January 2025

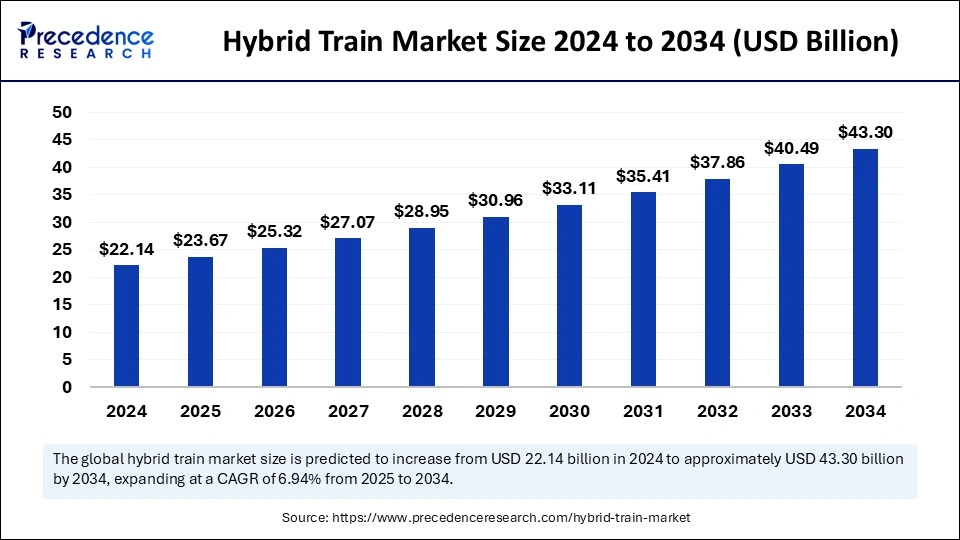

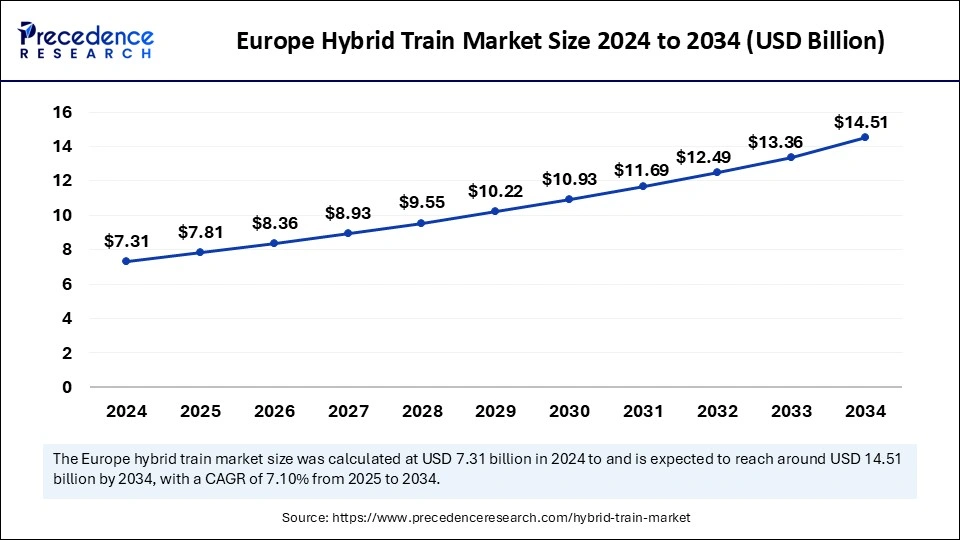

The global hybrid train market size is evaluated at USD 23.67 billion in 2025 and is forecasted to hit around USD 43.3 billion by 2034, growing at a CAGR of 6.94% from 2025 to 2034. The Europe market size was accounted at USD 7.31 billion in 2024 and is expanding at a CAGR of 14.51% during the forecast period. The market sizing and forecasts are revenue-based (USD Million/Billion), with 2024 as the base year.

The global hybrid train market size was calculated at USD 22.14 billion in 2024 and is predicted to increase from USD 23.67 billion in 2025 to approximately USD 43.3 billion by 2034, expanding at a CAGR of 6.94% from 2025 to 2034. The increasing demand for eco-friendly and energy-efficient transportation solutions is expected to fuel the growth of the market during the forecast period.

Artificial intelligence (AI) helps in predictive maintenance and fault detection in hybrid train systems by enabling real-time monitoring, early issue identification, and data-driven diagnostics. Machine learning algorithms analyze sensor data from parts like engines, braking systems, and batteries to find irregularities and anticipate possible problems before they arise. In addition to improving safety and lowering maintenance expenses, this proactive approach minimizes downtime. It increases component life and guarantees prompt interventions by detecting wear patterns and performance abnormalities. Prompt decision-making is made possible by the integration of technologies such as edge computing and digital twins, which also increase real-time monitoring and diagnostic accuracy. Moreover, AI-driven systems continuously learn from operational data, improving prediction accuracy. As a result, resource planning and maintenance scheduling are improved. Operators can increase fleet dependability and passenger satisfaction by ranking repairs according to priority. Therefore, AI makes hybrid rail operations more intelligent and sustainable by shifting the maintenance approach from reactive to predictive.

The Europe hybrid train market size was evaluated at USD 7.31 billion in 2024 and is projected to be worth around USD 14.51 billion by 2034, growing at a CAGR of 7.10% from 2025 to 2034.

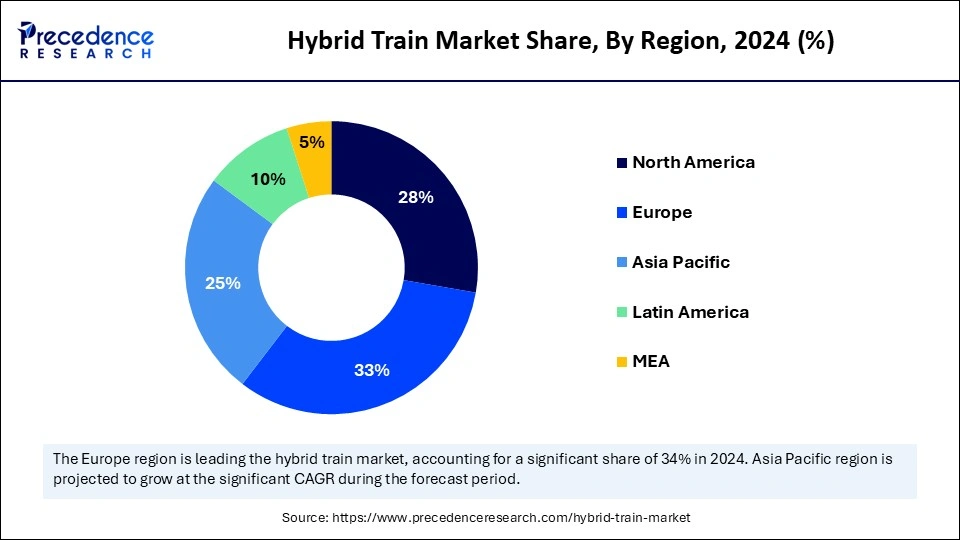

Europe dominated the hybrid train market by capturing the largest share in 2024. The market growth in Europe is driven by its strong emphasis on environmentally friendly transportation and sophisticated rail systems. The European Union has imposed stringent regulations for rail transport to reduce carbon emissions, encouraging the adoption of hybrid trains. As part of its decarbonization objectives and investment in green mobility, the region has witnessed the early adoption of hybrid propulsion systems. Government partnerships with top rail producers have further spurred innovation and established Europe as a pioneer in the use of hybrid rail technology.

Asia Pacific is expected to expand at the highest CAGR in the upcoming period. The growth of the hybrid train market in the region can be attributed to the rising investments in rail modernization. With the growing population and rapid urbanization, the demand for public transportation is increasing, contributing to the market’s growth. Governments around the region have imposed stringent regulations on the transportation sector to reduce carbon emissions, boosting the demand for hybrid trains. The region will be at the forefront of adopting hybrid trains in the upcoming years due to government initiatives supporting clean energy and infrastructure development. In addition, rising government initiatives to expand rail networks, especially in remote areas, support market growth.

North America is observed to grow at a considerable growth rate in the coming years. This is mainly due to the increase in interest in environmentally friendly rail options and modernizations of deteriorating infrastructure. The rising focus on expanding regional connectivity, emissions reduction, and fuel efficiency further supports market growth. Public-private partnerships, pilot projects, and strategic research investments are opening the door for a wider adoption of hybrid technologies. The need for environmentally friendly public transit systems is also growing in the region, especially in urban and intercity corridors. The rapid adoption of hybrid trains is further aided by national infrastructure plans financing for railway modernization and regulatory support for clean mobility. Rail operators are also investigating hybrid technologies to minimize operating expenses and adhere to more stringent environmental regulations.

The hybrid train market is experiencing rapid growth due to the global push for sustainable and energy-efficient transportation solutions. Hybrid trains are replacing traditional diesel trains as a result of stricter emission regulations and growing environmental concerns. Regenerative braking that converts kinetic energy into electrical energy during braking and enhanced energy storage systems are two examples of technological advancements that have increased the efficiency and appeal of hybrid trains. The popularity of hybrid trains is increasing due to government support in the form of incentives and green policies, particularly in Asia Pacific and other rapidly developing regions. The expansion of railway networks further contributes to market growth. However, the market faces several challenges due to limited infrastructure in some areas that must be resolved to maintain the long-term growth of the market.

| Report Coverage | Details |

| Market Size by 2034 | USD 43.3 Billion |

| Market Size by 2025 | USD 23.67 Billion |

| Market Size by 2024 | USD 22.14 Billion |

| Market Growth Rate from 2025 to 2034 | CAGR of 6.94% |

| Dominated Region | Europe |

| Fastest Growing Market | Asia Pacific |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Propulsion Type, Speed, Application, and Regions |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America and Middle East & Africa |

Technological Advancements

Ongoing technological advances are expected to drive the growth of the hybrid train market. Power management systems, regenerative braking, and battery technologies have advanced quickly, greatly enhancing hybrid train performance. In areas where complete electrification is not financially feasible, these advancements not only lessen energy loss but also increase the competitiveness of hybrid trains relative to conventional electric systems. Operator confidence in hybrid models is rising because of improved durability, range, and onboard systems. The adoption of these advanced technologies is being fueled by ongoing infrastructure improvements in emerging countries as well as in developed economies.

Focus on Noise Reduction

Noiseless operation is less evident but equally one of the important benefits of hybrid trains, particularly when braking and accelerating. This greatly lowers noise pollution in stations, tunnels, and residential areas, improving public health and the commuter experience as a whole. Quieter trains are required in areas with high population densities or noise levels such as those close to historical sites, schools, or hotels. Urban transit authorities find hybrid trains appealing because they successfully satisfy these requirements.

High Initial Investment and Development Costs

High initial investments required for hybrid trains hamper the growth of the hybrid train market. These trains require specialized components and dual-mode technology, making them costlier than conventional trains. The extra expenses of software integration testing and energy storage systems further increase project budgets. In many nations, funds are still allocated for diesel upgrades or electrification, which makes it more difficult to defend hybrid investments. Operators are also concerned about lifecycle costs and long-term ROI in comparison to established diesel-electric alternatives.

Inadequate Infrastructure

Infrastructure such as track compatibility, maintenance facilities, and charging stations are critical to the success of hybrid trains. Hybrid train deployment becomes logistically and financially challenging in areas with limited electrification or poor grid access. Minor system improvements, such as platform modifications for battery charging, can cause delays in projects. The performance of hybrid trains is also limited by infrastructure as they might not run as efficiently in the absence of energy recovery systems or designated charging stations.

Rising Demand for Sustainable and Low Emission Transportation

The rising demand for sustainable transportation solutions creates immense opportunities in the hybrid train market. With global efforts to reduce greenhouse gas emissions, hybrid trains are gaining immense popularity as a promising alternative to traditional diesel locomotives. These trains drastically reduce fuel consumption and carbon emission by using diesel in conjunction with electric or battery-powered propulsion. Clean mobility is being prioritized by governments and environmental organizations, which are driving the adoption of hybrid vehicles.

Expansion of Non-Electrified and Remote Rail Networks

Hybrid trains are a perfect fit for distant or partially electrified routes where it is not viable to extend electric lines. They can seamlessly switch between power sources thanks to their dual-mode operation, which preserves service quality without requiring additional infrastructure. This creates new opportunities to expand rail networks in underdeveloped or rural areas.

The electro-diesel segment dominated the hybrid train market with the largest share in 2024. This is mainly due to the heightened adoption of electro-diesel propulsion because of its hybrid capability, which gives it the freedom to run on both non-electrified and electrified routes. It is specifically useful in areas with partial electrification because of its dual-power capability, guaranteeing continuous service across varying infrastructure. Because of its dependability, lower fuel consumption than traditional diesel, and compatibility with current rail or transit systems, it has become widely used. Electro-diesel systems also require less infrastructure, which is appealing to operators looking to modernize at a reasonable cost. Switching between power modes preserves range and power in remote locations while lowering emissions in urban areas. Electro-diesel is still the go-to option in the current transportation sector transition phase because of its performance and sustainability balance.

The battery electric segment is expected to witness significant growth in the coming years. This is mainly due to ongoing technological advances and a growing worldwide emphasis on sustainability. Modern battery-electric systems are becoming more practical for both urban and regional rail networks due to their zero-emission operations, reduced maintenance needs, and optimized energy density. The expansion of electric charging infrastructure and stricter environmental regulations are predicted to drive the growth of this segment. Furthermore, battery electric technology reduces noise significantly, which makes it perfect for areas with a high population density. Advances in fast charging and battery longevity are being further accelerated by both public and private investments in R&D. Battery electric propulsion stands out as a future-ready, environmentally responsible mobility option as energy grids increasingly integrate renewable energy sources.

The above 200 km/h segment led the hybrid train market in 2024. This is mainly due to the increased need for high-speed transit networks that enhance intercity connectivity and drastically cut down on travel time. Advanced train models intended for quick acceleration and peak performance over extended distances are included in this section. These models are favored for their ability to lessen traffic, minimize carbon emissions, and offer a first-rate travel experience. The segment’s dominance is further cemented by increased investments in specialized high-speed corridors and cutting-edge rail infrastructure.

The 100-200 Km/h segment is expected to grow at a rapid pace in the coming years. This speed range provides a workable equilibrium between infrastructure flexibility, cost-effectiveness, and speed. It meets the increasing demand from commuters for dependable, quicker mid-range transportation options without requiring a substantial outlay of funds for ultra-high-speed systems. Trains with this speed range are compatible with current rail networks, making them suitable for regional and suburban transit. The rising demand for scalable and high-speed transportation solutions fuels the growth of this segment.

The passenger segment led the hybrid train market in 2024. This is mainly due to the increased need for sustainable, comfortable, and effective public transportation options. High-capacity passenger movement is being supported by modern rail and transit systems, which are also being developed to provide shorter travel times and better onboard experiences. Mass transit systems that put passenger convenience first are becoming more and more popular due to urbanization, the need for daily commuting, and traffic congestion in road networks.

The freight segment is anticipated to expand at a significant growth rate over the studied period. The segment growth is attributed to the rising requirements for dependable, affordable, and energy-efficient logistics solutions. As industries look to cut their carbon footprint and rely less on road transportation, rail-based freight transportation is becoming more popular. Rail freight systems are becoming more and more attractive due to technological developments in freight systems, intelligent tracking, and intermodal logistics solutions. Additionally, the rising investments in infrastructure and dedicated freight corridors that enable longer hauls and heavier loads with fewer delays support segmental growth. As international trade volumes increase and sustainability emerges as a key business concern, the freight segment is poised to witness rapid expansion.

By Propulsion Type

By Speed

By Application

By Region

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

January 2025

December 2024

December 2024

November 2024