January 2025

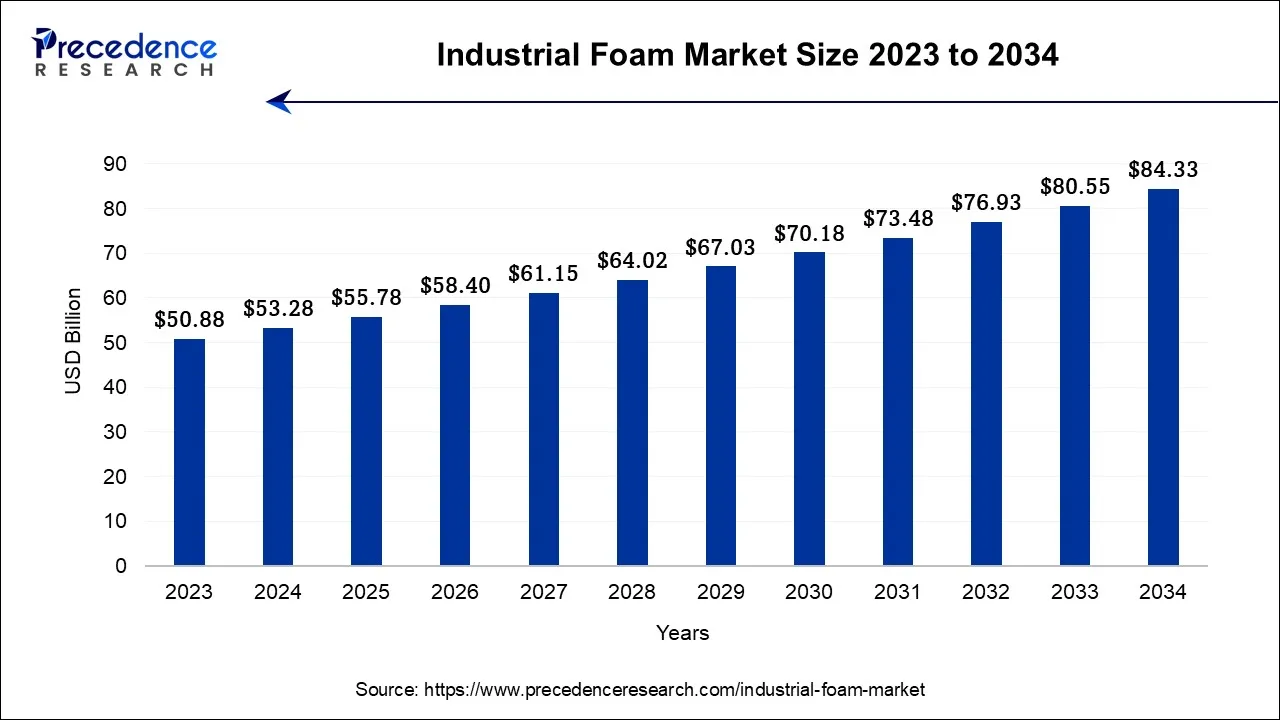

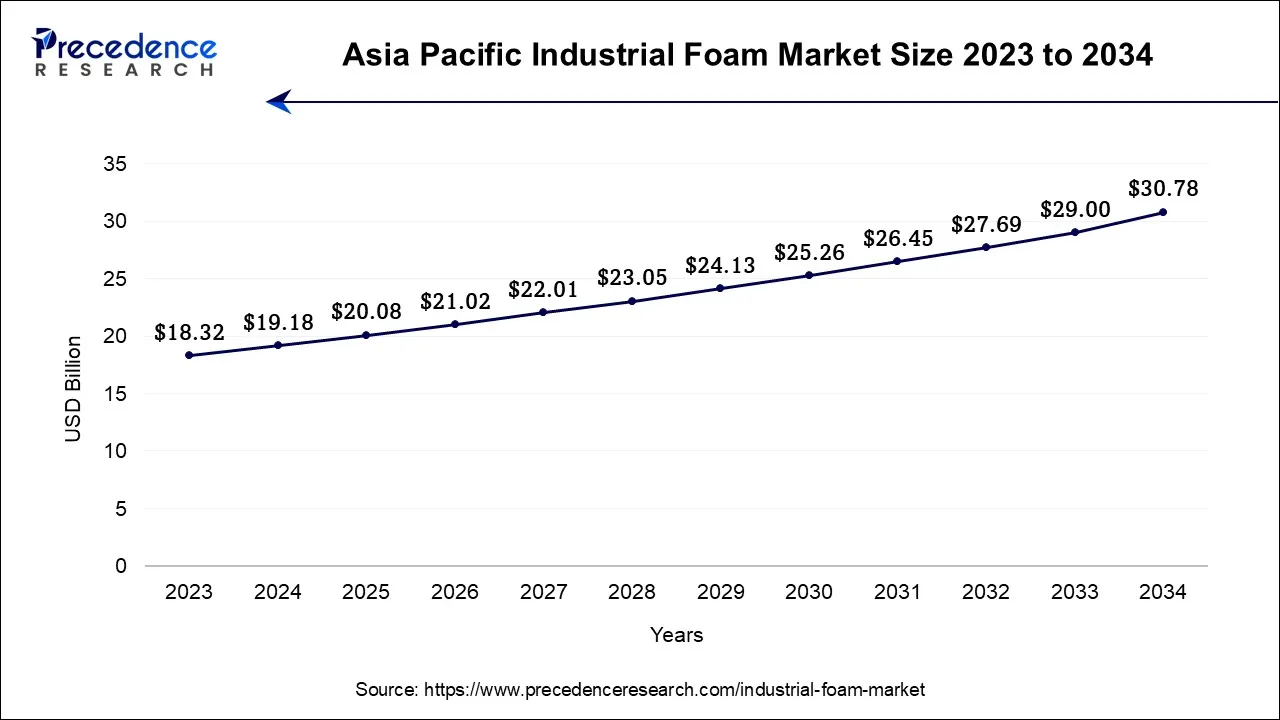

The global industrial foam market size is calculated at USD 50.88 billion in 2024, grew to USD 53.28 billion in 2025 and is predicted to hit around USD 80.55 billion by 2034, expanding at a CAGR of 4.70% between 2024 and 2034. The Asia Pacific industrial foam market size accounted for USD 18.32billion in 2024 and is representing a notable CAGR of 4.84% during the forecast period.

The global industrial foam market size accounted for USD 50.88 billion in 2024 and is anticipated to reach around USD 80.55 billion by 2034, growing at a CAGR of 4.70% from 2024 to 2034.

The Asia Pacific industrial foam market size was exhibited at USD 18.32 billion in 2024 and is projected to surpass around USD 29 billion by 2034, expanding at a CAGR of 4.84% between 2024 and 2034.

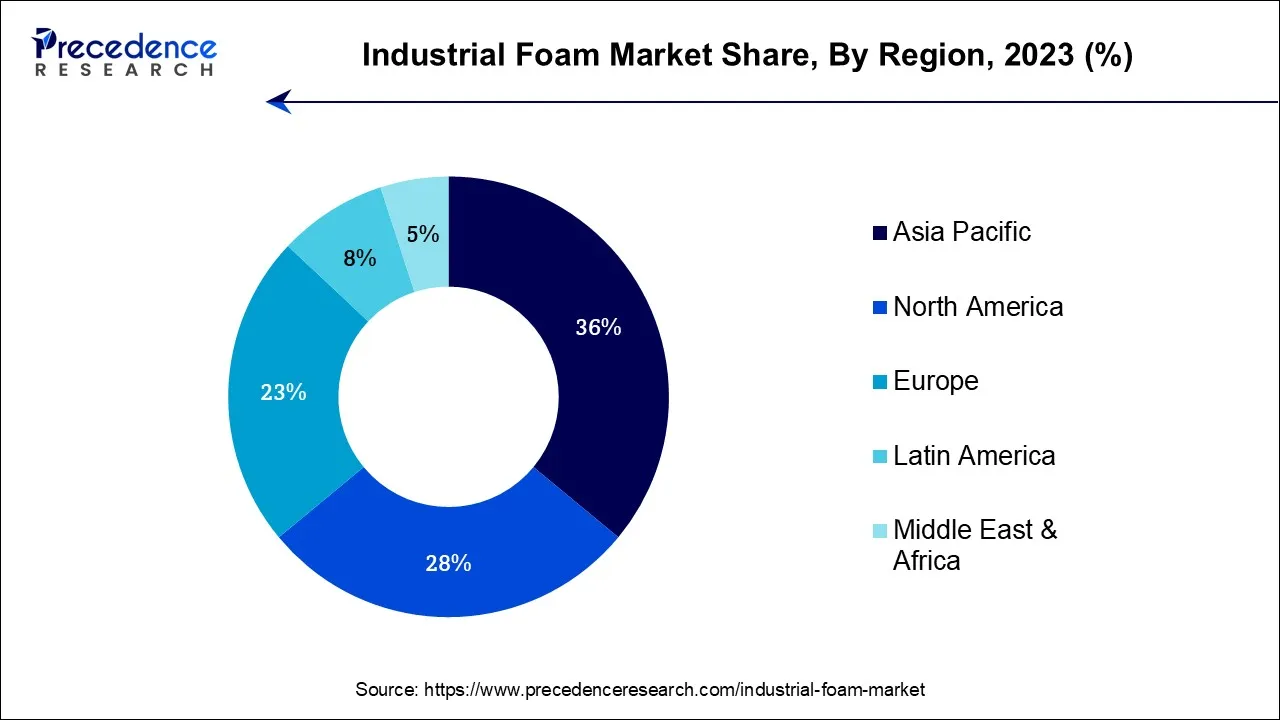

Asia-Pacific held the largest revenue share of 36% in 2023. In the Asia-Pacific region, the industrial foam market is witnessing robust growth due to rapid urbanization, infrastructure development, and increased manufacturing activities. Key trends include a rising demand for eco-friendly foam solutions in response to stringent environmental regulations. Additionally, the automotive and construction sectors are driving substantial foam consumption, while the region's expanding consumer electronics market is also contributing to market growth. Asia-Pacific's dynamic economic landscape and emphasis on sustainability are shaping the industrial foam market's trajectory in the region.

In Europe, the industrial foam market is witnessing several notable trends. There is a growing emphasis on sustainable foam materials to align with stringent environmental regulations. The automotive industry is increasingly adopting lightweight foams for electric vehicles, driven by green initiatives. Additionally, the construction sector is favoring foam insulation for energy-efficient buildings. Furthermore, the region is witnessing an expansion in aerospace applications, contributing to the market's steady growth in Europe.

Additionally, in North America, the industrial foam market is witnessing notable trends. There's a growing emphasis on sustainable and eco-friendly foam solutions, driven by environmental regulations and consumer preferences. Additionally, the automotive industry's shift towards electric vehicles is increasing the demand for lightweight foams. The construction sector is booming, particularly in urban centers, creating a robust need for foam insulation and soundproofing materials. These trends indicate a promising future for the industrial foam market in North America, with a focus on innovation and sustainability.

The industrial foam market encompasses the production and distribution of versatile foam materials tailored for various industrial applications. The industrial foam market pertains to a diverse range of foam materials, such as polyurethane, polyethylene, and polystyrene, which play a crucial role across sectors including construction, automotive, aerospace, and packaging. These industrial foams are highly valued for their lightweight composition and exceptional attributes, which encompass insulation, cushioning, and sound absorption capabilities. Their nature is characterized by adaptability to diverse requirements, enabling the creation of energy-efficient structures, safer transportation, and efficient packaging solutions. As industries continue to innovate and prioritize sustainability, the industrial foam market is evolving to offer eco-friendly options, reflecting the growing demand for greener alternatives.

| Report Coverage | Details |

| Market Size by 2034 | USD 80.55 Billion |

| Market Size in 2024 | USD 50.88 Billion |

| Growth Rate from 2024 to 2034 | CAGR of 4.70% |

| Largest Market | Asia Pacific |

| Base Year | 2023 |

| Forecast Period | 2024 to 2034 |

| Segments Covered | Foam Type, End Use Industry Resin Type, and Regions |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Automotive industry advancements, driven by the pursuit of lighter and more fuel-efficient vehicles, surge demand in the industrial foam market. Industrial foams, prized for their lightweight properties, are extensively used in automotive interiors, insulation, and lightweight solutions. As automakers increasingly prioritize these materials to meet emission standards and enhance performance, the industrial foam market experiences a significant upswing in demand, bolstering its growth and relevance within the automotive sector.

Moreover, the surge in E-commerce has significantly increased demand for the market. Industrial foams are essential for packaging fragile items purchased online, providing cushioning and protection during shipping. With the ever-growing volume of online orders, businesses require effective packaging solutions, thereby driving up the demand for industrial foam materials. This trend is expected to continue as E-commerce continues to expand, making industrial foams a vital component of the packaging supply chain.

The industrial foam market faces constraints due to substitute materials offering comparable properties. Alternatives like natural fibers, recycled materials, and composites can provide insulation and cushioning, reducing the demand for traditional foam products. Additionally, as sustainability becomes a priority, industries are exploring environmentally friendly alternatives, impacting market demand for foam materials. To remain competitive, the industrial foam sector must adapt by developing eco-friendly solutions and showcasing the unique advantages of foam materials over substitutes.

Moreover, recycling and waste management efforts present challenges for the industrial foam market by promoting eco-conscious practices and reducing waste generation. While this is beneficial for the environment, it can restrain market demand as companies seek sustainable alternatives and recycling options for foam materials. Stricter regulations on foam disposal and increased recycling initiatives may limit the market's growth potential, pushing manufacturers to innovate and develop more environmentally friendly foam products.

The surge in sustainable foam development has significantly boosted market demand in the industrial foam market. As industries prioritize eco-friendly solutions, the availability of biodegradable and recyclable foam materials has driven adoption. Consumers, regulators, and businesses alike are seeking foam products that align with sustainability goals, leading to increased market demand for these environmentally responsible alternatives, which cater to the growing need for greener, more sustainable industrial practices.

Moreover, diversification in the industrial foam market, offering a broader range of foam materials and applications, surges market demand. By catering to various industries such as construction, automotive, aerospace, and packaging with specialized foam solutions, it amplifies opportunities for growth. This diversification not only expands the customer base but also ensures resilience in the face of changing economic conditions and industry-specific trends, driving overall market demand and sustainability.

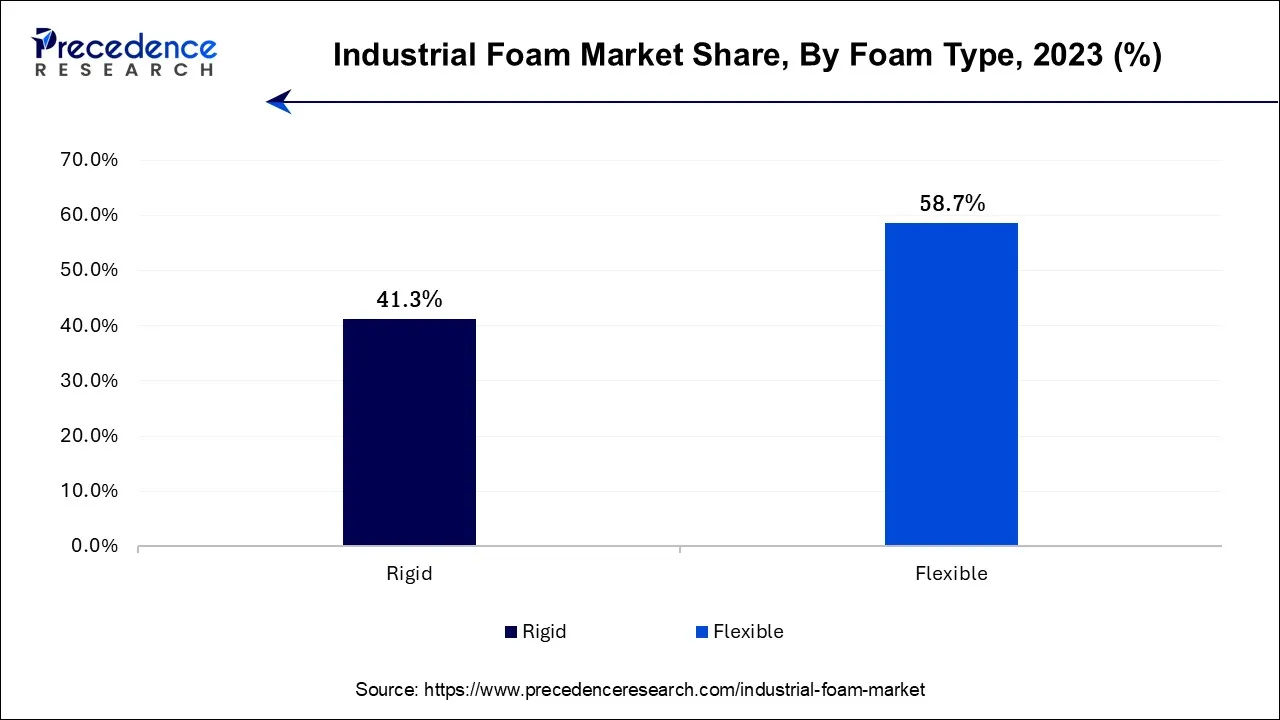

The flexible segment held a 58.7% revenue share in 2023. Flexible foams in the industrial foam market are characterized by their ability to deform under pressure and return to their original shape, offering resilience and cushioning. A notable trend in this segment is the growing demand for eco-friendly and recyclable flexible foams, driven by sustainability concerns. Additionally, advancements in material technology are enabling the development of flexible foams with improved performance attributes, enhancing their suitability for diverse applications across industries like automotive, furniture, and bedding.

The rigid segment is anticipated to expand at a significant CAGR of 7.8% during the projected period. Rigid foam, a prevalent type in the industrial foam market, is characterized by its structural stability and minimal flexibility. This foam type is widely used in insulation applications across the construction and refrigeration industries. Recent trends in the industrial foam market show a growing preference for eco-friendly rigid foams with improved insulation properties. Increasing demand for energy-efficient solutions and stricter regulations on building codes are driving the adoption of advanced rigid foam materials, creating opportunities for sustainable innovation.

The building & construction is anticipated to hold the largest market share of 29% in 2023. In the industrial foam market, the building & construction sector refers to the utilization of foam materials in construction projects. A prominent trend in this segment is the increasing demand for energy-efficient insulation foams to meet stringent environmental regulations. Additionally, lightweight and durable foam solutions are sought after for their ease of installation and ability to reduce construction costs. These trends reflect the industry's commitment to sustainable building practices and cost-effective construction techniques.

On the other hand, the HVAC segment is projected to grow at the fastest rate over the projected period. HVAC, or Heating, Ventilation, and Air Conditioning, is a critical end-use industry for the Industrial Foam Market. It relies on foam materials for insulation, sound absorption, and temperature control within heating and cooling systems. A significant trend in this sector is the growing demand for energy-efficient HVAC solutions, driving the need for advanced foam materials that enhance insulation and reduce energy consumption. As regulations tighten to promote sustainability, industrial foam innovations that meet these requirements will play a pivotal role in the HVAC industry.

The Polyurethane foam segment had the highest market share of 38.4% in 2023. Polyurethane foam, a versatile resin type in the Industrial Foam Market, is known for its exceptional insulation, cushioning, and sound absorption properties. In recent trends, polyurethane foam has gained prominence due to its eco-friendly formulations, contributing to sustainability goals. It finds increased application in automotive lightweight, energy-efficient construction, and furniture manufacturing. The demand for polyurethane foam is rising as industries prioritize eco-conscious materials and energy efficiency in their products and processes.

The polyolefin foam is anticipated to expand at the fastest rate over the projected period. Polyolefin foam, a prominent variety within the industrial foam category, is distinguished by its composition of polyethylene and polypropylene resins. This foam type is renowned for its exceptional attributes, including lightweight composition, effective thermal insulation, and remarkable resistance to moisture. A significant trend in the industrial foam market is the increasing demand for polyolefin foam due to its versatility and eco-friendly nature. Industries such as construction, packaging, and automotive are increasingly turning to polyolefin foam for insulation and cushioning applications, driven by sustainability and energy-efficiency considerations.

Segments Covered in the Report

By Foam Type

By End Use Industry

By Resin Type

By Geography

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

January 2025

January 2025

September 2024

October 2024