January 2025

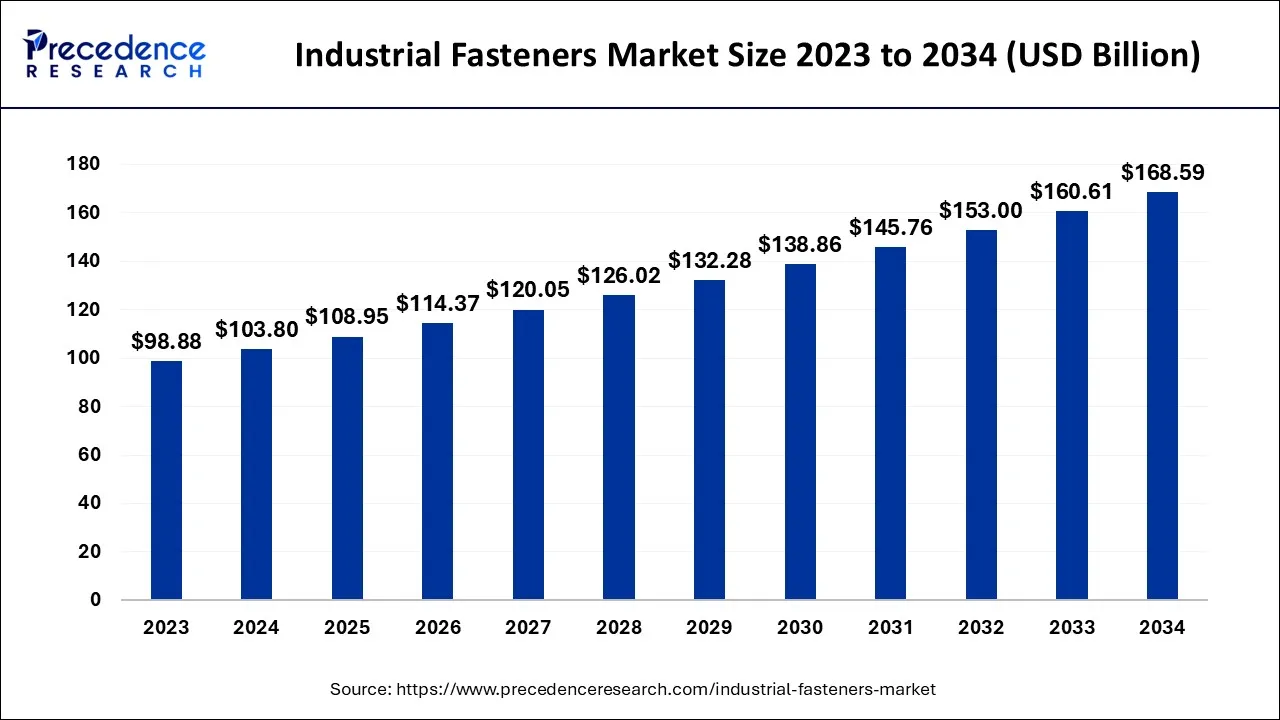

The global industrial fasteners market size is calculated at USD 103.80 billion in 2024, grew to USD 108.95 billion in 2025, and is predicted to hit around USD 168.59 billion by 2034, expanding at a CAGR of 4.97% between 2024 and 2034. The Asia Pacific industrial fasteners market size accounted for USD 45.67 billion in 2024 and is anticipated to grow at the fastest CAGR of 5.09% during the forecast year.

The global industrial fasteners market size is worth around USD 103.80 billion in 2024 and is anticipated to reach around USD 168.59 billion by 2034, growing at a CAGR of 4.97% over the forecast period from 2024 to 2034.

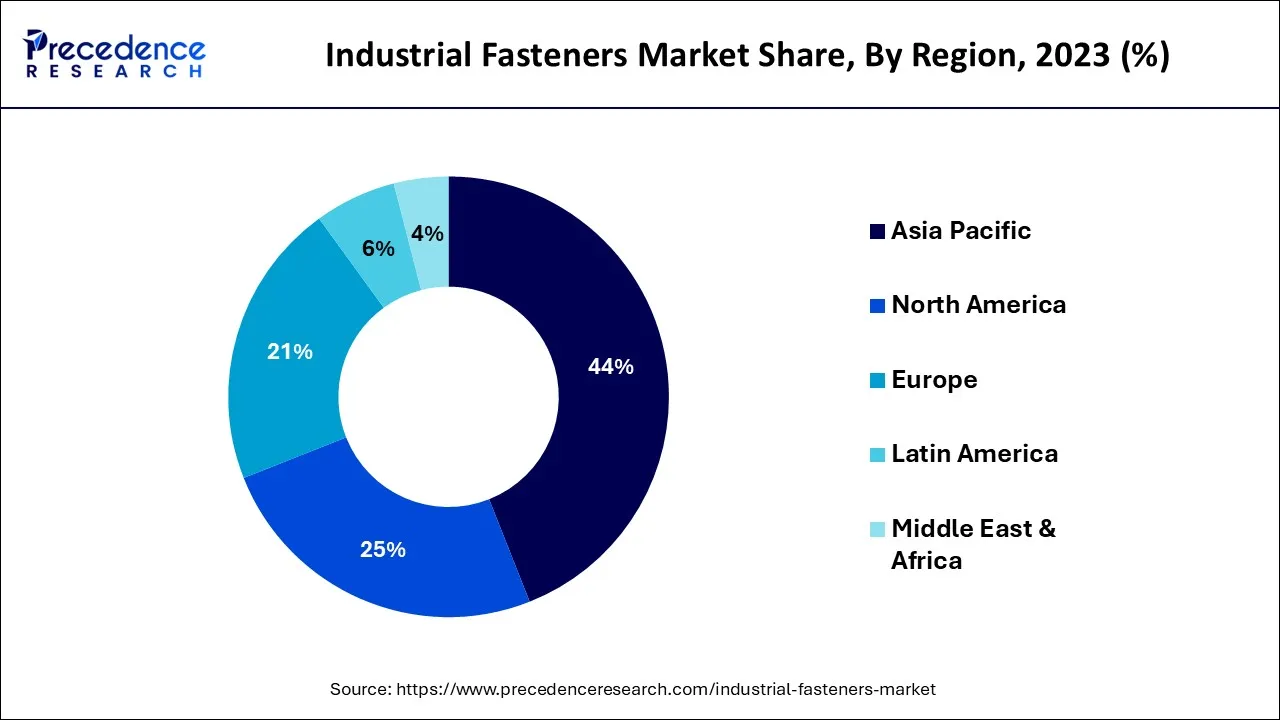

Asia Pacific dominated the market with the largest market revenue in 2023. The region will continue its dominance over the forecast period. Growth in the market is attributed to the increasing population and the rising need for residential buildings considering the population in countries such as India and China. Other infrastructural developments also contribute to the demand for industrial fasteners in the region. Increasing industrial development in the region will also boost the demand for the market.

Asia Pacific is expected to account for 44% of global sales in the year 2023. There is a stronger growth rate expected in China, India, and Southeast Asia in the year.

North America is expected to grow at a significant rate during the forecast period. Increasing manufacturing units in multiple industries such as automotive, electronics, aerospace, etc will likely boost the demand for industrial fasteners in the region. Increasing research and development programs and activities are expected to create demand for lightweight industrial fasteners in the market. Moreover, a well-established infrastructure for the development of new components will support the market’s growth in the region.

In addition, the presence of major key players in the region contributes to the market’s expansion. Bossard is a major fasteners manufacturer in North America serving OEMs globally in various markets such as rail, EV, industrial automobile and robotics. Major manufacturers in North America depend upon the products and services of Bossard.

Industrial fasteners are industrial tools for devices, that are observed as a main component that is widely utilized for safety of industrial devices and products by joining joints. Most of the industrial fasteners are mechanical in nature. The fasteners include screws, bolts, nuts, rods, anchors, and sockets. Industrial fasteners can be used in assembly equipment, tools, and related supplies for the installation of machinery. Industrial fasteners could be useful in various sectors like the electronics and automobile industries. Industrial fasteners are also used in day-to-day consumer goods such as vehicles, furniture, lighting, etc. Increasing global investment in the building and construction industry will result in higher demand for industrial fasteners across the globe, the element is observed to accelerate the market’s growth.

The globally leading provider of fasteners and other supportive components, LISI Group, published its revenue report. The revenue for the LISI Group’s first quarter of 2023 was 401.3 million Euros and 17.2% increase from the prior year.

Industrial fasteners are rapidly being deployed in the construction and automotive industry; the overall development of these industries is observed to play a significant role in the growth of the industrial fasteners market. Industrial fasteners are observed to be semi-permeant or sometimes permeant solutions for applications. Growing industrialization across the globe results in higher growth for the industrial fasteners market. The growing development in the construction industry notably impacted the growth of the market.

The increase in research and development programs positively impacts the market’s development that highlights the development of new and advanced industrial fasteners. Growing real estate infrastructure in urban areas like residential buildings, commercial buildings, and bridges has resulted in the substantial growth of the market. Moreover, the factor that supplements the growth of the market is increasing technological advancements in industrial fasteners for producing lightweight products that can be useful in the automotive and other industrial sectors.

| Report Coverage | Details |

| Market Size in 2024 | USD 103.80 Billion |

| Market Size by 2034 | USD 103.80 Billion |

| Growth Rate from 2024 to 2034 | CAGR of 4.97% |

| Largest Market | Asia Pacific |

| Base Year | 2023 |

| Forecast Period | 2024 to 2034 |

| Segments Covered | By Raw Material, By Product, and By Application |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Growing construction activities

The booming construction sector across the world will positively impact the growth of the market. In the building sector, fasteners are used to assemble items on a temporary basis. In order to guarantee a secure and lasting final framework, each construction project needs a distinctive kind of fastener. Because each piece of equipment, machinery, or vehicle needs these fasteners to keep it together, fasteners play a crucial role in construction. Fasteners are the primary elements that are used in a variety of industries, including automation, manufacturing, infrastructure, and others, where a variety of products are created that involve the assembly of machinery or components from various vehicles. The market for industrial fasteners is expected to rise as a result of the rising demand from several sectors.

High installation prices

The drawback of employing fasteners is that their installation frequently necessitates specialist equipment, which can raise project costs and complexity. It takes considerably more time and effort to install other kinds since they call for extra measures like pre-drilling holes or using thread-locking compounds. Last but not least, depending on your application, some kinds could not be strong enough or robust enough for long-term usage, which might result in expensive repairs down the line if not addressed correctly from the outset. Such expenses are observed to cause a restraint for the market.

Increasing demand from the aerospace industry

Standard fasteners including rivets, screws, nuts, pins, bolts, and collars are often used in the aircraft sector. Aerospace technology and equipment must be built to withstand harsh conditions, right down to the fasteners that hold them together, as they are frequently exposed to them. Examples of such extreme environments include elevated temperatures and pressures from leaving the earth's atmosphere and contact with burning rocket fuel. Because of this, a variety of high-quality fastener designs have been created, each of which has unique features and meets the standards and requirements of the aerospace sector. With the expansion of the aerospace industry, the demand for advanced and high-quality fasteners will grow while opening substantial opportunities for the market to grow.

The metal fasteners segment dominated the market with the highest revenue in 2023, the segment will continue to sustain its position throughout the forecast period. Higher tensile strength is expected to boost the demand for the market in several industries. There are various metal fasteners like steel, alloy, bronze, titanium, etc. Industrial equipment like bolts, screws, river clamps, etc. is made up of metal. The easy availability of metal materials promotes the segment’s growth. Metals offer better resistance and strength capacity than other fasteners for industrial and construction use. The metal has a strong holding capacity, so it is widely preferred in the industrial sector. All these factors collectively fuel the segment’s growth.

The plastics fasteners segment is expected to increase its market share during the forecast period. Plastic fasteners attract consumers with lower prices and easy availability. Plastic fasteners are gaining demand from the automotive and aerospace industries due to their lightweight properties. Plastic fasteners are corrosion resistive and chemical-resistive. Lightweight, lower cost and easy availability of plastic material fuel the growth of the segment.

The externally threaded segment dominated the market with the highest market share in 2023. The growth of the segment is expected to grow with the most commonly used by the various industries demand. Bolts, screws, and studs are a few examples of threaded fasteners. In order to establish a strong, temporary connection that may be removed as needed, bolts are frequently utilized with nuts, washers, and other accessories. By establishing a clamp load while the nut on the bolt is tightened, friction is produced, holding the fastener in place.

The non-threaded segment is expected to grow at a considerable rate during the predicted timeframe. The most popular non-threaded fasteners are blind and solid rivets. A number of non-thread pins are also utilized for fastening. Steel, copper, aluminum, brass, and stainless-steel solid rivets come in a variety of sizes and forms. Solid rivets are robust, have a complete look, and withstand vibration when used properly. The availability of variety of designs, dimensions, and materials, including steel, aluminum, and stainless steel for non-threaded fasteners promotes the segment’s growth. Increasing demand for nonthreaded fasteners in the construction industry will likely boost the growth of the segment.

The automotive segment dominated the market with the largest market share in 2023. Increasing automotive manufacturing plants across the world will anticipate the demand for industrial fasteners in the automotive industries. Fasteners like nuts, bolts, screws, panels, rivets, studs, etc. are heavily used in the automotive industry. Thus, the automotive segment will continue its dominance during the forecast period due to the higher demand for fasteners. The rising production of electric vehicles highlights the demand for lightweight fasteners, this element is expected to fuel the market’s expansion in the upcoming period.

The aerospace segment is expected to witness notable growth during the forecast period. In the manufacturing of aircraft, there is an enormous requirement for high-quality and reliable fasteners. With the rising production of airplanes and aircraft, especially for defense purposes, the aerospace segment is expected to be propelled.

Segments Covered in the Report

By Raw Material

By Product

By Application

By Geography

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

January 2025

January 2025

September 2024

October 2024