September 2024

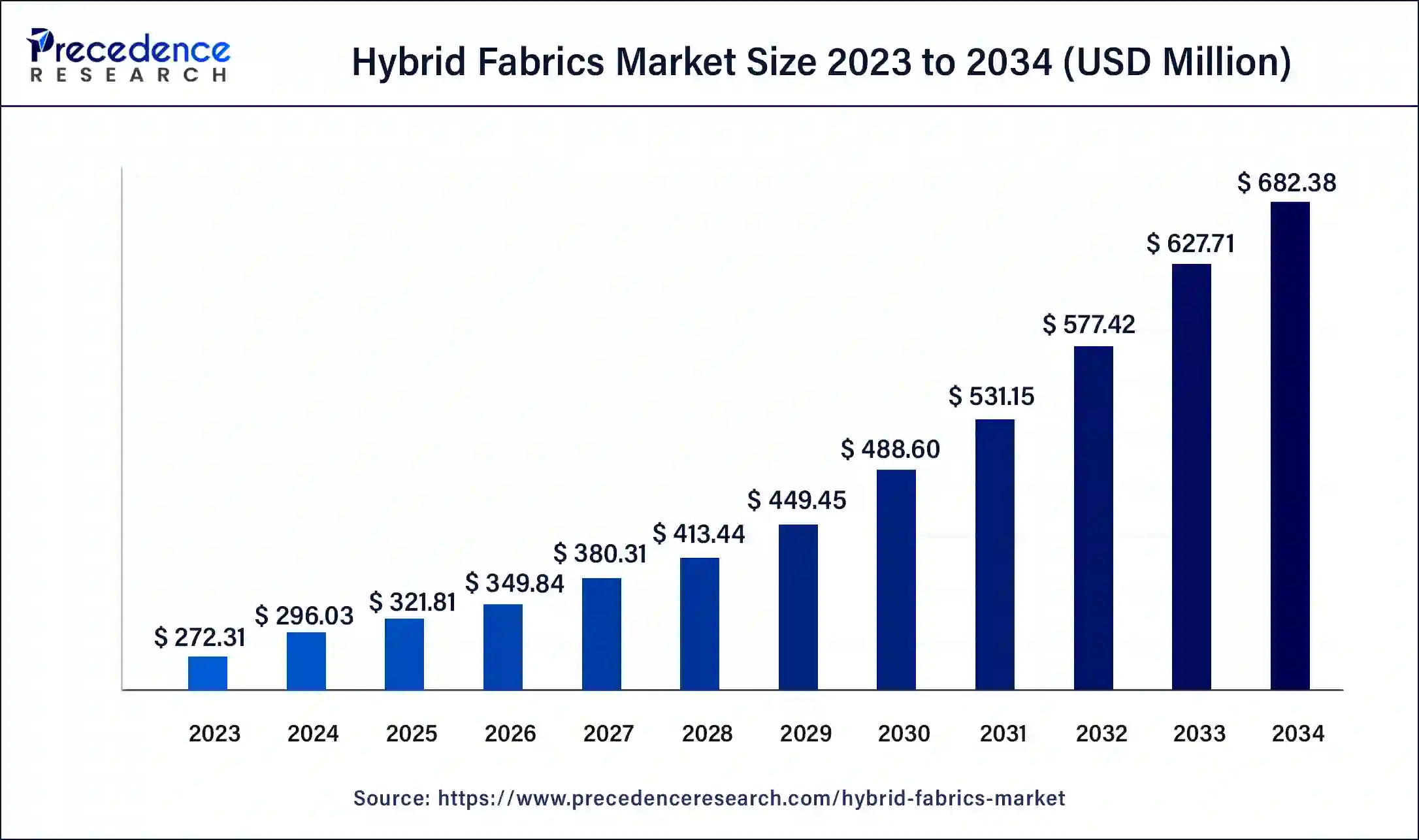

The global hybrid fabrics market size surpassed USD 272.31 million in 2023, estimated at USD 296.03 million in 2024 and is expected to reach around USD 682.38 million by 2034, expanding at a CAGR of 8.71% from 2024 to 2034.

The global hybrid fabrics market size is worth around USD 296.03 million in 2024 and is anticipated to reach around USD 682.38 million by 2034, growing at a solid CAGR of 8.71% over the forecast period 2024 to 2034. The rise in inclination toward hybrid fabrics due to stringent Government regulations is the key factor driving the hybrid fabrics market growth.

Hybrid fabrics are created by blending various types of fibers to achieve unique properties and performance benefits. These fabrics find applications in diverse sectors such as automotive, aerospace, military, marine, and other industrial fields. Known for their ability to reduce overall product weight while surpassing the strength of metals and conventional fabrics, hybrid fabrics are distinguished by their exceptional technical features. The hybrid fabrics market offers high strength, durability, and outstanding resistance to heat, flames, and chemicals. Additionally, their lightweight nature and improved toughness make them highly versatile, leading to their widespread use in industries like wind energy, aerospace, defense, and sports.

How is AI Changing the Hybrid Fabrics Market?

AI significantly impacts the hybrid fabrics market through the innovative discovery and design of new materials. Unlike traditional methods, which often involve slow and labor-intensive trial-and-error processes, machine learning algorithms can expedite material development. These algorithms enable rapid exploration of wide material design spaces, efficiently identifying promising candidates based on specific performance criteria and desired properties. High-throughput virtual screening involves evaluating millions of potential material compositions and structures quickly through computational models. By utilizing advanced algorithms and powerful computing capabilities, researchers can simulate and predict material properties before physical synthesis.

| Report Coverage | Details |

| Market Size by 2034 | USD 682.38 Million |

| Market Size in 2023 | USD 272.31 Million |

| Market Size in 2024 | USD 296.03 million |

| Market Growth Rate from 2024 to 2034Market Size in 2023 | CAGR of 8.71% |

| Largest Market | Europe |

| Base Year | 2023 |

| Forecast Period | 2024 to 2034 |

| Segments Covered | Fiber Type, Application, and Region |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America and Middle East & Africa |

Rise in applications in automotive and aircraft

In the automotive and aerospace sectors, hybrid fabrics are employed to enhance fuel efficiency and speed. The hybrid fabrics market contributes to a reduction in vehicle weight by 40-60% and bolsters compressive strength. In aerospace and defense applications, hybrid fabrics often include combinations of carbon, glass, aramid, and epoxy fibers. Moreover, these materials are particularly effective for high-temperature environments, helping to decrease the weight of aircraft and hence improve fuel efficiency.

Supply chain problems

Complex supply chains can lead to shortages, price volatility, and production delays, all of which may impede the hybrid fabrics market growth. This issue is particularly relevant for advanced polymers and specialized fibers utilized in hybrid fabrics. Additionally, ensuring consistent performance and quality across different batches of hybrid fabrics can be challenging. Variations in performance could lead to concerns among end users, which potentially decreases the adoption rates and undermines confidence in the products.

Rising focus on sustainability

A key trend in the hybrid fabrics market is the growing focus on sustainability. As environmental concerns become more prevalent, both consumers and businesses are increasingly favoring eco-friendly materials. Hybrid fabrics present an opportunity to integrate recycled fibers, organic cotton, and other sustainable components into their production. This trend supports the global shift toward more sustainable industry practices and appeals to consumers who prioritize products with a minimal ecological footprint. Additionally, recent advancements in textile technology have led to the creation of hybrid fabrics with improved properties.

The glass/carbon segment dominated the hybrid fabrics market in 2023. Carbon-glass hybrid fabrics combine carbon fiber, known for its high tensile strength and stiffness, with glass fiber to lower overall costs and reduce fabric density. These fabrics exhibit superior tensile and compressive strength compared to other carbon/epoxy hybrids. The inclusion of glass fiber, which is less prone to failure than carbon fiber, enhances the strain resistance of hybrid fabric. Moreover, Increased glass fiber content allows the fabric to endure higher strain levels before the low-elongation carbon fibers fail, making these hybrid materials ideal for use in the automotive and aerospace sectors.

The glass/aramid segment is expected to grow at the fastest rate in the hybrid fabrics market over the forecast period. Aramid fibers, composed of aromatic polyamide with over 85% amide bonds directly linked to two aryl groups, offer several key benefits. These fibers are lightweight, high-strength, and high-modulus, and they exhibit impressive resistance to high temperatures and corrosion. The growing preference for lightweight materials in transportation and marine applications is anticipated to boost the demand for glass-aramid hybrid fabrics.

The aerospace & defense segment led the hybrid fabrics market in 2023. The aerospace and defense sectors are major consumers of hybrid fabrics due to their need for materials that combine high strength, durability, and lightweight properties. Hybrid textiles are commonly used in the construction of aircraft components such as wings, fuselage, and engine parts. These materials offer several advantages, including enhanced fuel efficiency, reduced emissions, and improved safety. Furthermore, hybrid fabrics are designed to endure corrosion, abrasion, and impact, which makes them ideal for challenging Environments.

The automotive segment is anticipated to grow at the fastest rate in the hybrid fabrics market during the forecast period. This can be attributed to the growing demand for electric vehicles, the emphasis on utilizing lightweight materials for enhanced fuel efficiency, and the increasing implementation of advanced safety features are all expected to drive revenue growth. Hybrid fabrics are used in the manufacturing of body panels and chassis components and in the production of interior elements such as automobile seats, door panels, and other upholstered items. These materials offer numerous benefits, including a superior strength-to-weight ratio, improved impact resistance, and greater design versatility.

Europe dominated the global hybrid fabrics market in 2023. The European market includes countries such as the UK, Germany, France, Spain, Italy, and other European nations. The demand for hybrid fabrics in Europe is largely fueled by the presence of major global players like Gurit Holding AG DSM, Solvay SA, SGL Group, and Kordcarbon AS. The substantial number of hybrid fabric manufacturers providing a diverse array of products significantly impacts market demand. Furthermore, the European Commission's increasing focus on reducing greenhouse gas emissions is expected to drive growth in the market for lightweight hybrid fabrics used in the automotive industry.

North America is expected to show the fastest growth in the hybrid fabrics market throughout the projected period. The demand for hybrid textiles in this region is projected to grow due to the presence of leading industry players and the increasing need for advanced, high-performance materials across various sectors. Specifically, the aerospace and defense industries are expected to drive demand due to their requirement for durable, lightweight materials. The automotive sector’s rising demand for fuel-efficient and eco-friendly vehicles is likely to contribute to the increased need for hybrid fabrics. The construction industry is also experiencing a boost in activity, which is stimulating the demand for hybrid fabrics in this region.

India fabric export 2021-22 the percentages and shares

| Fabric Type | Exports 2021-22 | Share (%) |

| Cotton Woven | 2,453 | 49% |

| Synthetic Woven | 1,582 | 31% |

| Other Woven | 1,015 | 20% |

| Woven Fabric | 5,050 | 86% |

| Knitted Fabric | 850 | 14% |

| Total Fabric | 5,900 |

Segments Covered in the Report

By Fiber Type

By Application

By Geography

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

September 2024

March 2025

January 2025

February 2025