February 2025

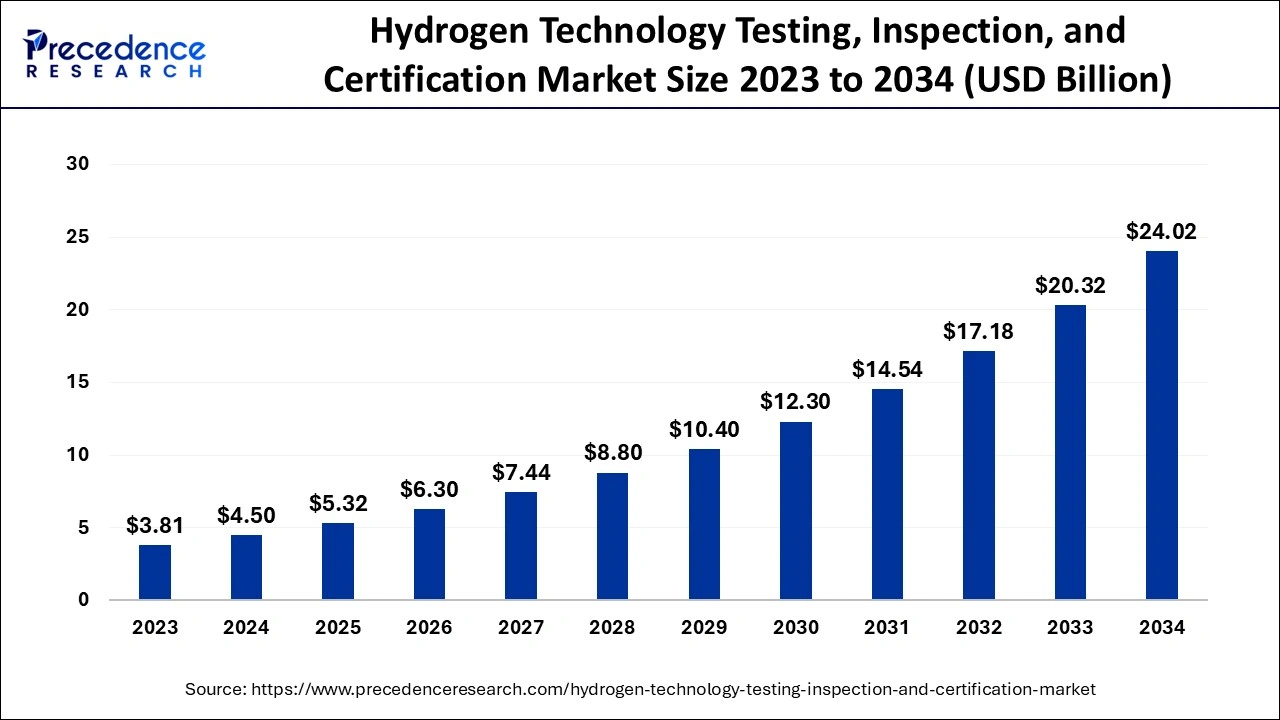

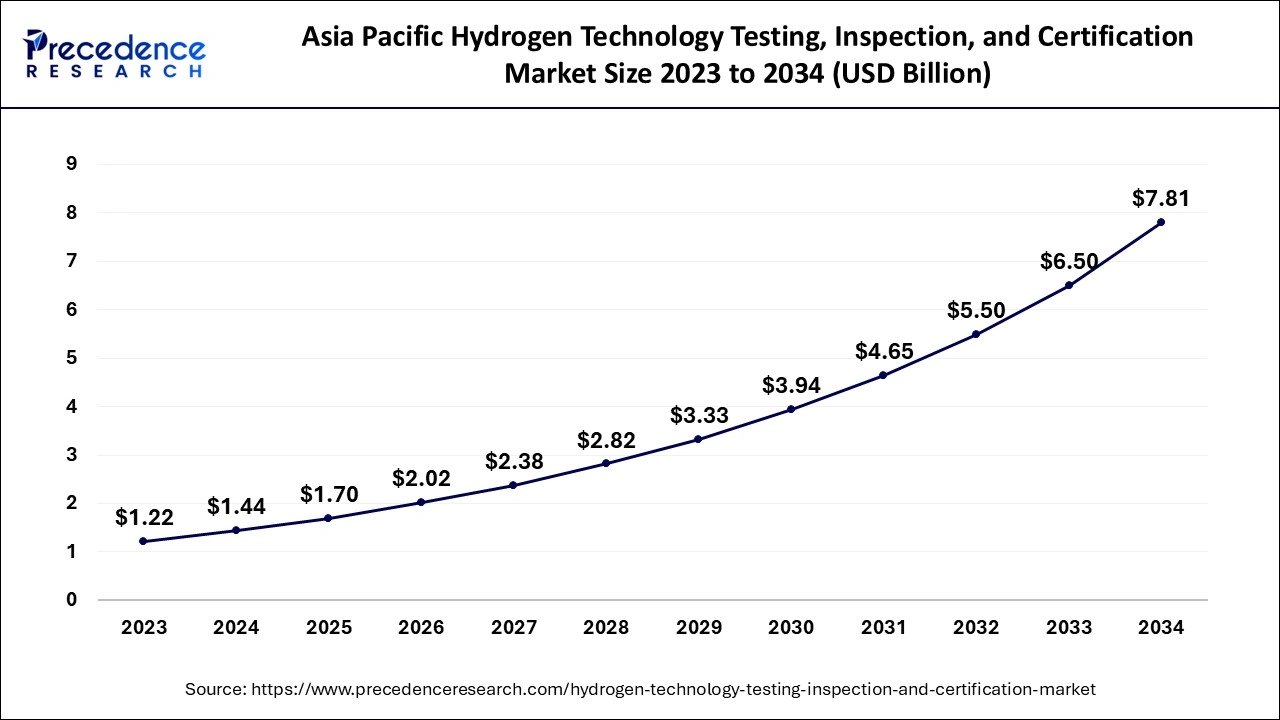

The global hydrogen technology testing, inspection, and certification market size is calculated at USD 4.50 billion in 2024, grew to USD 5.32 billion in 2025 and is projected to reach around USD 24.02 billion by 2034. The market is expanding at a healthy CAGR of 18.22% between 2024 and 2034. The Asia Pacific hydrogen technology testing, inspection, and certification market size is evaluated at USD 1.44 billion in 2024 and is projected to grow at a fastest CAGR of 18.38% during the forecast period.

The global hydrogen technology testing, inspection, and certification market size accounted for USD 4.50 billion in 2024 and is predicted to surpass around USD 24.02 billion by 2034, representing a healthy CAGR of 18.22% from 2024 to 2034. The global transition towards green energy resources and building robust infrastructure for it, moreover, major research institutes are investing heavily into the development of green energy like hydrogen due to its application in various industries, fuelling the hydrogen technology testing, inspection, and certification market on a global level.

The Asia Pacific hydrogen technology testing, inspection, and certification market size is exhibited at USD 1.44 billion in 2024 and is predicted to be worth around USD 7.81 billion by 2034, growing at a CAGR of 18.38% from 2024 to 2034.

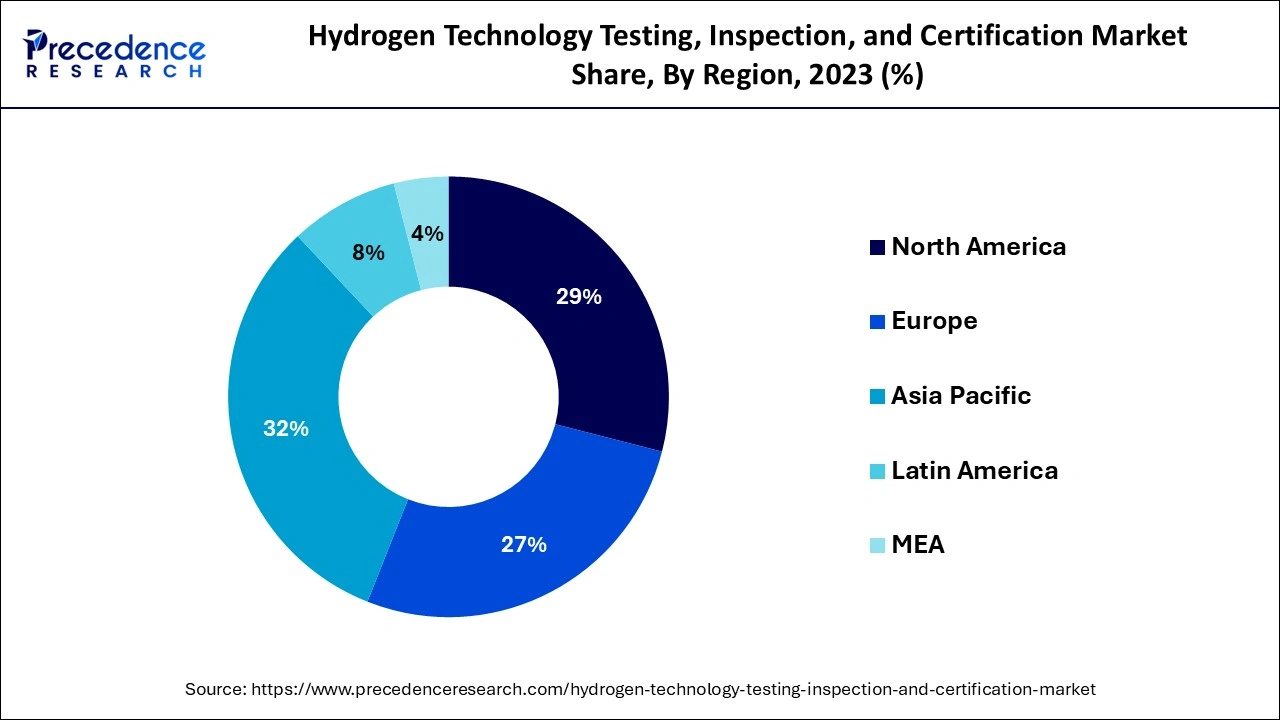

Asia Pacific accounted for the largest share of the hydrogen technology testing, inspection, and certification market in 2023. The market is proliferating due to evolving countries like Japan, China, and South Korea as they are making substantial investments to expand the projects for green hydrogen, and it is driven by ambitious projects like energy transitions. Furthermore, there is a significant government investment in hydrogen infrastructure, such as production facilities and technological advancements in fuel cell technologies.

North America is anticipated to witness the fastest growth in the hydrogen technology testing, inspection, and certification market during the forecasted years due to the region's strong emphasis on developing green energy, which is highly supported by the initiatives taken by institutes and government policies to produce more clean energy to reduce carbon footprints. Also, hydrogen refueling centers should be established, and research and development should be conducted to create safe and clean energy. North America has the highest standards for quality and safety regulations.

The hydrogen technology testing, inspection, and certification market is experiencing significant growth due to the global inclination toward cleaner energy resources. Since industries and governments have been inclined to use hydrogen adoption to meet targets like decarbonization. To ensure the safety, compliance, and performance of hydrogen-based technology, testing, inspection, and certification (TIC) services are crucial. The market covers various spectrum of services such as testing of hydrogen fuel cells, storage systems, electrolyzers, and transportation systems.

By region, North America and Europe are the frontiers of the global hydrogen technology testing, inspection, and certification market; on the contrary, Asia Pacific is emerging as a major key player in the global market, fuelling the growth of the market further. The rising production of green hydrogen is increasing the strength of the market. Also, significant players in the market are collaborating with governments and institutes to work on the project for green hydrogen.

AI Impact on the Hydrogen Technology Testing, Inspection, and Certification Market

Artificial Intelligence (AI) is playing a revolutionary role in the global hydrogen technology testing, inspection, and certification market in terms of safety, accuracy, and efficiency. AI-based technology can be integrated into TIC processes to improve certification processes. Predictive maintenance with AI can help to identify system failure before it occurs, especially in the hydrogen infrastructure. This will help enable preventive action that minimizes downtime and risks to safety. Furthermore, AI has the ability to handle complex data and perform accurate simulations, help handle safety standards, and speed up the certification process, which is generally time-consuming otherwise. Since the global inclination towards green energy has risen, AI is supporting hydrogen technology equally.

| Report Coverage | Details |

| Market Size by 2034 | USD 24.02 Billion |

| Market Size in 2024 | USD 4.50 Billion |

| Market Growth Rate from 2024 to 2034 | CAGR of 18.22% |

| Largest Market | Asia Pacific |

| Base Year | 2023 |

| Forecast Period | 2024 to 2034 |

| Segments Covered | Service Type, Testing Type, Process, Application, and Regions |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America and Middle East & Africa |

Accelerating demand for clean energy in diverse sectors

The major driver for the hydrogen technology testing, inspection, and certification market is accelerating demand for clean energy resources for diverse sectors to achieve goals like decarbonization. Governments and leading institutes are investing heavily in the development of hydrogen technology since it's the prime component of the energy transition. The market is experiencing robust growth due to hydrogen fuel cells and hydrogen storage systems becoming more critical aspects for transportation and power generation. In addition to this, the technological advancements in hydrogen technology to create clean energy are prominent.

Complexity in infrastructure development

The major restraining factor for the development of the hydrogen technology testing, inspection, and certification market is the high cost and complexity of developing a robust infrastructure to store the hydrogen in one place. Advanced and specialized technology is further required for the production, storage, and transportation of hydrogen, which is costly matter to implement practically and risky as well since hydrogen is quite an unstable gas, highly inflammable, and it's difficult to store at normal temperature, it requires the highly pressurized environment to store the hydrogen.

Emphasis on the production of green hydrogen

The significant opportunity that the hydrogen technology testing, inspection, and certification market holds is the increasing emphasis on producing green hydrogen in substantial amounts since it has various applications in diverse sectors. Governments and major institutes are prioritizing green energy to achieve the carbon-neutral goal; the demand for green hydrogen is surging significantly on a global scale.

Green hydrogen projects across Asia, Europe, and North America contribute substantially to the hydrogen technology testing, inspection, and certification market. Sectors like transportation, power generation, and heavy industries found numerous applications of green hydrogen since it offers comprehensive solutions to the sectors due to their innovative approach to safety efficiency and following regulatory compliance. Also, the increasing number of government initiatives to invest in green hydrogen and its production is observed.

The testing segment dominated the global hydrogen technology testing, inspection, and certification market in 2023. The segment is proliferating due to various attributes that ensure safety, efficiency, and performance are mandatory. Testing is also important to detect potential hazards like equipment failure or gas leakage. Hence, with the rising push towards green energy.

The inspection segment will register the fastest growth in the hydrogen technology testing, inspection, and certification market over the forecast period. The segment is expanding due to the stringent compliance for monitoring to avoid structural failures that might be life-threatening for workers.

The hydrogen permeation & compatibility segment accounted for the largest share of the hydrogen technology testing, inspection, and certification market in 2023. Hydrogen permeation and compatibility testing are essential due to their wide application across various industries and to ensure the compatibility of the materials used to build infrastructure where hydrogen can be stored.

The pressure cycle, leakage, & tightness segment is expected to witness rapid growth in the hydrogen technology testing, inspection, and certification market in the coming years. Testing for pipes, tanks, and other components that carry hydrogen is essential to avoid mishaps since hydrogen is under immense pressure due to its volatile nature.

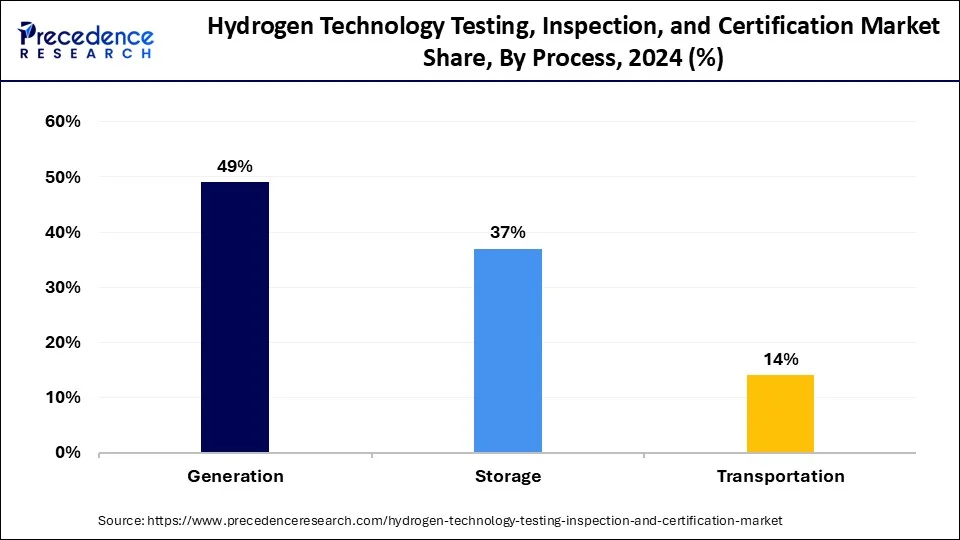

The generation segment accounted for a considerable share of the hydrogen technology testing, inspection, and certification market in 2023. The segment is expanding for various reasons, such as the increasing frequency of green hydrogen production and the need to meet stringent policies and regulations for quality control purposes.

The storage segment will witness rapid expansion in the hydrogen technology testing, inspection, and certification market over the studied period. The storage segment is proliferating due to the increasing demand for hydrogen-powered transportation, and various industrial applications of green energy require large storage systems like tanks, underground facilities, and huge pipelines.

The refining & chemical led the global hydrogen technology testing, inspection, and certification market. Hydrogen plays an important role in refining processes like hydrocracking and desulfurization, which produces clean energy. Since industries aim to follow stringent regulations for green energy, the segment is poised to grow further.

The mobility segment will register the fastest growth in the hydrogen technology testing, inspection, and certification market over the forecast period. The mobility segment is proliferating due to the expansion of the hydrogen-based transportation infrastructure and vehicles in the market. Also, the government and major institutes are investing heavily in the R&D of hydrogen mobility solutions.

Segments Covered in the Report

By Service Type

By Testing Type

By Process

By Application

By Geography

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

February 2025

April 2025

January 2025

October 2023