, pets, or anything not attached to the home, such as a shed or pool. Property valuations, construction and replacement costs, and location-associated risks have driven growth in the dwelling coverage segment.

Content coverage is also a growing segment in the home insurance market. This type of insurance offers financial compensation for damage to stand-alone goods and is suitable for tenants who move in furnishings and other appliances. Content insurance offers compensation for damage or theft of personal property.

The brokers segment held the largest share of the home insurance market in 2023. Brokers provide tailored advice and customized insurance policy solutions. They are able to educate the masses about insurance coverage and help them navigate the complex landscape of insurance policies. As a result, broker-mediated insurance services have seen substantial demand in the past decade.

The tied agents and branches segment is set to see the fastest growth between 2024 and 2033. Tied agents tend to have established connections in local communities and are seen as trusted sources of information regarding the insurance market. This puts them in a unique position to advise homeowners regarding which policy they should opt for and why. Tied agents and branches are backed by big players in the insurance market, providing them with adequate resources to educate consumers and support the sale of home insurance policies.

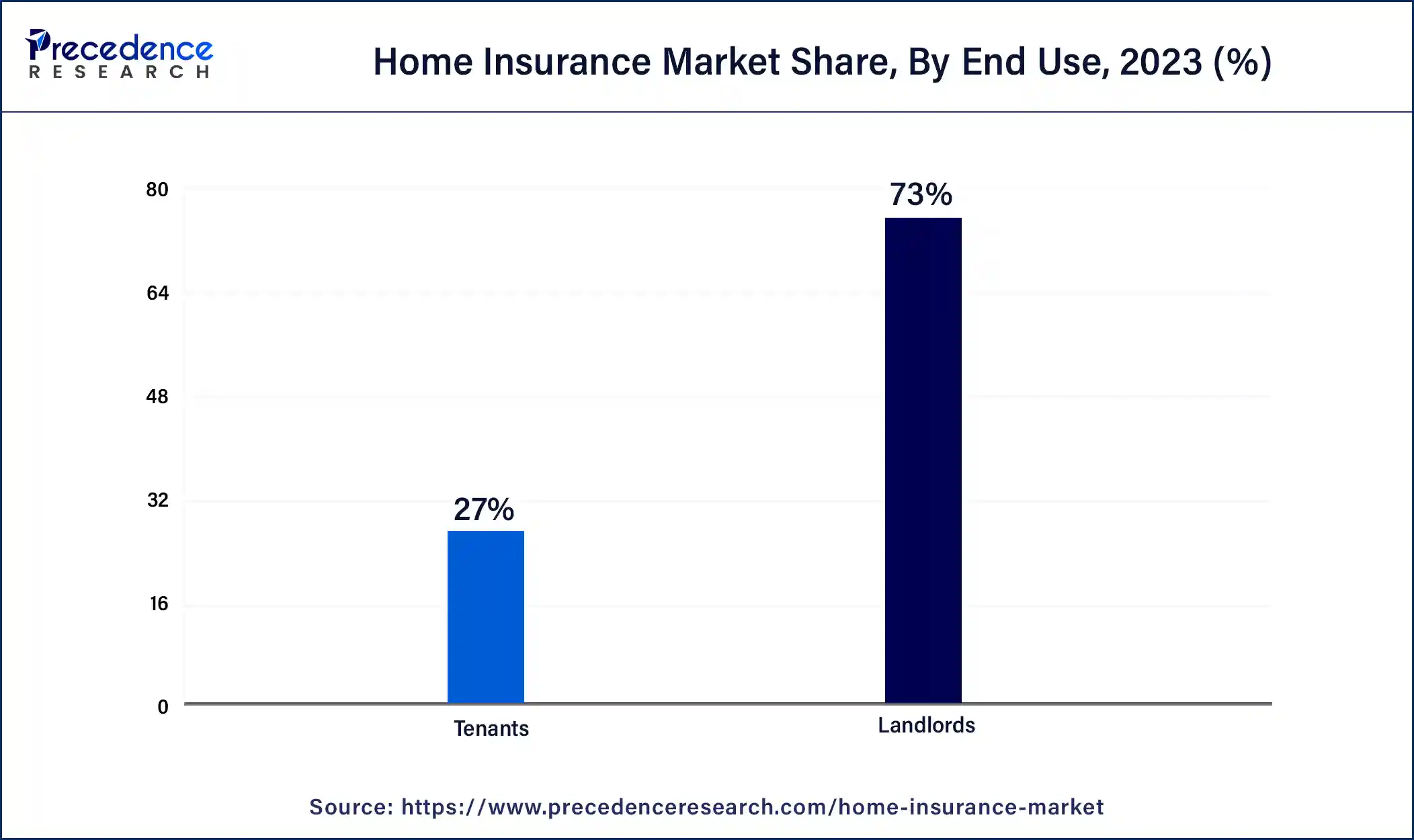

The landlords segment held the largest share of the home insurance market in 2023. Rapid urbanization and the development of new residential properties have led to a rise in consumers buying and renting houses globally. A rise in property leasing has led many landlords to opt for comprehensive home insurance policies to protect against damages, fire, and theft facing tenants in their properties. Landlord insurance generally covers the physical structure of the property and provides liability protection for landlords in cases of injury to tenants and property damage.

The tenants segment is expected to be the fastest growing in the period between 2024 and 2033. Consumers are increasingly opting for rental arrangements in cities where high costs of living delay home ownership. The rising cost of living is also making the cost of home ownership prohibitively high. In these cases, several city dwellers are turning to renting instead of buying property. There is an increasing awareness of insurance policies and the need for liability coverage, leading to rising demand in this segment.

Segments Covered in the Report

By Coverage

By Distribution Channel

By End Use

By Geography

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

August 2024

November 2024

January 2025

September 2024