December 2024

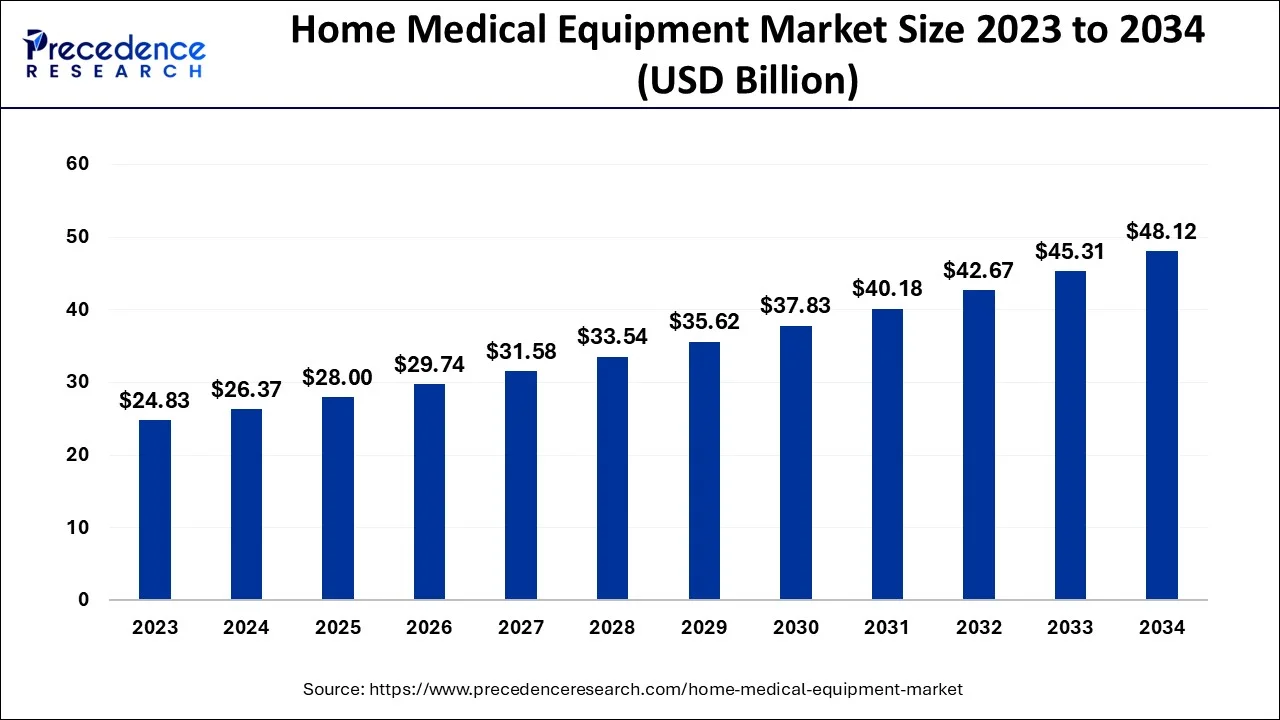

The global home medical equipment market size accounted for USD 26.37 billion in 2024, grew to USD 28 billion in 2025 and is predicted to surpass around USD 48.12 billion by 2034, representing a healthy CAGR of 6.20% between 2024 and 2034. The North America home medical equipment market size is calculated at USD 11.08 billion in 2024 and is expected to grow at a fastest CAGR of 6.31% during the forecast year.

The global home medical equipment market size is accounted for USD 26.37 billion in 2024 and is anticipated to reach around USD 48.12 billion by 2034, growing at a CAGR of 6.20% from 2024 to 2034.

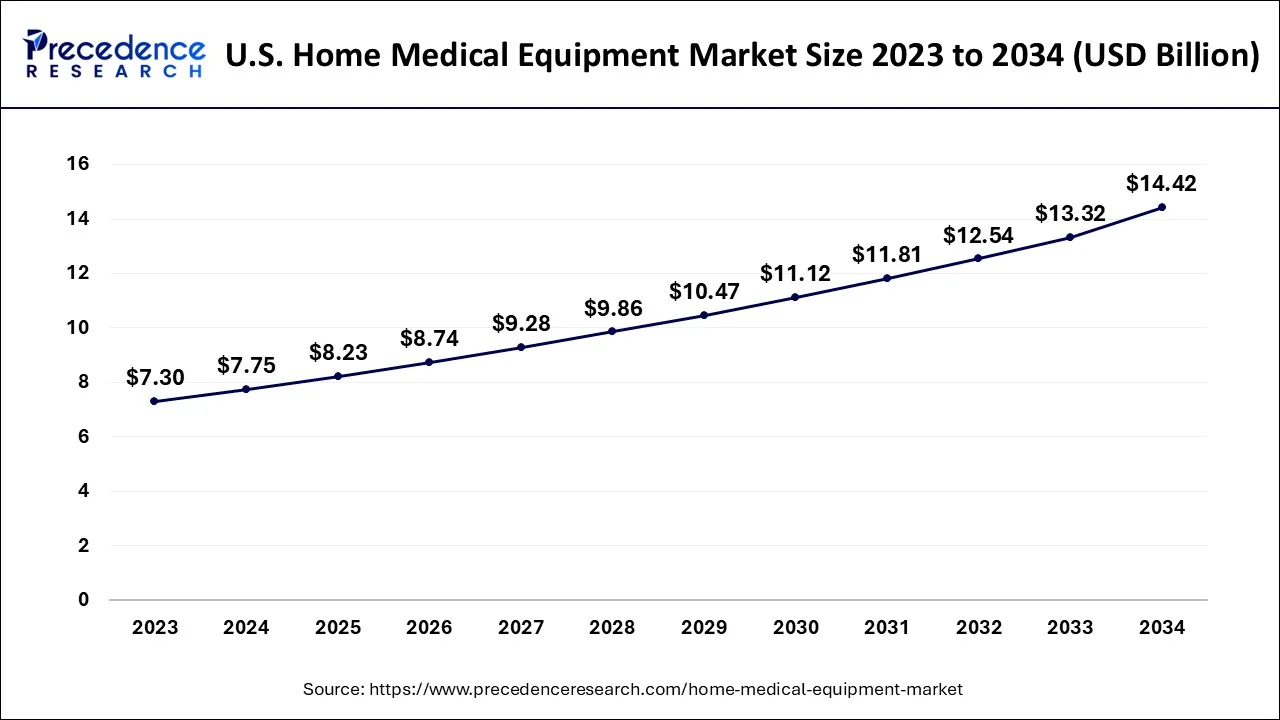

The U.S. home medical equipment market size is evaluated at USD 7.75 billion in 2024 and is predicted to be worth around USD 14.42 billion by 2034, rising at a CAGR of 6.38% from 2024 to 2034.

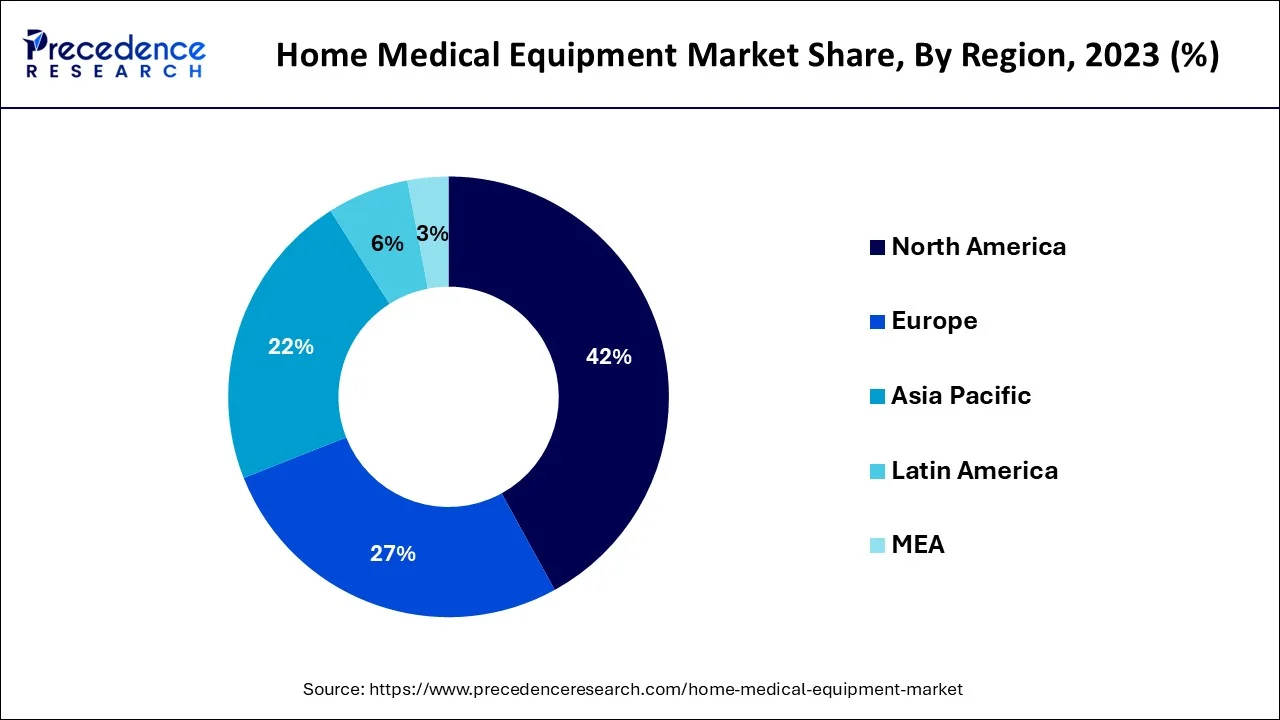

Based on region, North America dominated the global home medical equipment market in 2023, in terms of revenue and is estimated to sustain its dominance during the forecast period. North America is characterized by increased healthcare expenditure, high disposable income, a rapidly rising geriatric population, and an increasing prevalence of various chronic diseases among the population. All these factors are the significant market drivers of the North American home medical equipment market. Furthermore, the increased awareness regarding hospital-acquired infection in developed markets like the US and Canada is fueling the demand for home healthcare services, which augmented the demand for home medical equipment.

On the other hand, Asia Pacific is estimated to be the most opportunistic market during the forecast period. The Asia Pacific is home to around 4.4 billion people and the rising prevalence of chronic diseases, growing cases of road traffic accidents, and rising geriatric population in this region are the prominent factors that can be held responsible for the growth of home medical equipment in the upcoming future. According to the WHO, around 80% of geriatric people will be living in low and middle-income countries. Furthermore, the rising government investments in the development of healthcare infrastructure are improving the access to healthcare services, which is expected to have a positive impact on the market in the forthcoming years.

The global home medical equipment market is primarily spurred by the rising burden of chronic illnesses and the growing geriatric population across the globe. According to the International Diabetes Federation, the global diabetic population is estimated to reach 700 million by 2045. As per the WHO, around 262 million people were suffering from asthma and over 65 million people were suffering from COPD in 2019. The rising cases of cancer are another major factor that drives the market significantly as cancer survivors need to be regularly monitored. Furthermore, the global geriatric population is estimated to reach around 2 billion by 2050, as per the United Nations. Old-age people are the major demand drivers of home medical equipment. The convenience associated with acquiring treatment at home is a major factor that drives the demand for the home medical equipment market across the globe.

The rising prevalence of hospital-acquired infections and raising awareness about it is fueling the demand for home medical equipment across the globe. According to the WHO, around 7% of hospitalized patients in developed nations and 10% of patients in developing nations have the chance of getting infected with hospital-acquired infections. Moreover, in high-income countries, around 30% of ICU patients get affected by at least one hospital-acquired infection. Therefore, the rising awareness among people regarding hospital-acquired infection encourages them to acquire treatment at home, which in turn fuels the growth of the global home medical equipment market. Furthermore, the rising popularity of self-health management is positively impacting the market growth. Various organizations like the World Health Organization (WHO), the Center’s Chronic Disease Self-Management Program (CDSMP), the National Council of Aging (NCOA), and the Global Self-Care Federation (GSCF) promote self-health management amongst the population by providing appropriate guidelines and assistance.

The recent outbreak of the COVID-19 pandemic positively impacted the home medical equipment market in 2020. The demand for home healthcare services increased as people were restricted to stay in their homes and the fear of getting infected by the COVID-19 disease compelled the people to adopt healthcare services at home that boosting the demand for home medical equipment.

| Report Coverage | Details |

| Market Size in 2024 | USD 26.37 Billion |

| Market Size by 2034 | USD 48.12 Billion |

| Growth Rate from 2024 to 2034 | CAGR of 6.20% |

| Base Year | 2023 |

| Forecast Period | 2024 to 2034 |

| Segments Covered | Equipment Type, Distribution Channel, End Users, and Geography |

The growth of technology for self-health management, aimed to relieve financial strains on traditional healthcare systems, has increased the consumption of home medical equipment. People with chronic conditions utilize home medical equipment to get help managing their health, control their own health, and help others with healthcare. Chronic disorders such as high blood pressure and osteoporosis, which require lifetime medical care, are most suitable for cost-effective home healthcare solutions. These medical care solutions, on the other hand, must be both safe and convenient. In these situations, home medical equipment is the best alternative, and it is driving the industry.

Individuals dealing with a chronic condition, recuperating from surgery, or being treated for an infection may find that in-home care is a better alternative than hospitalization. As a result of these circumstances, there has been a continuous increase in the demand for home medical equipment over hospital or other healthcare organization medical services. Increased demand for home medical devices is driven by rising treatment and procedure expenses in hospitals and clinics.

This industry is growing in prominence, particularly in industrialized nations such as the United States and Europe. For example, respiratory therapy (RT) is a home care service that assesses and treats breathing illnesses such as asthma, bronchitis, and chronic obstructive pulmonary disease (COPD). In emerging nations like India and China, the industry is still in its infancy, but it is predicted to represent the future of the home medical equipment business. Due to a huge target audience and the growing senior population, developing destinations might serve as potential centers for producers of home medical equipment.

To get high-quality diagnosis and treatment, using home medical devices need specialized knowledge. There has been evidence of a dearth of expertise on how to operate medical equipment in a homecare setting, which might be a major stumbling block to market growth. Even though the global frequency of chronic illnesses is rising, there is a significant disparity between the availability of knowledge and the number of patients. As a result, professionals handling and coordinating medical equipment in homecare settings are in greater demand. The lack of competence in accessing medical equipment according to standards, on the other hand, might stifle the growth of home medical equipment.

Covid-19 Impact

The COVID-19 pandemic has had a favorable influence on the home medical equipment market. Since the outbreak of the pandemic increased, the need for home medical equipment such as life-supporting and life-sustaining devices. During the COVID-19 pandemic, the disruptions in traditional production, supply, and distribution systems resulted in significant medical supply shortages. As a result, government authorities are taking steps to address the interruption of the medical equipment supply chain.

For example, the United States Food and Drug Administration (USFDA) announced in 2020 that it is monitoring the medical device supply chain and is working closely with manufacturers to analyze the potential of interruptions in order to fulfill the increased demand for medical equipment for patients. In addition, in response to the COVID-19 pandemic, the Pan American Health Organization (PAHO) has produced a list of priority medical devices, which includes a continuous positive airway pressure (CPAP) machine, a vital monitor, and a pulse oximeter. Furthermore, the World Health Organization (WHO) issued a list of priority medical devices for managing cardiovascular diseases and diabetes in June 2021 to assist governments worldwide in growing the medical equipment available to enhance healthcare. During the current pandemic, such initiatives are driving the use of medical equipment at home.

Based on the equipment type, the therapeutic equipment segment dominated the global home medical equipment market in 2023, in terms of revenue and is estimated to sustain its dominance during the forecast period. This is mainly due to the rising prevalence of chronic respiratory diseases and increased demand for oxygen delivery equipment in the home healthcare setting. The rising disposable income, rising healthcare expenditure, and demand for quality and convenient healthcare services are fueling the growth of this segment.

On the other hand, patient monitoring equipment is estimated to be the most opportunistic segment during the forecast period. The need for continuous monitoring of the health and mental conditions of the patient is rising. The rising prevalence of cardiovascular disorders, sleep disorders, and diabetes is a significant contributor to the growth of patient monitoring equipment. The most widely used patient monitoring equipment at home includes blood pressure monitors, diabetes monitors, heart rate monitors, and Holter monitors.

Based on the distribution channel, the retail medical stores segment dominated the global home medical equipment market in 2023, in terms of revenue and is estimated to sustain its dominance during the forecast period. This is attributable to the increased penetration and higher preferences for retail medical stores across the globe. Retail medical stores are the traditional and the most popular channels that supply home medical equipment.

On the other hand, online retailers are expected to be the fastest-growing segment during the forecast period. The rising adoption of the internet and growing penetration of online retail stores are fueling the growth of this segment. Moreover, the easy payments, home delivery, and easy return and replacements offered by online retailers are expected to foster the growth of this segment during the forecast period.

Key Companies & Market Share Insights

The market is moderately fragmented with the presence of several local companies. These market players are striving to gain higher market share by adopting strategies, such as investments, partnerships, and acquisitions & mergers. Companies are also spending on the development of improved products. Moreover, they are also focusing on maintaining competitive pricing.

In March 2020, Invacare Corporation introduced AVIVA FX Power Wheelchair, a new brand of power wheelchairs that provides mobility solutions at home.

The various developmental strategies like new product launches, collaborations, acquisitions, and mergers foster market growth and offer lucrative growth opportunities to the market players.

By Equipment Type

By Distribution Channel

By End Users

By Geography

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

December 2024

August 2024

February 2025

January 2025