April 2025

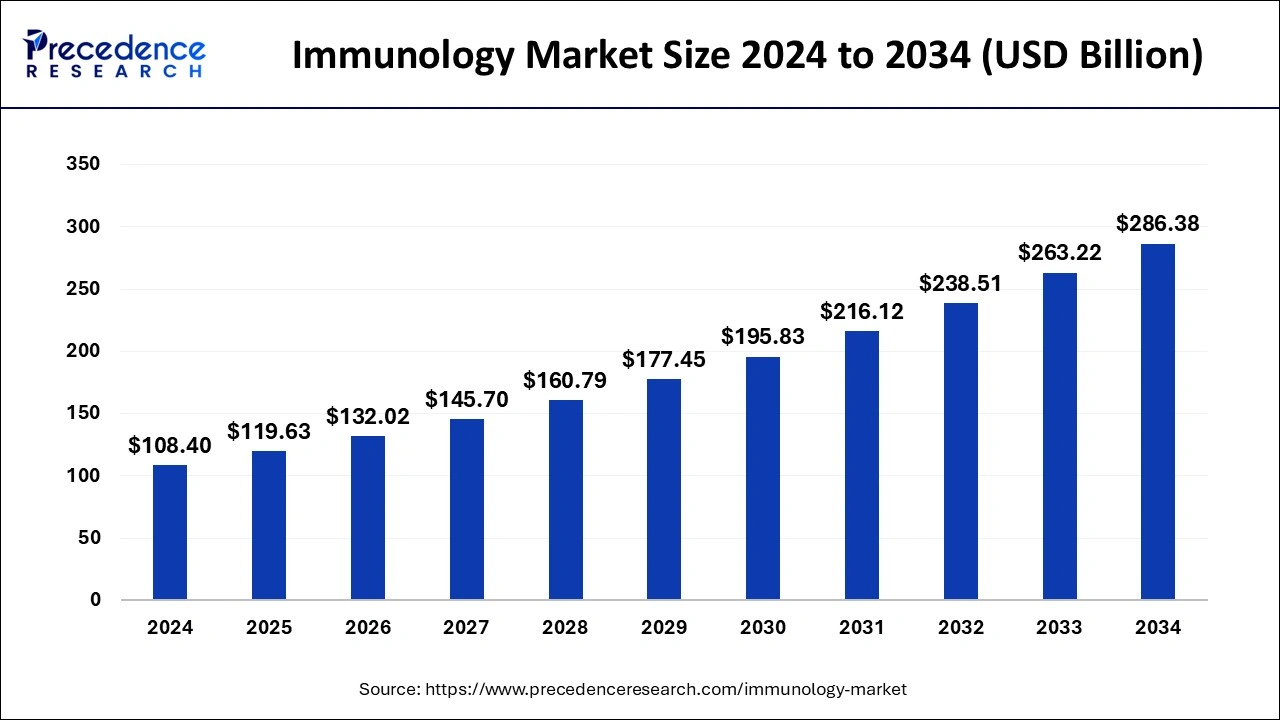

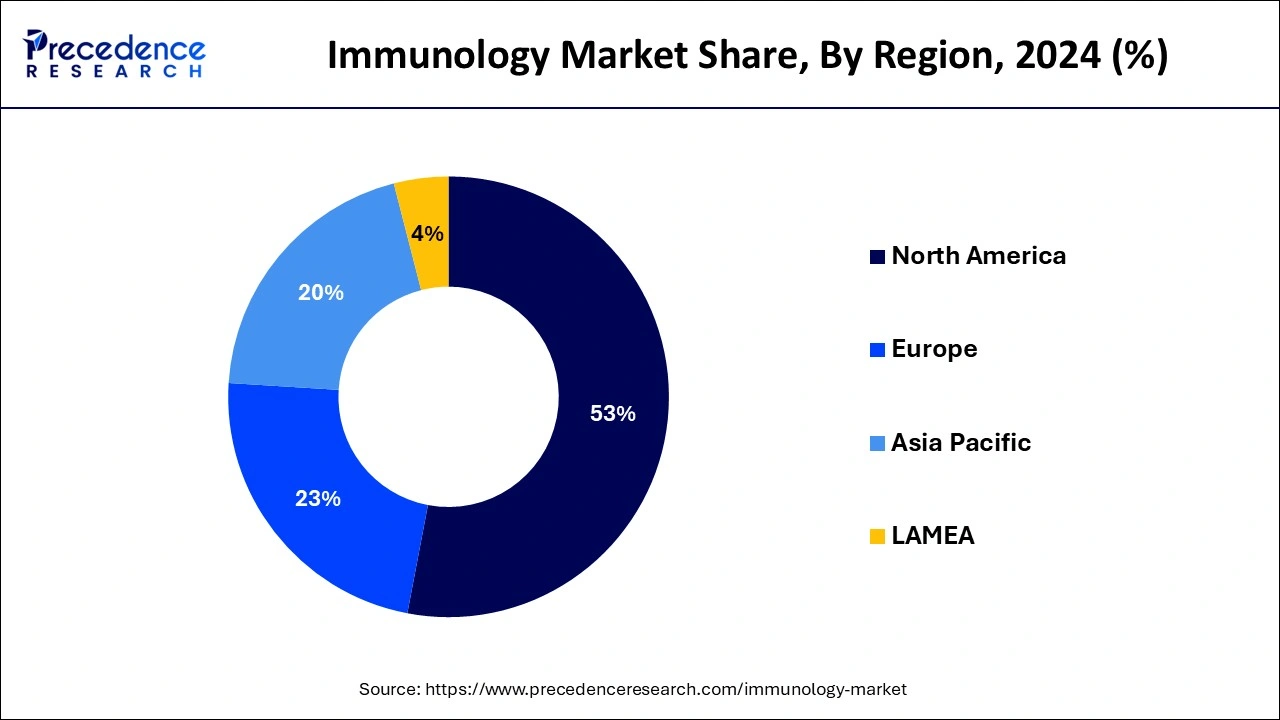

The global immunology market size is valued at USD 119.63 billion in 2025 and is forecasted to attain around USD 286.38 billion by 2034, accelerating at a CAGR of 10.20% from 2025 to 2034. The North America immunology market size surpassed USD 57.45 billion in 2024 and is expanding at a CAGR of 10.22% during the forecast period. The market sizing and forecasts are revenue-based (USD Million/Billion), with 2024 as the base year.

The global immunology market size reached USD 108.40 billion in 2024 and is estimated to hit around USD 286.38 billion by 2034 with a CAGR of 10.20% from 2025 to 2034. As the world's population ages, illnesses linked to the immune system and aging-related diseases are becoming more common, driving the growth of the market.

Artificial intelligence has the potential to enhance immunology research through various innovative approaches. One key area is the development of sophisticated algorithms designed for predicting antigens and neoantigens, which are crucial for designing targeted therapies and vaccines. AI algorithms can analyze vast datasets to identify patterns and potential biomarkers that may not be readily apparent through traditional methods. Additionally, AI can facilitate the inference of immune cell behaviors, allowing researchers to track and analyze how these cells interact within different tissues over time. This spatial and temporal analysis is vital for understanding immune responses and the progression of diseases in various environments within the body.

AI also plays an important role in the research and development of immunotherapeutics. By leveraging machine learning techniques, researchers can optimize the design of therapeutic agents that specifically manipulate immune responses, aiming to improve the efficacy and safety of treatments for conditions such as cancer and autoimmune disorders.

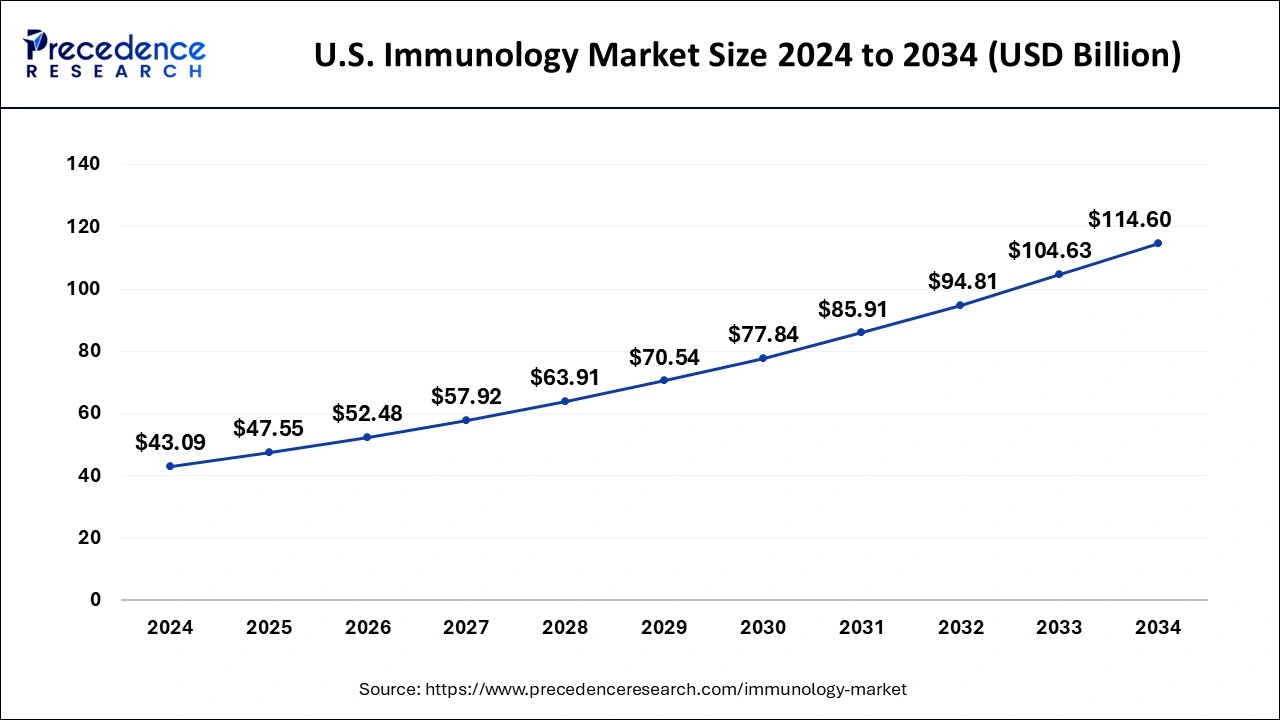

The U.S. immunology market size was valued at USD 43.09 billion in 2024 and is anticipated to reach around USD 114.60 billion by 2034, poised to grow at a CAGR of 10.28% from 2025 to 2034.

North America held the largest market share of 53% in 2024. In North America, the prevalence of autoimmune disorders like psoriasis, Crohn's disease, and rheumatoid arthritis has been rising significantly. The need for immunology therapies and drugs is increasing due to this development. Nowadays, biological medications are a vital component of immunology care. These medications, made from living things, treat autoimmune illnesses by focusing on particular immune system components. Effective therapy choices for patients who do not respond well to conventional medications have been successfully provided by biologics. Companies such as AbbVie, Johnson & Johnson, Amgen, and Pfizer are a few of the prominent participants in the immunology market in North America that have significant stakes in the form of research and development of cutting-edge immunology medicines.

Asia Pacific is observed to witness the fastest rate of expansion during the forecast period. In Asia Pacific, the frequency of immune-related conditions such as allergies, psoriasis, inflammatory bowel disease, and rheumatoid arthritis is rising. This growth fuels the need for immunology treatments, diagnostics, and medications. Spending on healthcare has increased in nations like China, India, Japan, and South Korea due to their economies growing. Consequently, the immunology market is expanding as more funds are allotted to diagnosing and treating immune-related illnesses. The governments of many Asia Pacific nations are concentrating on enhancing the availability of healthcare services, developing immunological research and development, and enhancing the infrastructure supporting healthcare. For instance, the immunology market is growing due to efforts to promote biosimilars and lower healthcare expenditures.

The area of the pharmaceutical and healthcare industries that is dedicated to creating, manufacturing, and marketing goods for the diagnosis, treatment, and management of immune-related illnesses and ailments is known as the immunology market. This covers a range of medications, treatments, diagnostics, and research instruments intended to identify, manage, or prevent immune-mediated illnesses, including allergies, cancer immunotherapy, autoimmune diseases, and infectious diseases. These medications and treatments were created using biotechnological techniques, and they frequently target particular immune system components to alter their activity. Vaccines, immunomodulators, and monoclonal antibodies are a few examples.

Tests and assays used in immunology diagnostics evaluate immune system performance, find antibodies, antigens, or other immunological markers that may indicate a disease, and track therapy outcomes. ELISA assays, flow cytometry, and PCR-based diagnostics are a few examples. This includes continuous research into the underlying mechanisms of immune-related disorders, the development of novel immunological therapeutics, and the identification of possible targets for intervention. Immunological therapies, which aim to modulate or harness the immune system to treat various diseases, include small molecules, biologics, gene therapies, and cell-based therapies, among many more modalities, which are some of the several services produced by the immunology market.

| Report Coverage | Details |

| Growth Rate from 2025 to 2034 | CAGR of 10.20% |

| Global Market Size in 2025 | USD 119.63 Billion |

| Global Market Size by 2034 | USD 286.38 Billion |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | By Drug Class, By Disease Indication, and By Distribution Channel |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Increasing investment in research and development

Novel immunological approaches are desperately needed in light of the ongoing rise of infectious illnesses such as COVID-19 and the danger of antibiotic resistance. To effectively address these risks, more money can be invested in research and development (R&D) to produce vaccinations, medicines, and diagnostic tools. The trend towards personalized medicine where therapies are customized for specific patients based on their immunological response, genetic composition, and other variables is being driven by advancements in immunology. Increased funding for research and development (R&D) can spur the creation of cutting-edge platforms and technologies that help scientists better understand the immune system and create novel treatments.

Resistance and relapse

Cancer cells can create defenses against the immune system's recognition and assault. For instance, they might suppress the expression of chemicals that immunotherapies are intended to target. Immunosuppressive substances may be present in the tumor microenvironment, reducing immunotherapy's efficacy. Over time, cancer cells may develop additional mutations that make them resistant to the original treatment. By focusing on several routes, resistance can be overcome by combining several immunotherapies or immunotherapy with other forms of treatment, such as chemotherapy or targeted therapy. Research into novel immunotherapeutic drugs and treatment techniques must continue to overcome resistance and enhance long-term patient outcomes.

Immuno-oncology combinations

Oncological research and studies create several opportunities in the immunology market. Checkpoint inhibitors have been extensively researched with other immunotherapies, targeted treatments, chemotherapy, and radiation therapy. Examples of these combinations include PD-1/PD-L1 inhibitors and CTLA-4 inhibitors. In some cancer cases, combining immunotherapy with targeted therapies—like tyrosine kinase inhibitors (TKIs) or monoclonal antibodies that target particular signaling pathways—has shown potential. Immunotherapy can be more successful when it is used with radiation and chemotherapy to modify the immune system. Immunotherapy combinations with chemotherapy or radiation therapy are being investigated for various cancer types to increase response rates and overall survival. Another tactic to improve anti-tumor immune responses is to combine several immunotherapies, such as adoptive cell therapy or checkpoint inhibitors, with cytokines.

The monoclonal antibodies segment held the largest share in the immunology market. An antibody known as a monoclonal antibody (mAb) is produced by immune cells, all clones of the same parent cell. These antibodies are highly specific to a specific antigen, a microbe, virus, or cancer cell. Monoclonal antibodies are widely used in medicine for therapy, diagnosis, and research. They are valuable tools for treating a wide range of illnesses, such as cancer, autoimmune disorders, and infectious diseases, since they may be designed to target specific molecules involved in diseases. Monoclonal antibodies have entirely transformed the therapy landscape for diseases like cancer, autoimmune diseases, inflammatory disorders, and infectious diseases.

Globally, the prevalence of conditions like psoriasis, inflammatory bowel illnesses, and rheumatoid arthritis is increasing, which has created a sizable market for monoclonal antibody therapy intended to reduce symptoms and enhance patients' quality of life. Pharmaceutical companies are investing in research and development to build a strong pipeline of possible treatments to find and develop innovative monoclonal antibody-based therapeutics for various immunological illnesses. Compared to conventional systemic medications, monoclonal antibodies provide tailored therapeutic techniques that selectively affect particular immune system components or disease pathways, resulting in more accurate and effective treatments with fewer side effects.

The rheumatoid arthritis segment held the largest share of the immunology market in 2024. Rheumatoid arthritis (RA) is a chronic autoimmune illness primarily affecting the joints. If treatment is not received, RA can cause discomfort, inflammation, joint destruction, and deformity. Since RA necessitates long-term management and treatment to control symptoms and stop disease progression, it represents a significant market share in the immunology sector.

The way rheumatoid arthritis is treated has changed dramatically because of biological treatments. These medications specifically target immune system elements contributing to inflammation, including B cells, interleukin-6 (IL-6), and tumor necrosis factor-alpha (TNF-alpha). In the treatment of RA, biologics such as TNF inhibitors (adalimumab, etanercept), IL-6 inhibitors (tocilizumab), and B cell-targeting medications (rituximab) are frequently utilized.

Methotrexate and other traditional DMARDs continue to be mainstays in treating rheumatoid arthritis. These medications reduce the aberrant immune response that causes inflammation and damage to joints. For increased efficacy, they are frequently used in conjunction with biologic therapy. New treatment medicines for rheumatoid arthritis are driving further changes in the immunology sector. Tofacitinib and baricitinib are examples of janus kinase (JAK) inhibitors, a more recent class of drugs that target intracellular signaling pathways implicated in inflammation. Individualized medicine methods are becoming increasingly important as knowledge about the genetic and molecular causes of rheumatoid arthritis advances.

In 2024, the hospital pharmacies segment held the largest share in the immunology market, by distribution channel. Hospital pharmacies provide various immunology-related drugs, such as corticosteroids, immunosuppressants, monoclonal antibodies, and biologics. Healthcare professionals prescribe these drugs to treat various immune illnesses, including multiple sclerosis, psoriasis, inflammatory bowel disease, and rheumatoid arthritis. Hospital pharmacy employees and pharmacists must educate patients about their prescription drugs. Patients must comprehend the correct administration of immunological disorders, possible adverse effects, and the significance of adhering to treatment regimens. Hospital pharmacists counsel patients to make sure they take their drugs as prescribed.

Hospital pharmacies are in charge of keeping track of supplies and guaranteeing that immunological drugs are available. They collaborate closely with medical professionals to track how patients respond to treatment and modify drug schedules as necessary. In order to guarantee that immunosuppressive therapies are used appropriately and safely, pharmacists may also perform drug usage reviews. Pharmacies in hospitals frequently take part in clinical studies for novel immunological drugs. They might work with academic institutions and pharmaceutical businesses to make testing and assessment of new treatments easier. This research involvement facilitates the improvement of immunology therapy choices.

By Drug Class

By Disease Indication

By Distribution Channel

By Geography

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

April 2025

September 2023

April 2025

May 2025