January 2025

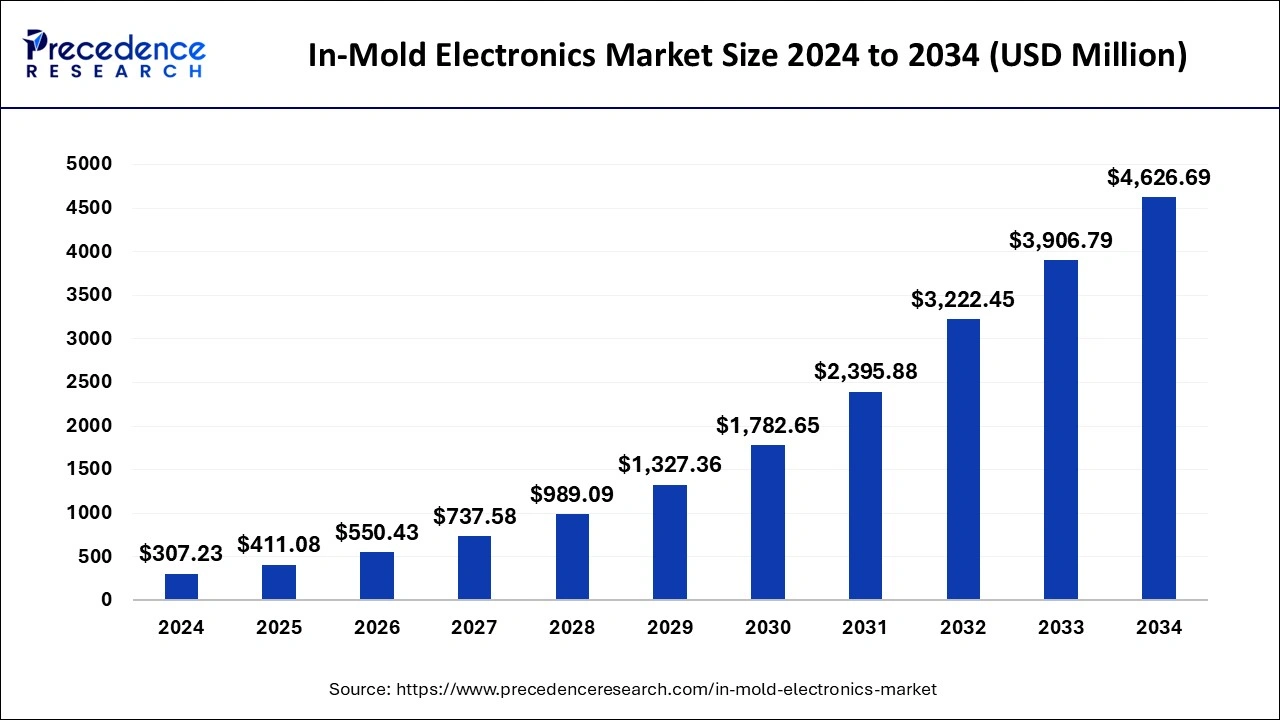

The global in-mold electronics market size is calculated at USD 411.08 million in 2025 and is forecasted to reach around USD 4626.69 million by 2034, accelerating at a CAGR of 31.15% from 2025 to 2034. The North America in-mold electronics market size surpassed USD 138.25 million in 2024 and is expanding at a CAGR of 31.20% during the forecast period. The market sizing and forecasts are revenue-based (USD Million/Billion), with 2024 as the base year.

The global in-mold electronics market size was estimated at USD 307.23 million in 2024 and is anticipated to reach around USD 4626.69 million by 2034, expanding at a CAGR of 31.15% from 2025 to 2034. The increasing production of electronic devices is a major factor boosting the growth of the market during the forecast period.

Artificial intelligence (AI) is revolutionizing the in-mold electronics market. AI improves the manufacturing processes of in-mold electronics by automating and monitoring processes in real-time. It also helps in quality control and predictive maintenance. Manufacturers of in-mold electronics are increasingly leveraging AI to optimize processes, improve product quality, and boost productivity. AI also assists in detecting any potential defects in in-mold electronics and ensures better quality while reducing wastage during production.

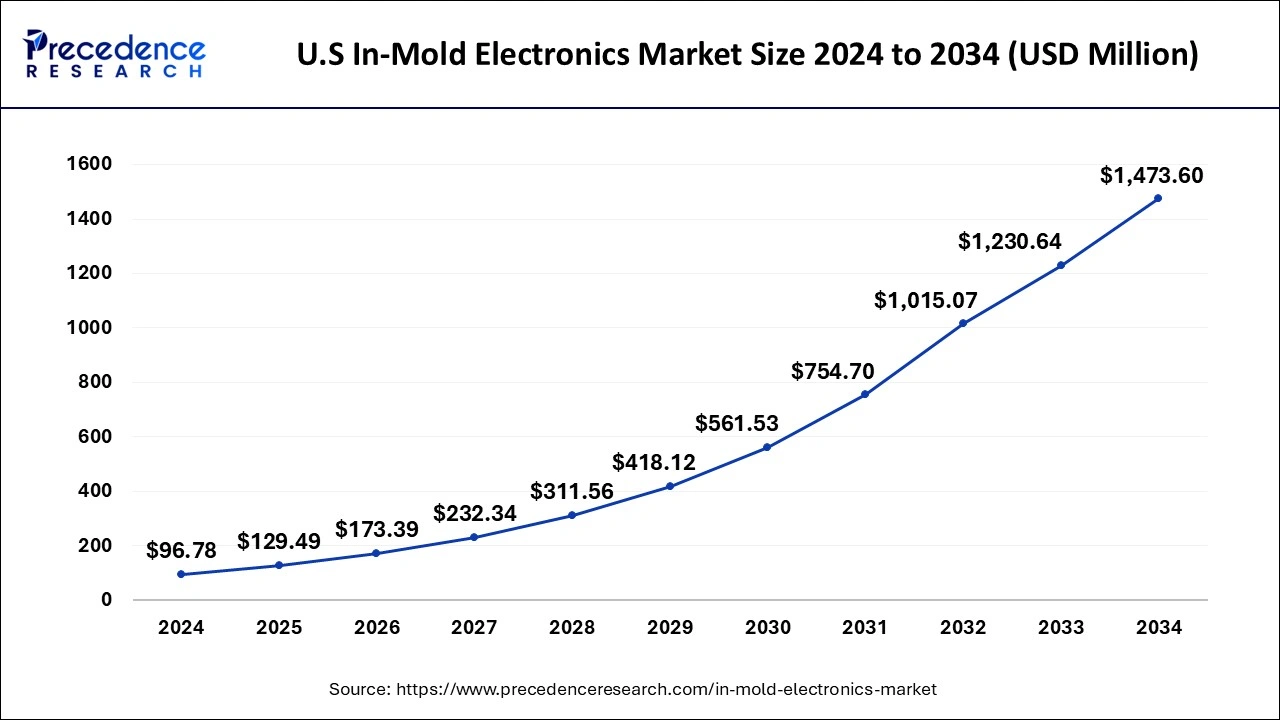

The U.S. in-mold electronics market size was evaluated at USD 96.78 million in 2024 and is predicted to be worth around USD 1473.60 million by 2034, rising at a CAGR of 31.29% from 2025 to 2034.

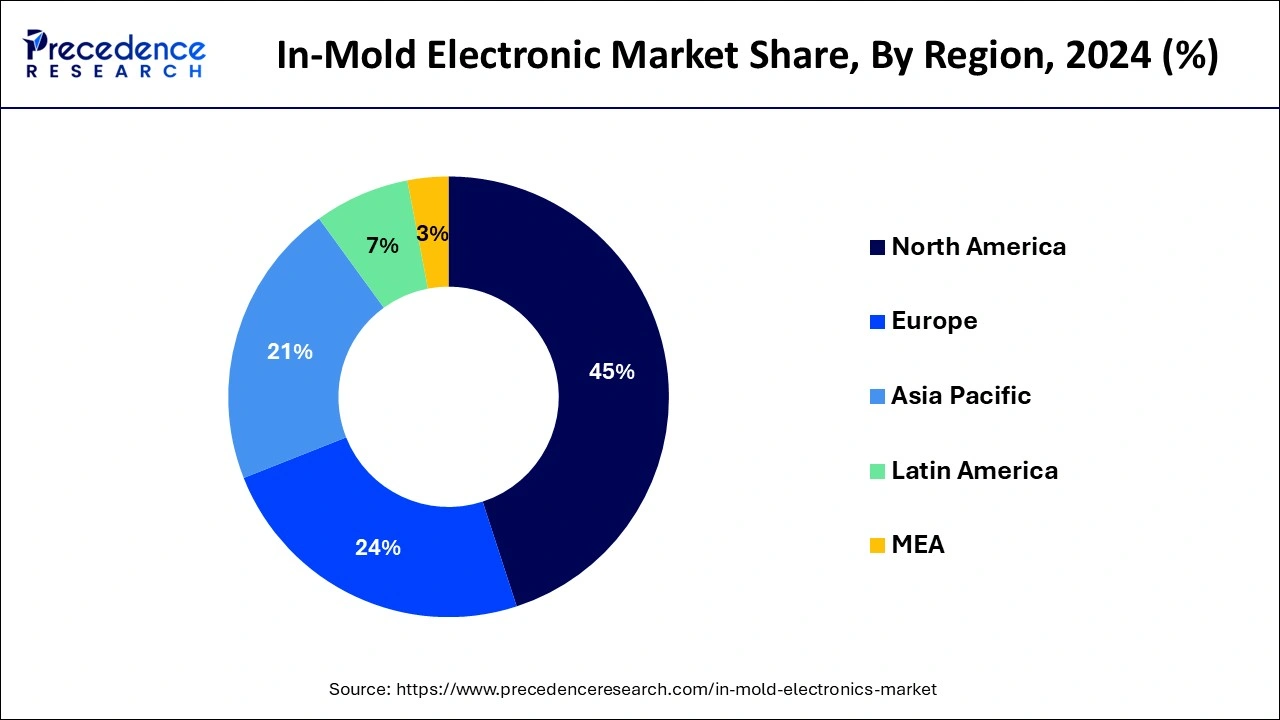

Based on region, North America dominated the global in-Mold electronic market with the largest market share of 45% in 2024 in terms of revenue and is estimated to sustain its dominance during the forecast period. This is due to the increased adoption of the latest and innovative technologies in the industries of North America. The countries like US and Canada are capital intensive economies, where the demand for automation and adoption of innovative technologies is higher. Moreover, the increased demand for various luxury consumer, healthcare, wearables, and automotive products is higher in the region that propels the adoption of the in-mold electronics among the manufacturing units of various products. The increased disposable income, higher demand for luxury electronic products, and increased demand for the automotive vehicles among the population of North America has fostered the growth of the in-mold electronics market in this region.

On the other hand, Asia Pacific is estimated to be the most opportunistic market during the forecast period. This is attributable to the increased presence of the world’s top electronic manufacturers in the nations like China, India, Japan, South Korea, and Taiwan. The enormous demand for the consumer electronics in this region is one of the most significant factors that is expected to rapidly drive the growth of the in-mold electronics market in the Asia Pacific region during the forecast period. Moreover, rising disposable income, growing healthcare infrastructure, rapidly growing automotive sectors, and rising demand for the home improvement products is significantly driving the growth of the market. The favorable government policies is attracting various top electronic manufacturer to expand their manufacturing facilities in this region which is estimated to the most crucial factor that would augment the market growth in this region.

| Report Coverage | Details |

| Market Size in 2025 | USD 411.08 Million |

| Market Size by 2034 | USD 4626.69 Million |

| Growth Rate From 2025 to 2034 | CAGR of 31.15% |

| Largest Market | North America |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Ink Type, Application, Region |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Increasing demand from various industries

There is a high demand for in-mold electronics (IME) in various industries, such as automotive, aerospace, consumer electronics, and healthcare, which is expected to drive the growth of the in-mold electronics market in the coming years. IME technology is widely used to design advanced HMIs, such as touch-sensitive dashboards, control panels, and integrated lighting. It eliminates the need for traditional mechanical buttons, connectors, and wires and provides a button-free interface. The rising production of consumer electronics such as smartphones, tablets, and laptops further contributes to market growth. Traditionally, the assembling of electronics was a time-consuming process. However, with the introduction of the in-mold electronics, the excess time consumed has been reduced significantly that improves the output of the manufacturing or the assembly units. The in-mold electronic technologies are increasingly used in consumer electronic devices such as dryers, washing machines, dishwashers, automotive consoles, and smartphones.

The growing popularity of touchscreen switches due to the increased safety and elimination of frail or torn mechanical switches is another major factor boosting the market’s growth. The adoption of in-mold electronics is rising in various end-use applications as it offers benefits like reduction of weight and facilitates the convenient processing of molding operations. The use of in-mold electronics offers cost reduction and design flexibility. It improves productivity, which is a major factor behind the increasing demand for in-mold electronics among various industry players.

High production cost

Producing in-mold electronics requires specialized equipment and materials, which significantly increases the production cost. Moreover, complexities in integrating electronics into molded structures lead to slower adoption in various industries, hampering the market's growth.

Technological advancements

Rising technological advancement in in-mold electronics creates lucrative opportunities in the in-mold electronics market. In-mold electronics (IMEs) involve the process of incorporating electronic elements into molded plastic objects. IME technology can transform the way 3D objects are manufactured for home appliances, aerospace, consumer electronics, automotive, and other applications. Technological advancement can result in the development of flexible and lightweight products, cost savings, and achieving lighter, functional, and visually appealing pieces. Moreover, technological advancements in the capacitive touch sensors in various consumer electronic devices are fostering the market's growth.

Based on the ink type, the silver conductive segment dominated the global in-mold electronics market in 2024, in terms of revenue. This is attributed to the extensive usage of the silver conductive in-mold electronics across the globe owing to its various benefits. The silver conductive ink provides strong adhesion, high conductivity, and crease resistance to various polymer substrates. Moreover, the lower ink consumption reduces the cost, which fuels its adoption across the industries.

On the other hand, carbon conductive is estimated to be the most opportunistic segment during the forecast period. The carbon conductive inks offers durability, abrasion resistance, and high electric conductivity. The carbon inks can be customized according to the needs of the user, which is expected to fuel it growth during the forecast period.

Based on the application, the consumer products segment dominated the global in-mold electronics market in 2024, in terms of revenue. This is simply due to the increased demand for the latest and innovative consumer electronic products among the global population. The manufacturers are now increasingly adopting the in-mold electronics for adding desired designs to the products in along with achieving cost efficiency and time savings. The exponentially growing demand for the consumer electronics across the globe is expected to sustain the leading position of this segment throughout the forecast period.

On the other hand, the automotive is expected to be the fastest-growing segment during the forecast period. This is attributed to the increasing production of the autonomous and luxury vehicles. The growing popularity of the latest and innovative electric vehicles loaded with features and growing adoption of these vehicles is signifi9cantly boosting the growth of this segment across the globe.

By Ink Type

By Application

By Geography

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

January 2025

January 2025

December 2023

August 2024