January 2025

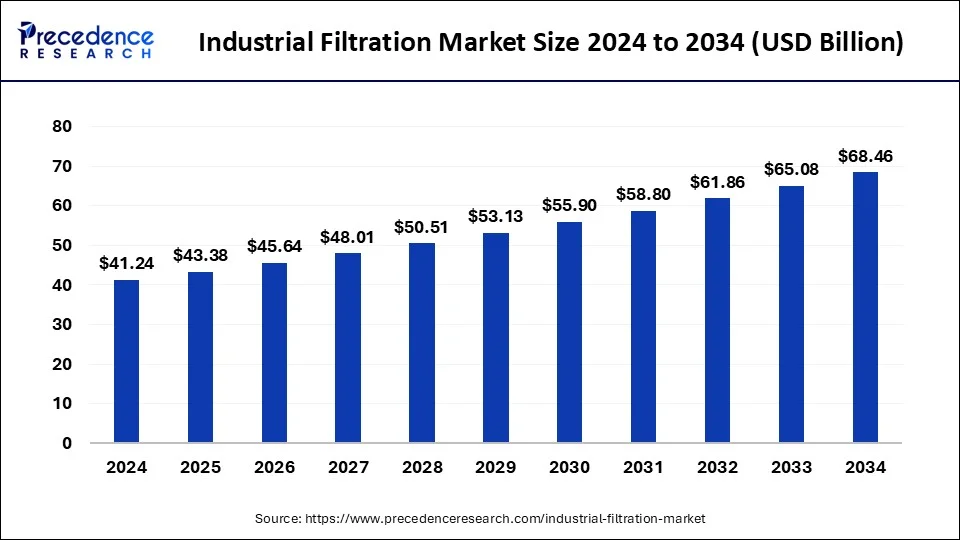

The global industrial filtration market size is calculated at USD 43.38 billion in 2025 and is forecasted to reach around USD 68.46 billion by 2034, accelerating at a CAGR of 5.20% from 2025 to 2034. The North America industrial filtration market size surpassed USD 16.91 billion in 2024 and is expanding at a CAGR of 5.33% during the forecast period. The market sizing and forecasts are revenue-based (USD Million/Billion), with 2024 as the base year.

The global industrial filtration market size was estimated at USD 41.24 billion in 2024 and is predicted to increase from USD 43.38 billion in 2025 to approximately USD 68.46 billion by 2034, expanding at a CAGR of 5.20% from 2025 to 2034.

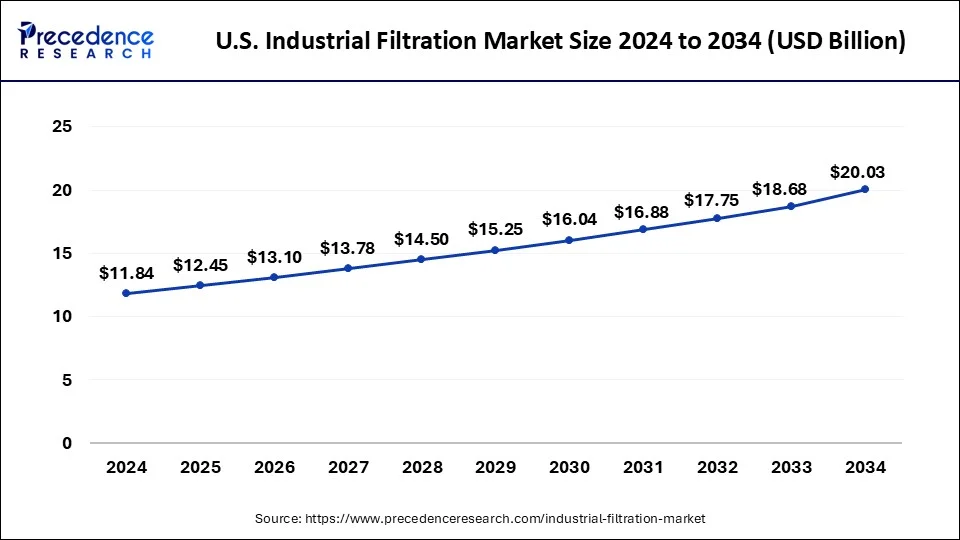

The U.S. industrial filtration market size is evaluated at USD 11.84 billion in 2024 and is predicted to be worth around USD 20.03 billion by 2034, rising at a CAGR of 5.40% from 2025 to 2034.

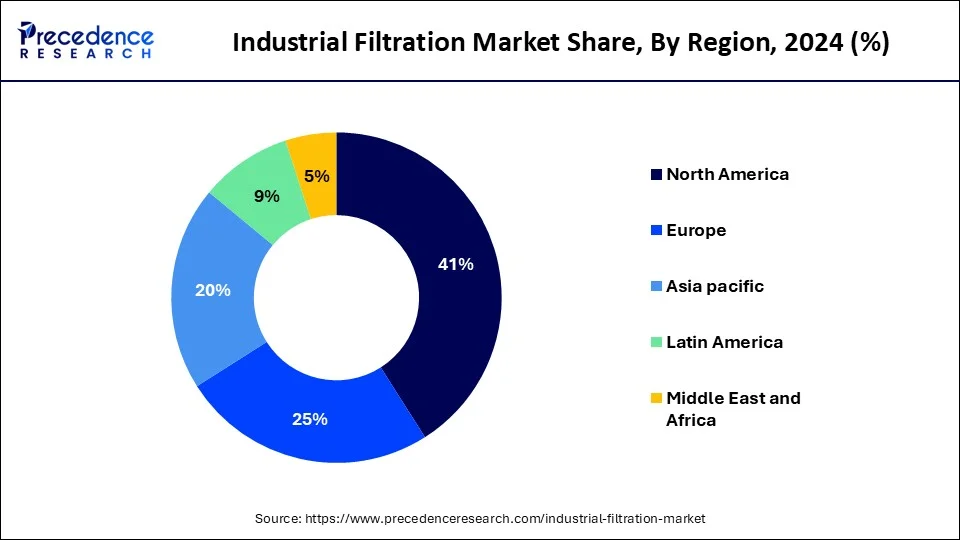

The North American region leads the global industrial filtration market, and it will maintain its market position continuously throughout the forecast period. The largest market for industrial filtration is expected to be in North America, followed by Asia Pacific. During the projected period, the North American region is expected to lead the industrial filtration market. The industrial filtration market in the area is being driven by rising investments in the manufacturing industry to control dangerous particle emissions and increasingly severe air pollution control requirements. The region is one of the most aggressive enforcers of the government's air pollution restrictions. It has one of the most polluting power producing industries in the world, with coal accounting for 26.86% of total electricity output. During the projected period, this aspect would provide sufficient chances for the industrial filtration market in the region.

In the Asia Pacific region, the industrial filtration market is proving to be a driving market for this sector pertaining to the rapid urbanization of this region. Asia-Pacific is the hub for the electronics industry and thus, has a significant share in the market. Worries about the negative effects of contaminants in the ambient air are driving an increase in the usage of filtration technology in a variety of settings, including manufacturing plants and warehouses in both developed and developing countries.

The removal of harmful particles from air and other gases is what industrial filtration is all about. Air filtration and separation systems are required in many industrial processes, not only to preserve equipment but also to safeguard the working environment.

Over the next years, the growing requirement to prevent dust and minute airborne particles generated within industrial plant spaces from being released into the environment may drive market demand. Major manufacturers' increased efforts to bring forward innovations such as reduced greenhouse gas emissions, improved performance, and increased energy efficiency in filter media are anticipated to stimulate usage even more. The demand for food may rise as the population grows. Purification of drinking water, combined with increasing industrialization, may soon necessitate purification of foods and beverages, transportation, and infrastructure. As the world population grows and urbanization increases, so does the demand for clean energy, clean water, safe food, and improved medical services for all humanity.

Environmental regulations and standards are gaining traction around the world as a means of reducing the impact of industrial emissions. These guidelines emphasize the use of non-toxic materials, the modification of manufacturing methods, and the use of conservation techniques. They also encourage people to reuse items rather than throwing them away, which help to reduce pollution. North America and Europe were among the first to enact environmental protection legislation around the world. Large-scale industrial installations must also get operational permits for environmental protection, according to the law. To reduce pollution, developing countries in Asia Pacific, the Middle East, and Africa are establishing various environmental emission standards. The need for industrial filtration is projected to increase because of these rules. Thus, the demand for industrial filtration market is increasing day by day.

Growing industrialization and urbanization is a major factor driving the industrial filtration market. Increasing industrialization operations and funding for industrial filtration companies, as well as the creation of new advanced-technology solutions lead to driving the market and need of such products in the market. The health of employees is being valuable and that’s why industries are stringent to use industrial filtration in their premises that ultimately increases the market of the product.

| Report Coverage | Details |

| Market Size by 2024 | USD 41.24 Billion |

| Market Size in 2025 | USD 43.38 Billion |

| Market Size by 2034 | USD 68.46 Billion |

| Growth Rate from 2025 to 2034 | CAGR of 5.20% |

| Largest Market | North America |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Type, Filter Media, Product, Industry, Geography |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America and Middle East & Africa |

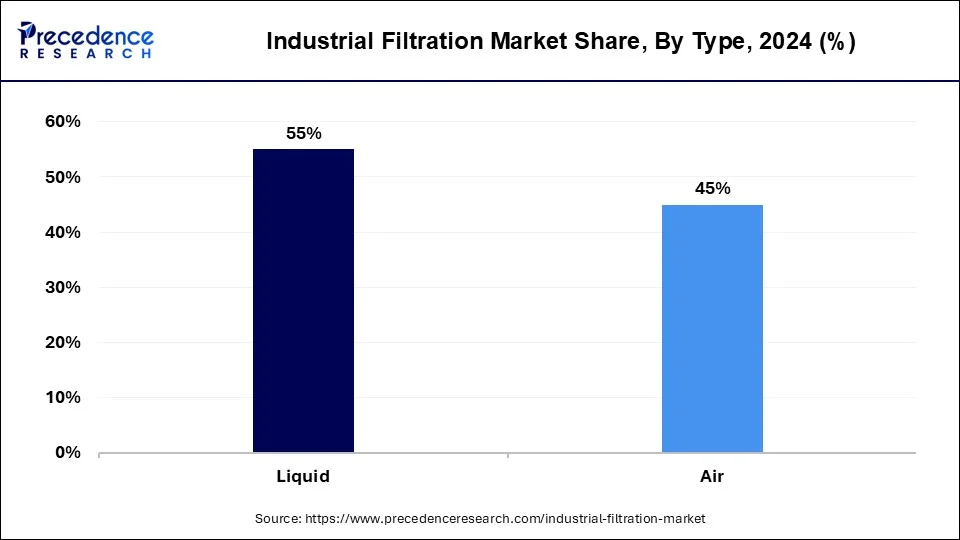

Depending upon the type, the liquid segment is expected to have the highest growth in the industrial filtration market in the forecast period. The liquid segment in the industrial filtration market had significant share in the recent years. It is addressed to every industry that they must treat the wastewater including processing water, which has intended to lead the liquid type segment. Furthermore, the need for liquid type filtration is projected to rise as new environmental technologies are installed in wastewater treatment plants to treat industrial water.

The air type industrial filtration will also witness a good growth during the forecast period. The air type industrial filtration market is supported due to the steps taken by government to take essential steps towards industries filtration system. To filter small objects from the air, industrial air filters are an integral feature of every heating, ventilation, and air conditioning system. In any sector where procedures generate smoke and pollution, industrial air filters are essential. These filters are used to keep indoor air quality (IAQ) in confined rooms by filtering out contaminants such pollen, dust, and chemical pollutants.

On the basis of by filter media, the non woven fabric segment is expected to be the largest contributor to the industrial filtration market. During the forecast period, the nonwoven fabric segment is estimated to account for the greatest share of the industrial filtration market. This filter media segment is growing in popularity since it is long-lasting, reusable, water-resistant, hypoallergenic, fire-resistant, soft, light, and sometimes washable. The most common filter media is nonwoven fabric. They are suited for application in a wide range of industries, including pharmaceuticals, mineral processing, and others, due to the complex arrangement of fibers, high speed and low-cost manufacturing procedures, and diverse design possibilities due to the structure's adaptability. The usage of reusable and recyclable filters such as activated carbon and non woven filters have gained popularity in the past.

The fiber glass media assures deep dirt penetration and high dirt-holding capacity because the filaments are electronically programmed to form effective high loft, gradient density patterns. Due to its use in air conditions for removing tiny particles, rising construction activities around the world have boosted demand for fiber glass filters. Residential and commercial buildings both use HVAC products. Emerging trends in green construction, which employ pollution-reduction and waste-reduction strategies, will also boost market growth. Industrial filtration systems can use a variety of high-tech activated carbon filters. The performance properties of activated carbon vary depending on the layers from which it is sourced and how it is created.

On the basis of industry type, the chemicals and petrochemicals is expected to be the largest market to show a tremendous growth during the forecast period. Chemical processes produce pollutants that may react with the collection equipment's material. These toxins have the potential to harm both workers and the environment. Another issue is cross-contamination with other materials, which might degrade the product's quality. Due to the vital function that industrial filtration plays in water treatment, these factors are projected to increase demand for industrial filtration during the forecast period.

The healthcare segment is also estimated to grow with the higher interest and hold a major part of the market as increasing requirement for high purity raw materials, both in liquid and air forms with occurrence of the recent pandemic of Covid-19, the focus on healthcare segment is projected to gain traction in the coming years. The food & Beverage industry is also set to gain significant market share in the forecast period.

Donaldson Inc., introduced a Rugged Pleat industrial dust collector which will be used in the various processes related to mining and processing of the grains. This heavy dust will be effectively collected by the collector and it shall be useful in many sectors.

By Type

By Filter Media

By Product

By Industry

By Geography

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

January 2025

January 2025

September 2024

October 2024