April 2025

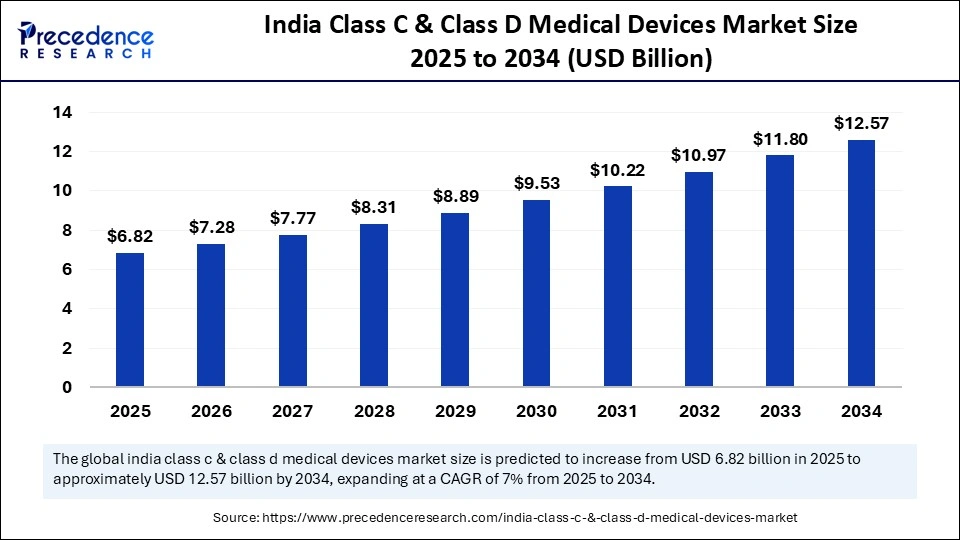

India Class C and Class D medical devices market size is calculated at USD 6.82 billion in 2025 and is forecasted to reach around USD 12.57 billion by 2034, accelerating at a CAGR of 7.00% from 2025 to 2034. The market sizing and forecasts are revenue-based (USD Million/Billion), with 2024 as the base year.

India Class C and Class D medical devices market size accounted for USD 6.40 billion in 2024 and is predicted to increase from USD 6.82 billion in 2025 to approximately USD 12.57 billion by 2034, expanding at a CAGR of 7.00% from 2025 to 2034. The market shows rapid growth because of increased healthcare investment, government endorsement, heightened chronic illness statistics, and technological progress, which leads to the use of advanced medical products.

Technology and Government Policies Boosting the Indian Marketspaces

Healthcare facilities require Class C and Class D medical devices to carry out fundamental therapeutic and monitoring functions as well as complex diagnostic operations. An example of Class C medical devices includes infusion pumps and other physiologic control or monitoring devices like anesthesia machines, imaging systems, and diagnostic devices. Class D medical devices, which are implantable defibrillators as well as pacemakers and heart valves, are considered high-risk medical devices because they carry life-sustaining invasive features, which makes them risky.

Advanced technology from various companies makes it possible to manufacture equipment that is operated safely with great precision and intelligence. The increase in the number of chronic illnesses, as well as an aging population, in addition to the growth of middle-class demographics, requires the development of sophisticated diagnostic and therapeutic procedures. The Indian government supports local production of sophisticated medical equipment through the Production Linked Incentive (PLI) scheme, and ‘Make in India’ creates a positive environment for local innovation and manufacturing.

The incorporation of Artificial Intelligence technology has changed the Class C and D segments of the Indian Medical Devices Market for the better and has increased operational efficiency and accuracy. With AI in diagnostics, images are analyzed in record time and with utmost precision, which ensures proper medical diagnoses and better detection. The growth of the market stems from Indian healthcare providers using AI-driven devices for the design of intelligent, interconnected, and sophisticated solutions that focus on specific patient issues and outcomes.

| Report Coverage | Details |

| Market Size by 2034 | USD 12.57 Billion |

| Market Size in 2025 | USD 6.82 Billion |

| Market Size in 2024 | USD 6.40 Billion |

| Market Growth Rate from 2025 to 2034 | CAGR of 7.00% |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Product Type, End-user |

Government initiatives

The government policies, such as the National Medical Devices Policy and Production Linked Incentive, aim at building domestic manufacturing capabilities, increasing investment, and enhancing regulatory efficiency. These actions are aimed at reducing dependency on imports while nurturing domestic competition, which positions India as a leader in the India C and D medical devices market.

The government also sponsors health systems to purchase life support devices such as ventilators and dialysis machines, along with sophisticated diagnostic tools. Under these government actions, the funding of health technologies is tailored towards the economically disadvantaged who require these systems, enabling them to access major healthcare systems. At the same time, the government encourages the adoption of advanced solutions by healthcare providers and extends the use of life-saving devices.

Growing prevalence of chronic disorders

Medical devices classified as Class C and D experience increased demand directly because of the expanding number of patients with chronic conditions such as diabetes, cancer, and cardiovascular diseases. The quick spread of chronic disorders demands advanced medical technologies because better monitoring methods and treatment approaches, and patient management strategies are essential.

The increasing number of diabetic cases worldwide drives market demand for insulin pumps and continuous glucose monitors because these devices help patients control their diabetes. This expansion of the market is due to government funding of health care agencies and industry stakeholders who promote new treatment options through awareness campaigns.

Lack of Skilled professionals

Healthcare tools that need specialized operating techniques require specialized, qualified personnel for the appropriate maintenance and functional use of the equipment. There is a shortage of specialized healthcare workers, which impacts developing regions the most, as these areas suffer from a lack of training opportunities. The lack of trained medical personnel creates operational problems with sophisticated medical equipment, which leads to inefficient and flawed outcomes. In this case, the lack of sufficient medical practitioners to sophisticated care tools will challenge the potential of market expansion.

Rising healthcare expenditures

Healthcare costs throughout the world are increasing at a rapid pace, which leads to increased market demand for sophisticated Class C and D medical devices. The adoption of novel medical technologies by healthcare facilities becomes possible through upgraded investments from public and private entities to address challenging health situations.

Healthcare spending in India equips them to invest in and maintain advanced medical equipment. The rising need, modernization, and mechanization of high-yield technologies drive their acceptance rate and adoption. The market for Class C and D medical devices expands as more patients can access contemporary treatment options, yielding superior outcomes.

The other segment held a significant share of the India Class C and Class D medical devices market in 2024. The growing demand for medical devices is due to increased heart-related illness cases among older populations. The combination of unhealthy habits, such as improper nutrition and insufficient exercise, results in more serious cardiovascular diseases at an increasing frequency. Modern cardiac monitoring devices have received better functionality and accuracy due to AI-powered technological developments and enhanced medical interventions in the field. The escalating rates of cancer worldwide have been the primary reason for market expansion. The section comprises major components such as chemotherapy infusion pumps, radiation oncology devices, and diagnostic imaging systems.

The surgical sutures segment is anticipated to show considerable growth in the India Class C and Class D medical devices market over the forecast period. The professional practice requires surgical sutures, which help surgeons perform incisions and wound closures to allow tissue recovery while protecting against infections. The success of various surgical interventions depends on surgical sutures, which are needed for regular surgeries and demanding medical procedures. Surgical sutures fall under Class C medical devices per India’s Medical Devices Rules of 2017 because they play a decisive role in surgical outcome success. The expanding healthcare industry of India delivers rising surgically demanded sutures because patients experience increased surgical needs, lifestyle illnesses, and natural population aging. The market will continue to expand due to surgical sutures maintaining their essential role in modern medical practice for achieving proper healing results and limited patient complications.

The hospitals and ambulatory surgery centers contributed the most revenue in 2024 and are expected to remain dominant throughout the projected period. Medical device requirements have risen during recent years because healthcare providers must manage growing numbers of complex operations linked to chronic disease increases and population aging. Class C and D devices are included in surgical, diagnostic, imaging, and various patient monitoring systems, as well as being used as surgical and critical instruments. Institutions procure advanced medical equipment, including ventilators, imaging machines, and surgical robots that provide automated treatment for patients with complicated disease processes. The expanding healthcare expenses across emerging markets, with the rising number of hospitals and ASCs, maintain demand for Class C and D medical devices, ensuring an ongoing dominance of these devices in the market.

The clinics and physicians' office segment is projected to be the fastest-growing segment during the forecast period. Specialized cardiology and orthopedic clinics, or those offering dermatology services, require these life-sustaining Class C and D medical devices, including pacemakers, defibrillators, and implantable prostheses, to perform procedures. The application of sophisticated technology for personalized medicine increases the demand for expensive medical devices.

The market growth receives momentum from the combination of developed healthcare infrastructure solutions and extensive medical technology investments. The Indian market experiences an innovation boom through substantial local and international medical device manufacturer research and development programs. Medical device companies continue to be attracted to the country because India functions as a center for superior and reasonably priced medical care.

By product type

By end-user

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

April 2025

January 2025

October 2023

August 2024