January 2025

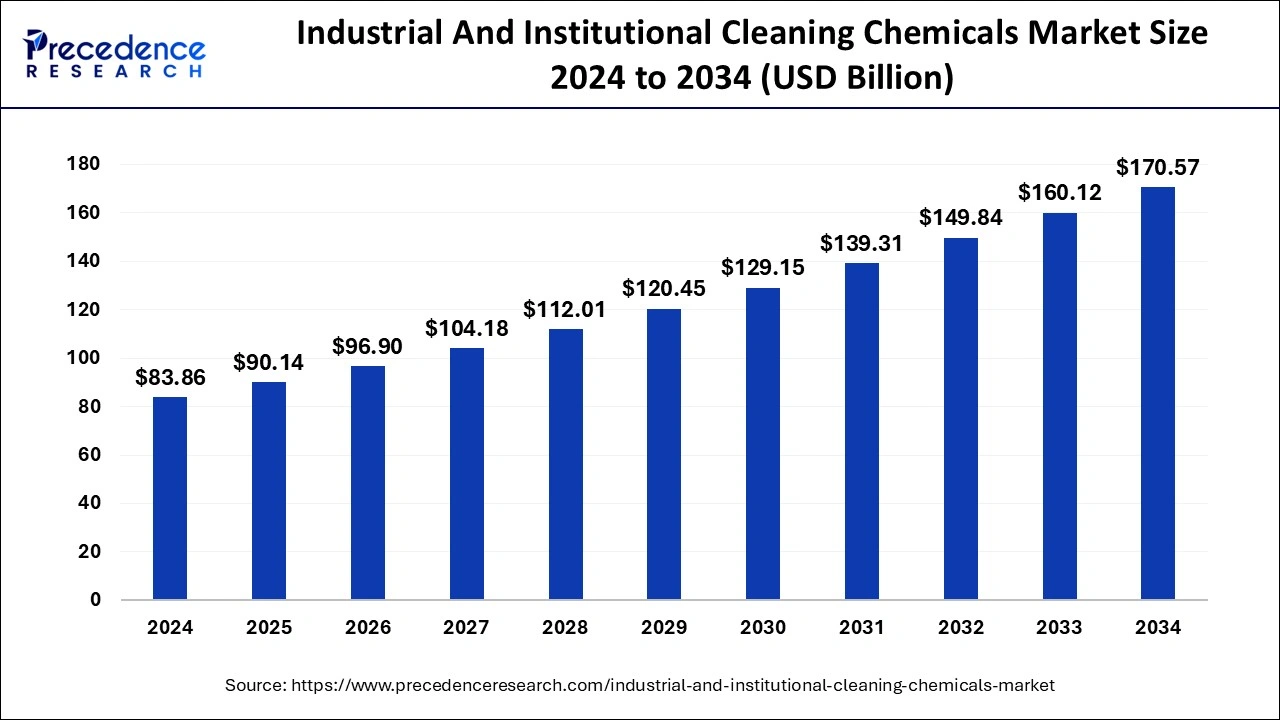

The global industrial and institutional cleaning chemicals market size is calculated at USD 90.14 billion in 2025 and is predicted to surpass around USD 170.57 billion by 2034, accelerating at a CAGR of 7.36% from 2025 to 2034. The North America industrial and institutional cleaning chemicals market size surpassed USD 31.03 billion in 2024 and is expanding at a CAGR of 7.39% during the forecast period. The market sizing and forecasts are revenue-based (USD Million/Billion), with 2024 as the base year.

The global industrial and institutional cleaning chemicals market size was estimated at USD 83.86 billion in 2024 and is predicted to increase from USD 90.14 billion in 2025 to approximately USD 170.57 billion by 2034, expanding at a CAGR of 7.36% from 2025 to 2034.

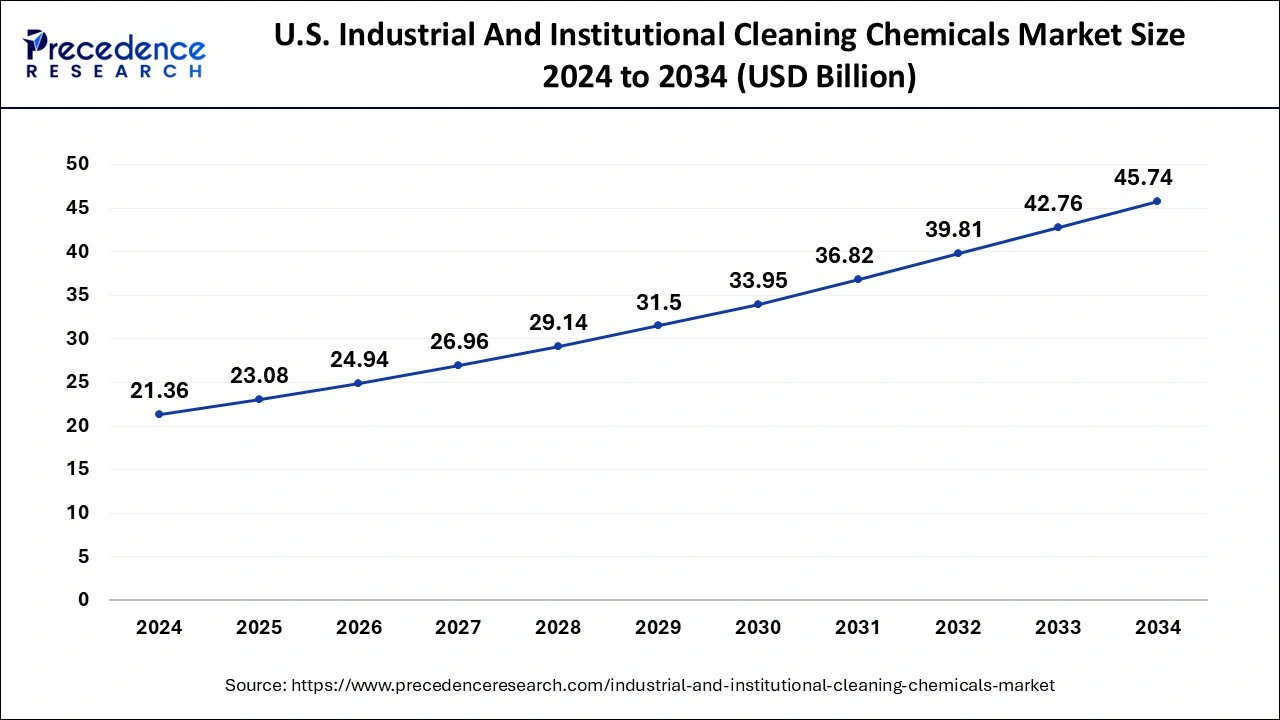

The U.S. industrial and institutional cleaning chemicals market size accounted for USD 21.36 billion in 2024 and is estimated to surpass around USD 45.74 billion by 2034, growing at a CAGR of 7.91% from 2025 to 2034.

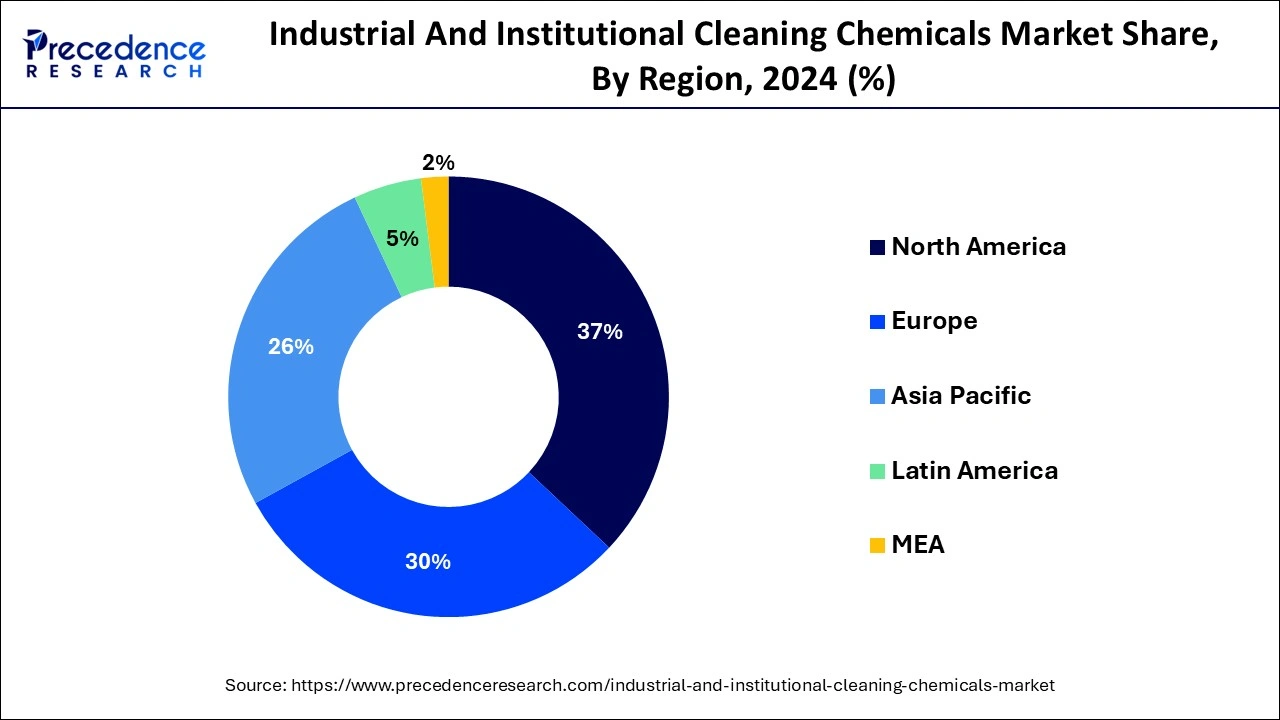

North America held the largest revenue share of 37% in 2024.

Asia-Pacific is estimated to observe the fastest expansion.

The industrial and institutional cleaning chemicals market encompasses the global industry engaged in the production, distribution, and sale of specialized chemical products used for cleaning and sanitation in industrial and institutional settings. These settings include manufacturing facilities, healthcare institutions, educational institutions, hospitality establishments, and commercial spaces.

The industrial and institutional cleaning chemicals market is a dynamic global industry dedicated to the manufacturing and distribution of specialized cleaning chemicals tailored for commercial, industrial, and institutional use. These chemicals serve as essential components in maintaining high standards of cleanliness, sanitation, and hygiene across various professional settings, including businesses, healthcare facilities, schools, and hospitality establishments.

| Report Coverage | Details |

| Growth Rate from 2025 to 2034 | CAGR of 7.36% |

| Market Size in 2025 | USD 90.14 Billion |

| Market Size by 2034 | USD 170.57 Billion |

| Largest Market | North America |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | By Raw Material, By Product, and By End Use |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Healthcare sector growth, hygiene, and sanitation awareness

The growth of the healthcare sector significantly surges market demand for institutional cleaning chemicals. Healthcare facilities, including hospitals, clinics, and medical offices, require stringent hygiene standards to prevent infections. This necessitates a constant need for specialized cleaning and disinfection products. As the healthcare industry expands globally due to population growth and increased healthcare awareness, the demand for high-quality cleaning chemicals escalates. The critical role these chemicals play in infection control and patient safety underscores their indispensability, making them a fundamental component of the institutional cleaning chemicals market in response to healthcare sector growth.

Moreover, hygiene and sanitation awareness have surged market demand for institutional cleaning chemicals by highlighting the critical role of cleanliness in public health. Heightened concerns about the transmission of diseases, particularly in the wake of the COVID-19 pandemic, have spurred institutions to prioritize effective cleaning and disinfection. This has led to increased demand for specialized cleaning chemicals that meet stringent hygiene standards, resulting in a sustained and growing market for products designed to ensure safe and sanitized environments across healthcare, education, hospitality, and other institutional settings.

Stringent regulations and raw material costs

Stringent regulations can restrain market demand for institutional cleaning chemicals by imposing compliance challenges and increased production costs. Meeting evolving standards necessitates research and development investments, which can raise the prices of compliant products. Additionally, the complexity of regulatory requirements may hinder product innovation and slow down time-to-market. The need for meticulous documentation and adherence to safety and environmental guidelines adds administrative burdens. Consequently, these regulatory hurdles can limit market accessibility and competitiveness, impacting the overall demand for institutional cleaning chemicals.

Moreover, raw material costs are a significant restraint on the market demand for institutional cleaning chemicals. Fluctuations in the prices of key ingredients like chemicals and plastics can impact the production costs of cleaning products. These cost increases often translate into higher prices for customers, potentially making cleaning solutions less affordable. Price-sensitive institutional buyers may seek cost-effective alternatives or reduce consumption, leading to a slowdown in market demand. Thus, the volatility in raw material costs can pose challenges for manufacturers and impact market growth in the institutional cleaning chemicals sector.

Hygiene emphasis and technological advancements

The heightened emphasis on hygiene, particularly due to the ongoing concerns surrounding public health and infectious diseases like COVID-19, has propelled the market demand for institutional cleaning chemicals. Institutions across sectors such as healthcare, education, and hospitality prioritize effective cleaning and disinfection. This sustained focus on hygiene drives the need for specialized cleaning chemicals, including disinfectants and sanitizers, to meet stringent cleanliness standards. Consequently, the institutional cleaning chemicals market experiences consistent growth as institutions continue to invest in maintaining safe and sanitized environments.

Moreover, technological advancements fuel market demand for institutional cleaning chemicals by enhancing product effectiveness and user convenience. Innovations in formulations lead to more efficient and eco-friendly cleaning solutions, meeting evolving hygiene standards and environmental regulations. Advanced packaging technologies improve product safety, storage, and dispensing, increasing user satisfaction. Furthermore, the development of automated cleaning devices and IoT-enabled systems simplifies and streamlines cleaning processes, driving the adoption of cleaning chemicals in various institutional settings. These technological enhancements address contemporary cleanliness needs, contributing to increased market demand for institutional cleaning chemicals.

According to the raw material, the surfactants segment has held a 31.1% revenue share in 2024. Surfactants, or surface-active agents, are crucial raw materials in the institutional cleaning chemicals market. They are compounds that reduce surface tension between liquids and solids, enabling effective dirt and grease removal. Trends in this market include a growing preference for biodegradable and environmentally friendly surfactants. Manufacturers are increasingly focusing on sustainable sourcing and production to align with eco-conscious consumer demands. Additionally, advancements in surfactant technology have led to improved cleaning performance and versatility, enhancing the overall effectiveness of institutional cleaning products.

The solvents segment is anticipated to expand at a significantly CAGR of 8.3% during the projected period. Solvents are chemical substances used to dissolve, disperse, or dilute other substances to create cleaning solutions in the Institutional Cleaning Chemicals Market. They facilitate the effective removal of dirt, grease, and stains. The growing preference for eco-friendly and sustainable solvents, driven by environmental concerns. Biodegradable and non-toxic solvents are gaining popularity, aligning with the industry's shift towards green cleaning products. Additionally, research focuses on developing solvents that are safer for users and compliant with stringent regulations, ensuring safer and more sustainable cleaning practices.

By product, the general-purpose cleaner’s product segment is anticipated to hold the largest market share of 36.2% in 2024. The General-Purpose Cleaners product segment in the institutional cleaning chemicals market includes versatile cleaning solutions designed for various surfaces and applications. These cleaners effectively remove dirt, grime, and stains and are suitable for daily cleaning tasks. Recent trends in this segment indicate a growing demand for eco-friendly formulations, with consumers and institutions seeking sustainable and non-toxic cleaning options. Additionally, the COVID-19 pandemic has emphasized the need for disinfecting properties in general-purpose cleaners, resulting in the development of multi-purpose products that combine cleaning and sanitizing capabilities to meet heightened hygiene standards.

On the other hand, the disinfectants segment is projected to grow at the fastest rate over the projected period. The disinfectants segment in the Institutional Cleaning Chemicals Market includes products designed to eliminate or control pathogenic microorganisms on surfaces and in the air. Recent trends show an increasing demand for disinfectants due to heightened awareness of hygiene, driven by the COVID-19 pandemic. Institutions prioritize disinfection protocols to ensure safe environments, leading to higher adoption rates of disinfectants in healthcare, education, and commercial sectors. Furthermore, there is a growing preference for environmentally friendly and non-toxic disinfection solutions, prompting manufacturers to develop eco-conscious disinfectant products to meet evolving consumer demands.

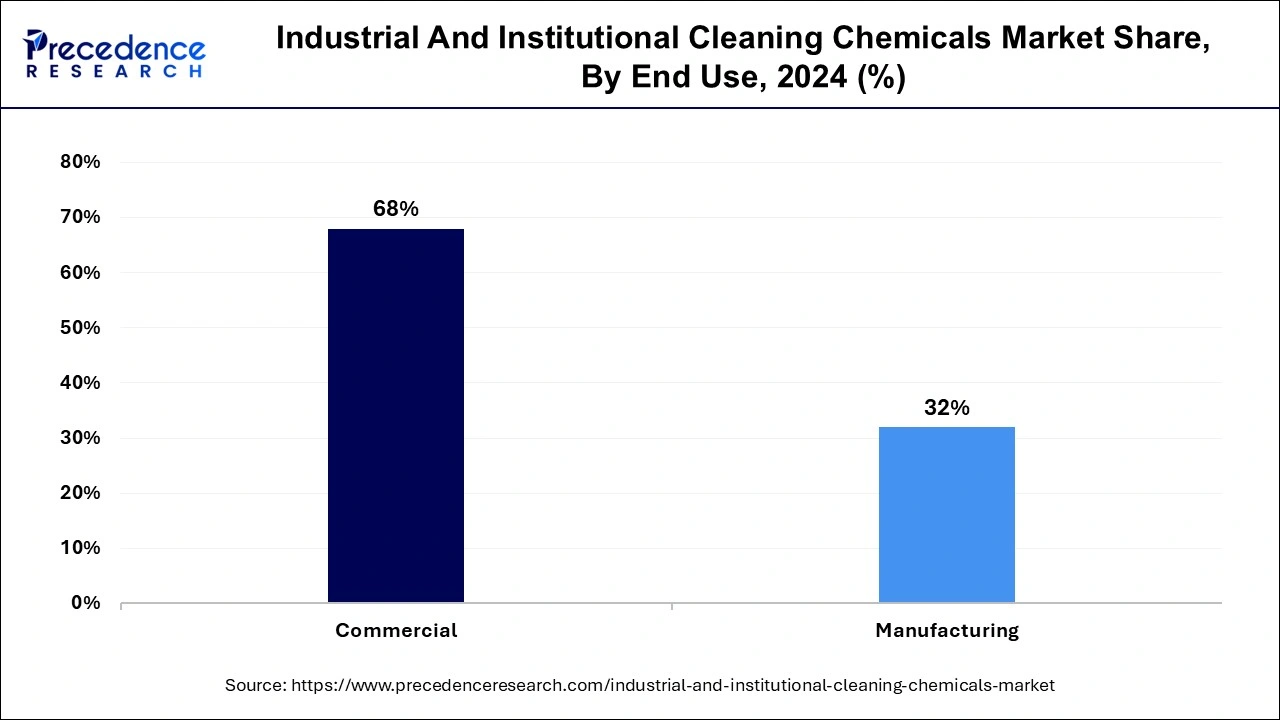

In 2024, the commercial sector had the highest market share of 68% on the basis of end use. The commercial segment in the institutional cleaning chemicals market refers to the usage of cleaning chemicals in various commercial settings, including businesses, offices, restaurants, hotels, and retail establishments. Recent trends in this segment include a heightened emphasis on eco-friendly and sustainable cleaning solutions to align with corporate responsibility and customer preferences.

The COVID-19 pandemic has driven increased demand for disinfectants and sanitizers in commercial spaces. Additionally, technological advancements, such as smart cleaning devices and automated systems, are gaining traction in commercial settings to enhance efficiency and cleanliness standards. These trends collectively shape the evolving landscape of cleaning chemical usage in commercial institutions.

The manufacturing segment is anticipated to expand at the fastest rate over the projected period. In the institutional cleaning chemicals market, the manufacturing segment refers to the use of cleaning chemicals within industrial and manufacturing facilities. These chemicals are crucial for maintaining cleanliness, safety, and compliance with stringent regulations in production environments. Trends in this segment include a growing emphasis on industrial hygiene due to the COVID-19 pandemic, increased demand for eco-friendly and sustainable cleaning solutions, and the adoption of advanced cleaning technologies to ensure worker safety and operational efficiency. Manufacturing facilities are investing in customized cleaning solutions tailored to their specific needs to achieve higher levels of cleanliness and sanitation.

By Raw Material

By Product

By End Use

By Geography

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

January 2025

January 2025

September 2024

October 2024