February 2025

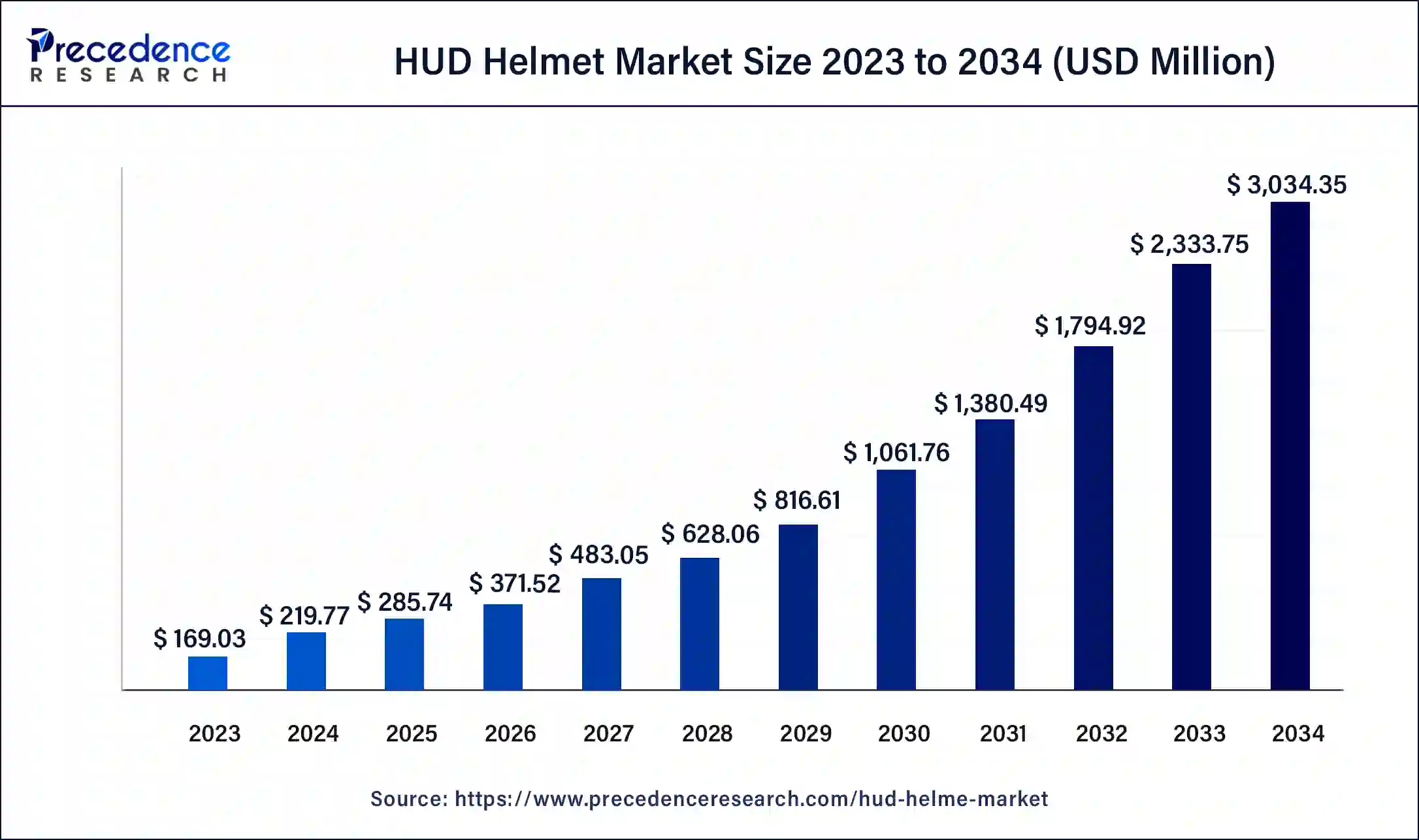

The global HUD helmet market size surpassed USD 169.03 million in 2023 and is estimated to increase from USD 219.77 million in 2024 to approximately USD 3034.35 million by 2034. It is projected to grow at a CAGR of 30.02% from 2024 to 2034.

The global HUD helmet market size is projected to reach around USD 3,034.35 million by 2034 from USD 219.77 million in 2024, at a CAGR of 30.02% from 2024 to 2034. Technological advancements in wearable technology and advances in AR and IoT are spurring growth in the HUD helmet market.

HUD helmets are traditional helmets equipped with head-up display technology to show information. HUD helmets display the information on the glass at which the user is looking without obstructing their view beyond the helmet. HUD helmets were first widely adopted in the military to allow fighter pilots access to crucial information at all times. Today, HUD helmets have more domestic applications and are used by motorcycle racing enthusiasts. The helmets integrate navigation, communication, action cameras, and music apps on a single device or through interconnected devices.

Technological innovations in heads-up display technology and the rise of augmented reality are driving growth in the HUD helmet market. Innovations in HUD have helped reduce the size of devices, making them less bulky and thus easier to mount on a number of helmet types. These advancements have also enabled the addition of new features such as Bluetooth and WLAN connectivity and safety.

Safety concerns around the distractibility of these devices and data privacy concerns around helmets are restricting growth in the HUD helmet market. However, with the rising popularity of smart wearables, opportunities such as the integration of AI agents and IoT technologies will boost growth in the market.

| Report Coverage | Details |

| Market Size by 2034 | USD 3,034.35 Million |

| Market Size in 2023 | USD 169.03 Million |

| Market Size in 2024 | USD 219.77 Million |

| Market Growth Rate from 2024 to 2034 | CAGR of 30.02% |

| Largest Market | Asia Pacific |

| Base Year | 2023 |

| Forecast Period | 2024 to 2034 |

| Segments Covered | Connectivity, Display, Technology, Outer Shell Material, Power Supply, End-user, Function, and Regions |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Technological advancement in wearables technology

The market has seen growing popularity and demand in the past decade. With rising demand for smart wearables, companies are undertaking more research and development in the industry, looking for ways to integrate augmented reality into newer devices. Developments in augmented reality have led to its integration into a variety of functions performed by HUD helmets, including navigation and communication. Large players in the automotive industry are investing in the HUD helmet market.

Restraints

High cost of development and safety regulations

While firms in the space are increasingly investing in the development of more advanced HUD helmets with more features, the high cost of production is restricting growth in the HUD helmet market. While futuristic, the integration of new augmented reality-based technologies drives up the product cost, making these helmets less cost-effective.

Safety concerns around HUD helmets are another factor restricting growth. Studies have consistently shown that overall performance suffers when an individual’s attention is divided among multiple tasks. Concerns around HUD-induced information overload and corresponding rising accident risk are discouraging consumers, posing challenges to growth in the market.

Government regulations in some countries restrict innovations in the HUD helmet market. The United States Department of Transportation requires motorcycle helmets to meet certain requirements (FMVSS 218). Similar restrictions are imposed in the European Union, where helmets must conform to the Economic Commission for Europe (ECE 22.05) and meet ISO requirements. These specifications are aimed at protecting the wearer from injury and include benchmarks for impact attenuation, energy absorption, penetration, and flame resistance, as well as a minimum of 105° peripheral visibility on both sides. Additionally, some countries require HUD helmets to pass Snell testing and/or obtain a CE product certification.

Opportunity

Advent of IoT

Several researchers have proposed Internet of Things (IoT) based technology for accident detection and notification integrated into HUD helmets. IoT applications leverage connectivity, sensing, and data analytics to facilitate smart machine interactions with each other, the environments, infrastructure, and objects. The unique advantages of Internet of Things applications include remote monitoring, management, and device control capabilities to get new insights and useful information from streams of real-time data. This information collection is crucial in implementing IoT with accident management. Using components such as a tri-axial accelerometer, GPS, and microcontroller present on the helmet, these systems can be designed to provide rapid accident detection and contact emergency services when necessary.

The tethered segment dominated the HUD helmet market in 2023. A tethered system is equipped with hardware that connects to the driver’s smartphone, directly linking components in the vehicle with IoT systems using the internet or USB cables. Tethered systems are more stable and have a secure connection, minimizing data and signal loss, and are useful for navigation, diagnostics, and implementation of safety features.

The embedded segment is expected to grow at the fastest rate in the HUD helmet market during the forecast period of 2024-2033. Embedded systems are devices added to carry out specific functions and interact with other components in the system. Embedded systems are used to control functions such as engine management, braking, and transmission control. These embedded devices work together to optimize the overall performance and safety of the vehicle.

The OLED segment made up the largest share of the HUD helmet market in 2023. Organic light-emitting diode displays are solid-state devices consisting of a carbon-based semiconductor layer that emits light when electricity passes through the adjacent electrodes. For light to be emitted, at least one of the electrodes is transparent. OLED displays are made of plastic, organic layers, which make them thinner, lighter, and more durable compared to LED or LCD displays. OLED displays are brighter than their LED counterparts and do not require backlighting, making them more energy-efficient as well. OLED displays also have a larger field of view, covering up to 170 degrees. These factors contribute to making OLED the dominating segment in the market.

The conventional HUD segment dominated the HUD helmet market in 2023. Conventional HUDs display information in symbolic form by projecting an image propagated to a combiner and reflected into the user’s eyes. The viewer sees the image in the far field in front of them, able to refocus quickly when the driver switches their gaze from the road to the display. Conventional HUDs are widely available and have been a tried and tested feature in the automotive market for decades. The accessibility and established nature of the technology drive growth in this segment of the market.

The AR HUD segment is expected to grow at the fastest rate in the HUD helmet market in the forecast period 2024-2033. Augmented reality-based HUDs superimpose information on objects in the outside world and draw attention to them. AR HUDs highlight information related to driving, such as way-finding, turning, and hazard warnings. These displays provide the driver with useful information without having to change focus to the HUD screen.

The navigation segment made up the largest share of the HUD helmet market in 2023. Rapid digitization and growth of IT infrastructure in several regions globally have led to increased adoption of GPS technology across various industries. Advances in automotive navigation are spurring demand for the services in the HUD helmet industry.

The carbon fiber segment dominated the HUD helmet market in 2023. Carbon fiber is a strong but lightweight material with high modulus and high strength to weight ratio. It is also fire and corrosion-resistant as well as chemically stable, making it a popular choice for manufacturing HUD helmets.

The plastic & glass segment is expected to see notable growth in the HUD helmet market during the forecast period. Fiberglass, another popular choice for helmets, is made from woven fibers and resin. Fiberglass is less expensive than carbon fiber and also tends to be more flexible. The material properties and cost-effectiveness are leading to fiberglass gaining popularity among manufacturers in the segment.

The rechargeable batteries segment made up the largest share of the HUD helmet market in 2023. Rechargeable batteries are cost-effective and environmentally friendly. Due to their high performance and other benefits, several manufacturers use rechargeable batteries for their helmets.

The solar-powered systems segment is expected to witness notable growth in the HUD helmet market during the forecast period. Solar-powered systems make helmets lighter and more comfortable to wear for longer durations. The use of solar power also prolongs battery life, making these a more economical choice compared to fully battery powered helmets.

The racing professionals segment dominated the HUD helmet market in 2023. The growing emphasis on safety and technological advances in HUDs are leading to their growing popularity among bike riders across the globe. Modern HUD helmets come with built-in GPS, Bluetooth connectivity, and integrated cameras, which are useful for racing professionals during their rides. Recent models are also integrating accident alert systems. These factors are contributing to demand in the segment.

Segments Covered in the Report

By Connectivity

By Display

By Technology

By Outer Shell Material

By Power Supply

By End-user

By Function

By Geography

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

February 2025