December 2024

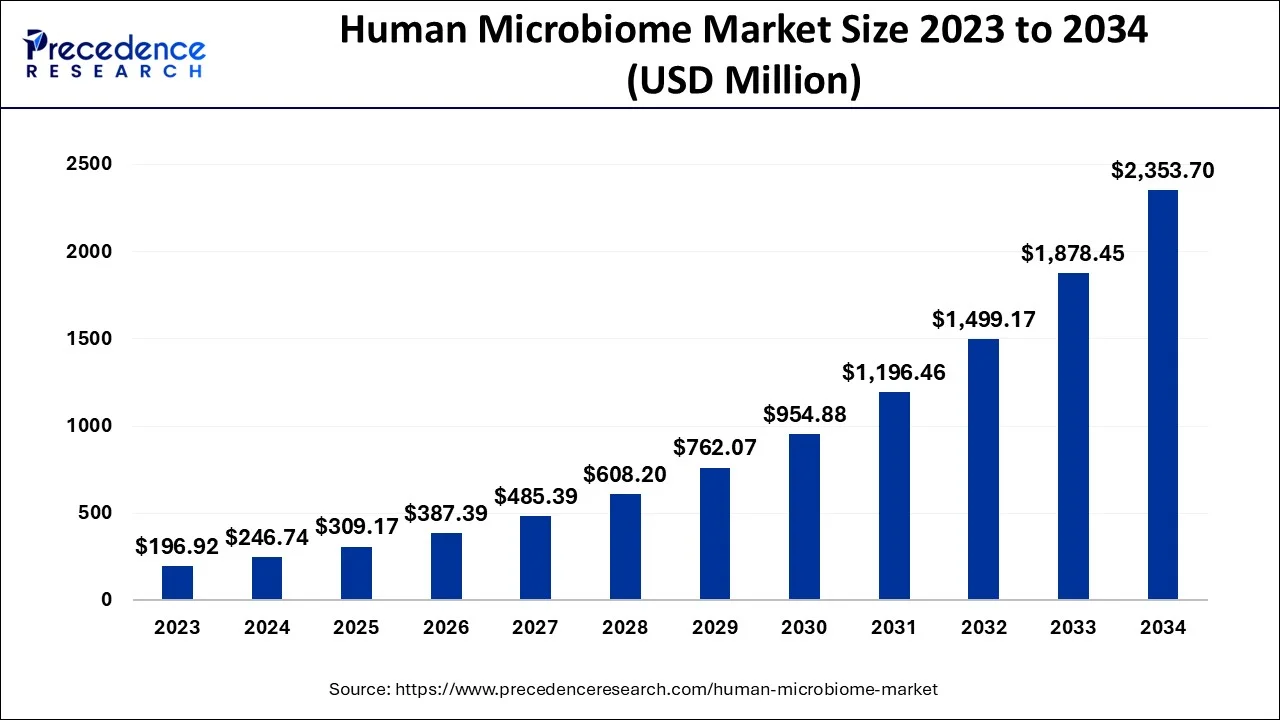

The global human microbiome market size is estimated at USD 246.74 million in 2024, grew to USD 309.17 million in 2025 and is predicted to surpass around USD 2,353.70 million by 2034, expanding at a CAGR of 25.30% between 2024 and 2034. The North America human microbiome market size accounted for USD 98.70 million in 2024 and is anticipated to grow at a fastest CAGR of 25.44% during the forecast year.

The global human microbiome market size accounted for USD 246.74 million in 2024 and is anticipated to reach around USD 2,353.70 million by 2034, expanding at a CAGR of 25.30% between 2024 and 2034.

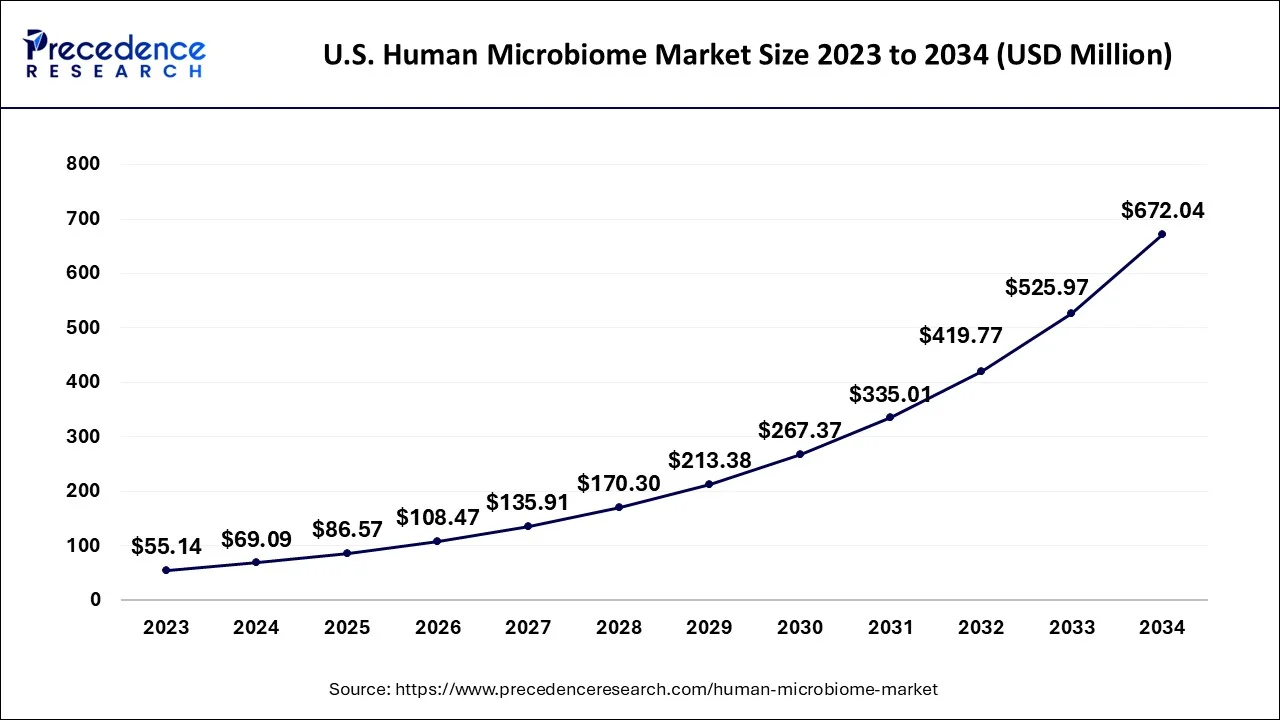

The U.S. human microbiome market size is estimated at USD 69.09 billion in 2024 and is expected to be worth around USD 672.04 billion by 2034, growing at a CAGR of 25.52% from 2024 to 2034.

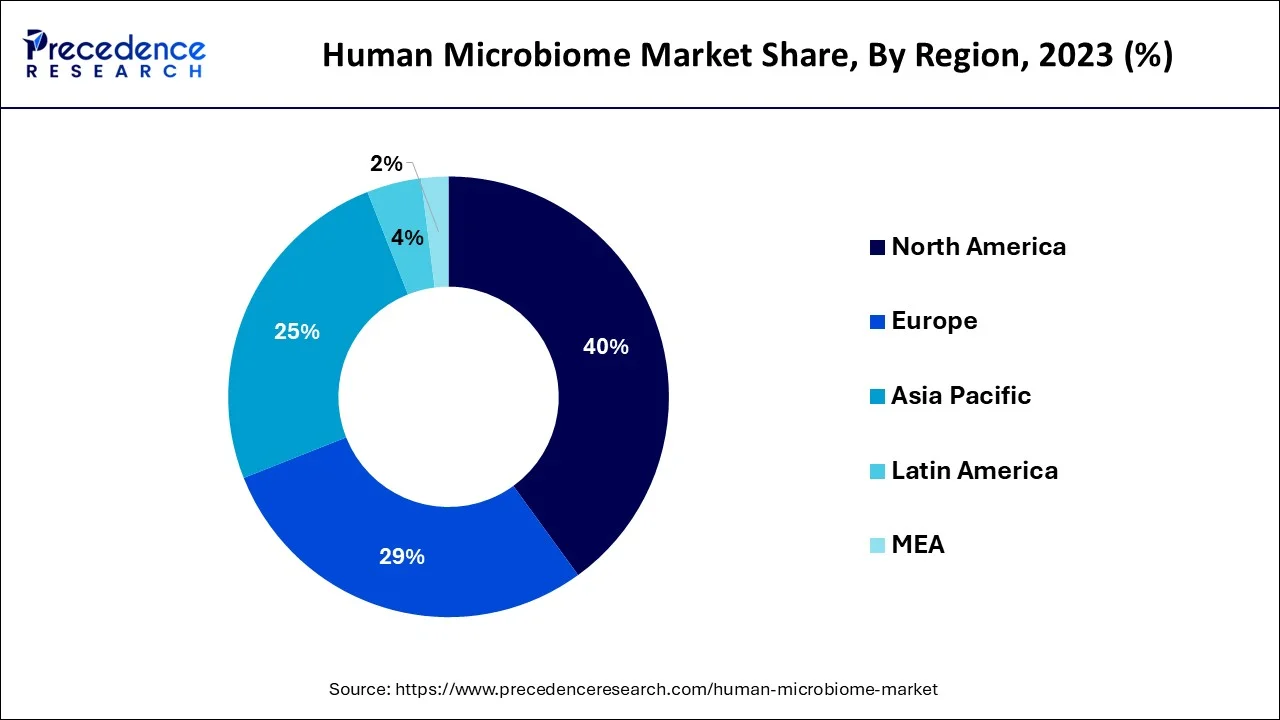

The Global Human Microbiome Market consists of North America, Asia Pacific, Europe, and the Rest of the World based on regional analysis. Because of their superior microbiological and biotechnological research infrastructure, Europe and North America lead the worldwide human microbiome market. Rising rates of autoimmune disorders and lifestyle diseases have also contributed to expanding the human microbiome industry in these countries.

The largest market in North America for the human microbiome is in the United States, followed by Canada. Germany, France, Spain, and the United Kingdom hold most of the European human microbiome market.

The region's escalating disease burden is contributing to the market's expansion. For instance, according to the American Cancer Society, there will be around 1,918,030 new cancer cases in the US in 2022. Additionally, the Globocan 2020 numbers show that there are currently 274,364 new cancer cases, with an anticipated 400,564 instances by 2040. As a result, the rising incidence of cancer will likely fuel market expansion as gut microbiota regulate tumor therapy by improving patients' receptivity to immunotherapy and minimizing the adverse effects of chemotherapeutic drugs.

The expansion of the market in the area is also being aided by the rising number of research studies and the regulatory bodies' support for the investigation. For example, 4D pharma plc, in February 2022, gained FDA approval for two Live Biotherapeutics, MRx0005 and MRx0029, which are investigational new drugs (IND) for the treatment of Parkinson's disease. The market will likely develop as a result of these approvals.

The human microbiome is the collection of microorganisms that live on and inside the human body. It includes bacteria, fungi, and viruses and plays a crucial role in maintaining human health. The human microbiome market is focused on developing products and therapies that manipulate the microbiome to improve human health. This includes probiotics, prebiotics, synbiotics, and other products designed to alter the microbiome's composition. The market for these products is multiplying as more research highlights the microbiome's importance in various health conditions. Some key players in the human microbiome market include Nestle, Danone, and Procter & Gamble.

Due to its links to several respiratory illnesses and immunology, the human microbiome has recently attracted attention. Immune health has been linked to healthy gut flora. Lung, pulmonary, and other diseases can arise as a result of variations in the number of microbes, including firmicute, actinobacteria, and Bacteroidetes, according to research.

For instance, Persephone Biosciences Inc. Started building a microbiome therapeutic that is immune-boosting in April 2020 to aid in the prevention and treatment of the novel coronavirus (SARS-CoV-2) as well as a potential diagnostic test that is stool-based intended to assist in identifying which patients are most at risk for experiencing severe complications and mortality after contracting COVID-19. To confirm this increase, more research investigations on the microbiome are one of the main factors. Since the pandemic raised microbiota therapies and diagnosis awareness, the market will likely continue to grow in this direction even after the outbreak.

The rising burden of diseases linked to a sedentary lifestyle and the increasing elderly population are additional significant drivers of this market's expansion. For instance, the International Diabetes Federation estimates that 52.7 million individuals in Europe between the ages of 20 and 79 have diabetes, with the figure rising to 69 million by 2045. For the forecast period, it is likely that increased gut microbial diversity—more particularly, an increase in butyrate-producing bacteria—will boost insulin resistance and type 2 diabetes risk, adding to the burden of lifestyle diseases like diabetes.

| Report Coverage | Details |

| Growth Rate from 2024 to 2034 | CAGR of 25.3% |

| Market Size in 2023 | USD 246.74 Million |

| Market Size by 2032 | USD 2,353.70Million |

| Base Year | 2023 |

| Forecast Period | 2024 to 2034 |

| Largest Market | North America |

| Segments Covered | By Product, By Application and By Disease Type |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America and Middle East & Africa |

The therapeutics segment, under these, had the most significant market share in 2023 and is anticipated to achieve a sizable CAGR in the years to come. This is primarily because of a rise in R&D spending for microbiome-based medicines and technology developments, which promotes segment growth.

Due to technological and scientific advancements in mapping the human genome and the advent of omics technologies, the diagnostics industry will likely grow at the quickest rate by application.

The market includes prebiotics, probiotics, drugs, and medical foods. The drug segment generated more than 36% of the revenue share in 2022. The human microbiota, a collective term for the billions of microorganisms that cover human tissues, contains bacteria, fungi, and viruses. The term "microbiome" refers to all of these microorganisms' genes.

The most significant product section belonged to the drugs category. This segment's considerable market share may be due to an increase in medicinal treatments based on the human microbiome that are now undergoing clinical trials and increasing funding for their development.

Competitive Analysis

The market for the human microbiome is moderately competitive, and many competitors are developing new goods. Organizations including Axial Biotherapeutics, Inc., Series Therapeutics, DuPont, Second Genome, and Synthetic Biologics hold significant market shares. Important firms are improving the therapies pipeline by creating effective and secure medications.

By Product

By Application

By Disease Type

By Geography

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

December 2024

October 2024

November 2024

March 2025