January 2025

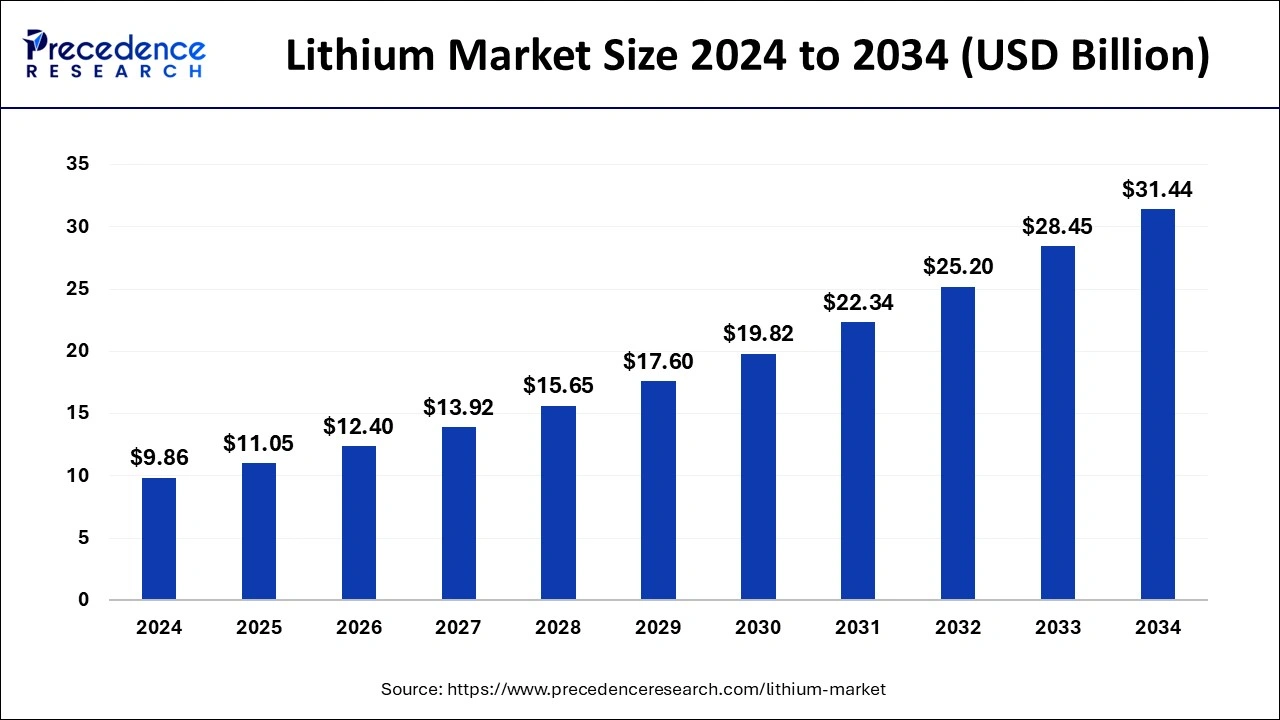

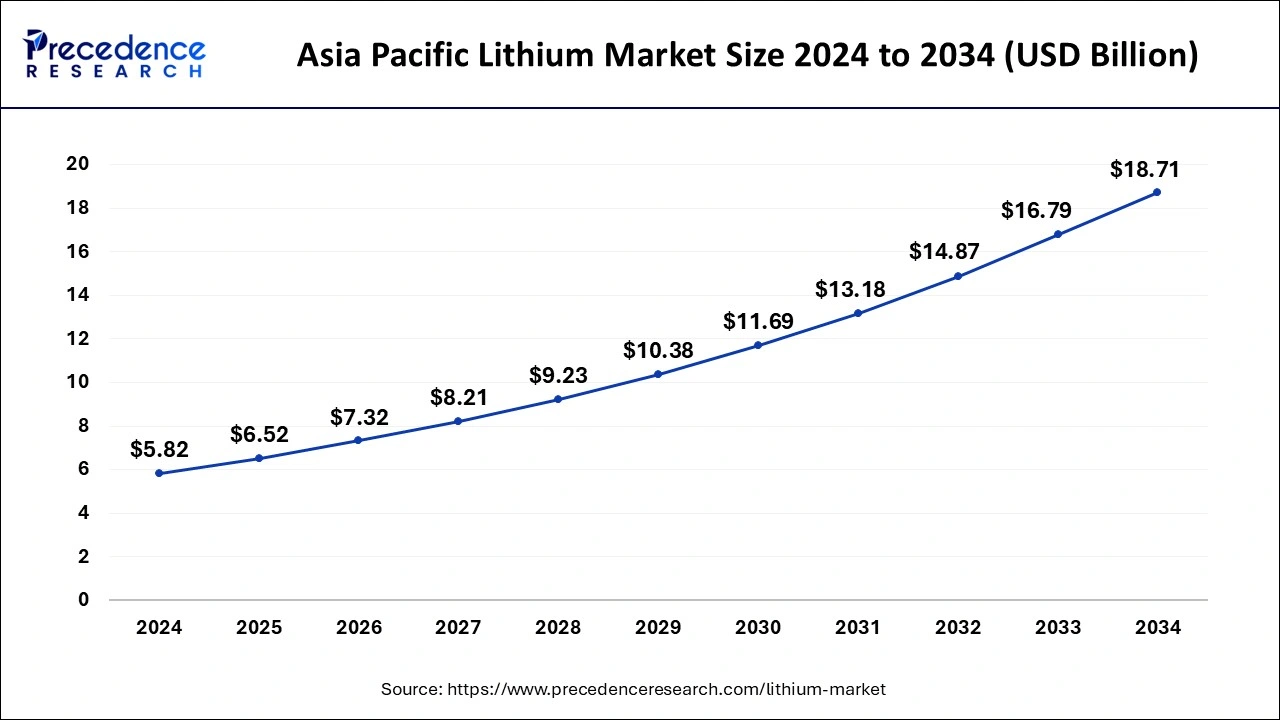

The global lithium market size is calculated at USD 11.05 billion in 2025 and is forecasted to reach around USD 31.44 billion by 2034, accelerating at a CAGR of 12.30% from 2025 to 2034. The Asia Pacific lithium market size surpassed USD 6.52 billion in 2025 and is expanding at a CAGR of 12.39% during the forecast period. The market sizing and forecasts are revenue-based (USD Million/Billion), with 2024 as the base year.

The global lithium market size was estimated at USD 9.86 billion in 2024 and is predicted to increase from USD 11.05 billion in 2025 to approximately USD 31.44 billion by 2034, expanding at a CAGR of 12.30% from 2025 to 2034.

The Asia Pacific lithium market size was valued at USD 5.82 billion in 2024 and is anticipated to reach around USD 18.71 billion by 2034, poised to grow at a CAGR of 12.39% from 2025 to 2034.

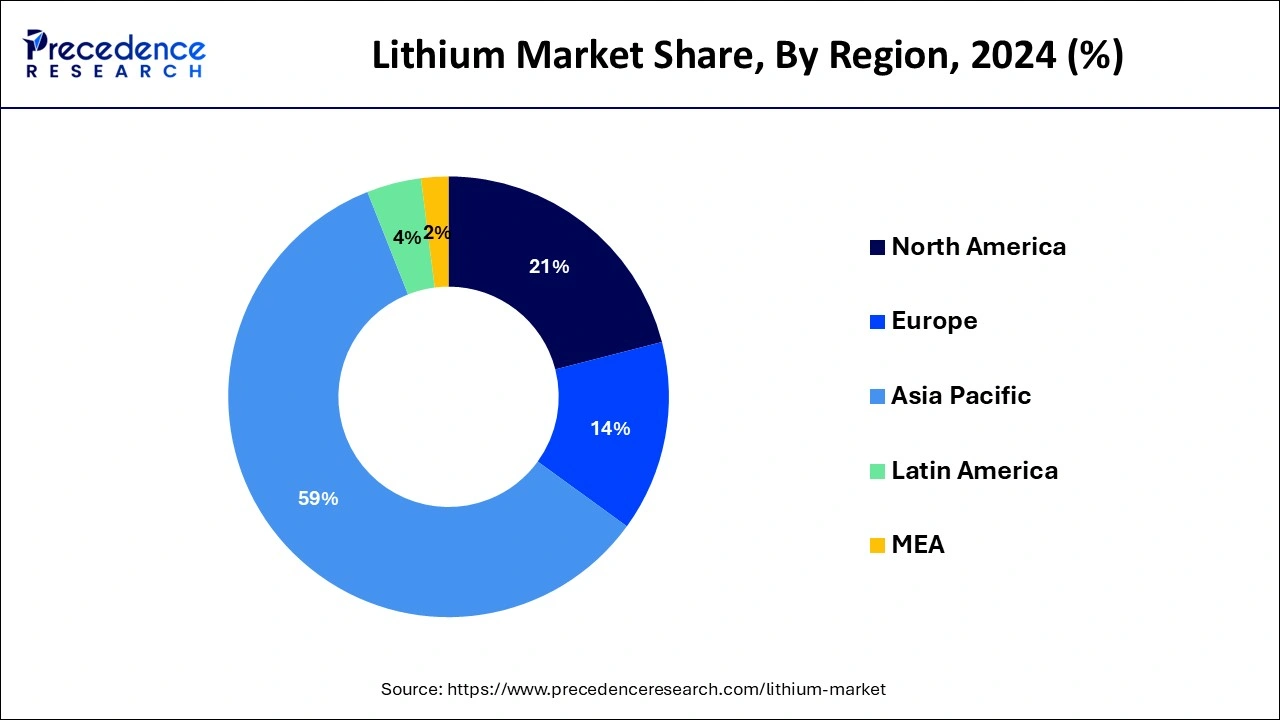

Asia-Pacific held the largest market share of 59% in 2024 in the lithium market due to robust demand for electric vehicles (EVs) and consumer electronics. Countries like China lead in EV adoption, driving the need for lithium-ion batteries. The region's economic growth, technological advancements, and government initiatives supporting clean energy contribute to the dominance. Additionally, key lithium producers and manufacturers are concentrated in Asia-Pacific, establishing it as a central hub for the lithium supply chain. These factors collectively position the region as a powerhouse in driving the growth and development of the lithium market.

North America is poised for rapid growth in the lithium market due to the increasing demand for electric vehicles (EVs) and renewable energy initiatives. The region's commitment to sustainability and the push for clean transportation has fueled a surge in EV adoption. Additionally, investments in energy storage projects and advancements in battery technology further contribute to the growing demand for lithium. With a focus on reducing dependence on fossil fuels, North America stands as a key player in driving the expansion of the lithium market in the coming years.

The U.S. is a major player in the regional market, growth driven by rising government focus toward fostering countries' mineral production capabilities. The US is stepping forward to reduce dependence on foreign sources, resulting in a boost to lithium production in the country.

Meanwhile, Europe is experiencing notable growth in the lithium market due to a strong push toward electric mobility and renewable energy. With stringent environmental regulations and increasing adoption of electric vehicles, the demand for lithium-ion batteries has surged. Governments are promoting sustainable energy solutions, fostering investments in lithium production and battery technologies. The European Union's commitment to carbon neutrality and the expansion of electric vehicle infrastructure contribute to the region's dynamic growth in the lithium market.

The lithium market revolves around the offering of a chemical element known for its lightweight and highly reactive properties. It is a crucial component in rechargeable batteries, playing a vital role in various electronic devices like smartphones, laptops, and electric vehicles. Due to its ability to efficiently store and release electrical energy, lithium-ion batteries have become the preferred choice for powering modern technology. Moreover, lithium has garnered significant attention in the renewable energy sector, where it is essential for storing energy generated by solar panels and wind turbines. As the demand for electric vehicles and clean energy solutions continues to rise, the importance of lithium in powering our digital and sustainable future becomes increasingly evident.

| Report Coverage | Details |

| Growth Rate from 2025 to 2034 | CAGR of 12.30% |

| Market Size in 2025 | USD 11.05 Billion |

| Market Size by 2034 | USD 31.44 Billion |

| Largest Market | Asia Pacific |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | By Product and By Application |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Surge in electric vehicle (EV) demand

The surge in electric vehicle (EV) demand has significantly bolstered the lithium market, a key component in rechargeable batteries. As more people globally embrace the shift towards cleaner and sustainable transportation, the demand for EVs has skyrocketed. Lithium-ion batteries, powered by lithium, are the preferred energy storage solution for electric vehicles due to their lightweight nature and high energy density.

The rise in EV adoption is not only driven by environmental concerns but also by advancements in battery technology, making electric cars more practical and affordable. This growing demand for electric vehicles directly translates to an increased need for lithium, as it remains a critical element in the production of batteries that power these environmentally friendly vehicles. As the automotive industry continues to prioritize electric mobility, the lithium market is witnessing a surge in demand, playing a pivotal role in shaping the future of clean and sustainable transportation.

Cobalt dependency in battery chemistry

Cobalt dependency in battery chemistry serves as a significant restraint on the demand for the lithium market. Lithium-ion batteries, while pivotal for powering electric vehicles and electronic devices, often rely on cobalt to enhance stability and performance. However, cobalt extraction poses ethical concerns, including issues related to child labor and unsafe mining practices, leading to increased scrutiny and calls for sustainable alternatives.

The fluctuating supply and rising prices of cobalt further contribute to the restraint, as the lithium market is vulnerable to disruptions in the cobalt supply chain. Industry stakeholders are actively seeking ways to reduce or eliminate cobalt in battery formulations to address these challenges. Efforts to develop cobalt-free battery technologies and explore alternative chemistries are crucial for ensuring the sustainability and resilience of the lithium market in the face of cobalt-related constraints.

Energy storage systems

Energy Storage Systems (ESS) represent a significant opportunity for the lithium market. As the world increasingly relies on renewable energy sources like solar and wind, the need for efficient energy storage becomes paramount. Lithium-ion batteries, being lightweight and offering high energy density, emerge as a key solution for storing excess energy generated by renewables. This surge in demand for ESS not only enhances the market for lithium but also positions it at the forefront of supporting grid stability and promoting the growth of sustainable energy.

Moreover, the versatility of lithium-ion batteries extends beyond electric vehicles, finding extensive use in grid-scale energy storage projects. These projects aim to store excess energy during periods of low demand and release it when demand is high, providing a reliable and flexible solution for managing energy grids. As the global focus on clean energy intensifies, the expanding role of lithium in energy storage systems presents a strategic opportunity for market players to contribute to a more sustainable and resilient energy infrastructure.

The carbonate segment held the highest market share of 55% in 2024. In the lithium market, the carbonate segment refers to lithium carbonate, a key chemical compound derived from lithium ore. Lithium carbonate is a crucial component in the production of lithium-ion batteries used in various applications, including electric vehicles and consumer electronics. A notable trend in this segment involves increasing demand driven by the growing electric vehicle market, renewable energy storage systems, and technological advancements in battery chemistry. The carbonate segment's prominence highlights its pivotal role in meeting the rising global demand for sustainable energy solutions.

The hydroxide segment is anticipated to witness rapid growth at a significant CAGR of 13.3% during the projected period. In the lithium market, the hydroxide segment refers to lithium hydroxide, a compound derived from lithium-bearing materials. Lithium hydroxide is a key component in the production of high-performance lithium-ion batteries, commonly used in electric vehicles and portable electronics. The trend in the hydroxide segment involves a growing preference for lithium hydroxide over lithium carbonate due to its suitability for advanced battery chemistries. Manufacturers and researchers are increasingly focusing on optimizing lithium hydroxide production processes to meet the rising demand for advanced energy storage solutions.

The automotive segment has held 41% market share in 2024. The automotive segment in the lithium market primarily involves the use of lithium-ion batteries to power electric vehicles (EVs). This application has witnessed remarkable growth due to the global shift toward clean transportation. The trend is driven by increased consumer awareness of environmental sustainability, government incentives for EV adoption, and advancements in battery technology. As automakers focus on expanding their electric vehicle portfolios, the demand for lithium in the automotive sector is expected to continue its upward trajectory, solidifying its role as a key driver in the lithium market.

The consumer electronics segment is anticipated to witness rapid growth over the projected period. The consumer electronics segment in the lithium market encompasses the use of lithium-ion batteries in devices such as smartphones, laptops, and wearable gadgets. These batteries offer lightweight and high-energy-density solutions, making them ideal for portable electronics. Trends in this segment include the demand for longer-lasting batteries, rapid charging capabilities, and a focus on eco-friendly battery technologies. As consumers increasingly rely on electronic devices, innovations in lithium-ion batteries continue to shape the consumer electronics market, emphasizing sustainability, efficiency, and improved user experiences.

By Product

By Application

By Geography

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

January 2025

January 2025