January 2025

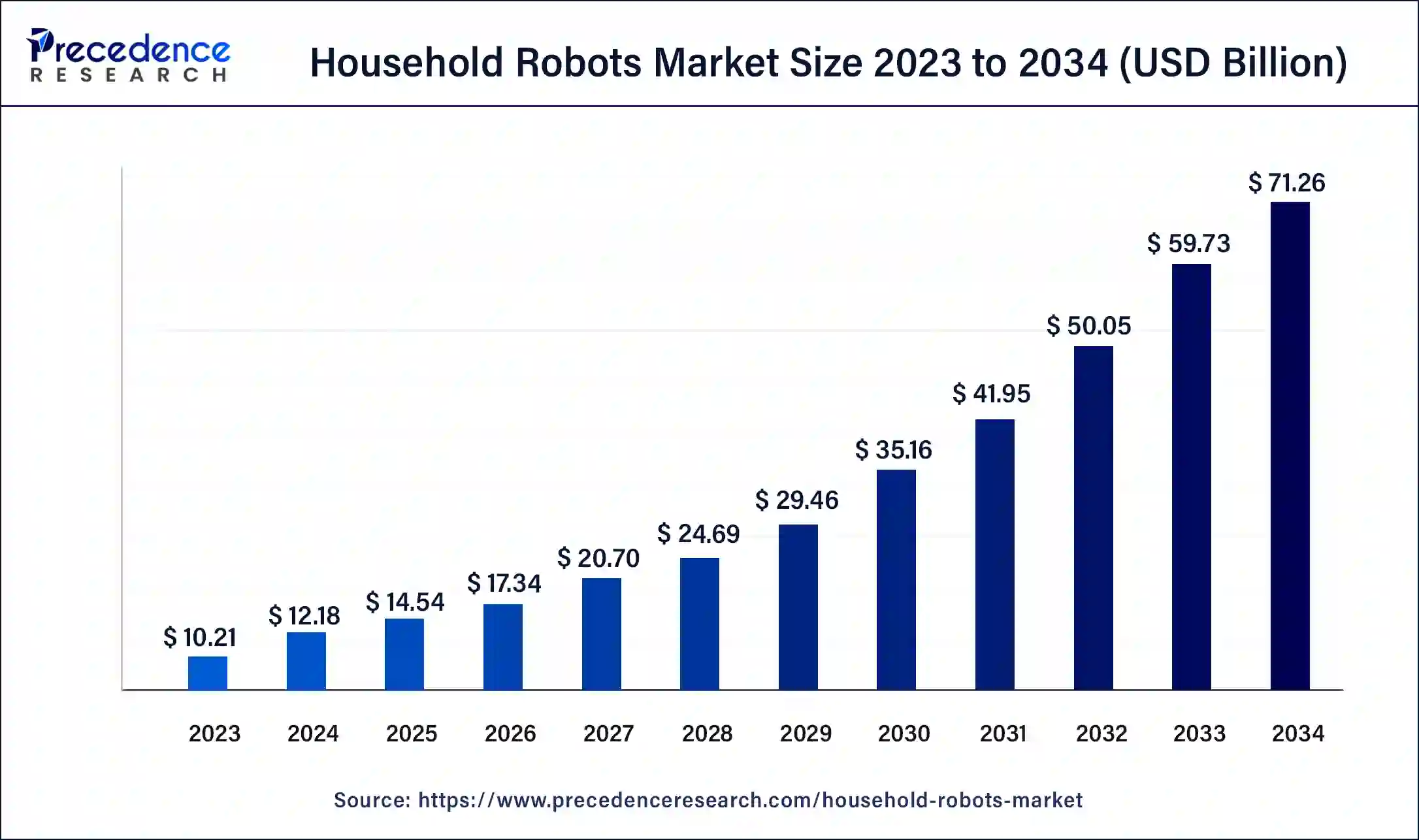

The global household robots market size was USD 10.21 billion in 2023, calculated at USD 12.18 billion in 2024 and is expected to be worth around USD 71.26 billion by 2034. The market is slated to expand at 19.32% CAGR from 2024 to 2034.

The global household robots market size is worth around USD 12.18 billion in 2024 and is anticipated to reach around USD 71.26 billion by 2034, growing at a CAGR of 19.32% over the forecast period 2024 to 2034. The household robots market growth is due to the increasing elderly population, integration of smart home technology and innovations that improves the consumers' interest.

Robots such as vacuum cleaners, lawnmowers, and window cleaners automate tasks. This automation leads to reduced working time for individuals and families to engage in more enjoyable or productive activities, enhancing the quality of life. The most common kind of home robot is the cleaning robot. These devices autonomously navigate through the home to provide cleaning services for floors without any obstruction.

The diverse roles that robots can play in different areas of the house

| Robot vacuums and mops | Robotic vacuum cleaners were first introduced in this category, followed by other cleaning robot such as window, grill and pool robot cleaners. |

| Security and surveillance | The high-tech cameras and sensors of security and surveillance robots monitor activities inside and around the house, offering the homeowners with peace of mind. |

| Entertainment and companionship | Social and companion robots revolutionize the way consumers interact and entertain. With innovative AI technology, these robots are able to engage in conversations, play games, tell jokes, and also assist with daily tasks. |

| Healthcare and personal well-being | From reminding users to take medication and monitoring vital signs to providing exercise guidance, they are a convenient and smart way to keep track of well-being in general. |

| Grill and gardening robot | For outdoor tasks, grill and garden robots can help keep up with maintenance. Gardening robots can automate tasks such as weeding gardens, mowing lawns, and cleaning patios. On the other hand, after the barbecue party, grill robot cleaners can clean, scrub, and scrap the grill grate, saving time and energy. |

| Pool cleaner robot | Pool cleaning can be labor-intensive and time-consuming. Therefore, many people have turned to pool cleaner robots. |

| Education robot | Unlike traditional teaching methods, they can tailor the content based on the child’s capability, and offer a range of activities, games and challenges that captivate young minds. |

AI Impact on the household robots market

Artificial intelligence (AI) integration with the household robot enhances the working efficiency, accuracy, and quality of the product. Most home AI-enabled robots interact with smart home systems via wireless networks such as Wi-Fi and Bluetooth. They are portable and can be operated through applications or voice and control other smart-based devices, including lights, thermostats, and security cameras, among others. Some examples of household robots are iRobot Roomba, which helps with cleaning; Amazon Alexa, which is a voice-activated personal assistant; and Ring's Always Home Cam, which is used for security.

| Report Coverage | Details |

| Market Size by 2034 | USD 71.26 Billion |

| Market Size in 2024 | USD 12.18 Billion |

| Market Growth Rate from 2024 to 2034 | CAGR of 19.32% |

| Largest Market | Asia Pacific |

| Base Year | 2023 |

| Forecast Period | 2024 to 2034 |

| Segments Covered | Component, Type, Distribution Channel, Application, and Regions |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America and Middle East & Africa |

Incorporation of smart home systems

Smart robots are specifically designed and programmed to interact intelligently with their environment, including humans. They use advanced technologies such as artificial intelligence, machine learning, and natural language processing (NLP) to learn and adapt to new situations. Security systems with the use of automation and robotics, and smart home systems have been integrated into home security as well and operations have transformed home automation or domestic and housework assisting solutions.

A smart home setup to control home heating, ventilation, air conditioning, lighting systems, entertainment appliances, and pro lucrative security systems including alarms, locks, sensors, etc. Exploiting Wi-Fi technology, home automation creates a network of smart electronic products within a home environment powered by Artificial Intelligence.

Rising aging population

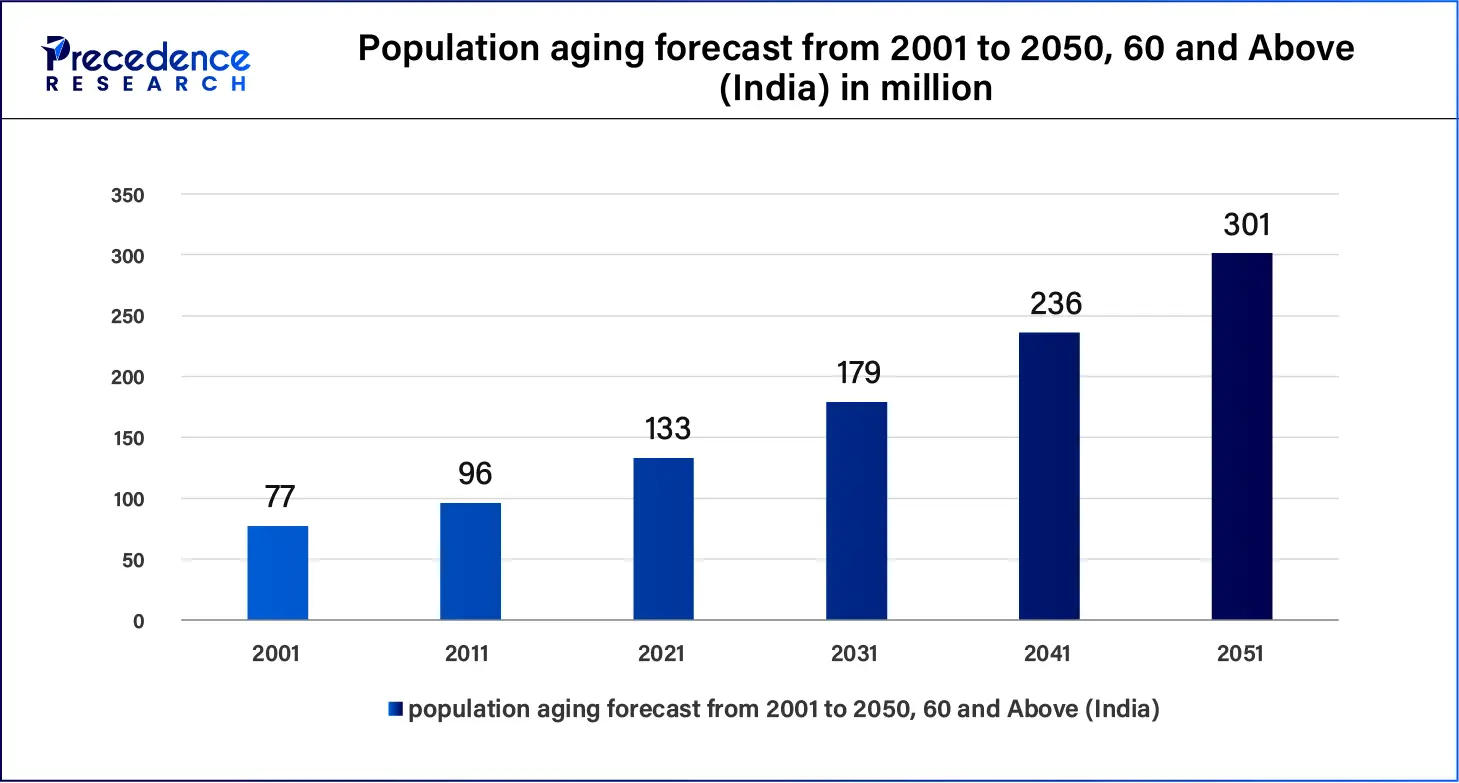

It is projected that more than 12% of the United States population will be aged 65 years and above in the year 2030. Technologies like robots make it possible to get help for older people with the problems that accompany aging. Human-sized mobile manipulators, especially robots, can successfully exist in the home environment and help elderly people. The population of the elderly is projected to rise. The geriatric population can face challenges in doing their daily activities. Mobile manipulators help older adults in performing daily tasks that help them to live in their homes.

High maintenance cost

The expenses such as purchasing, installing, and configuring the robot are expensive, with additional costs for maintenance and repairs. That hinders the growth of the market. Also, rising research and development costs are associated with the household robots market. The increased capital spent on technology by different organizations witnessed growth in the use of artificial intelligence, machine learning, and robotics.

Increased research and development

With the increasing research and development expenditures, there is an opportunity for the household robots market. Rising innovation through research and development offers the market a great chance for development. Several potential advantages are associated with the utilization of specific features, such as energy efficiency or improved compatibility with smart home systems to increase usage. Moreover, growth in safety and reliability will also mitigate the concerns of the users about relying on such services provided by the robots.

The hardware segment accounted for the largest share of the global household robots market in 2023. The growing trend has generated various product lines for household robots. Household robots include smart vacuums, social and companion robots, security robots, robot window cleaners, and educational robots. Increasing production of household robots that improve user experience and convenience by integrating smoothly with current smart home ecosystems. The acceptance of products such as robotic vacuums, as well as the increasing consumer awareness and adoption of indoor and outdoor smart home appliances.

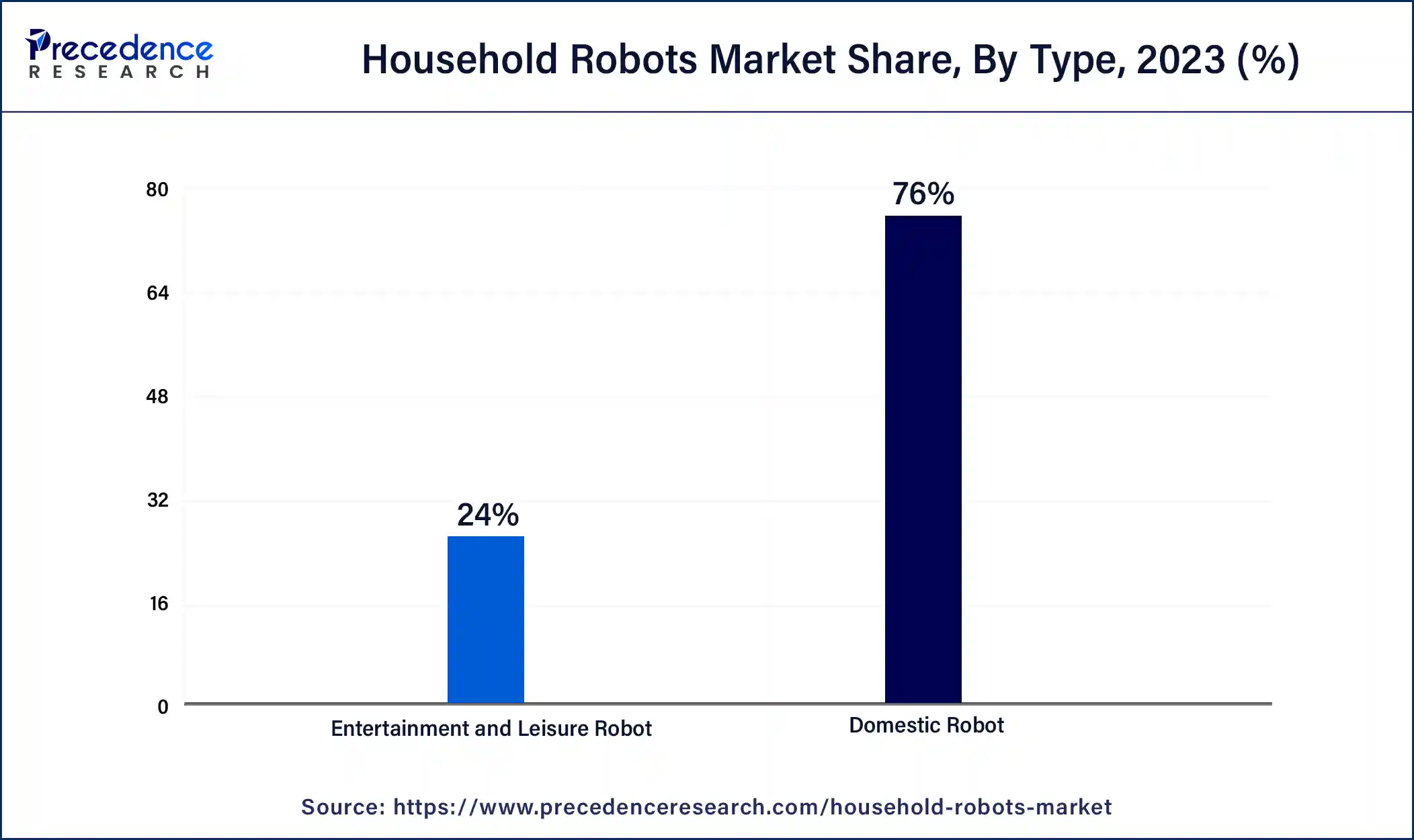

The domestic robots segment accounted for the largest share of the household robots market in 2023. A domestic robot or Homebot is a category of a service robot that is generally employed to perform household tasks, though it can also have education, entertainment, or therapeutic purposes. The households' robots were involved in the cleaning of floors and pools, gardening, security and surveillance, companionship, health care, and education, among others. Domestic robots are designed to elevate the daily living experience. From automated lawnmowers and pool cleaners to advanced pet care devices and smart home gadgets.

The entertainment & leisure robots segment will register the fastest growth in the household robots market during the foreseeable period. An entertainment robot is designed for the sole subjective pleasure of humans rather than utilitarian use in production or domestic services. Robotic technologies co-exist in many segments of culture and entertainment. Leisure is going to receive a new boost from robots. With innovative AI technology, these robots can engage in conversations, play games, tell jokes, and also assist with daily tasks. Social and companion robots revolutionize the way they interact and entertain.

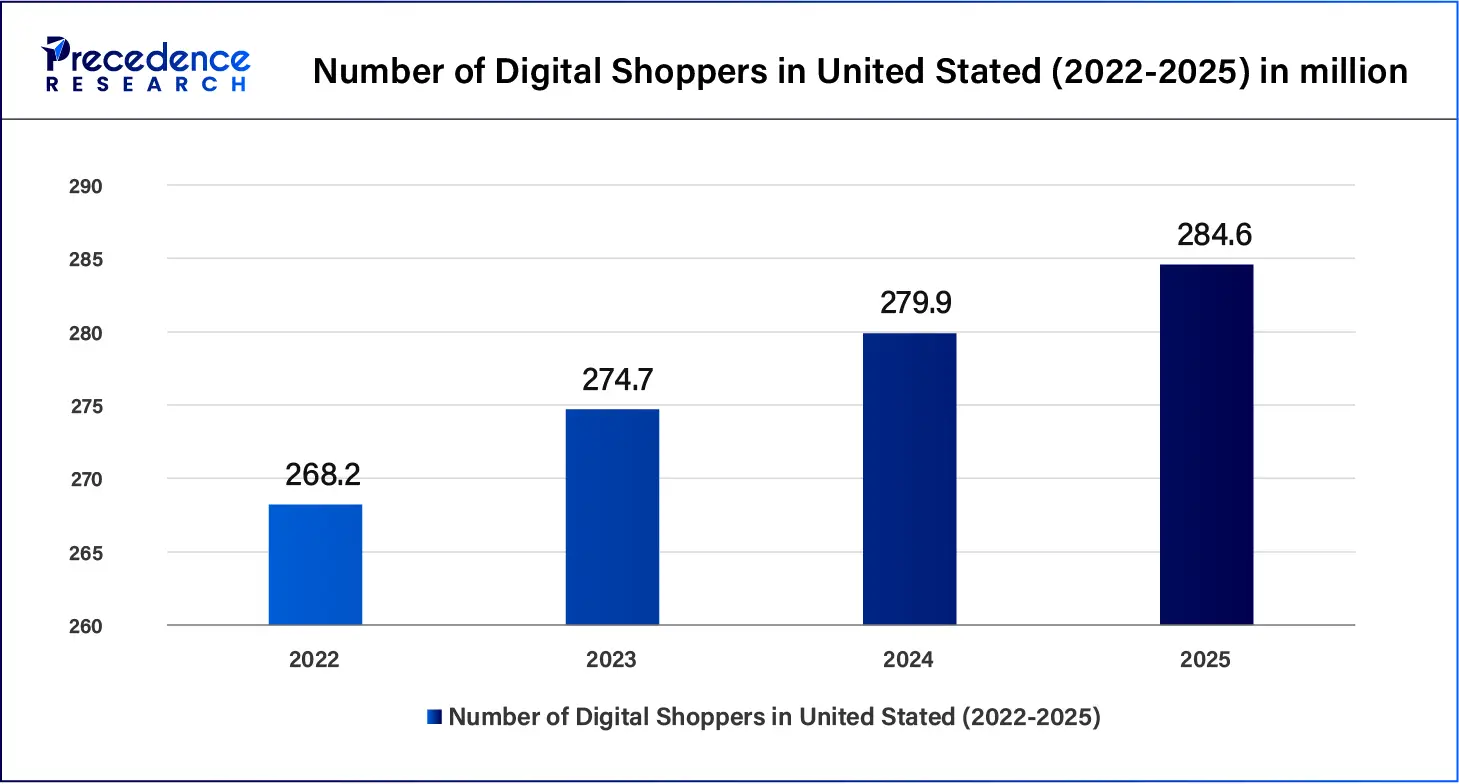

The online channel segment dominated the global household robots market in 2023. Increase in the sales of household robots through the online platform because of the closure of retail shops and shopping marts during the pandemic. Online channels have relatively less overhead costs as compared to offline channels and are inexpensive to install and maintain. 24/7 access, customers can purchase from anywhere at their convenience.

The retail stores segment is expected to grow significantly in the household robots market during the forecast period. Offline communication can help build trust, rapport, and empathy with interlocutors as they see their expressions, gestures, and emotions. This instant satisfaction can be appealing, especially for urgent or last-minute needs. The physical stores allow the firms to provide customer services face-to-face.

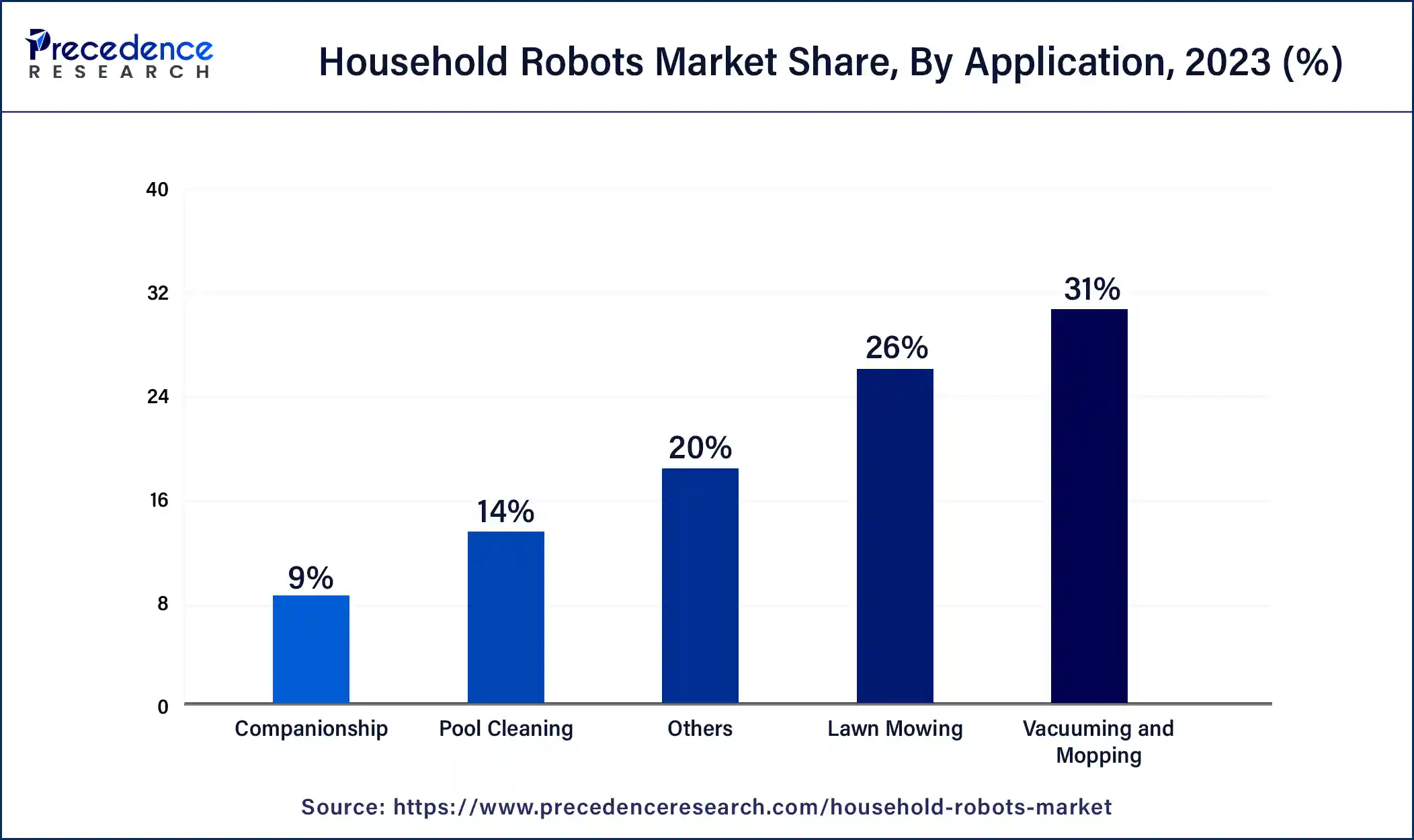

The vacuuming & mopping segment held the biggest share of the household robots market in 2023. The growth in sales of vacuum robots is due to their self-operating and self-sufficient character due to the hectic demand, which boosted the market. A type of robotic vacuum cleaner for the home that is capable of vacuum floor cleaning along with sensors and robotic drives that are equipped with programmable controllers and cleaning cycles.

The pool cleaning segment is expected to grow significantly in the household robots market during the forecast period. Robotic pool cleaners are small, wheeled machines that crawl along the surface of the pool and automatically clean it. There is a range of pool cleaners on the market, but the best ones are robotic ones. It cleans the pool better and faster and they are easier to manage. In addition, they consume less power and chemicals, hence cutting production costs.

Asia Pacific held the largest share of the household robots market in 2023. The advancement of new technology, increase of disposable income, and the growing inclination of people towards innovation. A rising elderly population is a significant driver of the household robot' demand.

The increasing necessity of cleaning houses, security, or even monitoring them through home automation systems in China, Japan, India, and South Korea has further fuelled the demand of the market. The growth in urbanization is also expected to grow the market for cleaning robots for vacuuming and mopping.

North America is expected to showcase notable growth in the household robots market in the upcoming period. The growth is due to the increasing desire of people to be more convenient by the use of robots. Smart home automation is adopting robotic services to help ease standard chores, security, and elder care, among others. Additionally, an increasing knowledge of environmental issues is forcing manufacturers to create energy-saving goods.

The high technology literacy level and high disposable income in regions like the United States and Canada also support the implementation of robotic applications. Thus, the pressures for innovation are mounting as firms seek to shield themselves and move for a larger share of this growing global market.

Segments Covered in the Report

By Component

By Type

By Distribution Channel

By Application

By Geography

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

January 2025

October 2024

November 2024

July 2024