April 2025

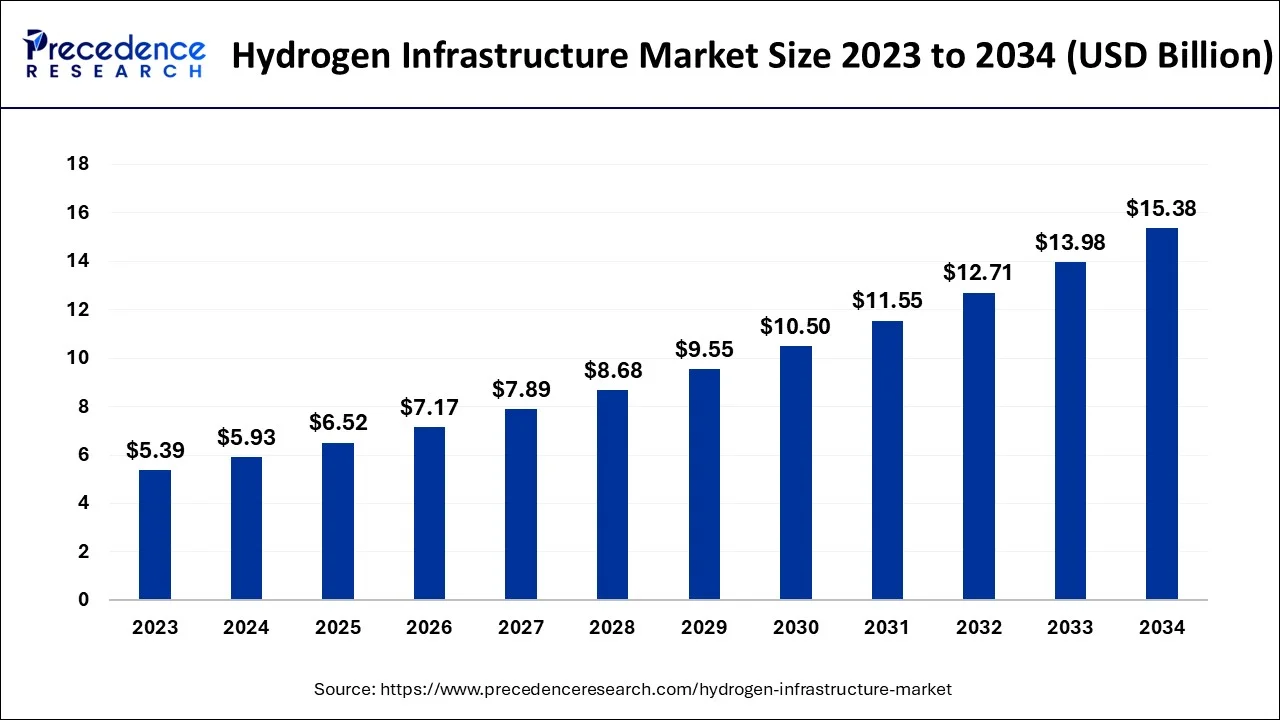

The global hydrogen infrastructure market size accounted for USD 5.93 billion in 2024, grew to USD 6.52 billion in 2025 and is projected to surpass around USD 15.38 billion by 2034, representing a healthy CAGR of 10% between 2024 and 2034.

The global hydrogen infrastructure market size accounted for USD 5.93 billion in 2024 and is anticipated to reach around USD 15.38 billion by 2034, expanding at a CAGR of 10% between 2024 and 2034.

A network of buildings and systems known as hydrogen infrastructure supports the generation, storage, distribution, and transportation of hydrogen as an energy carrier. The ability to transport hydrogen from the point of production to the point of use, such as an industrial facility, power generator, or fuelling station, is necessary for a functional hydrogen infrastructure. The infrastructure needed for fuel supply includes compressors, dispensers, trucks, storage facilities, liquefaction plants, and pipelines.

The market for hydrogen infrastructure has expanded as a result of the growing attention being paid to lowering greenhouse gas emissions and switching to a low-carbon economy. The expansion of renewable energy sources like solar and wind has made room for the construction of hydrogen infrastructure. Governments all across the world are putting supportive laws into place and offering rewards to encourage the construction of hydrogen infrastructure.

| Report Coverage | Details |

| Market Size in 2024 | USD 5.93 Billion |

| Market Size by 2034 | USD 15.38 Billion |

| Market Growth Rate from 2024 to 2034 | CAGR of 10% |

| Largest Market | Asia Pacific |

| Base Year | 2023 |

| Forecast Period | 2024 to 2034 |

| Segments Covered | By Production, By Storage, and By Delivery |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America and Middle East & Africa |

Environmental concerns

Environmental concerns have been a major driver of the enormous increase in the demand for hydrogen infrastructure in recent years. The need to lessen greenhouse gas emissions and fight climate change is one of the major environmental issues that has gained attention recently. Due to the fact that using hydrogen as a fuel produces no hazardous pollutants, including carbon dioxide, it is regarded as a clean and sustainable energy source. This quality has led authorities and businesses to investigate hydrogen as a potential replacement for fossil fuels in a variety of fields, including transportation, energy production, and industrial processes. In order to facilitate the mass use of hydrogen technologies, there has been a strong drive to build out and expand the hydrogen infrastructure.

A significant portion of greenhouse gas emissions are caused by transportation, primarily carbon dioxide from internal combustion engines. Since they operate with no harmful pollutants and only emit water vapour, hydrogen fuel cell vehicles (FCVs) offer a promising solution. Governments throughout the world have put in place supportive policies, such as financial incentives and plans for infrastructure development, after realizing the potential of FCVs to decarbonize the transportation industry. An extensive hydrogen refuelling network is now recognised as being essential to the widespread adoption of FCVs, which is motivating investments in hydrogen infrastructure.

High cost

The expense of building a hydrogen infrastructure has been a major barrier to the market's growth and general acceptance. Although hydrogen has a lot of potential as a clean, flexible energy source, its current cost issues prevent it from being scaled up and prevent the development of a hydrogen economy. The process of creating hydrogen is expensive in itself. The two most popular processes for producing hydrogen are electrolysis and steam methane reforming (SMR). SMR, which uses natural gas as a feedstock, is the most common and economical technique at the moment. However, it continues to use fossil fuels and emits carbon dioxide, which restricts its sustainability.

On the other hand, a more environmentally friendly option is electrolysis, which uses electricity to divide water into hydrogen and oxygen. However, despite falling prices for renewable energy sources, electrolysis is currently more expensive due to the high cost of electricity. The infrastructure and equipment requirements for SMR and electrolysis technologies also add significantly to the overall economic burden.

Transporting and storing hydrogen is another issue with costs. Due to its poor energy density, hydrogen needs huge storage spaces or high-pressure containment in order to be stored in significant quantities. Both alternatives are costly and dangerous. In addition, because of its low density and the requirement for specialised infrastructure, like pipelines or cryogenic tanks, long-distance transportation of hydrogen is difficult. The cost of starting from scratch with such infrastructure is a major obstacle to the development of the hydrogen infrastructure.

Furthermore, the installation and maintenance of hydrogen refuelling stations (HRS) for vehicles are costly. The number of HRSs is currently limited, making it difficult for hydrogen fuel cell vehicles to find refuelling options, which in turn hampers consumer adoption. To establish a comprehensive network of HRSs, significant investments are required, including land acquisition, equipment installation, safety measures, and ongoing maintenance. These costs often deter potential investors, resulting in a lack of HRS infrastructure and hindering the growth of the hydrogen-powered vehicle market.

Furthermore, although expensive, research and development (R&D) projects involving hydrogen technologies are essential for advancing technology and lowering costs. For hydrogen production, storage, transportation, and infrastructure development to become more affordable, both public and private sector expenditures in R&D are essential. However, the pace of innovation is slowed and cost competitiveness is hampered by the limited funding and resources dedicated to R&D.

Transition to sustainable energy and decarbonization

The transition to sustainable energy and decarbonization are urgent global concerns in the fight against climate change. Hydrogen has become a promising alternative to conventional fossil fuels as the globe looks for sustainable substitutes. Hydrogen is referred to as green hydrogen when it is created using renewable energy through a procedure called electrolysis since it uses clean power to separate water into hydrogen and oxygen. Since there are no carbon emissions as a result of this process, hydrogen is a viable option for cutting greenhouse gas emissions in a variety of industries.

Transport is one of the important sectors where hydrogen may accelerate decarbonization. Battery electric cars (BEVs) are becoming more and more popular, but they still have issues such a short driving range and lengthy charging times. Vehicles powered by hydrogen fuel cells (FCVs) provide an option. Hydrogen is used as a fuel source by FCVs to produce power, with the only byproduct being water vapour. Compared to BEVs, FCVs have a number of benefits, such as greater driving ranges, quicker refuelling periods, and the potential to power heavy-duty vehicles like trucks and buses. In order to facilitate the widespread adoption of FCVs, a strong hydrogen infrastructure, including refuelling stations, must be developed.

In addition, hydrogen is essential for energy storage, another important part of the switch to clean energy. The intermittent nature of renewable energy sources like wind and solar is one of their drawbacks. Through electrolysis, energy produced during times of low demand or surplus supply can be used to create hydrogen. The generated hydrogen can be used as a feedstock in industrial operations or stored and turned back into electricity when needed. The grid is more stable thanks to its capacity to store and distribute renewable energy, and it also allows for higher penetration of renewables, addressing the issue of intermittency.

Additionally, there are significant opportunities for hydrogen use in industrial applications. In many industrial processes, including the creation of ammonia and methanol as well as in industries like refining and steel production, hydrogen is a crucial component. Currently, emissions are created when fossil fuels are utilised to manufacture the majority of the hydrogen used in industry. These industrial processes can significantly reduce their carbon footprint by switching to green hydrogen, aiding in the decarbonization process.

Based on production, the steam methane reforming, coal, electrolysis, and others categories make up the segmentation of the worldwide hydrogen infrastructure market. Using electricity to divide water into hydrogen and oxygen with no carbon emissions, electrolysis is a green hydrogen production process. Despite being relatively inexpensive and effective, the production of hydrogen from natural gas steam reforming still produces greenhouse gases. Finding methods to produce hydrogen with the right purity at economically sensible prices while avoiding extra environmental restrictions is the challenge.

Based on storage, the compression, liquefaction, and material-based segments make up the worldwide hydrogen infrastructure industry. The compression segment accounted for the largest market share in 2022. This is because hydrogen can be stored easily and affordably and is thus expected to stimulate demand.

The hydrogen infrastructure market is divided into four categories based on delivery: transportation, refineries, power plants, and hydrogen refuelling stations. During the anticipated period, the transportation segment's market share will grow the fastest. The transportation sector has seen growth in the application category, which will fuel hydrogen demand in the next years, as a result of the growing focus on decarbonization.

Due to the rise of fuel cell-based electric cars and a hydrogen-based economy, Asia Pacific is predicted to have the largest market share over the projection period. Refineries and fuel cell cars in the region are consuming more hydrogen than usual, which is expected to propel market expansion.

Segments Covered in the Report:

By Production

By Storage

By Delivery

By Geography

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

April 2025

May 2025

May 2024

May 2025