January 2025

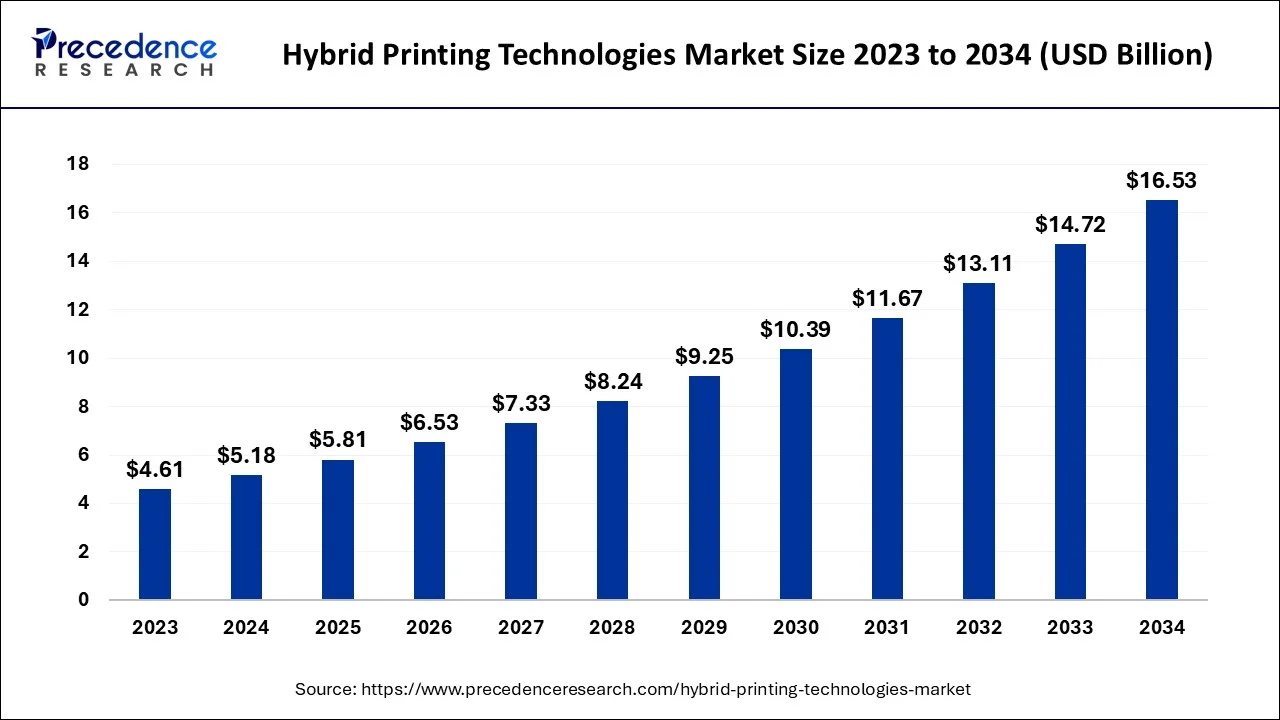

The global hybrid printing technologies market size accounted for USD 5.18 billion in 2024, grew to USD 5.81 billion in 2025 and is expected to be worth around USD 16.53 billion by 2034, registering a healthy CAGR of 12.31% between 2024 and 2034. The North America hybrid printing technologies market size is calculated at USD 1.76 billion in 2024 and is estimated to grow at a fastest CAGR of 12.43% over the forecast period.

The global hybrid printing technologies market size is calculated at USD 5.18 billion in 2024 and is projected to surpass around USD 16.53 billion by 2034, expanding at a CAGR of 12.31% from 2024 to 2034. The surge in the demand for customized printing is the key factor driving the market's growth. Also, the rising need for shorter lead times and faster job completion, along with the expansion of e-commerce, has increased the adoption of these technologies through the forecast period.

Hybrid printing technology aims to combine the abilities of analog and digital printing technology by integrating the efficiency and reliability of flexographic printing coupled with the creative possibilities of digital printing. Through this, businesses get the low cost of flexo printing with high print quality and flexibility. Hybrid printing machines have advanced features that help businesses customize their print runs, including a built-in UV drying system, printing and over-varnish facilities, mono and four-color options, etc.

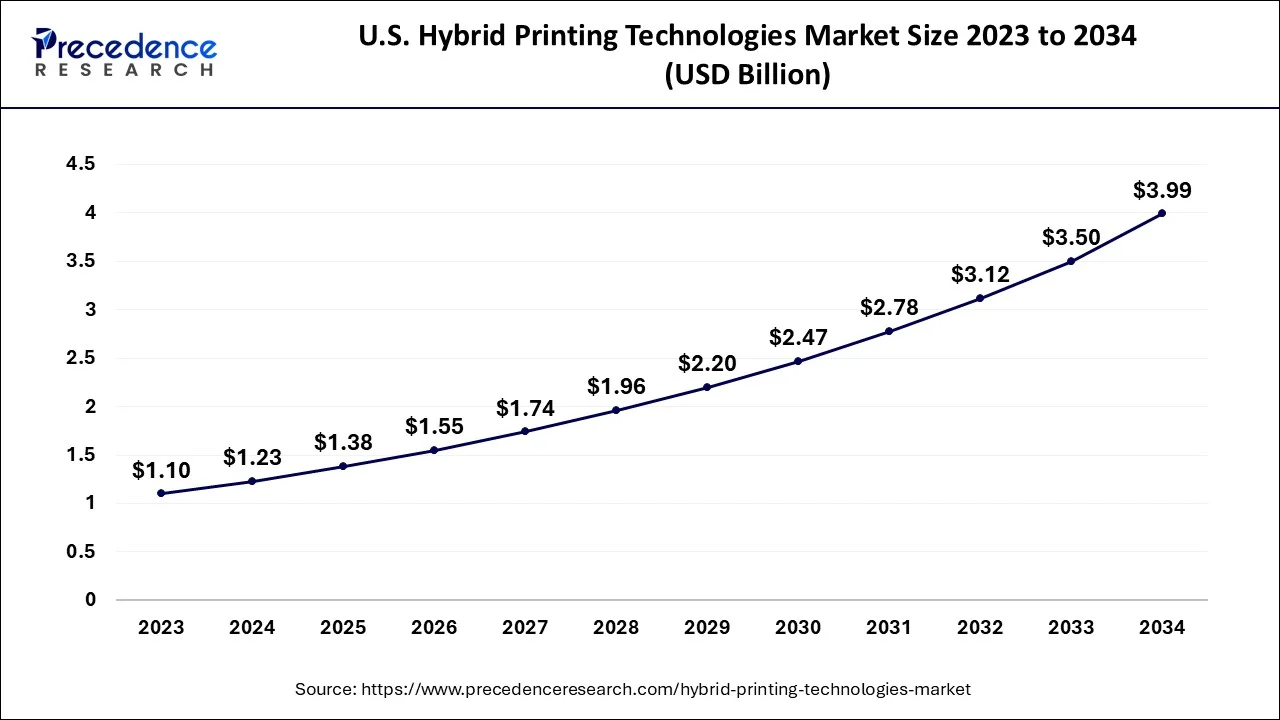

The U.S. hybrid printing technologies market size is exhibited at USD 1.23 billion in 2024 and is projected to be worth around USD 3.99 billion by 2034, growing at a CAGR of 12.42% from 2024 to 2034.

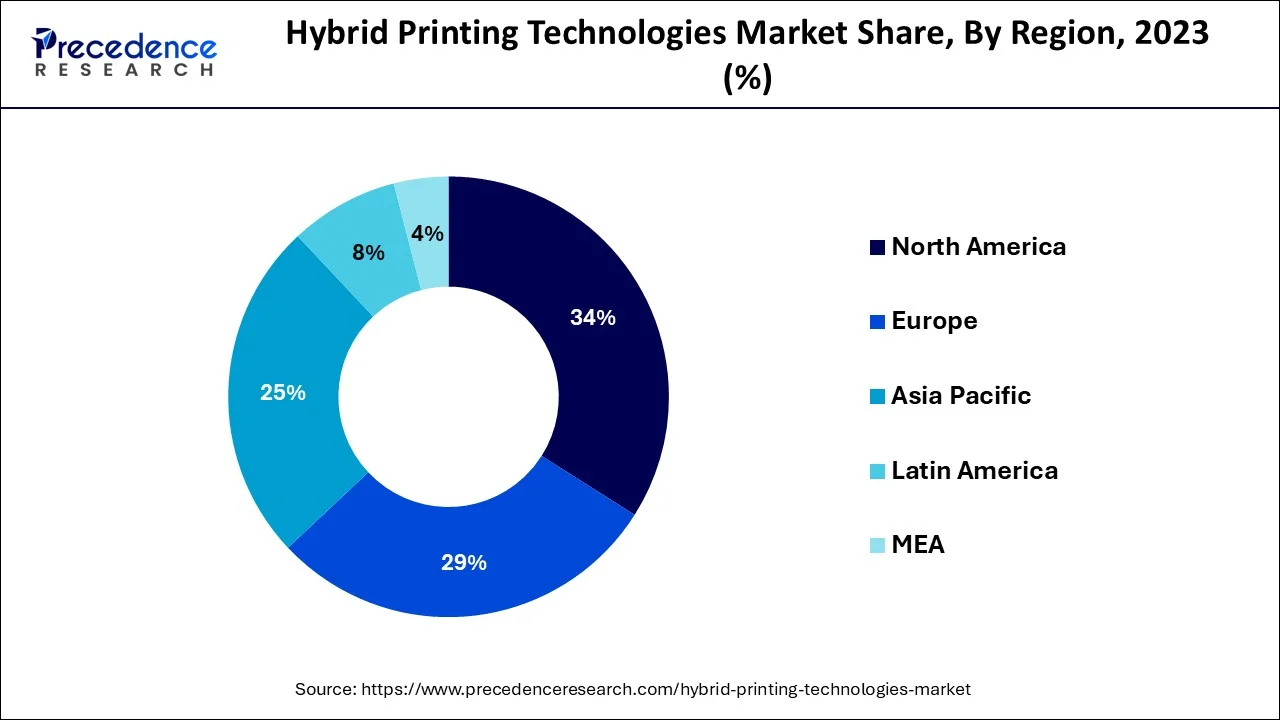

North America dominated the global hybrid printing technologies market in 2023. The region's supremacy may be ascribed to the ongoing development of printing technologies in conjunction with the acceleration of technical breakthroughs. Moreover, the adoption of cutting-edge hybrid printing technologies is being fueled by the region's robust R&D atmosphere. The US market for hybrid printing technology. Demonstrates the region's notable expansion in North America as a result of growing customer demand for individualized products.

Asia Pacific is expected to show the fastest growth during the projected period. An increase in the need for packaging and e-commerce is what is fueling the region's rise. It is commonly known that hybrid printing technologies may meet this need by offering bespoke, superior packaging options that let companies stand out in a crowded online marketplace. Furthermore, due to the rising demand for effective printing solutions, China's hybrid printing technologies market is expanding significantly.

The Role of AI in the Hybrid Printing Technologies Market

Artificial Intelligence is playing a transformative role in hybrid printing. From workflow automation to predictive maintenance, AI optimizes printing processes and ensures less downtime with greater efficiency. Furthermore, these technologies will continue to fuel innovation in the industry by stimulating the growth of hybrid printing further into future integration, which can also help businesses seek faster and more cost-efficient printing solutions that impel hybrid printing technologies market growth.

| Report Coverage | Details |

| Market Size by 2034 | USD 16.53 Billion |

| Market Size in 2024 | USD 5.18 Billion |

| Market Growth Rate from 2024 to 2034 | CAGR of 12.31% |

| Largest Market | North America |

| Base Year | 2023 |

| Forecast Period | 2024 to 2034 |

| Segments Covered | Component, Substrate, Application, and Regions |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America and Middle East & Africa |

Advanced features and greater flexibility

Hybrid printing technologies are capable of combining a variety of optional features that can be updated with advanced technologies and lead to market growth. They are also cost-effective and easy to maintain, which attracts customers. Additionally, the rapid production speed is possible due to hybrid printing because it does more work in a shorter period. Tasks like labeling, finishing, coating, packaging, and cutting can be completed automatically.

Printing defects and large capital investment

Hybrid printing can be difficult for industries as it deals with different forms of drivers for different operating systems. The accuracy of orientation is a major obstacle to this process. Moreover, the requirement for large capital investment can further constrain market growth by creating significant challenges for the end users.

Rising focus on flexographic printing

Flexographic printing is utilized for the transfer of ink onto substrates through flexible plates. Flexographic label printers manufacture labels quickly, and their inks are more cost-effective than digital label printers. Furthermore, flexographic printing also provides the freedom of printing on an extensive range of porous and non-porous materials, including cardboard, paper, and fabric. It can also be used to produce industrial labels, tamper-evident labels, and barcode labels.

The hardware segment dominated the hybrid printing technologies market in 2023. The dominance of the segment can be attributed to the increasing demand for high-quality and customized printing along with the advancements in printing technology. Additionally, the increasing need for high-resolution prints is enabling businesses to upgrade to advanced hybrid printing hardware. This demand is especially high in industries like textiles, packaging, and advertising, where accuracy and personalization are crucial.

The software segment is expected to experience the fastest growth in the hybrid printing technologies market over the forecast period. The growth of the segment is driven by a growing demand for personalization and customization in printing which has led to the requirement for advanced software solutions that optimizes precise control over print designs and workflows. Also, the integration of Artificial Intelligence (AI) and Machine Learning (ML) in software printing is improving quality, efficiency, and automation capabilities.

The paper and cardboard segment led the hybrid printing technologies market in 2023 by holding the largest market share. This dominance is due to the increasing use of paper and cardboard in publishing, packaging, and advertising because of their smooth surface. Moreover, these cardboard substrates and paper come in numerous textures, finishes, and weights specific to multiple printing needs. The low cost of the substrate compared to other substrates is fuelling the segment's expansion further.

The textile segment is expected to show the fastest growth in the hybrid printing technologies market during the forecast period. The growth of the segment is credited to the increasing demand for on-demand and customized textile products like home decor, personalized apparel, and fashion accessories. Furthermore, developments in hybrid printing technology have optimized higher print quality, intricate designs on textiles, and vibrant colors, fulfilling the needs of both mass production and niche markets.

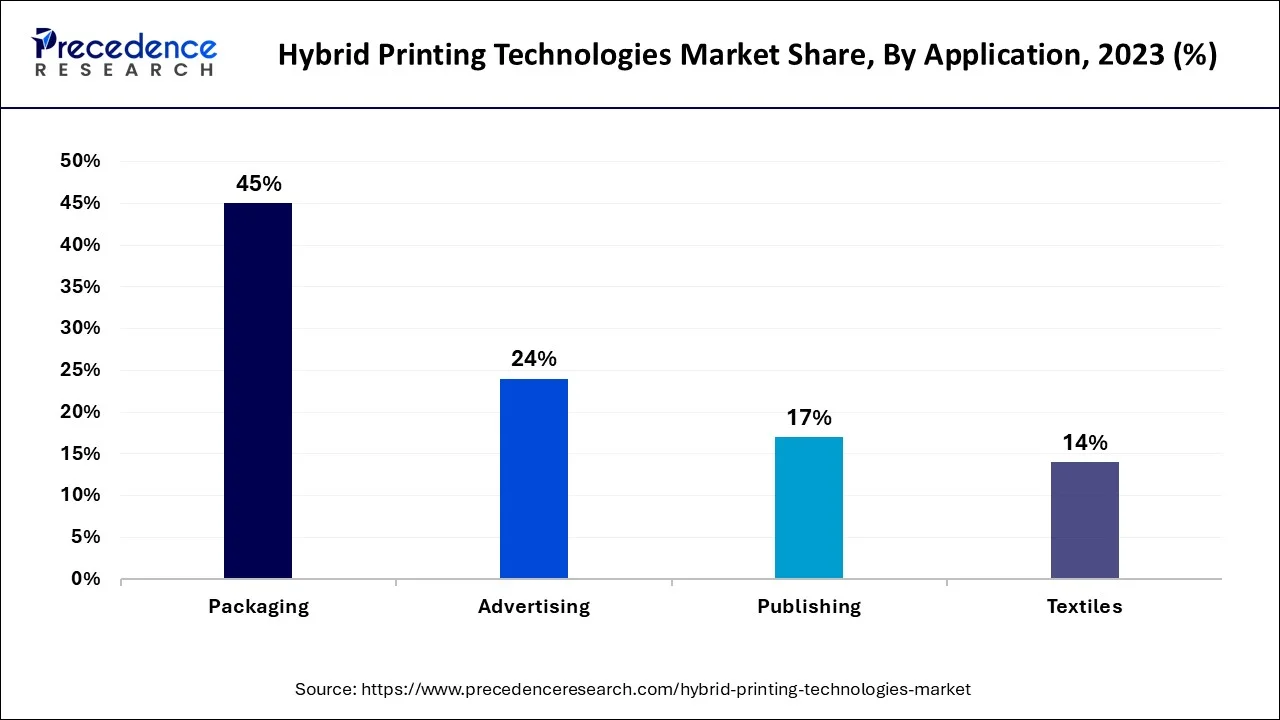

In 2023, The packaging segment dominated the hybrid printing technologies market. The dominance of the market is explained by the growing need for more robust and visually pleasing packaging solutions brought about by the expansion of e-commerce and the growing demand for premium customized packaging solutions. Additionally, since hybrid printing facilitates the creation of environmentally friendly packaging materials, sustainability trends are becoming more and more significant.

The textiles segment is expected to grow at the fastest rate in the hybrid printing technologies market over the studied period. The textile sector has grown as a result of the rise of the clothing and fashion industries. Textile printing is becoming faster, better, and more efficient because of continuous technical developments in the hybrid printing technologies industry, including improvements in print heads, ink formulas, and software. As a result, hybrid printing is now more profitable for textile producers.

Segments Covered in the Report

By Component

By Substrate

By Application

By Geography

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

January 2025

December 2024

November 2024

November 2024