January 2025

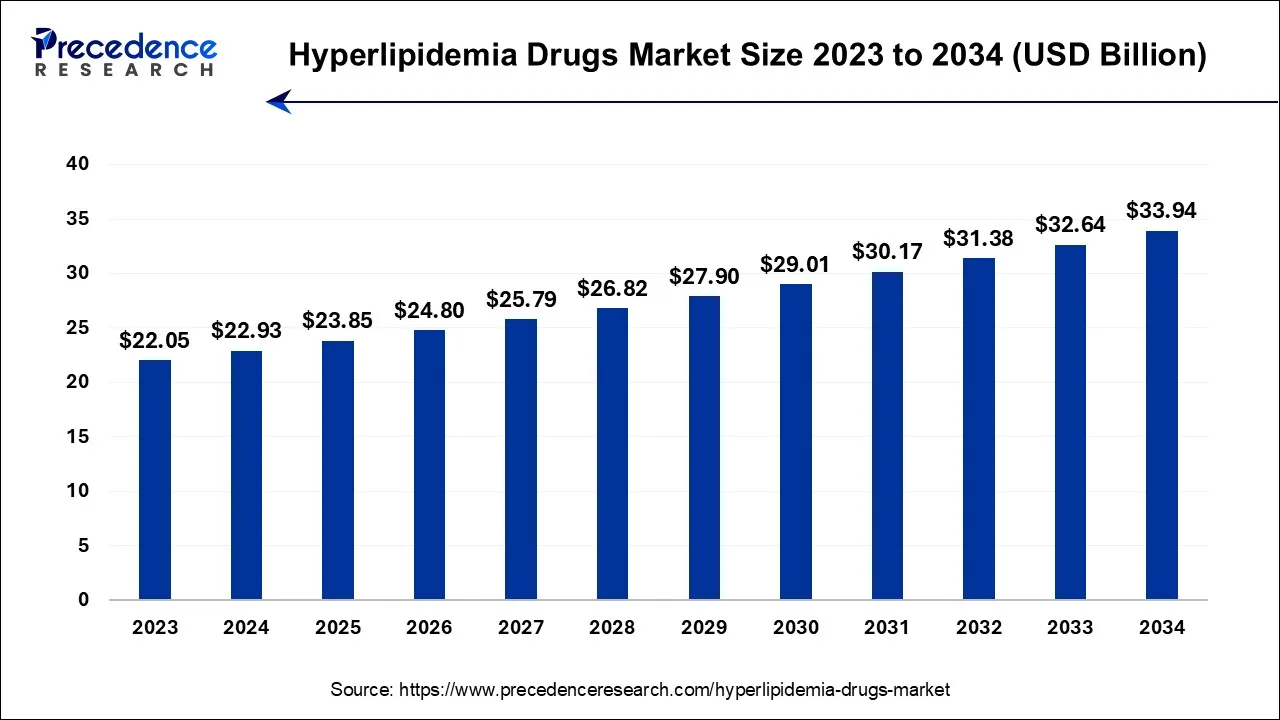

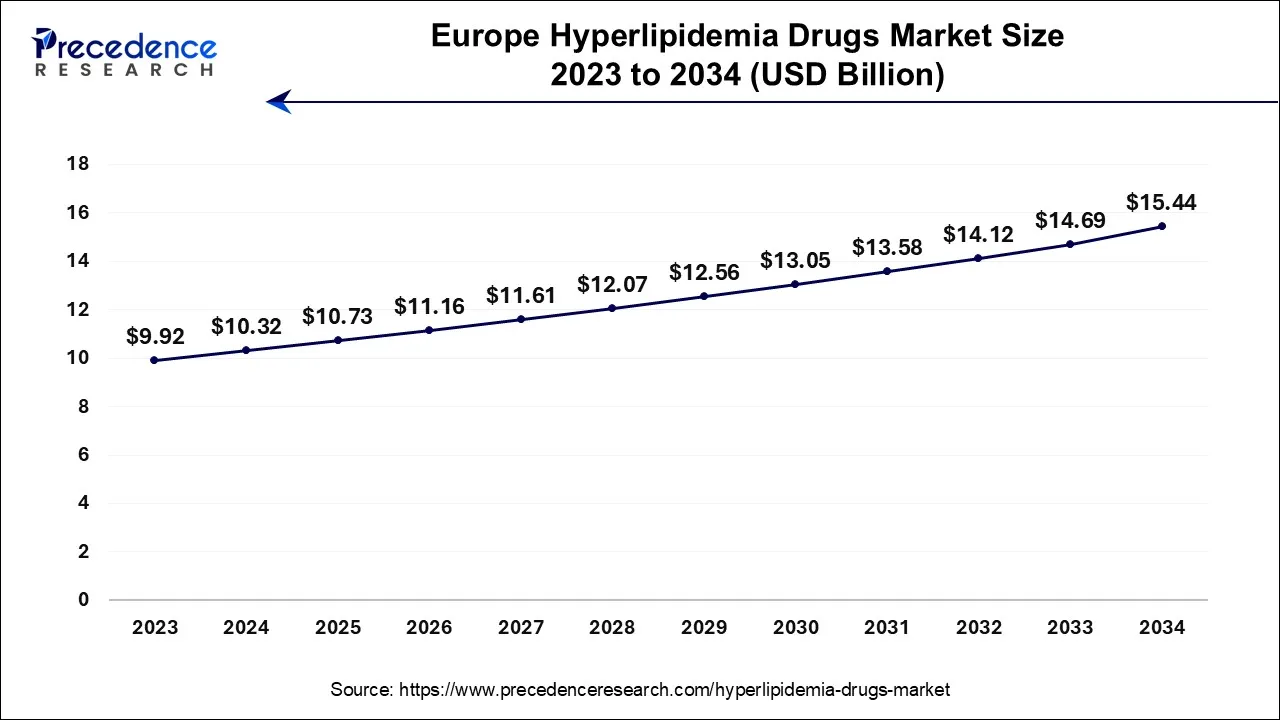

The global hyperlipidemia drugs market size is calculated at USD 22.93 billion in 2024, grew to USD 23.85 billion in 2025, and is predicted to hit around USD 33.94 billion by 2034, poised to grow at a CAGR of 4% between 2024 and 2034. The Europe hyperlipidemia drugs market size accounted for USD 10.32 billion in 2024 and is anticipated to grow at the fastest CAGR of 3.99% during the forecast year.

The global hyperlipidemia drugs market size is expected to be valued at USD 22.93 billion in 2024 and is anticipated to reach around USD 33.94 billion by 2034, expanding at a CAGR of 4% over the forecast period from 2024 to 2034.

The Europe hyperlipidemia drugs market size is accounted for USD 10.32 billion in 2024 and is projected to be worth around USD 15.44 billion by 2034, poised to grow at a CAGR of 4.11% from 2024 to 2034.

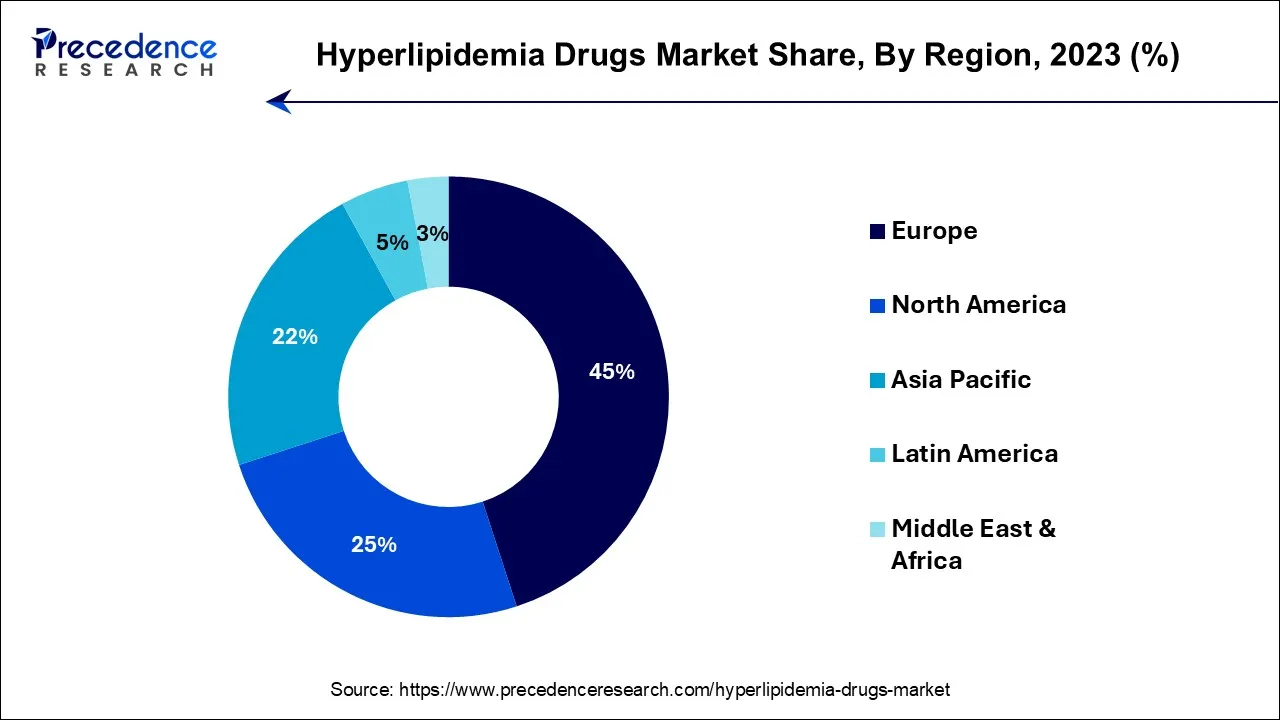

Europe has held the largest revenue share 45% in 2023. Europe holds a major share in the hyperlipidemia drugs market due to several factors. It has a relatively high prevalence of hyperlipidemia owing to dietary habits and an aging population. Robust healthcare infrastructure, access to advanced medical treatments, and strong pharmaceutical regulations facilitate the development and distribution of hyperlipidemia drugs. Furthermore, increased awareness of cardiovascular health and proactive government initiatives contribute to the market's growth. Europe's market leadership is also attributed to significant research and innovation in the field of lipid-lowering medications, leading to the availability of a wide range of effective treatment options.

Asia-Pacific is estimated to observe the fastest expansion with the highest CAGR of 6.1% during the forecast period. The Asia-Pacific region commands a substantial share in the hyperlipidemia drugs market for several compelling reasons. This prominence stems from a notable surge in lifestyle-related ailments, including hyperlipidemia, driven by shifting dietary patterns and sedentary lifestyles. Furthermore, the escalating elderly population in nations like Japan and China has generated a heightened demand for lipid-lowering pharmaceuticals.

The region's advancing healthcare infrastructure, augmented awareness of cardiovascular well-being, and increased healthcare investments in emerging markets collectively bolster market expansion. In addition, pharmaceutical enterprises are strategically targeting the Asia-Pacific region, further amplifying its dominance within the hyperlipidemia drugs market landscape.

The hyperlipidemia pharmaceutical sector pertains to the industry niche specializing in medications crafted to regulate elevated lipid (fat) levels in the bloodstream, notably cholesterol and triglycerides. Hyperlipidemia poses a significant risk for cardiovascular diseases. This market encompasses statins, fibrates, bile acid sequestrants, PCSK9 inhibitors, and various other lipid-lowering therapeutic agents.

Driving market expansion are factors such as the increasing incidence of hyperlipidemia due to shifts in lifestyles, dietary choices, and genetic predisposition. Furthermore, heightened awareness regarding cardiovascular health and ongoing drug development advances contribute to the growth of this competitive and ever-evolving hyperlipidemia pharmaceutical landscape.

The hyperlipidemia pharmaceutical sector constitutes a pivotal segment within the broader pharmaceutical industry, dedicated primarily to the creation and dissemination of therapeutics designed to effectively regulate and manage elevated levels of lipids, specifically cholesterol and triglycerides, in the bloodstream. This specialized market encompasses a diverse array of pharmaceutical products, including statins, fibrates, bile acid sequestrants, PCSK9 inhibitors, and various other lipid-lowering medications.

Hyperlipidemia, often correlated with lifestyle choices, genetic predisposition, and dietary habits, has burgeoned into a widespread health concern, considerably heightening the susceptibility to cardiovascular diseases. Consequently, the market has borne witness to substantial expansion, primarily driven by several pivotal factors.

One of the paramount impetuses steering the hyperlipidemia pharmaceutical market towards an upward trajectory is the relentless rise in the global incidence of hyperlipidemia. An ensemble of factors, ranging from sedentary lifestyles to less-than-optimal dietary regimens and genetic predispositions, collectively forms the backdrop to the mounting prevalence of this medical condition. Simultaneously, as the global population ages, the demand for lipid-regulating medications has surged, given the heightened propensity for hyperlipidemia with advancing age.

The incessant influx of cutting-edge developments in drug formulations and novel therapeutic paradigms has paved the path to introducing pharmaceuticals that are not only more efficacious but also safer, setting ablaze the market's growth prospects. The advent of pioneering therapies, epitomized by PCSK9 inhibitors, has provided patients with alternative therapeutic pathways, thereby expanding the market's overall potential.

However, amidst its robust growth trajectory, the hyperlipidemia drugs market encounters its share of challenges, notably the intensifying pricing pressures and cutthroat competition among pharmaceutical enterprises. The availability of generic versions of frequently prescribed medications, such as statins, has heightened the competitive pricing landscape, potentially impinging upon the profit margins of manufacturers.

Moreover, navigating the stringent regulatory landscape governing drug approvals represents a formidable obstacle for industry stakeholders. Meeting the exacting safety and efficacy standards mandated by regulatory bodies can translate into protracted development timelines and escalated costs for drug developers.

Nevertheless, within the ambit of these challenges, considerable business opportunities are ripe for plucking within the hyperlipidemia drugs market. Collaborative ventures and strategic partnerships between pharmaceutical firms and research institutions hold the potential to yield innovative therapeutic solutions. Furthermore, the market proffers prospects for the implementation of personalized medicine paradigms, and customizing treatment regimens to the distinct profiles of individual patients, which can potentially amplify therapeutic outcomes.

As awareness of cardiovascular health scales higher, a burgeoning market exists for combination therapies and complementary products. These may encompass dietary supplements and lifestyle management programs that can seamlessly complement pharmaceutical interventions. This diversification of product offerings augments the spectrum of revenue streams accessible to enterprises navigating this dynamic market.

In summation, the hyperlipidemia drugs market, propelled by surging global prevalence, advances in pharmaceutical innovation, and an aging populace, presents an intricate tapestry of opportunities and challenges. Enterprises can seize these prospects through innovation, strategic partnerships, and diversification of product portfolios, effectively addressing the evolving needs of patients and healthcare providers within this dynamic and ever-evolving sector.

| Report Coverage | Details |

| Market Size in 2024 | USD 22.93 Billion |

| Market Size by 2034 | USD 33.94 Billion |

| Growth Rate from 2024 to 2034 | CAGR of 4% |

| Largest Market | Europe |

| Base Year | 2023 |

| Forecast Period | 2024 to 2034 |

| Segments Covered | By Drug Class and By Route of Administration |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Increasing prevalence of hyperlipidemia

The surge in the occurrence of hyperlipidemia stands as a compelling force propelling the dynamic growth of the hyperlipidemia drugs market. This surge can be chiefly attributed to a convergence of factors, including evolving lifestyles and dietary patterns, genetic predisposition, and the maturation of the global populace. The prevalence of sedentary lifestyles and diets replete with saturated fats has surged, rendering a larger segment of the population susceptible to elevated lipid levels within their circulatory systems. Furthermore, genetic elements play an influential role, as certain individuals bear a genetic predisposition to hyperlipidemia, independent of their lifestyle choices.

The aging demographic on a global scale represents another pivotal driver, as hyperlipidemia tends to manifest more commonly with advancing age. With the continued expansion of the elderly population, the demand for medications aimed at lipid regulation also experiences a corresponding surge. In response to this burgeoning prevalence, healthcare practitioners increasingly emphasize the significance of early identification and intervention, leading to heightened awareness and an amplified requirement for hyperlipidemia pharmaceuticals. Overall, the escalating prevalence of hyperlipidemia serves as a potent impetus fueling the proliferation of this pharmaceutical market.

Competition from non-pharmacological interventions

The hyperlipidemia drugs market encounters a notable restraint in the form of competition from non-pharmacological interventions. These non-pharmacological strategies encompass dietary adjustments, exercise routines, and comprehensive lifestyle management programs, offering effective alternatives for addressing hyperlipidemia. Patients often favor these approaches due to perceived safety and their lower cost when juxtaposed with pharmaceutical treatments.

With the increasing awareness of the pivotal role that a healthy lifestyle plays and the profound impact of diet and physical activity on lipid levels, individuals are more inclined to explore non-pharmacological avenues before considering medication. This inclination can lead to delayed or diminished utilization of hyperlipidemia drugs, thereby affecting the demand within the market.

Healthcare practitioners, in alignment with prevailing medical guidelines, consistently emphasize lifestyle modifications as the initial approach to managing hyperlipidemia, further intensifying the competition between non-pharmacological and pharmacological interventions. Moreover, the presence of dietary supplements and readily available over-the-counter products marketed as cholesterol-lowering aids amplifies the diversion of attention away from prescription medications.

To address this particular constraint, pharmaceutical enterprises may need to pivot towards the development of combination therapies that seamlessly integrate pharmacological and non-pharmacological components or intensify efforts to educate both healthcare providers and patients about the compelling benefits of drug therapy, particularly in cases where lifestyle changes alone fall short in achieving optimal outcomes.

Combination therapies

Combination therapies represent a compelling avenue for creating substantial opportunities within the hyperlipidemia drugs market. By integrating multiple lipid-lowering drugs or combining pharmaceuticals with non-pharmacological interventions, this approach addresses the multifaceted nature of hyperlipidemia and its diverse patient population. Firstly, combination therapies can provide enhanced efficacy compared to monotherapy.

Different drugs with complementary mechanisms of action can work synergistically to achieve better lipid control and reduce cardiovascular risk, appealing to patients and healthcare providers seeking improved outcomes. Moreover, combination treatments may mitigate side effects, as lower doses of individual drugs may be used, enhancing patient tolerability and adherence.

Additionally, these therapies cater to patients with varying lipid profiles and treatment needs, expanding the market's addressable population. Customized combinations can be tailored to individual patients, offering a personalized approach to hyperlipidemia management. Overall, combination therapies enhance the versatility and effectiveness of hyperlipidemia drug regimens, positioning them as a crucial growth driver in this dynamic pharmaceutical sector.

According to the drug class, the statins segment has held a 30% revenue share in 2023. Statins dominate the hyperlipidemia drugs market primarily because of their recognized effectiveness, established safety credentials, and extensive adoption. As the foremost prescribed drug class for cholesterol reduction and cardiovascular risk mitigation, statins have a well-documented history of success in clinical trials, instilling confidence in healthcare providers. Their affordability, bolstered by the presence of generic versions, amplifies their popularity. Nevertheless, the evolving landscape of emerging therapies and the escalating demand for personalized treatment approaches may potentially reshape the competitive dynamics within the market in the years ahead.

The miscellaneous segment is anticipated to expand at a significantly CAGR of 4.7% during the projected period. The Miscellaneous segment holds significant growth in the hyperlipidemia drugs market because it includes a diverse range of lipid-lowering medications beyond the well-established drug classes. This segment encompasses innovative therapies like PCSK9 inhibitors, emerging biologics, and novel mechanisms of action. These advanced treatments offer alternatives for patients with statin intolerance or inadequate responses to traditional medications, expanding the market's reach.

Additionally, ongoing research and development efforts in this segment continuously introduce groundbreaking drugs, driving its prominence and contributing to the overall growth and diversity of hyperlipidemia treatment options.

In 2023, the oral segment had the highest market share of 44% on the basis of the Product. The dominance of the oral segment in the hyperlipidemia drugs market can be attributed to its paramount position, primarily stemming from its inherent advantages in terms of ease of administration and patient adherence. Oral medications offer a level of convenience that makes them the preferred choice for the prolonged treatment typically required in managing hyperlipidemia. This results in enhanced patient compliance and better treatment outcomes. Furthermore, the oral segment boasts a wide array of lipid-lowering medications, encompassing statins, fibrates, PCSK9 inhibitors, among others, providing healthcare providers with a versatile toolkit to tailor treatment regimens according to individual patient requirements.

The parenteral segment is anticipated to expand at the fastest rate over the projected period. The parenteral segment holds a major growth in the hyperlipidemia drugs market due to its effectiveness in delivering rapid and precise treatment. Parenteral administration, which includes injections and intravenous infusions, allows for direct drug delivery into the bloodstream, ensuring immediate therapeutic impact. This is particularly crucial in emergency situations and for patients who cannot tolerate oral medications. Additionally, parenteral formulations often provide consistent dosing, enhancing treatment reliability. As a result, healthcare professionals often prefer parenteral routes for lipid-lowering drugs, contributing significantly to this segment's substantial market growth.

Segments Covered in the Report

By Drug Class

By Route of Administration

By Geography

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

January 2025

March 2025

March 2025

March 2025